- Home

- »

- Advanced Interior Materials

- »

-

Optical Isolators Market Size, Share & Growth Report, 2030GVR Report cover

![Optical Isolators Market Size, Share & Trends Report]()

Optical Isolators Market Size, Share & Trends Analysis Report By Category (Polarization Dependent, Polarization Independent), By Power Level (High, Medium, Low), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-438-6

- Number of Report Pages: 202

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Optical Isolators Market Size & Trends

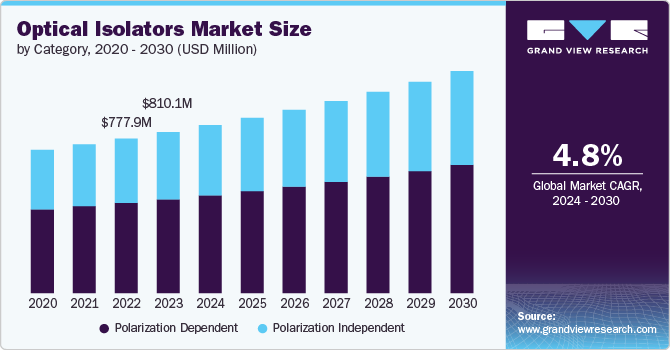

The global optical isolators market size was estimated at USD 810.1 million in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2030. This growth is driven by the increasing demand for high-speed communication systems, particularly in telecommunications and data centers. The proliferation of fiber-optic networks and the growing need for efficient signal integrity in these systems are also significant contributors. Additionally, advancements in laser technology and the rising adoption of optical isolators in medical devices and industrial applications further stimulate market growth.

The global market is significantly driven by the rapid expansion of telecommunications infrastructure and the increasing demand for high-speed data transmission. As businesses and consumers alike rely more heavily on internet connectivity, the need for efficient and reliable communication networks has surged. Optical isolators play a crucial role in fiber-optic systems by preventing back reflections that can disrupt signal integrity, making them essential components in modern telecommunication equipment.

Despite the promising growth prospects, the market faces several restraints that could impede its expansion. One of the primary challenges is the high cost associated with manufacturing advanced isolators, particularly those with superior performance characteristics. This can limit their adoption in cost-sensitive applications and markets, especially in developing regions where budget constraints are a significant factor.

One of the most promising areas is the rising integration of optical isolators in renewable energy systems, such as solar panels and wind turbines, where they can enhance performance and efficiency. As the world shifts toward sustainable energy sources, the demand for reliable components will likely increase. Additionally, advancements in material science and nanotechnology are paving the way for the development of next-generation optical isolators with improved performance, compact sizes, and lower costs, making them more accessible for a wider range of applications.

Category Insights

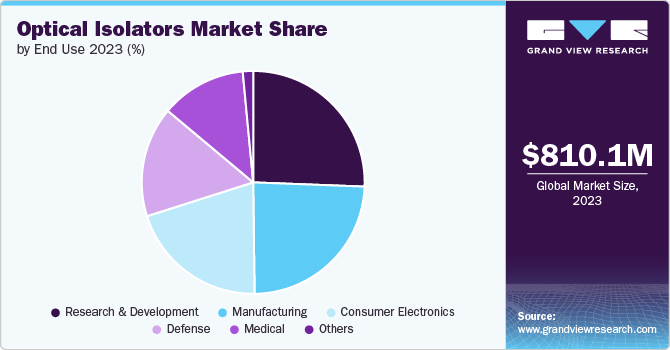

Based on category, polarization-independent optical isolators dominated the market with a revenue share of 58.3% in 2023 and are further expected to grow at a significant rate over the forecast period. Polarization-independent optical isolators are engineered to function effectively regardless of the polarization state of the incoming light. This adaptability is achieved through various design techniques, including the use of special configurations or materials that can accommodate multiple polarization states simultaneously. These isolators are particularly valuable in applications where the polarization of light can vary unpredictably, such as in multi-mode fibers or in environments with diverse light sources. Their ability to maintain consistent performance makes them ideal for a wide range of applications, including fiber-optic telecommunications, industrial lasers, and medical devices.

