- Home

- »

- Consumer F&B

- »

-

Organic Chocolate Confectionery Market Size Report, 2030GVR Report cover

![Organic Chocolate Confectionery Market Size, Share & Trends Report]()

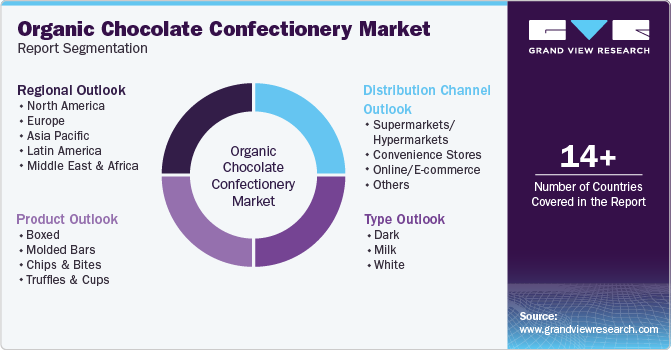

Organic Chocolate Confectionery Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Boxed, Molded Bars, Chips & Bites, Truffles & Cups), By Type, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-435-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Chocolate Confectionery Market Summary

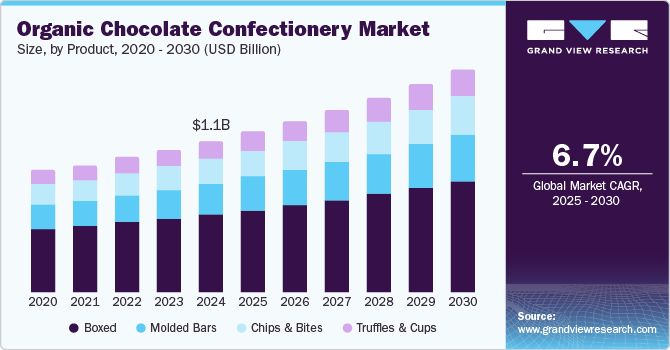

The global organic chocolate confectionery market size was estimated at USD 1.06 billion in 2024 and is projected to reach USD 1.55 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. The demand for organic chocolate confectionery is anticipated to substantially increase due to the favorable impact of advertising organic food items that increase consumer preference for such products.

Key Market Trends & Insights

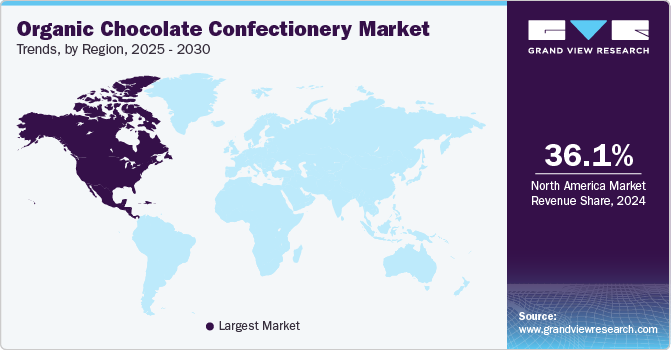

- North America organic chocolate confectionery market held the leading global revenue share of 36.1% in 2024.

- By product, the boxed segment held the largest revenue share of 51.3% in 2024.

- By type, the dark chocolate segment held the largest revenue share in 2024.

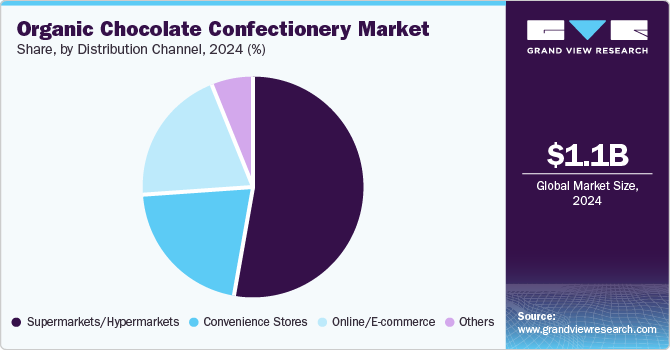

- By distribution channel, the supermarkets/hypermarkets segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.06 Billion

- 2030 Projected Market Size: USD 1.55 Billion

- CAGR (2025-2030): 6.7%

- North America: Largest market in 2024

Organic chocolate is often associated with fewer additives, pesticides, and preservatives, which appeals to health-conscious consumers. It is also perceived as a cleaner, more natural choice than conventional chocolate. The rising demand for products with reduced sugar content and options suitable for those with lactose intolerance or vegan diets has increased the popularity of organic chocolate offerings in recent years.

