- Home

- »

- Consumer F&B

- »

-

Orange Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Orange Market Size, Share & Trends Report]()

Orange Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Fresh Orange, Processed Orange), By Application (Food & Beverage, Pharmaceuticals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-485-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Orange Market Summary

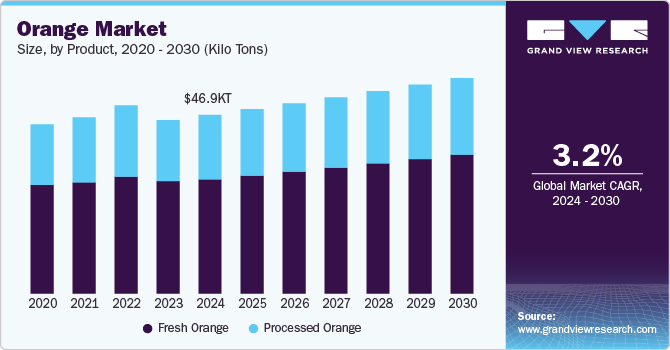

The global orange market size was estimated at 46,969 kilo tons in 2023 and is projected to reach 58,380 kilo tons by 2030, growing at a CAGR of 3.2% from 2024 to 2030. This growth is largely driven by heightened consumer awareness of the health benefits associated with oranges, including their rich vitamin C content and antioxidant properties.

Key Market Trends & Insights

- North America dominated the global market with the largest revenue share, and is expected to grow at a CAGR of 2.5% during the forecast period.

- The U.S. led the North America market and held the largest revenue share in 2023.

- By product, the fresh segment led the market, holding the largest revenue share over 30,000 kilo tons in 2023.

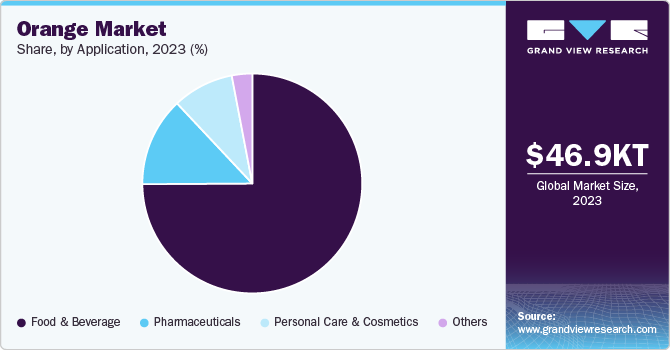

- By application, the food and beverage were the largest application for oranges, and total consumption exceeded 35,000 kilo tons in 2023.

Market Size & Forecast

- 2023 Market Size: 46,969 Kilo Tons

- 2030 Projected Market Size: 58,380 Kilo Tons

- CAGR (2024-2030): 3.2%

- North America: Largest market in 2023

Oranges are rich in vitamin C, folate, and dietary fiber, which have made them a staple for health-conscious consumers. This growing awareness is driving demand not only for fresh oranges but also for processed products such as juices, marmalades, and essential oils used in various industries, including food and cosmetics.

The growing demand for orange juice has also positively contributed to market growth. As more individuals seek quick and nutritious beverage options, orange juice has emerged as a popular choice due to its high vitamin C content and perceived health benefits, such as immune support and antioxidant properties. Moreover, innovations in packaging and product offerings have made orange juice more accessible and appealing to consumers.

The introduction of innovative blends and flavors has also contributed to premiumization. Brands are diversifying their product lines to include not-from-concentrate (NFC) juices, which are perceived as fresher and more authentic. This shift towards authenticity and quality resonates with consumers who prioritize natural and clean-label products. In addition, the development of fortified orange juices enriched with vitamins and minerals caters to health-focused consumers looking for added benefits.