Polarization-dependent optical isolators are designed to operate primarily based on the polarization state of light. These isolators utilize the Faraday effect, which relies on the magnetic field's interaction with the polarization of light to allow transmission in one direction while preventing back reflections. They are typically more efficient and exhibit lower insertion loss compared to their polarization-independent counterparts. This efficiency makes polarization-dependent optical isolators particularly suitable for applications where the polarization state of the light can be controlled or is consistent, such as in single-mode fiber-optic communication systems.

Power Level Insights

Based on power level, the high power segment dominated the market with a revenue share of 42.4% in 2023 and is further expected to grow at a significant rate over the forecast period. These isolators are crucial in applications where high-intensity laser beams are used, such as in industrial laser cutting, medical laser systems, and advanced telecommunications. The design of high-power isolators must account for thermal management, as excessive heat can lead to performance degradation and damage to the isolator components. Advanced materials and cooling techniques are often employed to mitigate thermal effects and ensure reliable operation under high power conditions.

Medium-power optical isolators typically operate within a power range of 10 to 100 watts, making them suitable for a variety of applications that require a balance between performance and cost. These isolators are commonly used in laboratory settings, telecommunications, and certain industrial applications where moderate laser power is utilized. The design of medium power isolators allows for effective management of thermal effects while providing adequate isolation and low insertion loss.

Low-power optical isolators are designed for applications that require minimal optical power, typically below 10 watts. These isolators are essential in environments where delicate signals must be protected from back reflections, such as in fiber-optic communication systems, sensor applications, and certain consumer electronics. The compact size and cost-effectiveness of low-power isolators make them ideal for integration into various devices, including sensors and low-power laser systems.

End Use Insights

Based on end-use, the research & development segment dominated the market with a revenue share of 25.6% in 2023 and is further expected to grow at a significant rate over the forecast period. R&D activities are essential for developing new optical isolator designs that enhance performance, reduce costs, and expand application areas. In laboratories and research institutions, optical isolators are utilized in various experiments involving lasers, fiber optics, and photonics, where maintaining signal integrity is crucial. The demand for high-precision components in R&D settings is increasing as researchers explore new frontiers in fields such as quantum computing, telecommunications, and materials science.

In the defense sector, optical isolators are critical components in various applications, including laser communication systems, targeting systems, and sensor technologies. The need for secure and reliable communication in military operations drives the demand for high-performance optical isolators that can withstand harsh environments and maintain signal integrity. These isolators help protect sensitive equipment from back reflections that could compromise operational effectiveness.

The manufacturing segment is a significant end-use market for isolators, particularly in industries that rely on laser technologies for production processes. They are used in laser cutting, welding, and engraving applications, where they help maintain the quality and precision of laser beams. As manufacturing processes become increasingly automated and reliant on advanced optical systems, the demand for robust and efficient optical isolators is expected to rise.

Regional Insights

North America optical isolators market, particularly the U.S., holds a prominent position in the global industry due to its advanced technological landscape and strong presence of key manufacturers. The region is characterized by high demand for optical isolators in telecommunications, defense, and medical applications. The increasing deployment of fiber-optic networks and the expansion of data centers are driving the need for high-performance components. Moreover, significant investments in research and development activities are fostering innovation in optical technologies, leading to the introduction of advanced isolators that cater to specific industry needs.

Asia Pacific Optical Isolators Market Trends

The optical isolators market in Asia Pacific dominated the global market in 2023 with a revenue share of 38.7% and is further expected to grow at a significant rate over the forecast period. Countries like China, India, and Japan are at the forefront of this growth, with increasing investments in telecommunications, manufacturing, and research and development. The region's booming electronics industry, particularly in consumer electronics and telecommunications, is propelling the demand for optical isolators, which are essential for maintaining signal integrity in fiber-optic networks. Additionally, the rise of smart technologies and automation in various sectors is further enhancing the need for reliable components.

China optical isolators market is driven by its rapid economic growth and significant investments in technology and infrastructure. The country's expanding telecommunications sector, characterized by the rollout of 5G networks and fiber-optic communication systems, is a major contributor to the demand for optical isolators. Additionally, China's focus on innovation and the development of advanced manufacturing capabilities are fostering the growth of optical component production.