Consumers are increasingly concerned about the environmental impact of their food choices. A study by Kearney conducted in March 2022 found that around 27% of the respondents stated that they think about the environmental impact of the food purchased during grocery shopping. Organic chocolate is often marketed as being environmentally friendly because it is produced using sustainable farming practices, lowering the use of harmful chemicals and pesticides. Companies nowadays establish detailed sustainability plans to address areas such as reduction in carbon footprint, waste minimization, and transition to better-for-environment products. They also use labels that highlight the sourcing of their ingredients and the sustainability practices followed during their cultivation. Chocolate confectionery manufacturing companies conduct various marketing & promotional activities to increase the reach of their products among the targeted end-users. In addition, premium and attractive packaging of products, innovative branding activities, and promotional events increase the awareness and demand for organic chocolates among consumers.

The promising growth of the vegan and plant-based demographics has resulted in healthy sales of organic chocolate products that are dairy-free and vegan-friendly. These products cater to individuals who seek to avoid animal-derived ingredients. Furthermore, chocolate that is free from gluten, soy, and other allergens, which many organic options can fulfill, has witnessed a steady rise in popularity and sales. Organic chocolate is generally considered a premium product associated with higher quality and superior taste. Consumers seeking gourmet or artisanal chocolate items are more inclined to purchase organic varieties. Moreover, this type of chocolate is often marketed as a luxury item, which aligns with the broader trend of consumers seeking high-end, indulgent experiences in food. Factors such as growing consumerism and rising disposable incomes further strengthen the advancement of the organic chocolate confectionery industry. Several key market players are investing significantly in research and development initiatives to offer new, improved, and unique flavors to target consumers. These factors are anticipated to substantially contribute to the overall market expansion in the coming years.

Product Insights

The boxed segment accounted for the largest revenue share of 51.3% in the global organic chocolate confectionery industry in 2024. Consumers are increasingly perceiving organic chocolate as a healthier alternative to conventional chocolates, associating it with fewer artificial ingredients, pesticides, and preservatives. Manufacturers are launching boxed chocolate assortments, seen as quality gifting items, benefitting from the rising demand for healthier and more sustainable treats. Boxed offerings are often marketed as premium products suitable for gifting purposes. They are highly popular during events and holidays such as Valentine’s Day, Christmas, and Easter when consumers are willing to spend more on higher-end, artisanal products. Many premium organic chocolate brands offer customization options for boxed chocolates, allowing consumers to choose specific flavors, ingredients, or packaging, enhancing their appeal as personalized gifts.

The molded bars segment is expected to advance at the fastest CAGR in the global market from 2025 to 2030. Organic chocolates are widely available in the form of bars in an oblong or rectangular shape. These bars can be homogeneous throughout or contain layering or a mixture of nuts, fruit, caramel, nougat, and wafer. In recent years, consumers in developed economies have become increasingly health-conscious, resulting in a notable shift toward organic chocolate bars from their conventional varieties. Furthermore, chocolate bars complementing various diets, such as keto and vegan, are gaining substantial traction among consumers. The shape of the molded chocolate bar itself can influence product demand. Artisanal and creatively designed molds, such as geometric patterns, logo designs, or luxury-style shapes, add an element of exclusivity and appeal, catering to the growing trend of aesthetic packaging and experience-driven purchases.

Type Insights

The dark chocolate segment accounted for the largest revenue share in the organic chocolate confectionery industry in 2024. Dark chocolate comprises cocoa solids, cocoa butter, and sugar, with zero milk solids. Most variants, including bittersweet, semi-sweet, and sweet, contain 50-100% cocoa. This form of chocolate caters to consumers with different preferences for bitterness, ranging from those who enjoy mild dark chocolate to those who prefer a more intense and less sweet experience. For instance, Theo Chocolate, a notable company in this market, offers products that range from 55%-85% cocoa content. The fast-expanding veganism trend worldwide has highly influenced the adoption of organic dark chocolate. Unlike dark chocolate, most confectionaries use some form of milk product, making them unsuitable for the vegan demographic. Consequently, the popularity of dark chocolate confectioneries has grown significantly among this demographic.

