Optogenetics Actuators And Sensors Market Size, Share & Trends Analysis Report By Product (Actuators, Sensors), By Disease (Retinal Disorders, Parkinson’s Disease), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-465-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

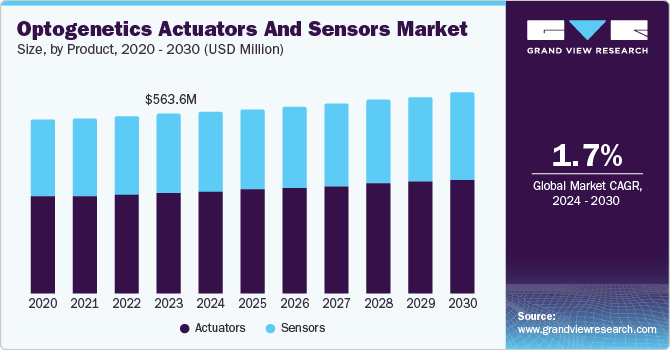

The global optogenetics actuators and sensors market size was valued at USD 563.6 million in 2023 and is projected to grow at a CAGR of 1.7% from 2024 to 2030. The market growth can be credited to the increasing prevalence of neurological and retinal disorders. Conditions such as Parkinson’s disease, schizophrenia, autism, and various disorders have become more prevalent. These conditions necessitate advanced research and treatment methods such as optogenetics. This genetic engineering allows precise control over neuronal activity using light and offers promising approaches for studying and potentially treating these disorders.

In addition, technological advancements have significantly augmented the market growth. Innovations in optogenetics technology, including the development of more efficient and precise actuators and sensors have enhanced the capabilities of researchers and clinicians. For instance, advancements in genetically encoded calcium indicators, voltage-sensitive fluorescent proteins, and pH sensors have enabled more accurate and detailed studies of neuronal activity.

Moreover, the growing investment in neuroscience research has been a crucial market driver. Governments, academic institutions, and private organizations have increasingly invested in neuroscience to better understand the nuances of brain function and develop treatments for neurological disorders. This investment has fueled the adoption of optogenetics tools as they provide comprehensive insights into biochemical and physiological pathways to neural circuits and brain connectivity. For example, initiatives by organizations such as the National Institutes of Health (NIH) and the World Health Organization (WHO) have supported the development and application of optogenetics in neuroscience research.

Furthermore, the optogenetics industry has been thriving with its ability to prevent inherited neurological and psychiatric diseases and the use of thin, flexible microchips as injectable devices to control nerves wirelessly. The demand was further fueled by the progressive acceptance of neuroscience. Geriatric patients with increasing per capita incomes have invested in optogenetics for better quality of life. This growing acceptance has resulted in the introduction of innovative technologies in neuroscience and ophthalmology by several market participants.

Product Insights

Actuators accounted for 56.0% of the market share in 2023 attributed to the rising prevalence of neurological disorders such as Alzheimer’s, Parkinson’s, and others. Actuators allow researchers to make accurate light simulations of the neurons, helping them to manipulate the neural circuits. Furthermore, considerable investments by major companies and government initiatives worldwide have led to increased research and development for developing efficient actuators to improve treatment quality.

The sensors segment is expected to grow at a CAGR of 1.3% during the forecast period. Industrial entities have made significant investments to develop genetically encoded calcium indicators and pH sensors. Researchers have created sensors based on voltage-sensitive fluorescent proteins that deliver crucial voltage readings. Additionally, numerous ongoing studies have aimed to develop rapid fluorescent protein voltage sensors. Scientists have enhanced these sensors by optimizing Förster Resonance Energy Transfer (FRET) interactions, which are useful for monitoring neuronal activities in vivo. These studies, funded by private and public organizations, are projected to boost segment growth in the coming years.

Disease Insights

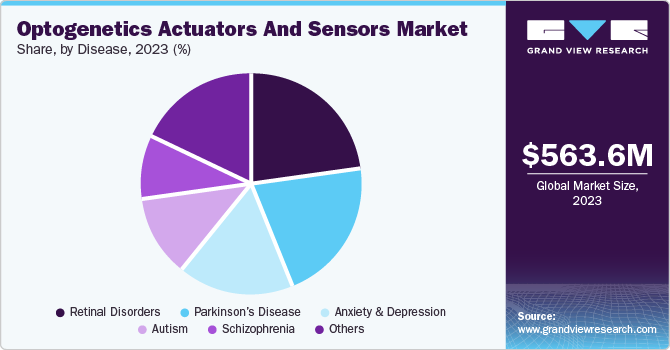

Retinal disorders have secured the dominant share with 22.3% of the market in 2023 pertaining to the increasing incidence of disorders such as retinitis pigmentosa, glaucoma, pigmentosa, and diabetes-related retinal disorders among the geriatric population. Exposure to blue light due to increased screen time has resulted in a growing number of patients with retinal disorders. The market was further supported by significant investments made by companies to cater to the lack of accurate and effective therapies of retinal disorders.

The anxiety and depression segment is projected to grow at a CAGR of 2.0% during the forecast period owing to the growing prevalence of mental disorders with urbanization and lifestyle shifts. Patients have increasingly become aware of mental health and its treatments.

They have favored optogenetics to address neurobiological mechanisms and aid in the treatment of anxiety and depression.

