- Home

- »

- Clinical Diagnostics

- »

-

Optical Emission Spectroscopy Market Size Report, 2030GVR Report cover

![Optical Emission Spectroscopy Market Size, Share & Trends Report]()

Optical Emission Spectroscopy Market (2025 - 2030) Size, Share & Trends Analysis Report By Offerings, By Form Factor, By Product, By Detector, By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-354-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

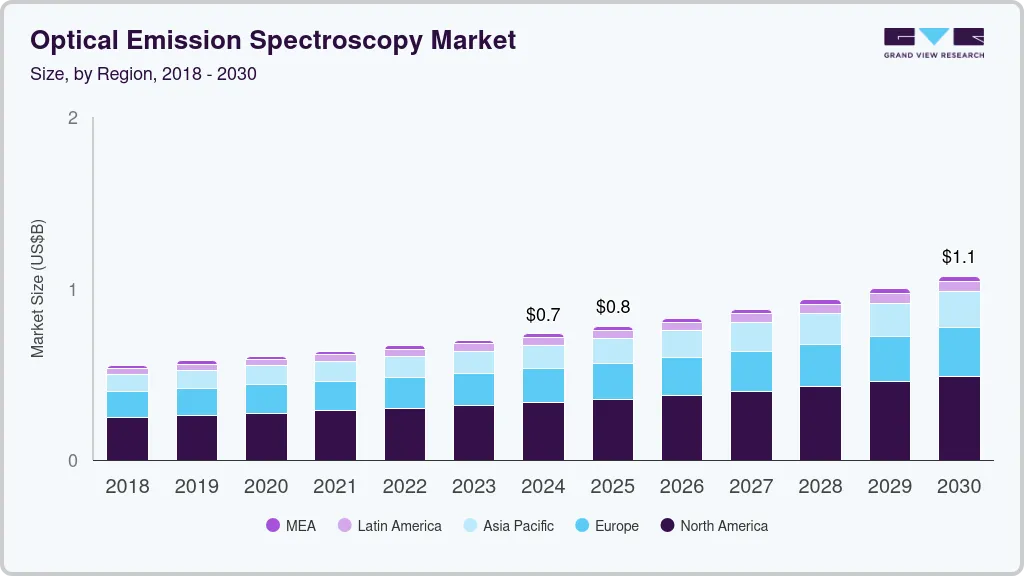

The global optical emission spectroscopy market size was estimated at USD 737.1 million in 2024 and is expected to reach USD 1.07 billion by 2030, growing at a CAGR of 6.6% from 2025 to 2030. This growth is attributed to the global increase in manufacturing and industrialization, strict regulatory standards, and the increasing importance of environmental monitoring. In addition, technological advancements by the leading manufacturers and the growing need for developing innovative and technologically advanced products that provide better customer outcomes is further anticipated to drive market growth. For instance, in January 2033, the SPECTRO Analytical Instruments announced the launch of the SPECTRO ARCOS ICP-OES system, representing the next generation of industry-leading OES technology.

Strict regulatory standards in industries such as automotive, aerospace, and pharmaceuticals are driving the adoption of OES to ensure compliance with safety and quality control requirements. For instance, the European Union (EU) announced the adoption of the Industrial Emissions Directive (IED) in 2010 to ensure compliance with safety and quality control requirements across various industries, particularly automotive and aerospace, further propelling the adoption of OES. Moreover, the EU has implemented a series of regulatory updates to support sectors and ensure competitiveness, including within the automotive industry. These updates encompass critical areas such as semiconductor development, raw materials sourcing, cybersecurity, data access requirements, and artificial intelligence (AI) deployment.

The growing demand from the metal and metallurgy industry is a key driver for the optical emission spectroscopy (OES) market. OES instruments are crucial in this sector, as they provide critical information about the quality and composition of metals used in various applications, from automotive and aerospace to construction. Leading providers of scientific instrumentation are focusing on developing and introducing innovative OES solutions to cater to the evolving needs of the metal industry. For instance, in November 2023, Thermo Fisher Scientific Inc. announced the launch of Thermo Scientific ARL iSpark Plus Optical Emission Spectrometer range. This newest series of OES spectrometers is tailor-made to optimize elemental analysis tasks in metal production, processing, and recycling sectors and in contract and research labs.