Europe Optical Isolators Market Trends

The optical isolators market in Europe is witnessing a robust growth trajectory fueled by the increasing adoption of technologies across various industries. The region's focus on renewable energy, telecommunications, and healthcare is driving demand for optical isolators, which are critical for ensuring the reliability and efficiency of systems. Countries like Germany, France, and the United Kingdom are leading the charge, with significant investments in research and development aimed at enhancing optical component performance.

Key Optical Isolators Company Insights

Some of the key players operating in the market are Corning Optical Communications and Edmund Optics Inc.

-

Corning Optical Communications is a leading manufacturer in the optical communications sector, specializing in high-performance fiber optic components and integrated modules. The company has a rich history of innovation in optical fiber technology, having pioneered the development of low-loss fiber that revolutionized telecommunications. Corning's product portfolio includes a wide range of optical isolators, connectors, and network interface devices designed to enhance the reliability and efficiency of communication networks.

-

Edmund Optics Inc. is a prominent supplier of optical components and systems, catering to a diverse range of industries, including telecommunications, defense, and medical technology. The company offers a comprehensive product portfolio that includes optical isolators, lenses, filters, and imaging systems.

Electro-Optics Technology, Inc. and Gould Fiber Optic are some of the emerging participants in the market.

-

Electro-Optics Technology, Inc. specializes in the design and manufacture of optical isolators and other components for various applications, including telecommunications, industrial lasers, and medical devices. The company is recognized for its expertise in producing high-quality optical isolators that provide excellent isolation and low insertion loss, making them ideal for demanding environments.

-

Gould Fiber Optics is a manufacturer of optical components, including optical isolators, primarily serving the telecommunications and industrial sectors. The company is dedicated to providing high-quality fiber optic products that enhance communication systems' performance and reliability. Gould Fiber Optics offers a range of isolators designed to meet the specific needs of various applications, ensuring optimal signal integrity and protection against back reflections.

Key Optical Isolators Companies:

The following are the leading companies in the optical isolators market. These companies collectively hold the largest market share and dictate industry trends.

- Corning Optical Communications

- Edmund Optics Inc.

- Electro-Optics Technology, Inc.

- Gould Fiber Optics

- Innolume GmbH

- Jiangxi Liansheng Technology Co., Ltd

- Maxphotonics Co. Ltd.

- Newport Corporation

Recent Developments

-

In November 2021, Purdue University published a paper stating the ways to improve photonic integrated circuits with magnetic free optical isolators, using technologies such as quantum computing. The creation of magnetic isolators by Purdue would help the circuits achieve higher bandwidth as well as better efficiency.

Optical Isolators Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 844.9 million

Revenue forecast in 2030

USD 1.11 billion

Growth Rate

CAGR of 4.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Category, power level, end use, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina

Key companies profiled

Corning Optical Communications, Edmund Optics Inc., Electro-Optics Technology, Inc., Gould Fiber Optics, Innolume GmbH, Jiangxi Liansheng Technology Co., Ltd, Maxphotonics Co. Ltd., Newport Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Optical Isolators Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global optical isolators market report on the basis of category, power level, end use, and region:

-

Category Outlook (Revenue, USD Million, 2018 - 2030)

-

Polarization Dependent

-

Polarization Independent

-

-

Power Level Outlook (Revenue, USD Million, 2018 - 2030)

-

High Power

-

Medium Power

-

Low Power

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Research and Development

-

Defense

-

Manufacturing

-

Consumer Electronics

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global optical isolators market size was estimated at USD 810.1 million in 2023 and is expected to reach USD 844.9 million in 2024.

b. The global optical isolators market is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2024 to 2030, reaching USD 1.11 billion by 2030.

b. Asia Pacific dominated the optical isolators market in 2023 with a revenue share of 38.7%. The region's booming electronics industry, particularly in consumer electronics and telecommunications, propels the demand for optical isolators, which are essential for maintaining signal integrity in fiber-optic networks.

b. Some key players operating in the optical isolators market include Corning Optical Communications, Edmund Optics Inc., Electro-Optics Technology, Inc., Gould Fiber Optics, Innolume GmbH, Jiangxi Liansheng Technology Co., Ltd, Maxphotonics Co. Ltd., Newport Corporation.

b. One major factor driving the demand for optical isolators in the global market is the increasing demand for high-speed communication systems, particularly in telecommunications and data centers.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."