The trend towards premiumization has led to a rise in demand for organic, cold-pressed, and freshly squeezed juices, which cater to health-conscious buyers looking for natural products with minimal processing. Younger consumers, particularly millennials, are driving the demand for premium beverages. They tend to favor products with high-quality ingredients, unique flavors, and ethical production methods. As their purchasing power increases, their preference for premium options is expected to shape the market further. The rise of ready-to-drink (RTD) options has made premium orange juice more accessible to consumers with busy lifestyles. Innovations in packaging have led to convenient single-serve formats that cater to on-the-go consumption, making it easier for consumers to choose premium beverages without sacrificing convenience.

The expansion of distribution channels, including supermarkets, convenience stores, and online platforms, has further facilitated access to these products, driving consumption rates higher. In addition to health trends, the market is benefiting from advancements in agricultural practices and technology, which enhance production efficiency and sustainability. The Asia-Pacific region, particularly countries like China and India, is expected to contribute significantly to this growth due to rising populations and increasing health consciousness among consumers. Cultural factors also play a role; for instance, in some Asian cultures, oranges are associated with good luck, further boosting demand.

Moreover, the trend towards organic farming is gaining traction as consumers increasingly prefer fruits grown without synthetic pesticides and fertilizers. This shift not only caters to health-conscious buyers but also aligns with broader environmental sustainability goals. Despite these positive trends, challenges such as fluctuating raw material prices and seasonal production variability continue to impact the market dynamics.

One of the primary challenges is the increasing frequency of climate change-induced extreme weather events. Fluctuations in temperature, precipitation patterns, and occurrences of droughts or floods can severely affect orange production. These environmental factors can lead to reduced yields and compromised fruit quality, making it difficult for producers to meet market demand.

The cultivation and processing of oranges involves significant investments in land, labor, water, and agricultural inputs. The capital-intensive nature of extracting and packaging orange juice adds another layer of financial burden. These high production costs can deter new entrants into the market and limit the expansion opportunities for existing producers. In addition, in some regions, restrictions on importing oranges in large quantities can create a demand-supply gap. This limitation can hinder market growth by preventing consumers from accessing a consistent supply of oranges, particularly in areas where local production is insufficient.

Product Insights

Fresh oranges consumption was the highest and exceeded 30,000 kilo tons in 2023. The fresh orange segment is experiencing notable growth driven by several key factors that align with changing consumer preferences and health trends. One of the primary drivers is the increasing awareness of the health benefits associated with oranges, particularly their high vitamin C content and antioxidant properties. As consumers become more health-conscious, the demand for fresh oranges as a nutritious snack and ingredient in various products, including juices and supplements, has surged. This trend is further supported by the versatility of oranges in culinary applications, making them a staple in both home cooking and food processing industries.

In addition to health awareness, advancements in agricultural practices have significantly boosted production capabilities. Improved irrigation techniques, soil management, and pest control measures have led to higher crop yields and more consistent supply. Investments in research and development aimed at creating disease-resistant varieties also contribute to enhanced productivity. Furthermore, effective supply chain management, including better transportation infrastructure and cold storage facilities, minimizes post-harvest losses and ensures that fresh oranges reach consumers efficiently.

Seasonal consumption patterns also play a crucial role in market dynamics. Fresh oranges are particularly popular during winter months when they are in peak season, aligning with consumer preferences for healthy snacks during this time. In addition, the growing popularity of supermarkets and convenience stores as primary retail channels facilitates easier access to fresh oranges, catering to diverse consumer needs.

Geographically, regions like North America have shown strong market performance due to favorable climatic conditions for orange cultivation and robust consumer demand. Brazil remains a significant player in both production and export markets, capitalizing on its extensive citrus groves. Emerging markets in Asia-Pacific are also contributing to growth, driven by rising demand for fresh oranges and related products in countries like India and China.

The other key product was processed orange, which is used to make multiple products such as juice, paste, syrups, and concentrated. The demand for orange juice concentrate and fresh orange juice reflects distinct consumer preferences and market dynamics. Fresh orange juice is often favored for its perceived health benefits and natural taste, as it retains more of the fruit's nutrients and flavors due to minimal processing. Many consumers prefer fresh juice for its freshness and higher vitamin C content, which can degrade during the concentration process. This preference is particularly strong among health-conscious individuals who seek beverages rich in vitamins and antioxidants to support their well-being.