The growing emphasis on sustainability practices across industries is forcing companies to adopt advanced technologies such as optical emission spectroscopy (OES) to support efficient resource utilization, waste reduction, and environmental impact mitigation. OES involves the analysis of the electromagnetic radiation emitted by atoms when they are excited, providing valuable insights into the elemental composition of materials. This method facilitates effective process monitoring and empowers organizations to make data-driven decisions to improve the sustainability of their operations.

Offerings Insights

Equipment segment dominated the market and accounted for a share of 61.90% in 2023. This can be attributed to the growing demand for advanced and sophisticated OES instruments across various industries. Manufacturers are continuously focusing on investing in research and development to launch new OES equipment with enhanced features and capabilities, driving the adoption of these equipment. For Instance, in April 2020, Thermo Fisher Scientific introduced the innovative Thermo Scientific iCAP PRO Series ICP-OES platform, an instrument developed to offer quick and sensitive solutions for trace element analysis. This platform is engineered to enhance trace element analysis through its focus on rapidity, sensitivity, improved workflow efficiency, and affordability.

Services segment is projected to grow at the fastest growth rate over the forecast period. This can be attributed to the increasing demand for outsourcing analytical testing requirements from various end users. Companies increasingly prefer outsourcing their OES testing and analysis to third-party service providers rather than investing in expensive OES equipment and maintaining in-house expertise. This trend is driven by the need to reduce capital expenditure, access specialized expertise, and ensure compliance with stringent quality standards. For instance, leading OES market players such as Thermo Fisher Scientific Inc., Agilent Technologies Inc., and PerkinElmer offer customers comprehensive OES testing and analysis services across industries such as metals, automotive, aerospace, and environmental monitoring.

Form Factor Insights

Benchtop segment held the largest share of 71.93% in 2023. Benchtop OES instruments are preferred for their ease of use, stability, and ability to provide accurate and reliable elemental analysis. They are widely used in applications such as metals and heavy machinery, automotive, aerospace, and power generation, where precise material composition analysis is critical for quality control and regulatory compliance. For instance, Thermo Fisher Scientific's ARL iSpark 8860 is a benchtop OES system designed to analyze metals and alloys, offering high-speed analysis and advanced data processing capabilities.

Portable segment is anticipated to grow significantly during the forecast period. This is attributed to the increasing demand for compact and mobile OES instruments across various industries. Portable OES systems offer advantages such as ease of use, on-site analysis capabilities, and reduced sample preparation requirements, making them suitable for remote and field applications. For Instance, Hitachi High-Tech's PMI-MASTER Smart is a portable OES system that combines high performance with a user-friendly interface, making it ideal for applications in the metals industry.

Product Insights

The Arc/Spark OES segment held the largest share of 63.51% in 2023. This dominance can be attributed to the high accuracy, sensitivity, and reliability of Arc/Spark OES instruments in analyzing metallic samples. The ability of Arc/Spark OES to provide precise elemental analysis across a wide range of metals, alloys, and materials makes it a preferred choice for industries such as manufacturing, automotive, aerospace, and research laboratories. In addition, technological advancements have led to the development of Arc/Spark OES systems with enhanced features such as automation, improved detection limits, and faster analysis times, further solidifying its position in the market. The growing demand for quality control and material verification in various industries also drives the adoption of Arc/Spark OES instruments.

ICP-OES (Inductively Coupled Plasma) is anticipated to witness lucrative growth over the forecast period. This growth can be attributed to several drivers, such as its high sensitivity, multi-element analysis capabilities, and low detection limits. In environmental testing, ICP-OES is crucial for detecting trace elements in soil and water samples to ensure compliance with regulatory standards. The versatility and efficiency of ICP-OES make it a preferred choice for laboratories requiring precise elemental analysis across a wide range of applications.

Detector Insights

The Solid-State Detector (SSD) segment held the largest share, accounting for 45.93% in 2023. Solid-state detectors are semiconductor devices that convert incident photons into electrical signals, offering high sensitivity and resolution for detecting various elements in samples. Their ability to analyze every wavelength simultaneously in the UV and visible portions of the electromagnetic spectrum makes them preferred in end user verticals such as metal analysis in environmental samples, food and beverages, pharmaceuticals, chemicals, and oil and gas.