Regional Insights

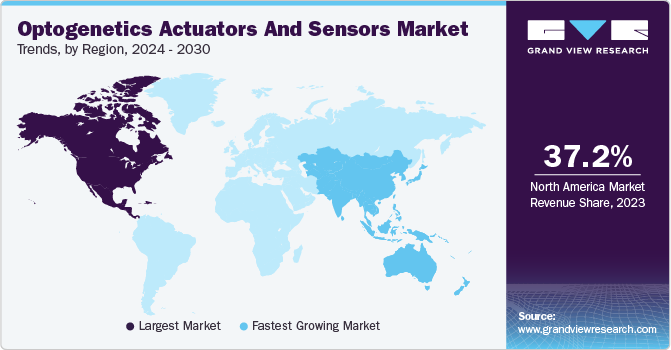

The North America optogenetics actuators and sensors market dominated with a share of 37.2% in 2023. The presence of major market players, technological advancements, and well-established healthcare frameworks have collectively catered to the rising prevalence of neurological and retinal disorders. In addition, several awareness campaigns led by government initiatives have made patients increasingly invest in optogenetics as a part preventive healthcare.

U.S. Optogenetics Actuators and Sensors Market Trends

The optogenetics actuators and sensors market in U.S. was driven by the presence of major healthcare institutions and significant investment by government and private companies. These aims are aimed at developing effective treatments for neurological disorders to combat their increasing prevalence among the geriatric population.

Europe Optogenetics Actuators and Sensors Market Trends

The Europe optogenetics actuators and sensors market held a market share of 29.7% in 2023. This growth can be attributed to the rising geriatric population suffering from neurological disorders and rapid growth in the healthcare sector in this region. Increased funding by the government and private research companies to develop technologically advanced treatments for neurological disorders has further aided in the market growth.

Asia Pacific Optogenetics Actuators and Sensors Market Trends

The Asia Pacific optogenetics actuators and sensors market is expected to witness the fastest CAGR of 2.45 over the forecast period driven by emerging economies and increased R&D expenditure. Collaborations among entities are expected to boost revenue generation. Intensive research efforts have contributed to technological advancements in the region. For instance, studies conducted by the RIKEN-MIT Centre for Neural Circuit Genetics and the Japan Science and Technology Agency, in collaboration with international entities, are expected to propel regional growth.

Key Optogenetics Actuators and Sensors Company Insights

Some of the major companies in the optogenetics actuators and sensors market are Elliot Scientific Ltd., Thorlabs, Inc., The Jackson Laboratory Bruker, and more. Companies have focused on enhancing their product portfolios with strategic collaboration, mergers, and acquisitions. They have focused on improving the product efficiency and performance to treat neurological disorders effectively.

-

Elliot Scientific Ltd. is a medical company specializing in the manufacturing and supply of components and systems such as opto-mechanics, lasers and LEDs, temperature instruments, spectroscopy, and microscopy equipment. The company deals with scientific, research, academic, and industrial industries.

-

Gensight Biologics is a biopharma company specializing in developing and manufacturing gene therapies for retinal neurodegenerative diseases and central nervous system disorders.

Key Optogenetics Actuators and Sensors Companies:

The following are the leading companies in the optogenetics actuators and sensors market. These companies collectively hold the largest market share and dictate industry trends.

- Elliot Scientific Ltd.

- GenSight Biologics

- Thorlabs, Inc.

- Addgene, Inc.

- The Jackson Laboratory

- Bruker

- Noldus Information Technology BV.

- Prizmatix

- Danaher Corporation

- Merck KGaA

- Shanghai Laser & Optics Century Co., Ltd. (SLOC)

- AGTC

- Scientifica (Judges Scientific Plc Company)

Recent Development

- In February 2023, GenSight Biologics released the 1-year safety data and efficacy indicators from the phase I/II clinical trial of their optogenetic treatment candidate for retinitis pigmentosa, GS030. The findings demonstrated enhanced patient tolerability and safety.

Optogenetics Actuators and Sensors Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 570.7 million |

|

Revenue forecast in 2030 |

USD 630.1 million |

|

Growth rate |

CAGR of 1.7% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, disease, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Elliot Scientific Ltd.; Gensight Biologics; Thorlabs, Inc.; Addgene, Inc.; The Jackson Laboratory; Bruker, Noldus Information Technology BV.; Prizmatix, Danaher Corporation; Merck KGaA; Shanghai Laser & Optics Century Co., Ltd. (SLOC); AGTC; Scientifica (Judges Scientific Plc Company) |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Optogenetics Actuators and Sensors Market Report Segmentation

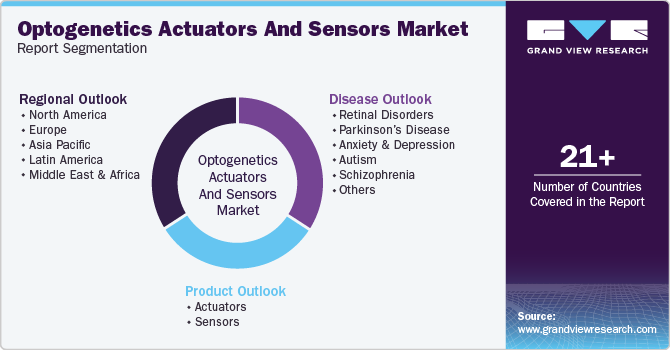

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global optogenetics actuators and sensors market report based on product, disease, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Actuators

-

Channelrhodopsin

-

Halorhodopsin

-

Archaerhodopsin

-

-

Sensors

-

Genetically Encoded Calcium Indicators

-

Voltage-Sensitive Fluorescent Proteins

-

pH Sensors

-

-

-

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Retinal Disorders

-

Parkinson’s Disease

-

Anxiety & Depression

-

Autism

-

Schizophrenia

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."