Conversely, orange juice concentrate has gained popularity due to its convenience, longer shelf life, and cost-effectiveness. The concentrate is produced by removing most of the water content from the juice, making it easier to transport and store. This process allows manufacturers to offer a more affordable product, appealing to budget-conscious consumers. In addition, the rise of busy lifestyles has led to increased demand for convenient food and beverage options, positioning juice concentrates as a practical choice for many households.

Application Insights

Food and beverage were the largest application for oranges, and total consumption exceeded 35,000 kilo tons in 2023. The demand for oranges in the food and beverage industry is driven by several key factors that reflect changing consumer preferences and market trends. One of the primary drivers is the increasing consumer awareness regarding the health benefits associated with orange products, particularly orange juice. Another significant driver is the shift towards convenience and ready-to-drink (RTD) products, which cater to modern lifestyles. The demand for single-serve packaging and portable options has surged, making it easier for consumers to enjoy orange juice on the go. Innovations in packaging technology have further enhanced the appeal of orange juice products, making them more accessible to a wider audience. In addition, the trend towards organic and fortified orange juices is gaining traction, as consumers increasingly prefer products that are free from artificial additives and offer enhanced nutritional benefits.

Sustainability also plays a crucial role in driving demand within the food and beverage sector. Companies are adopting eco-friendly practices in their production and packaging processes to meet consumer expectations for environmentally responsible products. This focus on sustainability aligns with broader health and wellness trends and is expected to further propel market growth.

The fastest-growing applications of oranges in the cosmetics industry are primarily centered around orange extracts, orange peel powder, and hesperidin, a bioactive compound derived from orange peels. Orange extracts are increasingly popular due to their refreshing aroma and beneficial properties, making them key ingredients in a variety of skincare products, including creams, lotions, and serums. The global market for orange extracts is projected to grow significantly as consumers increasingly seek natural and botanical ingredients that promote skin health.

The orange peel powder segment is also experiencing rapid growth, driven by its high vitamin C content and antioxidant properties. This powder is often used in face masks, scrubs, and other skincare formulations aimed at brightening the complexion, reducing dark spots, and providing anti-aging benefits. Its versatility allows it to be incorporated into a wide range of cosmetic products, appealing to health-conscious consumers who prefer clean-label options.

In addition, hesperidin is gaining attention for its potential applications in skincare. Known for its anti-inflammatory and antioxidant properties, hesperidin can help enhance skin barrier function, combat UV damage, and improve overall skin texture. As research continues to uncover the benefits of this compound, its incorporation into sustainable skincare formulations is expected to rise.

Orange is also being used in the pharmaceutical industry and is expected to grow at a CAGR of 3.6% from 2024 to 2030. Orange extracts are increasingly recognized for their potential health benefits, particularly in the development of nutraceuticals and dietary supplements. These extracts can be formulated into products that support immune health, enhance cardiovascular function, and provide antioxidant properties. For instance, recent research has highlighted the ability of orange peel extracts to inhibit harmful compounds associated with cardiovascular disease, demonstrating their therapeutic potential in heart health management.

Hesperidin, specifically, has garnered attention for its anti-inflammatory and antibacterial properties, making it a promising ingredient in skincare pharmaceuticals. Studies suggest that hesperidin can aid in wound healing and may be effective against conditions such as hyperpigmentation and skin aging. Its ability to scavenge free radicals and suppress pro-inflammatory cytokines positions it as a valuable bioactive compound for various therapeutic applications.