ThePhotomultiplier Tube (PMT) segment is anticipated to grow significantly over the forecast period. The increasing demand for high-performance analytical instruments in various industries, such as healthcare, environmental monitoring, and material science, is a key driver behind the rapid adoption of PMTs. In addition, advancements in PMT technology, such as enhanced quantum efficiency and reduced noise levels, have further propelled their popularity.

Application Insights

Chemical composition analysis held the largest share of 42.93% in 2023 and is anticipated to grow rapidly over the forecast period. The market is driven by its wide range of applications across various industries, including metallurgy, pharmaceuticals, and environmental monitoring. The increasing demand for accurate and rapid elemental analysis in materials testing and quality control processes fuels this dominance. Optical emission spectroscopy's ability to provide precise quantitative analysis of elements present in a sample makes it indispensable in ensuring product quality, compliance with regulations, and process optimization.

Material testing and quality control is the second largest segment in the market. Optical emission spectroscopy's ability to provide rapid and accurate elemental analysis of materials makes it a valuable tool for ensuring product quality and compliance with industry standards. For instance, in the automotive industry, optical emission spectroscopy is used to analyze the composition of metals in components to ensure they meet stringent performance requirements. Similarly, this technology is employed in the aerospace sector to verify the integrity of materials used in aircraft parts, contributing to enhanced safety and reliability.

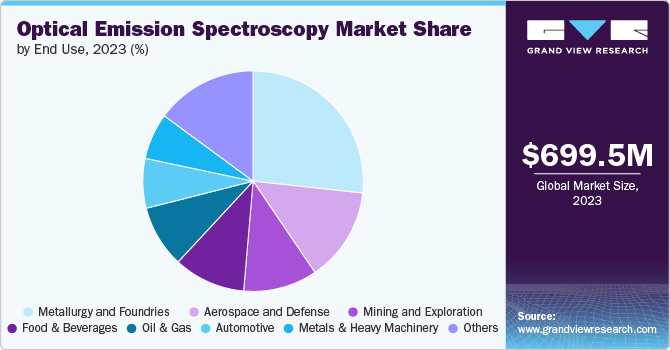

End-use Insights

Metallurgy and foundries segment held the largest share of 26.73% in 2023. This can be attributed to the extensive use of OES in various metallurgical applications, such as analyzing the composition of metals and alloys in foundries. OES is a crucial analytical technique for the metals industry, as it accurately determines the elemental composition of materials, ensuring quality control and compliance with industry standards. The steel manufacturers rely on optical emission microscopy to verify the chemical composition of steel alloys, enabling them to maintain the desired properties and performance characteristics. Similarly, aluminum producers use OES to analyze the composition of aluminum alloys, which is essential for producing high-quality components for the automotive, aerospace, and construction industries.

Aerospace and defense is anticipated to witness significant growth over the forecast period. Optical emission spectroscopy is widely employed in the aerospace and defense sector for analyzing metals, alloys, and other materials used in aircraft and spacecraft manufacturing. This ensures that their composition adheres to the necessary specifications and safety standards. This method is utilized to examine the composition of aluminum alloys in aircraft fuselages, wings, and landing gear to confirm their strength and durability. Similarly, it is applied to determine the composition of titanium alloys used in jet engines and other critical components, ensuring their resistance to high temperatures and stresses. The growing demand for lightweight and high-performance materials, coupled with the need for rigorous quality control measures in the aerospace and defense industry, is driving the adoption of OES market.

Regional Insights

North America dominated the market and accounted for a share of 42.74% in 2023, owing to increasing demand for quality control and process optimization in various industries such as manufacturing, pharmaceuticals, and metals. The US is a major contributor to this growth, driven by the presence of key industry players and a robust research and development landscape. In addition, government initiatives promoting the adoption of advanced analytical techniques are also driving market growth.

U.S. Optical Emission Spectroscopy Market Trends

The U.S. optical emission spectroscopy market is anticipated to witness significant growth over the forecast period. The U.S. market is characterized by the presence of leading OES manufacturers, such as Thermo Fisher Scientific Inc. and Agilent Technologies Inc. These companies offer a wide range of products and services to cater to diverse application needs. These companies continuously invest in research and development to launch new OES equipment with enhanced features and capabilities, further propelling the market's growth.

Europe Optical Emission Spectroscopy Market Trends

Europe's optical emission spectroscopy market is projected to witness significant growth driven by a focus on technological innovation and sustainability. The European Union's rising focus on environmental policies and industries in the region are under pressure to adopt cutting-edge analytical tools that can help them minimize their ecological footprint. This has fueled the demand for OES systems that can accurately detect and quantify various elements, enabling companies to optimize manufacturing processes and comply with stringent regulations.

