Optical Sensors Market Size, Share & Trends Analysis Report By Type (Extrinsic Sensor, Intrinsic Sensor), By Sensor Type (Fiber Optic Sensor, Photoelectric Sensor), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-184-5

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Optical Sensors Market Size & Trends

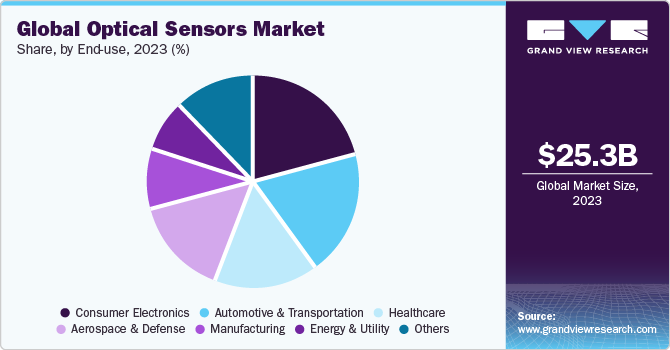

The global optical sensors market size was estimated at USD 25.32 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 11.8% from 2024 to 2030. Factors such as the rising adoption of automation in various industries and growing demand for consumer electronics products such as smartphones, laptops, & wearable smart devices are driving market growth. Moreover, the increasing demand for optical sensors in the healthcare, automotive, and aerospace & defense industries presents significant growth opportunities for the market.

The market is experiencing significant growth due to their diverse applications across various industries. In the consumer electronics industry, optical sensors are pivotal in improving display technologies, enhancing the performance of digital cameras, and enabling innovations in optical mice for computers. These sensors are crucial in advancing safety features like automatic headlights and adaptive cruise control systems in the automotive sector. Also, the medical field benefited from optical sensors for diagnostics, imaging, and surgical instruments, aiding in minimally invasive procedures.

Industrial applications also expanded, with optical sensors integral in quality control systems, robotics, and environmental monitoring. The demand for optical sensors is propelled by the pursuit of higher efficiency, accuracy, and miniaturization, as well as the increasing need for automation and precision in various industries. This era marks a significant shift towards integrating optical sensor technologies in everyday devices, underpinning advancements in multiple sectors and paving the way for further innovation.

The COVID-19 pandemic had a positive impact on the market. The COVID-19 pandemic created an unprecedented need for social distancing. A contactless sanitizer dispenser was one of the most demanded products during the lockdown for personal safety concerns, as people tried to avoid contacting common products with random people. Proximity sensors are used to detect if a hand is seen under the nozzle in the sanitizer dispenser.

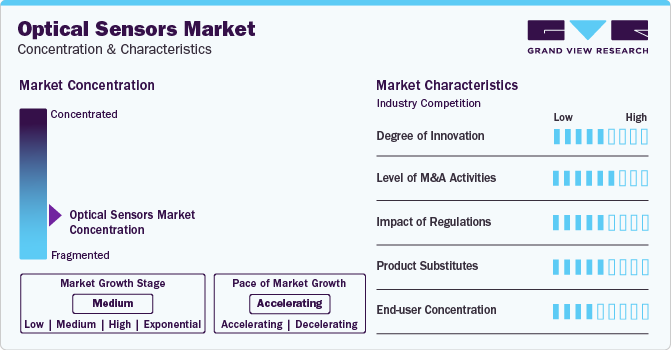

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The market is characterized by a high degree of innovation owing to rapid technological advancements. Continuous and diverse research and development efforts in optical sensors are going on. State-of-the-art technological advancements consistently introduce new sensing devices and methodologies. Simultaneously, there is a rapid inflow of affordable and easily implementable sensor products into the market. Optical sensors have gained increasing attention due to their immunity to electromagnetic interference, exceptional performance, and substantial potential for miniaturization.

The market is characterized by a medium level of leading players' merger and acquisition (M&A) activity. The mergers and acquisition activities were majorly carried out for growth and expansion by the businesses. For instance, in October 2022, Vishay Inter technology, Inc., a producer of discrete semiconductors and passive electronic components, declared its acquisition of MaxPower Semiconductor, Inc. Based in San Jose, California, MaxPower is a fabless power semiconductor provider focused on delivering inventive and economically efficient technologies to enhance power management solutions.

