- Home

- »

- Medical Devices

- »

-

Oral Appliances Market Size, Share & Growth Report, 2030GVR Report cover

![Oral Appliances Market Size, Share & Trends Report]()

Oral Appliances Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Tongue Retaining Devices, Hybrid Devices), By Indication, By End-use, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-407-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oral Appliances Market Summary

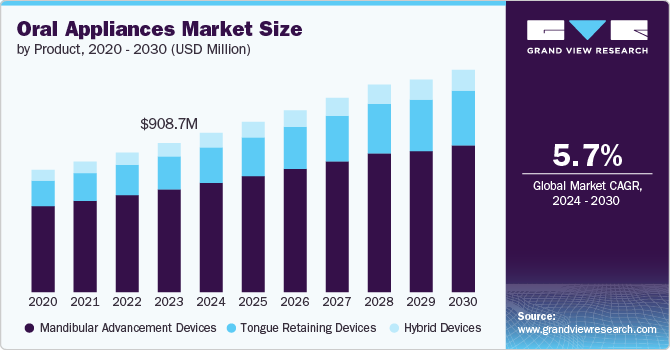

The global oral appliances market size was estimated at USD 908.7 million in 2023 and is projected to reach USD 1.4 billion by 2030, growing at a CAGR of 5.72% from 2024 to 2030. This growth is attributed to the increasing awareness of sleep disorders, rising prevalence of obstructive sleep apnea, and growing demand for non-invasive treatment options.

Key Market Trends & Insights

- The North America oral appliances market held the dominant global revenue share in 2023.

- The U.S. accounted for the largest market share in 2023.

- Based on product, the mandibular advancement devices (MADs) segment dominated the market with the largest revenue share of 69.0% in 2023.

- Based on distribution channel, the direct-to-consumer (DTC) segment dominated the market with the largest revenue share in 2023.

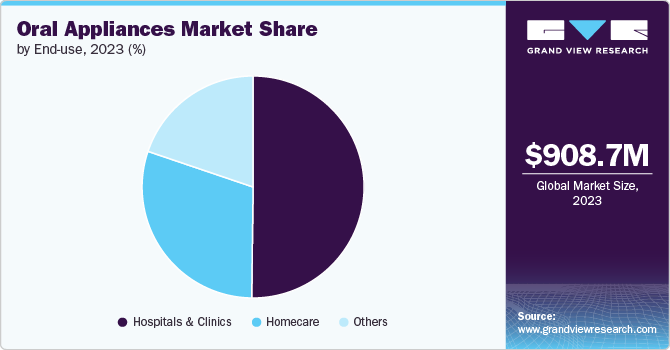

- Based on end use, the hospitals & clinics segment dominated the market with the largest revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 908.7 Million

- 2030 Projected Market Size: USD 1.4 Billion

- CAGR (2024-2030): 5.72%

- North America: Largest market in 2023

The market is also bolstered by advancements in technology, improved product designs offering greater comfort, and increased focus on oral health. In addition, favorable reimbursement policies and the presence of key market players contribute to the expansion of this market.

The increasing prevalence of sleep disorders, such as obstructive sleep apnea (OSA), is significantly driving the growth of the market. As of October 2023, National Council on Aging data indicates that OSA, characterized by irregular breathing and reduced oxygen supply to the brain, affects about 39 million adults in the U.S. and an estimated 936 million adults globally.

The high prevalence of sleep apnea in an elderly population often goes undiagnosed due to factors like lack of awareness and non-specific symptoms. With the global population aged 60 and above projected to reach 2 billion by 2050 and the elderly population expected to double from 12% to 22%, the incidence of sleep disorders, particularly OSA, is on the rise. OSA affects 13% to 32% of individuals aged 65 and above. The growing geriatric population's vulnerability to sleep apnea is expected to drive the adoption of oral appliances.

Furthermore, as awareness of the health risks associated with untreated sleep disorders rises, more patients are seeking effective treatment options. Oral appliances, known for their convenience and effectiveness in managing sleep apnea, are becoming a preferred choice for both patients and healthcare providers. This surge in demand is further fueled by advancements in oral appliance technology, making these devices more comfortable and accessible. Consequently, the market is experiencing robust growth, propelled by the urgent need to address the widespread issue of sleep disorders.

