- Home

- »

- Consumer F&B

- »

-

Organic Chocolate Spreads Market, Industry Report, 2030GVR Report cover

![Organic Chocolate Spreads Market Size, Share & Trends Report]()

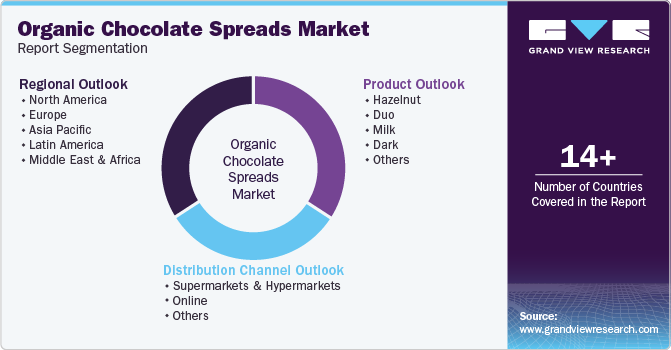

Organic Chocolate Spreads Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Hazelnut, Duo, Milk, Dark), By Distribution Channel (Supermarkets & Hypermarkets, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-437-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Chocolate Spreads Market Summary

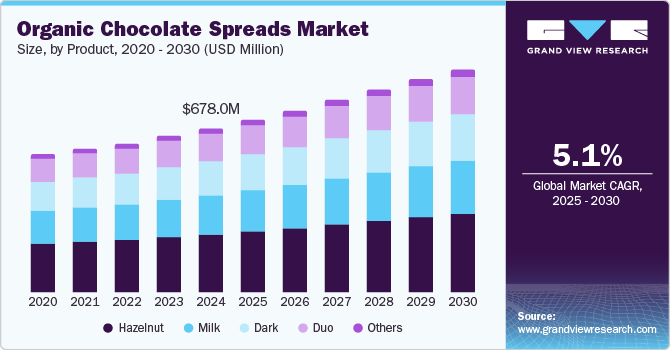

The global organic chocolate spreads market size was estimated at USD 678.0 million in 2024 and is expected to expand at a CAGR of 5.1% from 2025 to 2030. Rising consumer awareness regarding the product's health benefits, especially those made with dark chocolate, coupled with constant product innovation, has favored the industry's growth over the last few years.

Key Market Trends & Insights

- North America dominated the global organic chocolate spreads market with the largest revenue share in 2024.

- The organic chocolate spreads market in the U.S. led the North America market and held the largest revenue share in 2024.

- By product, the hazelnut segment led the market, holding the largest revenue share of 37.6% in 2024.

- By distribution channel, the online segment is expected to grow at the fastest CAGR from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 678.0 Million

- 2030 Projected Market Size: USD 913.7 Million

- CAGR (2025-2030): 5.1%

- North America: Largest market in 2024

With organic chocolate spreads gaining popularity as a breakfast staple, demand is anticipated to grow, driven by the growing preference for low-calorie spreads.

Numerous vegan food manufacturers have recently entered the organic chocolate spread industry. The growing popularity of veganism and vegetarianism further supports this shift. According to a Consumption Habits poll conducted by Gallup in 2023, one percent of the U.S. population identifies as vegan, and four percent identifies as vegetarian. Although this percentage has declined in the past couple of years, the trend is again rising. For instance, according to World Population Review, in 2024, the vegan and vegetarian population in the U.S. stood at 1.5% and 4.2%, respectively.

The growing demand for convenience foods is contributing to the increased availability of organic chocolate spreads in the consumer goods market. These spreads are considered a quick and healthy snack that is also easy to carry. Organic chocolate spreads are mainly used in various cooking methods, such as baking, as toppings for bread and fruits, and as key ingredients in recipes aimed at health-conscious consumers. Their use is common in households, cafés, and restaurants that prioritize organic products. Furthermore, the expansion of e-commerce and improved distribution networks are making these products more accessible to a larger audience.

Product Insights

Hazelnut organic chocolate spread dominated the market, with a revenue share of 37.6% in 2024. Hazelnut promotes heart health and is highly nutritious, containing vitamins, minerals, antioxidant compounds, and healthy fats and its rich flavor and smooth texture make it perfect for various culinary applications. The segment growth is attributed to the increasing consumer preferences for indulgent and premium food products, alongside a growing awareness of health and wellness, which encourages the choice of organic options with lower sugar content. Additionally, the rise in convenient food options and innovative product formulations, such as vegan varieties, are enhancing the appeal of hazelnut chocolate spreads.