The market is also subject to increasing regulatory scrutiny. Regulations related to optical sensors cover various aspects like safety, accuracy, and industry-specific needs. These regulations exist to guarantee the reliability of optical sensors used for different applications.

Limited direct product substitutes exist for optical sensors, such as thermal, electromagnetic, chemical, and acoustic sensors. These substitutes cater to specific applications where optical sensors might not be the most suitable.

End-use Insights

Consumer electronics dominated the market in 2023. The consumer electronics industry has seen a surge in the integration of optical sensors due to their versatility and applicability in various devices. These sensors, including ambient light, proximity, and image sensors, have become fundamental components in smartphones, smartwatches, cameras, and augmented reality (AR) devices. Smartphones utilize ambient light sensors for automatic screen brightness adjustment and proximity sensors for screen activation during calls.

Additionally, image sensors enhance camera functionalities, enabling high-resolution photography and advanced features like depth sensing and facial recognition. Increasing smartphone adoption is expected to fuel the demand for optical sensors. According to the Indian Ministry of Information and Broadcasting, India had over 1.2 billion mobile phone users and 600 million smartphone users in 2022.

The healthcare segment is projected to grow at the fastest CAGR over the forecast period. The use of optical sensors in healthcare has grown significantly due to technological advancements and the increased need for precise and economical diagnostic tools. These sensors are applied across patient observation, imaging, diagnostics, and therapy. For instance, pulse oximeters, relying on optical sensors to measure blood oxygen levels, have become pivotal in healthcare. Optical coherence tomography (OCT) systems also offer detailed images in fields like ophthalmology and cardiology, aiding early disease identification.

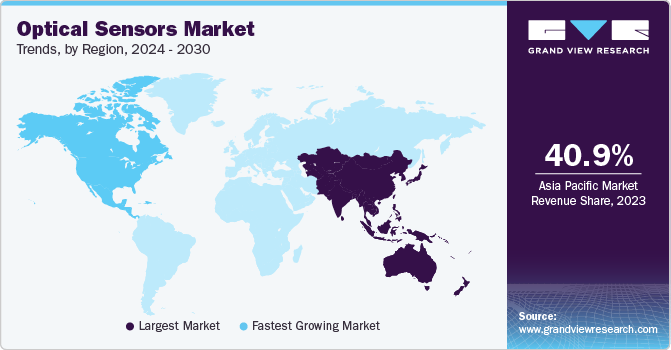

Regional Insights

Asia Pacific dominated the market and accounted for a 40.9% share in 2023. Expansion in automotive sales and technological advancement in consumer electronics in the Asia Pacific region is expected to fuel the market growth. The region has a rising demand for smartphones, tablets, PCs, and smartwatches. In the first quarter of 2022, India witnessed a surge of 48% in PC shipments (desktops, notebooks, and tablets), reaching an exceptional 5.8 million units. It surpasses the previous record of 5.3 million units set in Q3 of 2021. As India accelerates its digitalization shift, the requirement for increased process automation, error detection, and predictive maintenance capabilities drives unusual sensor technology adoption. Agriculture, manufacturing, data centers, meteorology, heating, ventilation, and air conditioning (HVAC) are some sectors in China where the sensors are employed.

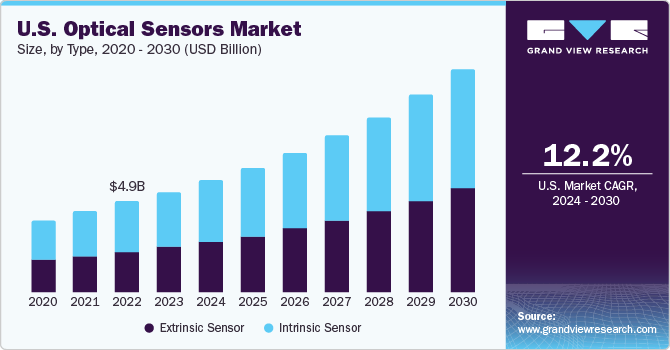

North America is anticipated to witness the highest CAGR growth over the forecast period, driven by the widespread adoption of smartphones, electric vehicles, and various smart home applications. In addition, integration with popular social media platforms boosts the visibility of live commerce events. The U.S. market is experiencing a rapid surge due to the increasing demand for advanced safety systems and vehicle technology. The growing consumer preference toward road safety and rising government concern to curtail road accidents are primary reasons for adopting optical sensors in ADAS and blind spot detection. The U.S. government introduced initiatives like FMVSS (Federal Motor Vehicle Safety Standard) to reduce road accidents, boosting the growth opportunities for optical sensors in the U.S. market.

