- Home

- »

- Consumer F&B

- »

-

Organic Beverages Market Size, Industry Report, 2030GVR Report cover

![Organic Beverages Market Size, Share & Report]()

Organic Beverages Market (2025 - 2030) Size, Share & Analysis Report By Product (Non-dairy Beverages, Fruit Beverages, Coffee & Tea, Beer & Wine), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-702-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Organic Beverages Market Summary

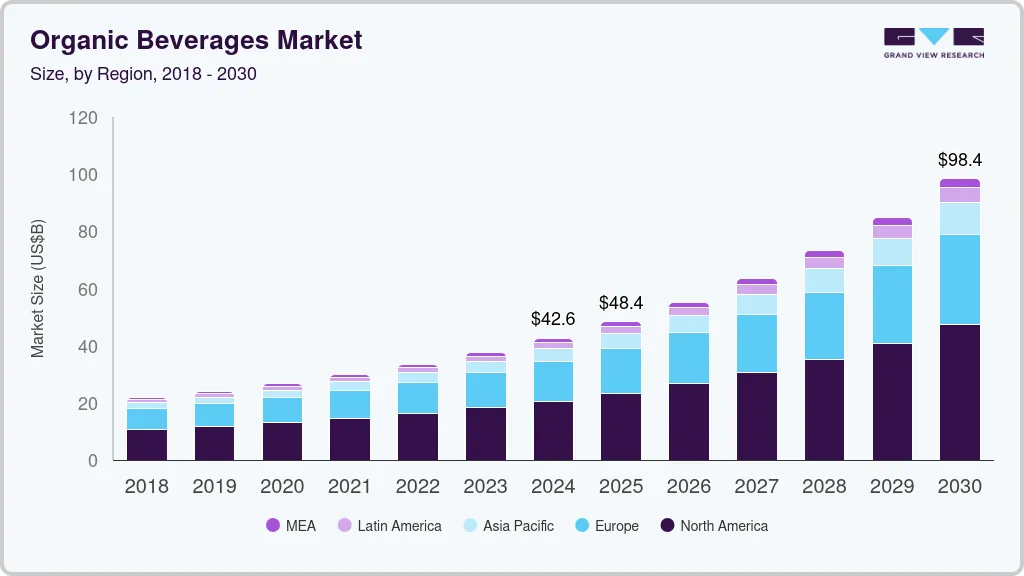

The global organic beverages market size was estimated at USD 42,555.8 million in 2024 and is projected to reach USD 98,447.1 million by 2030, growing at a CAGR of 15.3% from 2025 to 2030. Increasing awareness about the health benefits of consuming organic products is expected to drive market growth in the coming years.

Key Market Trends & Insights

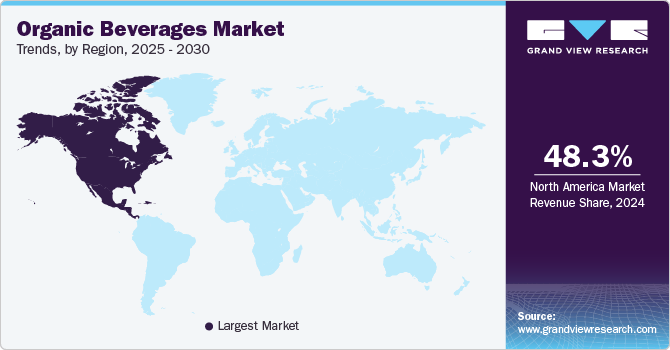

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, non dairy beverages accounted for a revenue of USD 16,628.9 million in 2024.

- Fruit Beverages is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 42,555.8 million

- 2030 Projected Market Size: USD 98,447.1 million

- CAGR (2024-2030): 15.3%

- North America: Largest market in 2024

Rising disposable income levels in developing economies are one of the factors boosting market growth. Demand for non-caffeinated, non-sugary drinks is expected to fuel the product demand over the coming years. The availability of products with new flavors and ingredients like turmeric, aloe Vera, and activated charcoal in attractive, easy-to-carry & -store packaging will also fuel the demand.

