Organic Baby Shampoo Market Size, Share & Trends Analysis Report By Distribution Channel (Hypermarket & Supermarket, Pharmacies & Drug Stores, E-commerce), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-859-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Organic Baby Shampoo Market Trends

The global organic baby shampoo market size was valued at USD 668.5 million in 2024 and is projected to grow at a CAGR of 7.9% from 2025 to 2030. Organic baby products have gained substantial traction among parents seeking to protect their babies from the harmful effects of synthetic chemicals present in conventional products. These products often contain ingredients including sulfates, parabens, phthalates, and synthetic fragrances, which can cause skin irritation and other health concerns. As awareness about the potentially harmful effects of these ingredients grows, many parents are opting for organic baby shampoos, which are formulated with natural, non-toxic ingredients and are generally free from chemicals and preservatives. As a result, the organic baby shampoo industry has witnessed promising growth.

The increasing use of plant-based ingredients by cosmetic and personal care companies is further expected to drive substantial growth in the global market. Ingredients such as calendula, aloe, and chamomile, which do not contain any recognized skin irritants, are being widely incorporated into these products to appeal to health-conscious consumers. An infant's skin is more sensitive than adult skin, thus requiring the application of safe products that contain certified and high-quality organic ingredients. According to a blog by Kids Clinic, around 80% of eczema (atopic dermatitis) cases are observed in children between 3 months and 6 years of age. As a result, consumers are moving away from products that can increase the severity of such skin conditions or lead to the development of new ones. Organic baby shampoos are considered safer because they use gentle, plant-based ingredients that are less likely to cause skin irritation or allergic reactions.

With growing environmental awareness, many consumers are choosing organic products as part of their broader interest in sustainability. Organic baby shampoos are often made with natural, plant-based ingredients and are available in eco-friendly packaging, which appeals to eco-conscious parents. Certification labels, such as "Certified Organic" or "Made with Organic Ingredients," further help solidify consumer trust in these products. Organic baby shampoos focus on their safety, hypoallergenic properties, and dermatologically tested formulations, making them appealing to new parents. The use of social media channels such as Instagram and TikTok further enables brands to increase the visibility of their products. Influencers, parenting bloggers, and experts often recommend organic baby products to their audience, boosting their popularity. The availability of positive reviews and testimonials further contributes to consumer confidence in choosing such shampoos.

Distribution Channel Insights

The hypermarket & supermarket segment accounted for the largest revenue share of 39.2% in the global organic baby shampoo industry in 2024. Sales of these products through hypermarkets and supermarkets have witnessed strong growth, driven by increasing consumer demand for natural and organic products, particularly in the baby care category. These retail channels are profitable in reaching a broader consumer base, as they offer high convenience, accessibility, and competitive pricing. Supermarkets and hypermarkets offer a wide selection of baby care products, including organic baby shampoos, to appeal to modern parents who are aware of the harms of chemical-based baby care items. A substantial proportion of this demographic prefers to shop in these stores because they trust the availability of safe and quality products.

The e-commerce segment is expected to grow at the fastest CAGR from 2025 to 2030 in the organic baby shampoo industry. The rising consumer preference for convenience in their buying habits, increased awareness regarding product ingredients, and the strong demand for natural and organic baby care products are factors aiding segment expansion. Consumers can easily browse, compare, and purchase organic baby shampoos from the comfort of their homes. This convenience is especially important for working parents, as online shopping saves substantial time and effort when compared to physically visiting stores. E-commerce platforms such as Amazon, Walmart, Target, and specialized organic product retailers often carry a broader range of brands, formulations, and sizes than physical retail stores. Parents can choose from different product lines based on their preferences for organic certification, ingredients, scent, and packaging.

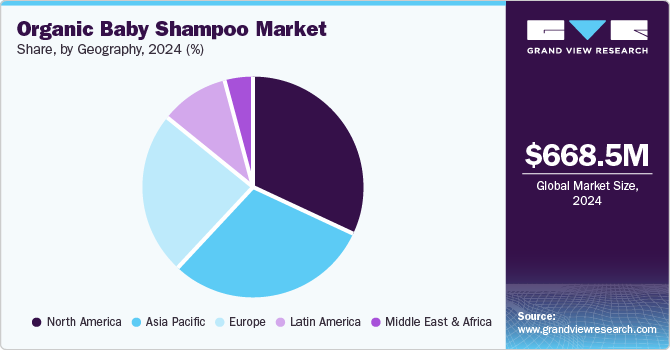

Regional Insights

The North America organic baby shampoo market accounted for the largest revenue share of 32.3% globally in 2024. The demand for organic baby shampoo in the region is rapidly increasing, driven by changing consumer preferences toward health, safety, and sustainability. This trend is particularly notable in the United States and Canada, where parents increasingly seek natural, non-toxic alternatives for baby care products. A growing proportion of millennial parents in these economies are tech-savvy and highly informed about product ingredients. These parents are more likely to research and choose products that align with their values, such as organic, eco-friendly, and cruelty-free products. The well-established e-commerce sector further presents notable growth avenues for the regional market.