The dark chocolate segment is expected to grow at the highest CAGR over the forecast period. Dark chocolate spreads are becoming more popular due to their perceived health benefits, including high antioxidants, making them a healthier option than milk chocolate spreads, while still offering a rich, indulgent flavor. Manufacturers are providing innovative dark chocolate spread flavors with additions like nuts, fruits, or spices to enhance its taste. The major health advantages of dark chocolate have made it a staple option for morning breakfasts. For instance, according to a study published by Harvard T.H. Chan School of Public Health in December 2024, consuming dark chocolate may help reduce the risk of developing type 2 diabetes.

Distribution Channel Insights

Supermarkets & hypermarkets led the organic chocolate spreads market with the largest revenue share in 2024. Consumers appreciate the ability to see, touch, and taste products in-store, which helps build trust, especially with food items such as organic chocolate spreads. This direct interaction reassures customers about quality and authenticity. Additionally, in-store shopping often leads to impulse purchases, as attractive packaging catches the eye. Traditional shopping habits remain prevalent in many regions, with many preferring the convenience of immediate access to products rather than waiting for delivery, which suits their fast-paced lifestyles.

The online segment is expected to grow at the fastest CAGR over the forecast period. Online platforms offer the convenience of comparing prices, discounts, and deals on organic chocolate spreads, helping consumers find the best offers. As digital shopping grows, awareness of buying organic products online has increased. Consumer reviews and ratings on these platforms also help build trust and influence purchasing decisions. The pandemic accelerated digital transformation across various sectors, including the organic food market. E-commerce has gained significant popularity in recent years due to its convenience and accessibility.

Regional Insights

North America organic chocolate spreads market held a substantial market share in 2024. Rising demand for convenient, ready-to-eat products, coupled with increased disposable income, is driving the growth of chocolate spread sales. The growing preference for clean, transparent labeling and European-style breakfasts featuring chocolate spreads has increased the demand for organic chocolate spreads free from artificial ingredients. Since vegan diets avoid animal-based ingredients, many organic chocolate spreads, which are naturally dairy-free, serve as a perfect alternative. As more individuals embrace plant-based lifestyles, the demand for vegan-friendly organic products, including chocolate spreads, has significantly increased.

U.S. Organic Chocolate Spreads Market Trends

The organic chocolate spreads market in the U.S. dominated the North America market with the highest revenue share in 2024. As health consciousness grows in the region, leading chocolate spread companies are increasingly focused on introducing organic chocolate spreads made from natural, preservative-free ingredients, making them healthier for consumers. Organic chocolate spreads are popular as breakfast toppings on bread, pancakes, or waffles, driving high demand. Their dairy-free nature makes them ideal for plant-based diets. Additionally, the convenience of online shopping has made these spreads easily accessible to U.S. consumers.

Europe Organic Chocolate Spreads Market Trends

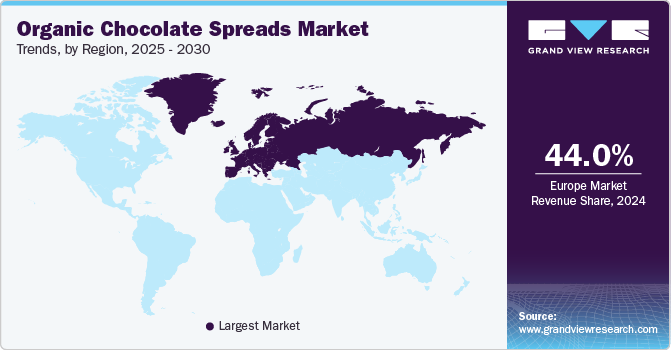

Europe organic chocolate spreads market dominated the global market with a revenue share of 44.0% in 2024. Europe is home to some of the world’s highest revenue-generating countries, including Spain, Russia, and Switzerland, for organic foods owing to a large number of exports. Europe is the world’s top chocolate exporter and has the largest chocolate market as well, along with the largest number of organic-certified companies manufacturing spreads, such as Mars, Mondelēz, and Nestlé. In addition, increasing organic and fair-trade certified cocoa companies and growing sales of organic products in the region are likely to favor regional market growth. Furthermore, chocolate spread is a staple ingredient in European breakfasts.