The milk chocolate segment is anticipated to grow at a significant CAGR in the global market during the forecast period. Organic milk chocolate combines the well-known taste of traditional milk chocolate with the appeal of organic and cleaner ingredients. While milk chocolate is typically sweeter than dark chocolate, many organic brands launching these products cater to the growing demand for reduced-sugar options. Additionally, there has been a steadily expanding market for dairy-free varieties to meet the needs of lactose-intolerant individuals or those following a vegan diet. For instance, Raaka Chocolate, a U.S.-based company, produces a range of plant-based chocolate bars using ingredients such as coconut and oat milk. These offerings are kosher-, organic-, and non-GMO-certified while also being soy- and gluten-free. Similar launches by other companies are expected to widen product availability, aiding market expansion.

Distribution Channel Insights

The supermarkets/hypermarkets segment accounted for the largest revenue share in the global market for organic chocolate confectionery in 2024. Supermarkets and hypermarkets have been reliable long-term sales channels for manufacturers, owing to the high customer traffic in these outlets and the option to utilize innovative methods to promote products in such settings. The wide variety of options available and the convenience in selecting and buying processes appeal to consumers. These benefits also extend to emerging product categories such as organic chocolate confectioneries. The ability to verify these products physically, the presence of samples to build customer trust, and the availability of expert assistance are major factors contributing to high product sales through this distribution channel. To boost visibility, brands strategically position these confectioneries near checkout points that ensure higher purchase chances, particularly among impulsive buyers.

The online/e-commerce segment is expected to witness the highest growth in the global organic chocolate confectionery industry in 2024. The rapidly growing Internet penetration worldwide and rising use of smartphones have resulted in substantial sales of products through online platforms. This channel offers the advantage of high convenience during product selection and purchase and the option for same-day or next-day delivery. Online platforms further allow consumers to purchase products from other countries where the market for organic chocolate products is well-established, removing geographical constraints. Market players such as Pascha Chocolate, Theo Chocolate, and Original Beans have been aiming to sell their products through their websites to maximize profits. As the demand for organic chocolate grows, brands constantly innovate and launch new products that cater to evolving consumer preferences.

Regional Insights

The North America organic chocolate confectionery market accounted for a leading global revenue share of 36.1% in 2024. Factors such as rising awareness regarding the health benefits of this form of chocolate and the increasing environmental awareness in the region are driving the regional market growth. Organic chocolate often uses natural sweeteners such as cane sugar, coconut sugar, or stevia, which appeals to consumers looking to reduce their sugar intake. This aligns with the rising demand for low-sugar and sugar-free alternatives in the chocolate market. Manufacturers in the U.S. and Canada are also looking to incorporate processes that support fair labor practices and sustainable farming to appeal to ethically conscious consumers. Standards like USDA Organic certification in the U.S. and Canadian Organic Standards assist local manufacturers in promoting their products effectively.

U.S. Organic Chocolate Confectionery Market Trends

The U.S. organic chocolate confectionery market accounted for a dominant revenue share in North America in 2024. Growing consumer interest in healthy lifestyle practices has led to a sustained rise in the country's consumption of organic, sugar-free, and dark chocolate products. Furthermore, the high purchasing power of American consumers, coupled with the rising demand for premium confectioneries and chocolates, has aided market expansion. Sales of dark organic chocolate have witnessed strong growth due to its high cocoa content, increasing prevalence of lactose intolerance, and rising vegan population in the U.S. In addition to veganism, many consumers are transitioning towards a plant-based diet for its perceived health benefits. Organic chocolate is an appealing option for such demographics, with many brands now offering dairy-free dark chocolate to boost sales and revenue.

Europe Organic Chocolate Confectionery Market Trends

Europe accounted for a substantial revenue share in the global market for organic chocolate confectionery in 2024. The region is a major market for cocoa and contributes significantly to the organic products industry. An increasing focus on healthy lifestyles and concerns regarding sustainability in farming and production processes drives consumer interest in organic products in Europe. According to IFOAM Organics Europe, the total area in the European Union under organic production reached 16.9 million hectares in 2022, indicating strengthening policy support by national governments and the rising popularity of sustainable and high-quality food production practices. Furthermore, the region's per capita consumption of organic food items reached an average of USD 106 in the same year. These factors have created an ideal scenario for companies developing organic chocolate confectioneries to launch an extensive range of offerings and appeal to a wider demographic.