The COVID-19 pandemic significantly impacted the oral appliances industry, particularly in the fields of dentistry and sleep medicine. With the onset of the pandemic, many dental practices faced temporary closures or reduced operations, leading to a decline in routine and elective procedures, including those involving oral appliances. This disruption affected the market as patient visits for sleep apnea and other conditions requiring oral devices were postponed or canceled.

In addition, the focus on urgent care and the implementation of infection control measures redirected resources and attention away from elective treatments. On the other hand, the pandemic also accelerated the adoption of telehealth and remote consultations, facilitating increased access to diagnosis and management of conditions like obstructive sleep apnea. As the healthcare system adapts to post-pandemic norms, there is a growing emphasis on integrating digital solutions and enhancing patient care through innovative oral appliance technologies.

The transition from PAP devices to oral appliances is driven by a combination of enhanced comfort, ease of use, positive clinical outcomes, and patient satisfaction. Feedback from lapsed PAP users highlights the effectiveness of oral appliances in improving sleep quality and overall user experience. This shift indicates a strong user preference for oral appliances, contributing to their increasing market adoption. These insights provide a solid foundation for understanding the adoption trends and patient preferences in the market.

Increasing Preference for Comfort and Convenience

-

Trend Insight: One of the primary reasons lapsed PAP (Positive Airway Pressure) users are transitioning to oral appliances is the comfort and convenience offered by these devices. Unlike PAP machines, which can be bulky and uncomfortable, oral appliances are compact and easier to wear.

-

Instance: A study published in the Journal of Clinical Sleep Medicine highlighted that over 60% of former PAP users reported improved comfort and ease of use with oral appliances. This shift is particularly notable among patients who experienced discomfort or intolerance with PAP masks.

Rising Awareness and Accessibility:

- Trend Insight: There is a growing awareness of oral appliances as a viable alternative to PAP devices. This is coupled with increased accessibility due to advancements in dental technology and more dental practitioners offering these solutions.

-

Instance: According to a survey by the American Academy of Dental Sleep Medicine, the number of dental practices offering oral appliance therapy has increased by 35% over the past five years. This surge has facilitated easier access for patients seeking alternatives to PAP therapy.

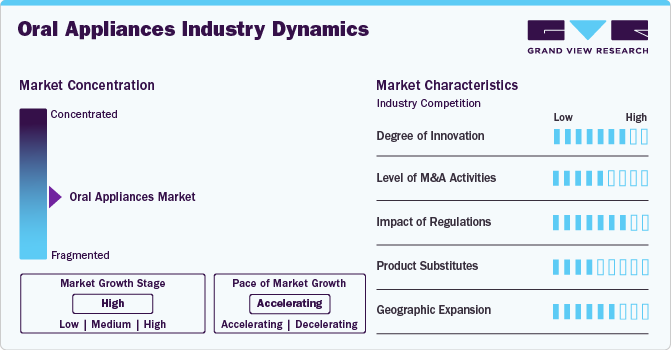

Market Concentration & Characteristics

The degree of innovation in the oral appliances industry is high. Advancements in materials and design drive innovation in the market, leading to more noninvasive, effective, and comfortable treatment options for conditions like OSA and snoring. In November 2023, Vivos Therapeutics received FDA 510(k) clearance for its Complete Airway Repositioning and Expansion (CARE) oral appliances designed for the treatment of severe OSA. These removable CARE oral appliances offer a non-invasive alternative to CPAP for patients with severe OSA.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically. For instance, in March 2023, Vivos Therapeutics, Inc. announced the acquisition of U.S. and international product rights, patents, and other intellectual property from Advanced Facialdontics, LLC (AFD), which holds proprietary technology for certain FDA 510(k) cleared medical and dental devices. This acquisition strengthens Vivos' intellectual property and technology portfolio, enabling the company to offer new complementary products for OSA patients experiencing symptoms such as discomfort, pain, tooth loss, headaches, and conditions like TMD and bruxism.

The regulatory impact on the oral appliances industry is significant. The regulatory framework for the market is primarily governed by the FDA, which classifies these devices as Class II medical devices and requires 510(k) clearance for market entry. Moreover, the market must adhere to the European Union's Medical Device Regulation (MDR) for CE marking to penetrate the European region. In addition, manufacturers must follow Good Manufacturing Practices (GMP) to ensure product quality and safety.