Asia Pacific Optical Emission Spectroscopy Market Trends

Asia Pacific optical emission spectroscopy market is growing at the fastest CAGR over the forecast period. The market is driven by the region's booming industrial sector. Countries such as China and India are undergoing rapid industrialization and urbanization, leading to increased demand for advanced analytical technologies such as OES across various applications, from metals processing to food safety. In addition, the region's growing emphasis on environmental protection has created new opportunities for OES in water and air quality monitoring areas.

Key Optical Emission Spectroscopy Company Insights

Some of the key players operating in the market include Agilent Technologies, Inc., Bruker, HORIBA and others. These companies have a strong global presence and are continuously innovating to meet the growing demand for precise and efficient material analysis across different sectors.

Key Optical Emission Spectroscopy Companies:

The following are the leading companies in the optical emission spectroscopy market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies, Inc.

- Anritsu Corporation

- Bruker

- HORIBA

- JEOL Ltd.

- PerkinElmer

- Rigaku Holdings Corporation and its Global Subsidiaries.

- Shimadzu Corporation

- SPECTRO Analytical Instruments GmbH.

- Thermo Fisher Scientific Inc.

Recent Developments

-

In March 2024, SPECTRO Analytical Instruments launched the latest version of SPECTROMAXx arc/spark optical emission spectrometry (OES) analyzer. This is one of the industry's best-selling OES analyzers for material control analysis. The LMX10 delivers outstanding repeatability, reproducibility, and reliability in material analysis across the supply chain.

-

In August 2021, HORIBA Scientific, a leading provider of spectroscopy solutions, collaborated with Covalent Metrology, a provider of analytical services, to inaugurate the HORIBA Scientific North American Demonstration Lab at Covalent's Silicon Valley headquarters.

Optical Emission Spectroscopy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 779.0 million

Revenue forecast in 2030

USD 1.07 billion

Growth rate

CAGR of 6.6% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offerings, form factor, product, detector, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia UAE; Kuwait

Key companies profiled

Agilent Technologies, Inc.; Anritsu Corporation; Bruker; HORIBA; JEOL Ltd.; PerkinElmer; Rigaku Holdings Corporation and its Global Subsidiaries.; Shimadzu Corporation; SPECTRO Analytical Instruments GmbH.; Thermo Fisher Scientific Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Optical Emission Spectroscopy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global optical emission spectroscopy market report based on offerings, form factor, product, detector, application, end use, and region.

-

Offerings Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Services

-

-

Form Factor Outlook (Revenue, USD Million, 2018 - 2030)

-

Benchtop

-

Portable

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Arc/Spark OES

-

ICP-OES (Inductively Coupled Plasma)

-

-

Detector Outlook (Revenue, USD Million, 2018 - 2030)

-

Photomultiplier Tube (PMT)

-

Solid State Detector (SSD)

-

Hybrid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chemical Composition Analysis

-

Material Testing and Quality Control

-

Environmental Testing

-

Research and Development

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Metallurgy and Foundries

-

Mining and Exploration

-

Automotive

-

Aerospace and Defense

-

Oil and Gas

-

Food and Beverages

-

Metals and Heavy Machinery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global optical emission spectroscopy market size was estimated at USD 699.46 million in 2023 and is expected to reach USD 737.12 million in 2024.

b. The global optical emission spectroscopy market is expected to grow at a compound annual growth rate of 6.44% from 2024 to 2030 to reach USD 1.07 billion by 2030.

b. North America dominated the optical emission spectroscopy market with a share of 42.74% in 2023. This is attributable to an increasing demand for quality control and process optimization in various industries such as manufacturing, pharmaceuticals, and metals.

b. Some key players operating in the optical emission spectroscopy market include Agilent Technologies, Inc.; Anritsu Corporation; Bruker; HORIBA; JEOL Ltd.; PerkinElmer; Rigaku Holdings Corporation and its Global Subsidiaries.; Shimadzu Corporation; SPECTRO Analytical Instruments GmbH.; Thermo Fisher Scientific Inc.

b. Key factors that are driving the market growth include an increase in manufacturing and industrialization, strict regulatory standards, and the increasing importance of environmental monitoring.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.