Asia Pacific Organic Chocolate Confectionery Market Trends

The Asia Pacific organic chocolate confectionery market is expected to grow at the highest CAGR during the forecast period. Increasing concerns regarding health and wellness, particularly in economies such as Japan, South Korea, Australia, and China, have made consumers more cautious about their food consumption and snacking habits. Organic chocolate confectionery, which is considered to be healthier than conventional chocolate due to its natural ingredients and absence of synthetic chemicals, has gained substantial appeal among this demographic. The fast-growing Millennial and Gen Z population presents another notable growth avenue for organic and ethical food product manufacturers, including organic chocolate. These younger consumers prioritize sustainability, transparency, and the health benefits of organic products, aiding industry expansion.

India accounted for the largest revenue share in the Asia Pacific market in 2024. The demand for organic foods in the country has increased considerably over the past few years due to rapid socio-economic development. Overall food quality, the establishment of various certifications, food safety, and information regarding nutritional value are the key reasons that Indian consumers are choosing organic food items, with this trend extending to industries such as chocolate confectionery. In recent years, there has been a noticeable growth in the number of farmers and the area involved in cocoa production. As per 2020-21 data from the Directorate of Cashewnut and Cocoa Development, Andhra Pradesh accounted for the highest annual yield of 10,903 metric tons of cocoa production, followed by Kerala with 9,647 metric tons. The increasing production volume and shift toward organic practices are expected to bring positive developments in India's organic chocolate confectionery sector.

Key Organic Chocolate Confectionery Company Insights

Some major companies involved in the global organic chocolate confectionery industry include Theo Chocolate, Green & Black’s, and Original Beans, among others.

-

Theo Chocolate is a chocolate manufacturer based in Seattle, Washington, which develops dark chocolate and milk chocolate, along with their vegan and gluten-free variants. The company sources its cocoa beans from the Democratic Republic of Congo and ensures that all ingredients are sourced to meet extensive organic and fair trade standards. Notable products Theo Chocolate offers include dark chocolate and milk chocolate bars, cups & candy, and filled chocolate products. It further sells chocolate for baking purposes and has a range of seasonal chocolate gifting options.

-

Original Beans is a chocolate company based in the Netherlands that develops chocolate bars and minibars made from ethically sourced beans. Notable offerings include Cusco 100%, Arhuaco 82%, Virunga 70%, Udzungwa 70%, Beni Wild 66%, and Esmeraldas 42%, among others. The company further sells chocolate variants for cooking and baking purposes, such as Esmeraldas Dark 65%, Femmes De Virunga 55%, and Esmeraldas Nibs 100%.

Key Organic Chocolate Confectionery Companies:

The following are the leading companies in the organic chocolate confectionery market. These companies collectively hold the largest market share and dictate industry trends.

- PASCHA CHOCOLATE CO

- Theo Chocolate, Inc.

- Rococo Chocolates London Limited

- Pana Chocolate Pty Ltd.

- Original Beans

- DOISY AND DAM

- Green & Black's

- Lake Champlain Chocolates

- Love Cocoa

- Daylesford Organic Limited

- Seed & Bean

- Taza Chocolate

- K'UL CHOCOLATE

- Alter Eco Foods

- EQUAL EXCHANGE COOP

Recent Developments

-

In October 2024, Nurture Brands announced that Doisy & Dam, its plant-based chocolate brand, had been acquired by Food Thoughts, which develops cocoa products. Doisy & Dam specializes in manufacturing ethical and sustainable plant-based chocolates, with its offerings available across various major UK-based retailers, including Ocado, Boots, and Planet Organic. Food Thoughts provides a range of fair-trade cocoa products, including organic cacao powder and chocolate-coated cacao nibs. The acquisition would help Food Thoughts expand its ethical cocoa powder brand for the snacking and home baking categories.

Organic Chocolate Confectionery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.12 billion

Revenue forecast in 2030

USD 1.55 billion

Growth Rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia, Brazil, UAE, South Africa

Key companies profiled

PASCHA CHOCOLATE CO; Theo Chocolate, Inc.; Rococo Chocolates London Limited; Pana Chocolate Pty Ltd.; Original Beans; DOISY AND DAM; Green & Black's; Lake Champlain Chocolates; Love Cocoa; Daylesford Organic Limited; Seed & Bean; Taza Chocolate; K'UL CHOCOLATE; Alter Eco Foods; EQUAL EXCHANGE COOP

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Chocolate Confectionery Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organic chocolate confectionery market report based on product, type, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Boxed

-

Molded Bars

-

Chips & Bites

-

Truffles & Cups

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dark

-

Milk

-

White

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online/E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.