Geographical expansion contributes to market growth by tapping into emerging markets with rising healthcare awareness and investments. It allows companies to access new customer bases, increase sales, and diversify revenue streams. Regulatory approvals and strategic partnerships in different regions facilitate market entry and expansion.

Product Insights

The Mandibular Advancement Devices (MADs) segment dominated the market with the largest revenue share of 69.0% in 2023. This growth is primarily driven by increasing regulatory approvals and clearances, which enhance the credibility and market reach of these devices. According to the National Library of Medicine insights from March 2022, recent changes in German healthcare regulations have expanded the availability of MADs as a treatment option for OSA, making them more accessible to general dentists and their patients.

Furthermore, rising FDA regulations are also fueling market growth. For instance, in January 2024, SnoreLessNow announced that the FDA granted 510(k) clearance for its OTC mandibular advancement device, known as SomniFit-S in Europe. The Anti-Snore Mouth Guard+ reduces snoring by gently advancing the jaw, thereby eliminating airway obstruction and enhancing airflow without the need for masks, hoses, or electronics.

The Tongue-Retaining Devices (TRDs) segment is expected to grow significantly over the forecast period. Increasing awareness of sleep-related disorders, particularly obstructive sleep apnea (OSA), has led to greater demand for noninvasive treatment options. TRDs are favored for their effectiveness in preventing airway obstruction during sleep by maintaining the tongue's position. Technological advancements in these devices improved the comfort and efficacy of TRDs, enhancing patient compliance.

Indication Insights

The mild-to-moderate OSA segment dominated the market with the largest revenue share in 2023. This growth can be attributed to the increasing awareness of the condition, advancements in diagnostic technologies, and the rising prevalence of obesity, a major risk factor for OSA. In addition, the demand for non-invasive treatment options and growing recognition of the long-term health impacts of untreated OSA are driving more individuals to seek diagnosis and treatment. This expanding patient base, coupled with innovations in therapy devices, is propelling the segment growth.

Furthermore, the severe OSA segment is expected to grow significantly during the forecast period. Oral appliances serve as a viable alternative for patients who cannot tolerate CPAP therapy, offering a more comfortable and user-friendly option. With approximately 39 million adults in the U.S. and an estimated 936 million globally affected by mild to severe OSA, rising awareness of the health risks associated with severe OSA and advancements in appliance technology that improve efficacy and comfort are key factors contributing to the segment's dominance.

Distribution Channel Insights

The Direct-to-Consumer (DTC) segment dominated the market with the largest revenue share in 2023. The increasing consumer preference for convenient and accessible healthcare solutions has led to a surge in demand for at-home treatments. The rise of e-commerce platforms has made it easier for consumers to purchase oral appliances online, offering a seamless shopping experience with a wide range of products available at their fingertips. In addition, the growing awareness of the importance of sleep health and the prevalence of conditions such as obstructive sleep apnea have fueled consumer interest in non-invasive treatment options like oral appliances.

The availability of detailed product information, customer reviews, and virtual consultation services online has also empowered consumers to make informed purchasing decisions. Offline channels, such as retail stores and specialty clinics, continue to play a crucial role by providing hands-on product demonstrations and personalized consultations, further enhancing consumer confidence. Together, these factors contribute to the robust growth of the DTC segment in the market.

The hospitals & clinics distribution channel segment held a substantial market share in 2023. The growth is due to their central role in diagnosing and treating sleep disorders. These facilities provide comprehensive care, including assessing and managing OSA, making them primary venues for prescribing and fitting oral appliances. The extensive reach and integrated care provided by hospitals and clinics, coupled with their access to advanced diagnostic tools and specialists, drive the segment's prominence in the market.

End Use Insights

The hospitals & clinics segment dominated the market with the largest revenue share in 2023, owing to their central role in diagnosing and managing sleep disorders such as OSA. These healthcare facilities are equipped with advanced diagnostic tools and have the expertise to accurately prescribe and fit oral appliances. Hospitals and clinics often have established referral networks and patient bases that drive demand for oral appliances. Their comprehensive care, including follow-up and adjustments, ensures higher adoption rates and contributes to the segment's market leadership.

