Optical Coherence Tomography Market Size, Share & Trends Analysis Report By Technology (Time Domain OCT, Frequency Domain OCT), By Application (Ophthalmology, Oncology, Cardiovascular, Dermatology), By Type, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-251-8

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

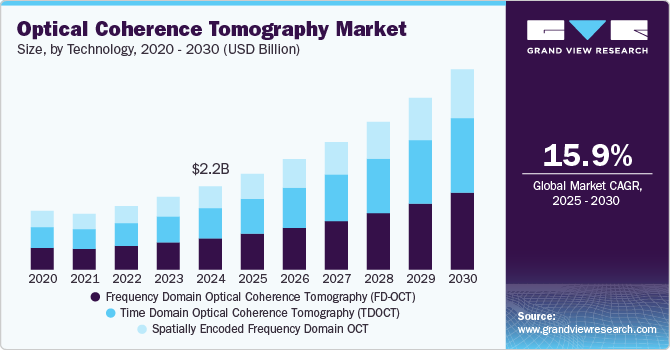

The global optical coherence tomography market size was estimated at USD 2.2 billion in 2024 and is projected to grow at a CAGR of 15.9% from 2025 to 2030. The continuous innovation and development of newer technologies, higher demand from new biomedical application areas such as drug delivery, growing demand for early diagnosis of diseases, and rising prevalence of eye disorders, are expected to drive the industry growth.

According to Canadian Health Measures Survey (2018-2019), 2.6% of children aged between 6 to 19 and 1.4% of adults aged between 40 to 79 have a visual impairment that cannot be corrected. Several organizations, such as the canadian council of blind (CCB), are working towards it, with the mission of improving the quality of life of visually impaired people.

Optical coherence tomography (OCT) uses light for the cross-sectional imaging of the tissue structure on the micron scale, in situ, and in real time. It is a non-invasive imaging technique, which is used to perform optical biopsies. It is used in areas where traditional imaging techniques cannot be used. OCT is based on fiber optics and can be integrated with instruments, such as endoscopes, catheters, surgical probes, and laparoscopes, which enable imaging of the body. Furthermore, OCT is a portable and compact device. All these factors are expected to drive the industry’s growth during the forecast years.

OCT is useful in the diagnosis of some major health disorders, such as cardiovascular diseases, non-melanoma skin cancer, prostate cancer, and age-related macular disease. This requires the need for non-invasive and in vivo imaging technology to monitor and diagnose the disease and its overlying condition. Continuous development of newer technologies and high demand for OCT imaging from developing countries are expected to drive industry growth.

The increasing prevalence of eye diseases is projected to fuel market growth during the forecast period. According to the World Health Organization (WHO), almost 2.3 billion people were suffering from vision loss in 2019 due to unaddressed medical conditions, such as cataracts, refractive errors, corneal opacities, glaucoma, trachoma, and diabetic retinopathy. The WHO also estimates that over 2.2 billion individuals worldwide suffer from a near- or distance-vision disability brought on by eye conditions, such as cataracts, diabetic retinopathy, refractive error, glaucoma, and other conditions. Out of which, approximately 1 billion cases could have been prevented or are yet to be addressed. The demand for cutting-edge disease diagnostic tools like OCT systems is growing as a result of the rise in these eye ailments.

Increased R&D efforts, the development of many unique products, and innovative hybridization technologies characterize the industry. One of the top OCT companies, Novacam Technologies Inc., creates and manufactures highly accurate advanced 3D metrology systems for use in biomedicine and other fields. The company’s devices use non-contact fiber-based scanning probes and low-coherence interferometry as their foundation. By collaborating with OEMs and system integrators that aim to use the vendor's cutting-edge LCI-based components in standard assemblies for vertical sectors, Novacam is actively looking for new methods to strengthen its market position.

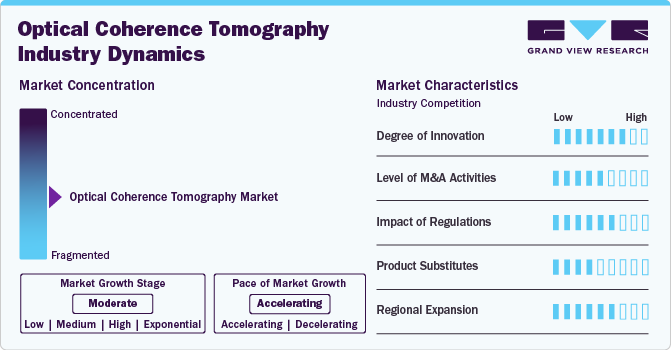

Market Concentration & Characteristics

The optical coherence tomography (OCT) industry is moderately concentrated, with key players like Carl Zeiss Meditec, Topcon Corporation, and Heidelberg Engineering dominating the market. Industry characteristics include rapid technological advancements, such as AI integration and portable devices, fostering competition and innovation. The market benefits from growing applications across ophthalmology, cardiology, and oncology. Barriers to entry include high R&D costs and stringent regulatory requirements. Consolidation is evident, with mergers and acquisitions enhancing product portfolios and global reach.