Regional Insights

The North America orange market is expected to grow at a CAGR of 2.5% over the forecast period. One of the primary factors is the growing health consciousness among consumers, who increasingly seek nutritious options rich in vitamins and antioxidants. The U.S. orange market consumption was 2,182 kilotons in 2023. Oranges, particularly sweet varieties, are favored for their high vitamin C content and perceived health benefits, which has led to a steady increase in demand for fresh oranges and orange juice products. Favorable climatic conditions in key producing states like Florida and California also play a crucial role in sustaining orange production. These regions benefit from ideal growing conditions that support the cultivation of various orange varieties, including Navel and Valencia oranges. Additionally, advanced agricultural practices have enhanced yield and fruit quality, contributing to a robust supply chain that meets consumer demand.

U.S. Orange Market Trends

The U.S. orange market consumption was 2,182 kilo ton in 2023. One of the primary factors is the growing health consciousness among consumers, who increasingly seek nutritious options rich in vitamins and antioxidants. Oranges, particularly sweet varieties, are favored for their high vitamin C content and perceived health benefits, which has led to a steady increase in demand for fresh oranges and orange juice products. Favorable climatic conditions in key producing states like Florida and California also play a crucial role in sustaining orange production. These regions benefit from ideal growing conditions that support the cultivation of various orange varieties, including Navel and Valencia oranges. In addition, advanced agricultural practices have enhanced yield and fruit quality, contributing to a robust supply chain capable of meeting consumer demand.

The diversification of product offerings further drives market growth. The popularity of orange-based products-ranging from juices and snacks to dietary supplements-has expanded consumer choices and increased consumption rates. Moreover, the rise of e-commerce and retail channels provides greater accessibility to these products, catering to diverse consumer preferences across different demographics.

Asia Pacific Orange Market Trends

The Asia Pacific orange market is primarily driven by increasing consumer demand for healthy and nutritious products, favorable climatic conditions for cultivation, and expanding applications in various industries. China stands out as the leading producer and consumer of oranges in the region, accounting for approximately 28.66% of global citrus production. The country's production is expected to reach 7.6 million metric tons in the 2022-2023 season, reflecting a growing domestic appetite for fresh oranges and orange-based products. This rising demand is not only fueled by health trends but also by the popularity of orange-flavored beverages, particularly among younger consumers seeking refreshing and nutritious drink options.

India orange market is anticipated to grow at a lucrative rate over the forecast period. India also plays a significant role in the regional market, being one of the top producers of citrus fruits. The increasing awareness of the health benefits associated with oranges, such as their high vitamin C content, has led to a shift in consumer preferences towards natural and organic products. In addition, the expansion of food processing industries in both China and India is driving the demand for orange extracts and powders, which are utilized in a variety of applications ranging from snacks to dietary supplements.

The Australian orange market contributes to regional growth by exporting significant quantities of oranges to Asian markets, particularly China and Japan. As these countries enhance their cold storage and transportation capabilities, they are better positioned to meet rising consumer demand for quality citrus products.

Latin America Orange Market Trends

The Latin America market for oranges is expected to show robust growth over the forecast period. The Brazilian market for processed oranges is experiencing significant growth driven by several key factors. As the world's largest producer of oranges, Brazil utilizes over 70% of its harvested oranges for juice production, which highlights the importance of this sector to its economy. The demand for processed orange products, particularly orange juice and concentrates, is increasing at a rate of about 10% per year, reflecting a strong consumer preference for convenient and nutritious beverage options. This trend is supported by rising health consciousness among consumers, who are increasingly seeking natural and vitamin-rich products.

Brazil's favorable climatic conditions and advanced agricultural techniques contribute to high-quality orange production. The country's Citric Belt, primarily located in São Paulo, provides optimal growing conditions that enhance both yield and fruit quality. Furthermore, innovations in processing technology have improved the efficiency and sustainability of orange juice production, allowing manufacturers to meet growing domestic and international demand.

The expanding export market also plays a crucial role in driving growth. Despite recent fluctuations in export volumes due to limited supply, Brazil remains a key player in the global orange juice market, with a significant share of exports going to North America and Europe. The increasing popularity of not from concentrate (NFC) juices is particularly noteworthy, as this segment now represents nearly 50% of Brazilian juice exports, catering to consumer preferences for fresh-tasting products.