In addition, government participation in helping consumers to understand the difference between falsely labeled products and legitimate ones has also contributed toward overall market development. The government in some parts of the globe has also issued certain guidelines barring the use of chemicals, pesticides, growth hormones, and other synthetic chemicals to promote the cultivation of organic products.

The intensification of the traditional farming system has generated a need for organic farming methods to maintain healthy soil in the long run. However, the high cost of production and operations and shorter shelf life are projected to limit the market growth over the forecast years. Moreover, premium pricing of products limiting widespread customer acceptance and limited options to choose from the product assortments are hampering the market expansion. High packaging, logistics, and distribution costs to extend shelf life also restrict market growth.

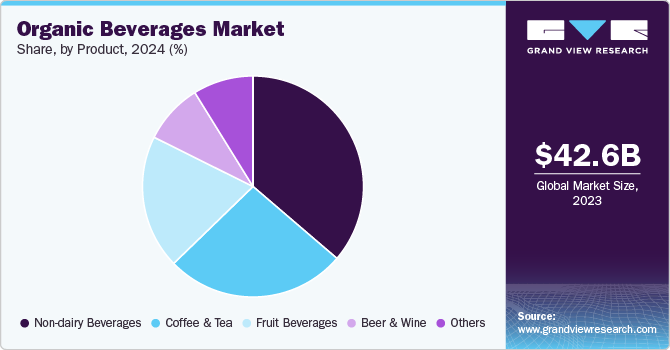

Product Insights

The non-dairy beverages segment dominated the market and accounted for the largest revenue share of 34.9% in 2024. These products are made from sources like legumes, plant materials, nuts, and cereals, and thus, act as functional drinks. Plant-based beverages, such as milk and smoothies, are expected to grow rapidly due to their nutritional properties, health benefits, and the least contribution to the global carbon footprint. These beverages are not only consumed by health-conscious people but also by lactose-intolerant consumers. The increasing trend of veganism is also promoting non-dairy beverages across the globe. According to a research study conducted by the British Nutrition Foundation (BNF) in January 2021, younger consumers aged between 18 and 40 years are more likely to choose a plant-based diet and are the primary promoter of plant-based beverage trends across the globe.

The fruit beverages segment is expected to grow at the fastest CAGR of 17.6% over the forecast period. Increasing consumer awareness about the health benefits of fruit beverages, such as their rich content of vitamins, antioxidants, and other essential nutrients, is a major driver propelling the market growth. The rising trend towards healthier lifestyles and dietary habits has also increased the demand for natural and organic fruit beverages. Furthermore, introducing innovative flavors and product varieties by major market players and better marketing strategies has attracted a broader consumer base.

Distribution Channel Insights

The offline segment dominated the market and accounted for the largest revenue share of 64.6% in 2024. The increasing number of supermarket & hypermarket chains and the altering retail landscape, particularly in developing economies, boost product sales via this channel.

The online segment is expected to grow at the fastest CAGR over the forecast period. Growing internet penetration and target marketing by companies to reach all customer touchpoints are likely to propel the segment growth. Increasing penetration of online food delivery platforms and online groceries, coupled with the surge in smartphone adoption, is further expected to increase the segment growth in the coming years.

Regional Insights

North America dominated the global organic beverages industry in 2024. This is attributed to the availability of farmlands for organic farming and growing awareness about the benefits of organic products in the region. Additionally, the rise of health-conscious lifestyles and the growing preference for clean-label products have significantly boosted the market. The presence of major market players and their continuous investment in product innovation and marketing campaigns also contribute to the robust growth of the organic beverages industry in North America. Furthermore, expanding retail channels, including online platforms and specialty stores, has made organic beverages more accessible to a wider audience.