The degree of innovation in the optical coherence tomography industry is exemplified by NIDEK CO., LTD.’s launch of the RS-1 Glauvas Optical Coherence Tomography in June 2024. This advanced system features a 250kHz scan speed, delivering high-quality imaging for wide and deep areas, enhanced operability, and deep learning-based analytics. Designed for glaucoma and retinal vascular disease diagnostics, it streamlines workflows while ensuring diagnostic confidence in high-volume practices. Its rapid imaging capability minimizes capture time and reduces fixation errors, resulting in clearer images and improved patient comfort, demonstrating significant advancements in OCT technology for efficient and accurate clinical applications.

Regulations significantly influence the OCT industry by ensuring safety, efficacy, and quality standards for devices. Regulatory bodies like the FDA and CE authorities mandate compliance with strict guidelines for device approval, including clinical trials and performance validation. These regulations impact innovation timelines and market entry, requiring manufacturers to invest heavily in research and documentation. Additionally, evolving regulations, such as those focusing on data security and interoperability, shape product development. While stringent regulations can delay commercialization, they also enhance trust among healthcare providers and patients, ensuring OCT devices deliver accurate, reliable, and safe diagnostic solutions.

Mergers and acquisitions (M&A) in the optical coherence tomography (OCT) industry have been growing as companies seek to expand their technological capabilities, product portfolios, and market presence. In July 2024, EssilorLuxottica, owner of brands like Ray-Ban and Oakley, is acquiring an 80% stake in Heidelberg Engineering, a leader in ophthalmic diagnostics. Heidelberg specializes in OCT, confocal microscopy, and scanning lasers, with equipment widely used in diagnosing conditions such as AMD and glaucoma. The move expands EssilorLuxottica into photonics technology. Such strategic moves enable companies to improve operational efficiency and accelerate innovation, further driving competition and growth within the industry.

In the optical coherence tomography (OCT) industry, substitute products include diagnostic imaging technologies like fundus photography, ultrasound biomicroscopy (UBM), fluorescein angiography, and scanning laser ophthalmoscopy (SLO). These alternatives cater to similar diagnostic needs, such as retinal and corneal imaging, but differ in precision and application scope. UBM is effective for anterior segment imaging, while fundus photography is less detailed but widely used for retinal examinations. However, OCT's superior resolution, non-invasiveness, and ability to provide cross-sectional imaging give it a distinct advantage. Continued innovation in OCT, such as AI integration and faster scan speeds, further reduces the competitiveness of substitutes.

Regional expansion in the optical coherence tomography (OCT) industry is gaining momentum as healthcare systems integrate advanced imaging technologies to improve patient care worldwide. Notably, NHS England's initiative to roll out OCT devices in hospitals across the country by November 2024 aims to enhance diabetic retinopathy screenings. This effort supports the NHS Diabetic Eye Screening Programme, which registers around 4 million patients and conducts digital screenings every two years for 3.3 million people. The program is expected to reach 60,000 high-risk individuals showing early signs of eye disease, marking a significant expansion of OCT access for improved diagnosis and outcomes.

Technology Insights

The frequency domain optical coherence tomography (FD-OCT) segment held the largest revenue share of 37.6% in 2024. FD-OCT systems are mainly based on the measurement of the interference spectrum, hence also called spectral-domain OCT (SD-OCT). The SD-OCT uses interferometric signals to speed up imaging speed up to 50 times, thus providing a greater number of images per unit area and boosting the industry penetration during the projection years.

The time-domain OCT (TD-OCT) segment is expected to grow at the fastest CAGR of 16.40% during the forecast period. TD-OCT is the traditional technique used to examine the retinal screen of the eye. It examines the retinal thickness by measuring the distance between the internal limiting membrane and the highest hyper-reflective band. It is used in the diagnosis of several retinal conditions, such as the macular hole, macular pucker, vitreomacular traction, and macular edema.