Type Insights

Intrinsic optical sensors dominated the market and accounted for a share of 55.0% in 2023. Intrinsic sensors measure various physical quantities like strain, temperature, pressure, and more by modulating the intensity, wavelength, or time of light in fiber. Intrinsic optical sensors have fewer connection problems than extrinsic optical sensors and are also challenging to multiplexer. These sensors are majorly considered for distributed sensing over large distances. Typical applications of intrinsic sensors are used for rotation, acceleration, strain, and acoustic pressure. Innate sensors are resistant to electromagnetic interference and can operate in extreme temperatures.

The extrinsic sensors type is projected to grow at the fastest CAGR over the forecast period. Extrinsic optical sensors transmit modulated light from a non-fiber optical sensor coupled to an optical transmitter via optical fiber. These sensors use optics to extract the light from the fiber and modulate it in another medium. They measure vibration, rotation, displacement, velocity, acceleration, torque, and temperature.

Sensor Type Insights

Optical temperature sensors dominated the market in 2023. The increasing adoption of Industrial Internet of Things (IIoT) technologies and smart manufacturing processes has increased demand for temperature sensors. Accurate temperature monitoring ensures efficient operation and prevents critical failures in the renewable energy sector and conventional power generation. The growth in the renewable energy sector presents significant growth opportunities for optical temperature sensors.

For instance, in 2022, India witnessed the most significant year-on-year rise in renewable energy installations, with a growth rate of 9.83%. As of July 2023, the country's solar energy capacity has surged 30-fold over the past nine years, reaching 70.10 GW. Also, optical temperature sensors find significant applications in the healthcare, biomedical, aerospace, and defense sectors.

The biomedical sensors segment is projected to grow at the fastest CAGR over the forecast period. A biomedical sensor is an electronic device that transfers various non-electrical quantities in biomedical fields into easily electrically detectable amounts. Due to this reason, these sensors are included in health care analysis. This sensing technology is the key to collecting human pathological and physiological information.

Application Insights

Biometric applications dominated the market in 2023. A specialized sensor is necessary to determine a biometric signal. The particular type of sensor employed depends upon the measured biometric signal. The inclusion of a biometric sensor in the contactless payment card enables individuals to personally verify each transaction using a distinctive credential, such as their fingerprint. The increase in contactless payment globally is expected to increase the demand for biometric optical sensors. According to a survey by Fingerprint Cards AB, a biometrics company, consumers have a significant demand for biometric payment cards, with 51% indicating their willingness to switch banks to obtain one.

The temperature sensing application is projected to grow significantly over the forecast period. Progress in materials science and optical technology has resulted in the development of sensors with enhanced temperature detection precision. It involves leveraging novel materials to improve both light modulation and detection. These sensors are now more frequently incorporated into IoT setups and intelligent networks, finding applications across diverse sectors such as residential automation, industrial control, and healthcare.

Key Companies & Market Share Insights

Some of the key players operating in the market include ams-OSRAM AG, STMicroelectronics, and ROHM CO., LTD.

-

ams-OSRAM AG manufactures sensors, sensor interfaces, and analog integrated circuit solutions. This company serves the medical, automotive, and industrial end markets. The organization operates in two segments: semiconductors and lamps and systems. The majority of its revenues are generated from semiconductors.

-

STMicroelectronics product portfolio contains a variety of semiconductor products, including analog chips, discrete power semiconductors, microcontrollers, and sensors.

-

ROHM CO., LTD. manufactures electronic components for automotive, transportation, medical, healthcare, audiovisual, telecommunications, digital power, computer, and home appliance end markets.

-

Vishay Intertechnology, Inc, and KEYENCE CORPORATION are some of the emerging market participants in the optical sensors market.