U.S. Organic Baby Shampoo Market Trends

The U.S. accounted for a dominant revenue share in the regional market in 2024, aided by increasing product demand among target users, particularly younger and working parents. Moreover, celebrity endorsements and social media influence have had a significant impact on the popularity of organic baby care products. Influencers and well-known figures in the parenting and wellness spaces often promote organic and natural baby care products to their followers. As a result, organic baby shampoo brands gain visibility and credibility, which helps drive demand. Organic certifications such as USDA Organic or Non-GMO Project Verified are increasingly being sought by parents who want assurance that the products they use are genuinely organic and free from harmful chemicals.

Europe Organic Baby Shampoo Market Trends

Europe accounted for a substantial revenue share in the global organic baby shampoo industry in 2024, driven by health and safety concerns among parents, cultural preferences for natural products, increasing environmental awareness, and higher disposable income levels. Major economies, particularly in Western Europe, have witnessed strong sales in this industry in recent years. For instance, Germany has a well-established demand for organic baby care products. These items are commonly available in pharmacies, health stores, and supermarkets, and German parents are highly receptive to organic alternatives. Meanwhile, in the UK, the extensive presence of brands such as Odylique and Green People has created widespread awareness regarding organic products and their ingredients.

Asia Pacific Organic Baby Shampoo Market Trends

Asia Pacific is anticipated to grow at the fastest CAGR in the global market for organic baby shampoo from 2025 to 2030. The region has a large and diverse population base, with increasing disposable income levels, urbanization, and heightened awareness of health and wellness trends. As disposable incomes grow, particularly in emerging regional markets such as China and India, there is a willingness to spend more on premium products, including organic baby shampoos. The middle class in these economies is expanding rapidly, and parents are more inclined to invest in higher-quality, safer, and more sustainable products for their children. Furthermore, regional governments are increasingly focusing on implementing stringent regulations regarding product sourcing and usage across different sectors, compelling market players to launch chemical-free and safe products.

China accounted for a dominant revenue share in the Asia Pacific organic baby shampoo market in 2024. China has witnessed significant exposure to global trends, particularly through the Internet and social media, which has positively impacted consumer behavior. An increasing number of Chinese parents are following international health trends, including the preference for organic and natural products. Social media platforms, including WeChat, Weibo, and Douyin (TikTok), have also made it easier for consumers to learn about and purchase organic baby shampoo brands from abroad, particularly from countries such as the U.S., Germany, Japan, and South Korea, where the market for organic products is well-established.

Key Organic Baby Shampoo Company Insights

Some major companies involved in the global organic baby shampoo industry include Johnson & Johnson, Unilever, and Earth Mama Organics, among others.

-

Johnson & Johnson develops, manufactures, and sells medical devices, pharmaceuticals, and consumer products. The company offers a range of personal care products formulated for infants under its Johnson’s Baby division, including hair care products, bubble bath, oils, powders, baby lotions, baby wash, and wipes. Johnson & Johnson states that 96% of their formulas have natural origins, as defined by the guidelines from the International Organization for Standardization (ISO).

-

Earth Mama Organics manufactures and sells herbal care products specialized for pregnant and breastfeeding women, babies, and children. The company offers a range of solutions for babies and kids, including diaper balm, soap, oil & lotion, sunscreen, and eczema relief products. Under the eczema relief segment, Earth Mama Organics has developed products such as Eczema Cream, Uber-Sensitive Mineral Sunscreen Lotion, Simply Non-Scents Baby Wash, and Simply Non-Scents Baby Lotion.

Key Organic Baby Shampoo Companies:

The following are the leading companies in the organic baby shampoo market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson & Johnson Services, Inc.

- The Clorox Company

- Himalaya Wellness Company

- Amishi Consumer Technologies Private Limited

- Unilever

- Galderma laboratories, L.P.

- Earth Mama Organics

- Pigeon Corporation

- Expanscience Laboratoires

- Beiersdorf AG

View a comprehensive list of companies in the Organic Baby Shampoo Market

Recent Developments

-

In October 2024, Mothercare plc, which manufactures products for young children and parents, announced the formation of a joint venture (JV) with Reliance Brands Holding UK Limited (RBL UK), a subsidiary of Reliance Brands Limited. As per the deal, RBL UK will have majority ownership of the Mothercare brand as well as its intellectual property (IP) assets related to India, Bhutan, Sri Lanka, Nepal, and Bangladesh markets. The new venture would be responsible for ensuring brand consistency and optimal customer engagement in these regions.

-

In June 2024, Mustela announced the launch of its Mustela Bébé range of baby products that contain, on average, 92% natural ingredients and have been formulated to be free of phthalates, parabens, and phenoxyethanol. These products leverage the active ingredient Perseose, which is present in avocados, to help the skin of infants strengthen and protect it from daily stress due to external environments.

Organic Baby Shampoo Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 716.6 million |

|

Revenue forecast in 2030 |

USD 1,050.5 million |

|

Growth Rate |

CAGR of 7.9% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil |

|

Key companies profiled |

Johnson & Johnson Services, Inc.; The Clorox Company; Himalaya Wellness Company; Amishi Consumer Technologies Private Limited; Unilever; Galderma laboratories, L.P.; Earth Mama Organics; Pigeon Corporation; Expanscience Laboratoires; Beiersdorf AG |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Organic Baby Shampoo Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global organic baby shampoo market report based on distribution channel and region:

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket & Supermarket

-

Pharmacies & Drug Stores

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."