The homecare segment is expected to grow significantly during the forecast period. With a growing preference for convenient at-home treatment options that offer flexibility and comfort, more patients are seeking non-invasive solutions for conditions like obstructive sleep apnea. Oral appliances are emerging as a practical alternative to in-clinic therapies, prompting market players to expand their homecare offerings. For instance, in March 2021, Oventus Medical partnered with Connect DME to provide its O2Vent Optima oral appliance therapy through third-party administrators. Connect DME, a supplier of durable medical equipment, will utilize virtual consultations with dentists and physicians nationwide to support the treatment of sleep apnea.

Regional Insights

North America oral appliances market held the dominant global revenue share in 2023. This large share is attributed to the increasing prevalence of sleep apnea and the growing need to diagnose these disorders. Furthermore, the increasing number of FDA approvals for sleep apnea conditions would likely drive market growth in the region. For instance, in November 2023, Vivos received FDA 510(k) clearance for its CARE oral appliances, designed to treat severe obstructive sleep apnea (OSA). Vivos' CARE oral appliances offer a non-invasive alternative to CPAP for severe OSA patients by gradually repositioning the airway's hard and soft tissues, thereby enhancing airway function and flow. The FDA-cleared suite includes the DNA, mRNA, and mmRNA oral appliances. Data submitted to the FDA demonstrated superior treatment outcomes in patients with severe OSA compared to those with mild-to-moderate OSA, with an average treatment duration of 9.7 months.

U.S. Oral Appliances Market Trends

The oral appliances market in the U.S. accounted for the largest market share in 2023. One of the key factors driving the market is growing innovation. In November 2022, ProSomnus announced that it received FDA 510(k) clearance for its ProSomnus EVO [PH] snore and sleep device. This precision oral appliance therapy (OAT) device is engineered to meet coding guidelines by the Centers for Medicare Services (CMS). As per the company's press release, the device is nearly 13% more compact than predicate devices. The devices are personalized and manufactured based on a patient’s unique treatment and anatomy plan.

Europe Oral Appliances Market Trends

The oral appliances market in Europe is expected to grow significantly during the forecast period, driven by increasing awareness of sleep disorders such as OSA and growing demand for non-invasive treatment options. Moreover, advances in technology, such as custom 3D printing and smart devices, enhance oral appliances' effectiveness and comfort. Supportive regulatory frameworks and an aging population seeking alternatives to CPAP therapy contribute to market growth.

The oral appliances market in the UK had a substantial share in 2023, owing to the increasing awareness of sleep disorders such as obstructive sleep apnea, the rising prevalence of snoring, and the growing preference for non-invasive treatment options. In addition, advancements in dental technology and increased focus on patient comfort are further driving market expansion.

The Germany oral appliances market held a substantial market share in 2023. The market growth in Germany is driven by increasing awareness of sleep disorders such as obstructive sleep apnea (OSA) and the growing emphasis on preventive dental care. Technological advances, including developing customizable and comfortable oral devices, also contribute to market growth. In addition, supportive healthcare policies and reimbursement options enhance the accessibility and adoption of oral appliances.

Asia Pacific Oral Appliances Market Trends

The oral appliances market in Asia Pacific is expected to grow significantly during the forecast period due to various factors. For instance, in April 2024, IDEM Singapore 2024, a leading dental event in the Asia-Pacific region, showcased the latest advancements in dentistry, drawing industry leaders, innovators, and practitioners. Smartee's involvement highlighted mandibular repositioning technology, showcasing its commitment to advancing orthodontic services through advanced technologies and innovative clear aligner solutions, driving growth in the oral appliance market in the region.

The Australia oral appliances market held a significant market share in the Asia Pacific region in 2023. The growth is due to market players undertaking initiatives to get clearance from the national regulatory body. For instance, in July 2022, Vivos Therapeutics, Inc. received multiple Class I clearances from the Therapeutic Goods Administration for its series of oral appliances. These clearances cover indications for treating snoring and obstructive sleep apnea (moderate, mild, and severe) in both children and adults.

The oral appliances market in India is expected to grow significantly during the forecast period. The growth is due to the increasing awareness of sleep disorders and their treatment, rising healthcare spending, and advancements in dental technology. The growing prevalence of OSA and related conditions also contributes to higher demand for effective oral appliance solutions. In addition, expanding access to dental care services and improved patient education drive the market growth.