-

Vishay Intertechnology, Inc. offers a diverse product portfolio of discrete semiconductors and passive electronic components to OEMs and distributors. These devices can be found in the industrial, computing, automotive, consumer, telecommunications, power supply, military, aerospace, and medical markets, serving customers worldwide.

-

Keyence develops factory automation sensors, machine vision systems, barcode readers, programmable logic controllers, laser markers, measuring instruments, and digital microscopes.

Key Optical Sensors Companies:

- ams-OSRAM AG

- Semiconductor Components Industries, LLC

- TOSHIBA CORPORATION

- Texas Instruments Incorporated

- Renesas Electronics Corporation

- ROHM CO., LTD

- STMicroelectronics

- Rockwell Automation

- SICK AG

- Vishay Intertechnology, Inc

- Honeywell International Inc.

- ifm electronic gmbh

- KEYENCE CORPORATION

- Cisco Systems, Inc.

- Amphenol Corporation

Recent Developments

-

In July 2023, ams OSRAM, an optical solutions provider, introduced the TCS3530, a cutting-edge color sensor. This innovative sensor empowers smartphone cameras to achieve near perfect color accuracy regardless of lighting conditions. Moreover, it aids displays in delivering a more authentic and natural picture quality.

-

In June 2023, Renesas Electronics Corporation, a provider of advanced semiconductor solutions, announced the successful conclusion of its acquisition of Panthronics AG, a semiconductor firm recognized for its high-performance wireless products. This strategic acquisition facilitated the establishment of technological synergy between the two companies.

-

In January 2021, Honeywell launched an optical caliper measurement sensor tailored to enhance lithium-ion battery (LIB) production processes. This newly introduced sensor offers an efficient method for precisely measuring the authentic thickness of electrode material both during coating and at the pressing station in LIB manufacturing. Ensuring accurate thickness measurement is critical for achieving optimal battery performance.

Optical Sensors Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 28.07 billion |

|

Revenue forecast in 2030 |

USD 54.83 billion |

|

Growth rate |

CAGR of 11.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Type, sensor type, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Netherlands; China; Japan; India; South Korea; Australia; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa |

|

Key companies profiled |

ams-OSRAM AG; Semiconductor Components Industries, LLC; TOSHIBA CORPORATION; Texas Instruments Incorporated; Renesas Electronics Corporation; ROHM CO., LTD; STMicroelectronics; Rockwell Automation; SICK AG; Vishay Intertechnology, Inc; Honeywell International Inc.; ifm electronic gmbh; KEYENCE CORPORATION; Cisco Systems, Inc.; Amphenol Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Optical Sensors Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global optical sensors market report based on type, sensor type, application, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Extrinsic Sensor

-

Intrinsic Sensor

-

-

Sensor Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fiber Optic Sensor

-

Photoelectric Sensor

-

Optical Temperature Sensors

-

Biomedical Sensors

-

Displacement & Position Sensors

-

Point Sensors

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Pressure & Strain Sensing

-

Temperature Sensing

-

Geological Survey

-

Biometric

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Consumer Electronics

-

Energy & Utility

-

Aerospace & Defense

-

Automotive & Transportation

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global optical sensors market size was estimated at USD 25.32 billion in 2023 and is expected to reach USD 28.07 billion in 2024.

b. The global optical sensors market is expected to grow at a compound annual growth rate of 11.8% from 2022 to 2030 to reach USD 54.83 billion by 2030

b. Asia Pacific dominated the optical sensors market with a market share of 40.9% in 2022. Expansion in automotive sales and technological advancement in consumer electronics in the Asia Pacific region is expected to fuel the market growth.

b. Some key players operating in the optical sensors market include ams-OSRAM AG, Semiconductor Components Industries, LLC, TOSHIBA CORPORATION, Texas Instruments Incorporated, Renesas Electronics Corporation, ROHM CO., LTD, STMicroelectronics, Rockwell Automation, SICK AG, Vishay Intertechnology, Inc, Honeywell International Inc., ifm electronic gmbh, KEYENCE CORPORATION, Cisco Systems, Inc., and Amphenol Corporation.

b. Factors such as the rising adoption of automation in various industries and growing demand for consumer electronics products such as smartphones, laptops, & wearable smart devices are driving market growth. Moreover, the increasing demand for optical sensors in healthcare, automotive, and aerospace & defense industry present significant growth opportunities for the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."