Key Orange Company Insights

The competitive landscape for the market for oranges is characterized by a diverse array of players and significant regional dynamics, reflecting the growing demand for both fresh and processed orange products. In terms of key competitors, several prominent companies dominate the market. Major players include Dole Food Company Inc., Fresh Del Monte Produce Inc., Sunkist Growers Inc., and Wonderful Citrus, which are well-established in both domestic and international markets. These companies leverage their extensive distribution networks and brand recognition to maintain competitive advantages. In addition, Citrosuco and Louis Dreyfus Company are significant players in the processed orange segment, focusing on juice concentrates and other value-added products.

Key Orange Companies:

The following are the leading companies in the orange market. These companies collectively hold the largest market share and dictate industry trends.

- Berje Inc

- Citrosuco

- Citrus World Inc.

- Hyatt Fruit Co.

- INDIAN RIVER FRUIT Co.

- LEMONCONCENTRATE SLU

- Nielsen Citrus Products Co. Inc.

- Paradise Juice Pvt. Ltd

- Perricone Farms

- Schacht Groves

- SEQUOIA ORANGE Co. Inc

- SUNRISE FRUITS COMPANY SL

- The Fruit Co.

- Trinity Fruit Co.

Orange Market Report Scope

Report Attribute

Details

Market size value in 2024

48,425 kilo tons

Volume forecast in 2030

58,380 kilo tons

Growth rate (volume)

CAGR of 3.2% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilo tons and CAGR from 2024 to 2030

Report coverage

Volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, Germany, UK, France, Italy, Poland, China, Japan, India, Australia & New Zealand, South Korea, Brazil, Egypt

Key companies profiled

Berje Inc; Citrosuco; Citrus World Inc.; Hyatt Fruit Co.; INDIAN RIVER FRUIT Co.; LEMONCONCENTRATE SLU; Nielsen Citrus Products Co. Inc.; Paradise Juice Pvt. Ltd; Perricone Farms; Schacht Groves; SEQUOIA ORANGE Co. Inc; SUNRISE FRUITS COMPANY SL; The Fruit Co.; Trinity Fruit Co.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Orange Market Report Segmentation

This report forecasts volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global orange market report based on product, application, and region:

-

Product Outlook (Volume, Kilo Tons, 2018 - 2030)

-

Fresh Orange

-

Processed Orange

-

-

Application Outlook (Volume, Kilo Tons, 2018 - 2030)

-

Food & Beverage

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilo Tons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Poland

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Egypt

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global orange market was 46,969 kilo tons in 2023 and is expected to reach 48,425 kilo tons in 2024.

b. The global orange market is expected to expand at a compound annual growth rate (CAGR) of 3.2% from 2024 to 2030 to reach USD 58,380 kilo tons by 2030.

b. Fresh oranges consumption was the highest and exceeded 30,000 kilo tons in 2023. The fresh orange market is experiencing notable growth driven by several key factors that align with changing consumer preferences and health trends. One of the primary drivers is the increasing awareness of the health benefits associated with oranges, particularly their high vitamin C content and antioxidant properties.

b. Some of the key players operating in the orange market include Berje Inc; Citrosuco; Citrus World Inc.; Hyatt Fruit Co.; INDIAN RIVER FRUIT Co.; LEMONCONCENTRATE SLU; Nielsen Citrus Products Co. Inc.; Paradise Juice Pvt. Ltd; Perricone Farms; Schacht Groves; SEQUOIA ORANGE Co. Inc; SUNRISE FRUITS COMPANY SL; The Fruit Co.; Trinity Fruit Co.

b. This growth is largely driven by heightened consumer awareness of the health benefits associated with oranges, including their rich vitamin C content and antioxidant properties. Oranges are rich in vitamin C, folate, and dietary fiber, which have made them a staple for health-conscious consumers. This growing awareness is driving demand not only for fresh oranges but also for processed products like juices, marmalades, and essential oils used in various industries including food and cosmetics.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.