Key Oral Appliances Company Insights

The oral appliances industry is expanding with the presence of many companies. Intense competition among market players can be attributed to the growing demand for oral appliances, such as MADs and Tongue Retaining Devices (TRDs).

Key Oral Appliances Companies:

The following are the leading companies in the oral appliances market. These companies collectively hold the largest market share and dictate industry trends.

- ResMed Inc.

- ProSomnus

- Vivos

- SomnoMed.com

- Glidewell

- Airway Management (TAP)

- Mitsui Chemicals, Inc. (Whole You)

- Achaemenid, LLC

- Apnea Sciences

- Signifier Medical Technologies

Recent Developments

-

In May 2024, Glidewell launched a new Digital Silent Nite 3D Sleep Appliance. It is a mandibular advancement device developed from Glidewell’s Silent Nite Sleep Appliance. Made from durable light-cured resin, it effectively treats mild to moderate obstructive sleep apnea (OSA) & snoring.

-

In February 2024, Sleep Doctor partnered with Airway Management to offer the myTAP Oral Appliance. This device, holding FDA clearance for snoring and obstructive sleep apnea (OSA), provides a cost-effective and convenient solution for same-day treatment.

-

In January 2024, ProSomnus, Inc. announced adopting UnitedHealthcare's updated medical policy (#2024T0525NN) for Obstructive and Central Sleep Apnea, effective March 1, 2024. The revised policy mandates oral appliance therapy (OAT), including ProSomnus's Precision OAT devices, as a prerequisite for implantable hypoglossal nerve stimulation in adult patients with moderate to severe obstructive sleep apnea (OSA). The policy specifies a "failure of adequate trial of Oral Appliance therapy" as the new requirement.

-

In May 2023, Glidewell acquired ORB Innovations Limited for the development of smart oral appliances technology.

-

"We see the platform the ORB team has developed as an exciting evolution for the sports market. And it's easy to envision application in other wellness-related areas, in line with Glidewell's mission to bring innovative solutions to dental practitioners and their patients all over the world." - Glidewell CEO

-

Oral Appliances Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 970.7 million

Revenue forecast in 2030

USD 1.4 billion

Growth rate

CAGR of 5.72% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, indication, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ResMed Inc.; ProSomnus; Vivos; SomnoMed.com; Glidewell; Airway Management (TAP); Mitsui Chemicals, Inc. (Whole You); Achaemenid, LLC; Apnea Sciences; Signifier Medical Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oral Appliances Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global oral appliances market report based on product, indication, end use, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Mandibular Advancement Devices (MADs)

-

Tongue Retaining Devices (TRDs)

-

Hybrid Devices

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Mild to Moderate Obstructive Sleep Apnea (OSA)

-

Severe Obstructive Sleep Apnea (OSA)

-

Snoring

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Homecare

-

Hospitals & Clinics

-

Others (Sleep Laboratories, etc.)

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct-to-Consumer (Online and Offline)

-

Hospitals & Clinics

-

Others (Dental Clinics, etc.)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global oral appliances market size was estimated at USD 908.7 million in 2023 and is expected to reach USD 970.7 million in 2024.

b. The global oral appliances market is expected to grow at a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 1.4 billion by 2030.

b. North America held the dominant revenue share in 2023. This growth is attributed to the increasing prevalence of sleep apnea and the growing need to diagnose these disorders. Furthermore, the increasing number of FDA approvals for sleep apnea conditions would likely drive market growth in the region.

b. Some key players operating in the oral appliances market include ResMed Inc.; ProSomnus; Vivos; SomnoMed.com; Glidewell; Airway Management (TAP); Mitsui Chemicals, Inc. (Whole You); Achaemenid, LLC; Apnea Sciences; Signifier Medical Technologies

b. Key factors that are driving the market growth include increasing awareness of sleep disorders, rising prevalence of obstructive sleep apnea, and growing demand for non-invasive treatment options. The market is also bolstered by advancements in technology, improved product designs offering greater comfort, and increased focus on oral health. In addition, favorable reimbursement policies and the presence of key market players contribute to the expansion of this market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.