Germany organic chocolate spreads industry dominated the Europe market with the largest revenue share in 2024. Germany leads Europe in plant-based eating, with a strong organic food market where consumers prioritize sustainable and healthier options such as organic chocolate spreads. Germany is the top exporter of chocolate globally with an export of 16.7% of the global export in 2024. The cultural focus on organic and fair-trade products boosts demand, making these spreads popular as toppings for bread, toast, and pancakes. Germany’s efficient retail network, including supermarkets and online platforms, ensures easy access, further driving organic chocolate spreads’ availability and widespread popularity.

Asia Pacific Organic Chocolate Spreads Market Trends

Asia pacific organic chocolate spreads industry is expected to grow at the highest CAGR over the forecast period. The regional market is competitive and fragmented, with international and regional players. Companies utilize social media marketing and celebrity endorsements to capture market share. International brands are expanding into developing countries such as China and Japan. Increased consumer awareness of organic food’s health benefits and millennials’ focus on ingredient sourcing are driving demand and market growth.

The China organic chocolate spreads industry led the Asia Pacific market with the largest revenue share in 2024. As the urban population in China embraces Western-style diets, including breakfast items such as chocolate spreads, the demand for such products continues to rise. With increasing awareness of food quality and sustainability, Chinese consumers are increasingly favoring organic and ethically sourced options. As a result, organic chocolate spreads are seen as a healthier alternative to traditional spreads, further driving their popularity.

Key Organic Chocolate Spreads Company Insights

Some key players in the organic chocolate spreads industry include Ferrero, Histon Sweet Spreads Limited, Premier Foods plc, Unilever, and others. Major organic chocolate spread companies stay competitive globally by innovating products, expanding distribution networks, and focusing on sustainability. They adapt to local tastes, emphasize health benefits, and leverage e-commerce for wider reach, ensuring continued growth in health-conscious, ethical markets.

-

Ferrero is headquartered in Alba, Piedmont, Italy. Its chocolate spreads feature ingredients such as organic cocoa, sugar, and hazelnuts. The company has become one of the largest chocolate and sweet snack manufacturers worldwide. It is also known for its iconic brands, such as Nutella, Kinder, and Ferrero Rocher.

-

Histon Sweet Spreads Limited specializes in the production of sweet spreads, including chocolate spreads, jams, and related products. The company is headquartered in Histon, Cambridgeshire, UK, and often emphasizes clean labels, natural ingredients, and sustainable sourcing practices in its products.

Key Organic Chocolate Spreads Companies:

The following are the leading companies in the organic chocolate spreads market. These companies collectively hold the largest market share and dictate industry trends.

- Ferrero

- Histon Sweet Spreads Limited

- Premier Foods plc

- Unilever

- Dr. Oetker

- Hormel Foods Corporation

- Mondelēz International

- Nestlé

- Conagra Brands, Inc.

- The Kraft Heinz Company

Recent Developments

-

In October 2024, Ferrero launched a plant-based version of Nutella, incorporating chickpeas to appeal to vegan consumers. The product was initially available in European markets such as Italy, France, and Belgium in a 350 g format. It was certified vegan and sold in recyclable jars, meeting Ferrero's sustainable sourcing standards.

-

In September 2024, Teralys, a subsidiary of Morocco's Al Mada, purchased the Italian agro-industrial company Nutkao for €450 million to enhance its presence in the agro-industry sector. Nutkao, known for its hazelnut, cocoa, and pistachio-based products, operates production facilities in Italy, Belgium, the U.S., and Ghana. This acquisition supports Teralys' strategy of investing in agro-industry ventures and fostering the development of African resources.

Organic Chocolate Spread Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 710.9 million

Revenue forecast in 2030

USD 913.7 million

Growth Rate

CAGR of 5.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in thousand units, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Switzerland, Russia, Netherlands, Italy, France, Spain, Sweden, Denmark, Belgium, China, Japan, South Korea, Australia, Brazil, South Africa, Saudi Arabia, and Israel

Key companies profiled

Ferrero, Histon Sweet Spreads Limited, Premier Foods plc, Unilever, Dr. Oetker, Hormel Foods Corporation, Mondelēz International, Nestlé, Conagra Brands, Inc., and The Kraft Heinz Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Chocolate Spreads Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organic chocolate spreads market report based on product, distribution channel, and region:

-

Product Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Hazelnut

-

Duo

-

Milk

-

Dark

-

Others

-

-

Distribution Channel Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Online

-

Others

-

-

Regional Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Switzerland

-

Russia

-

Netherlands

-

Italy

-

France

-

Spain

-

Sweden

-

Denmark

-

Belgium

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Israel

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.