U.S. Organic Beverages Market Trends

The U.S. organic beverages industry is expected to grow significantly over the forecast period. Well-established distribution networks, including hypermarkets, supermarkets, and online channels, ensure that the products are easily accessible to consumers. The growing trend of health and wellness, coupled with the increasing disposable income, has further fueled the market’s expansion in the U.S.

Asia Pacific Organic Beverages Market Trends

The Asia Pacific organic beverages industry was identified as a lucrative region in 2024. The region’s increasing urbanization and population have increased the demand for healthy beverages. Changing dietary preferences and rising disposable incomes have further boosted the consumption of fruit beverages.

Europe Organic Beverage Market Trends

The Europe organic beverages industry is expected to grow at a CAGR of 14.8% over the forecast period. This is attributed to the increasing number of health-conscious consumers across the region. The demand for organic and clean-label fruit beverages is strong as consumers become more aware of the benefits of organic ingredients.

Key Organic Beverage Company Insights

Some key players in the market are Uncle Matt's Organic, Parker’s Organic Juices, Danone S.A., and others. Key factors influencing competition include product innovation, certification standards, and strategic alliances to capture a share of the expanding market driven by increasing consumer demand for organic and sustainable choices.

-

Uncle Matt's Organic is USDA Certified Organic and offers organic juices & teas. Its product portfolio of juices includes 52 oz Organic Juices, 12 oz Organic Juices, 2 oz Organic Juice Shots, 6.75 oz Organic Juice Boxes.

Key Organic Beverage Companies:

The following are the leading companies in the organic beverage market. These companies collectively hold the largest market share and dictate industry trends.

- Uncle Matt's Organic, Inc.

- Boncafe International Pte. Ltd.

- Parker’s Organic Juices

- Hain Celestial

- Bison Organic Beer

- Belvoir Fruit Farms Ltd.

- The Whitewave Foods Company.

- The Coca-Cola Co.

- PepsiCo, Inc.

- Danone S.A.

Recent Developments

-

In January 2024, Suja Organic announced the launch of its new line of Suja Organic Protein Shakes, marking its entry into the ready-to-drink protein market. These shakes offer 16 grams of plant-based protein derived from rice, pea, and hemp and are available in chocolate, coffee bean, and vanilla cinnamon flavors. Each 200-calorie shake includes almond milk, coconut cream, 3-4 grams of Acacia fiber, and essential vitamins and minerals, providing convenient and nutritious options for consumers.

-

In May 2023, Topo Chico launched a line of fruit-flavored sparkling waters with herbal extracts, available in three bold, unique flavors: lime with mint extract, blueberry with hibiscus extract, and tangerine with ginger extract.

-

In March 2022, Uncle Matt’s Organic launched Matt50 Orange Juice Beverage. The beverage contains half the sugar and calories of regular orange juice and is enriched with 100% DV vitamin C, prebiotics, and probiotics to support gut health and the immune system.

-

In March 2022, Uncle Matt’s Organic launched two new offerings for kids: No Sugar Added Lemonade Juice Box and No Sugar Added Strawberry Lemonade Juice Box. The shelf-stable range contains organic Reb M Stevia with zero calories, eliminating the health concerns associated with artificial sweeteners.

Organic Beverages Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 48.35 billion

Revenue forecast in 2030

USD 98.45 billion

Growth Rate

CAGR of 15.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Distribution Channel, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Brazil, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Uncle Matt's Organic, Inc.; Boncafe International Pte. Ltd.; Parker’s Organic Juices; Hain Celestial; Bison Organic Beer; Belvoir Fruit Farms Ltd.; The Whitewave Foods Company.; The Coca-Cola Co.; PepsiCo, Inc; Danone S.A.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Organic Beverages Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global organic beverages market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Non-dairy Beverages

-

Fruit Beverages

-

Coffee & Tea

-

Beer & Wine

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.