SD-OCT, also known as spatial encoded frequency domain OCT, is anticipated to expand rapidly during the forecast period. By examining the spectrum of the interference fringe pattern, SD-OCT, a type of interferometric technology, can provide depth-resolved tissue structural data that is encoded in the size and deferral of the backscattered light. In addition, the SD-OCT technology enables ultra-high-speed OCT imaging in contrast to Temporal Domain (TD) OCT. SD-OCT is crucial in applications related to biological imaging because of its quick operation and outstanding sensitivity.

Type Insights

The handheld segment dominated the market in 2024 with the largest revenue share of 46.9% and is expected to retain its dominance over the forecast period. Handheld OCT devices are a combination of microelectromechanical systems (MEMS) with 3D imaging to help in the early detection of multiple eye disorders like diabetic retinopathy, macular degeneration, and glaucoma.

The Doppler OCT segment is anticipated to grow at the fastest CAGR of 17.3% during the forecast period on account of the wide usage in the areas of ophthalmology, dermatology, gastrointestinal endoscopy & cardiology; the ability to image dynamic flow parameters, such as pulsatility; and reduced time of processing. Tabletop OCT devices are the traditional type of non-invasive devices used to scan the retina to check for any kind of eye disorders or the occurrence of certain symptoms. Tabletop OCTs require proper infrastructure and are non-portable.

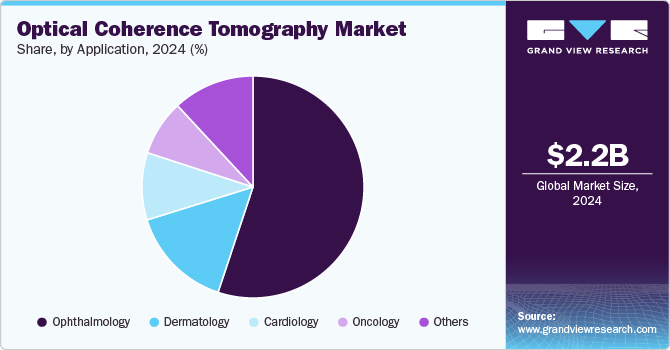

Application Insights

The ophthalmology segment had the largest revenue share of 55.1% in 2024. The segment is projected to witness rapid growth in the future due to the increasing incidences of choroidal and retinal disorders, which, in turn, lead to increased product adoption by ophthalmologists for imaging and diagnosing purposes. Furthermore, the rising importance and awareness about early disease diagnosis and better treatment options with OCT devices are expected to boost growth.

The dermatology segment is estimated to register the fastest CAGR of 21.4% during the forecast period owing to the rising prevalence of skin disorders and the use of OCT to diagnose conditions, such as solid skin tumors. OCT has also been found to be useful in diagnosing early-stage cancer as it provides a real-time image of what lies beneath the skin in vivo.

The oncology segment is also predicted to grow at a CAGR of 19.4% over the forecast period. Cancer ranks as a primary cause of mortality and a significant barrier to growing life expectancy. The WHO estimated that around 19.3 million new cases of cancer and almost 10 million cancer-related deaths occurred in 2020 (which is 1 in every 6 deaths). Europe accounts for 22.8% of all cancer cases and 19.6% of all cancer deaths. The Americans come in second with 21.0% incidence and 14.2% worldwide mortality. Every cancer type requires an appropriate diagnosis and an accurate treatment schedule. The growing product demand can be attributed to the utilization of imaging techniques for screening cancer.

Regional Insights

North American optical coherence tomography market held a dominant position, capturing 34.1% of the global revenue share in 2024. The growing geriatric population, increasing approvals, R&D investments, inclination towards adopting newer products in the U.S., expansion of hospitals, and the presence of well-established healthcare infrastructure are boosting the growth of the region.

U.S. Optical Coherence Tomography Market Trends

The optical coherence tomography market in the U.S. held a significant share of North America's OCT market in 2024. For instance, in May 2024, ZEISS announced advancements to its OCT technology to enhance support for the growing demand for data-driven patient care. The ZEISS Medical Ecosystem strengthens the CIRRUS 6000, integrating the largest OCT reference database in the U.S. and bolstering its cybersecurity features to provide improved performance and security in clinical environments, ensuring the reliable management and protection of patient data.

Europe Optical Coherence Tomography Market Trends

Europe optical coherence tomography market dominated the global market with 23.5% share in 2024 driven by advanced healthcare infrastructure, increasing prevalence of eye diseases, and rising demand for non-invasive diagnostic tools. The region benefits from strong investments in medical technology and widespread adoption of OCT systems in clinical settings.

The UK optical coherence tomography market is experiencing steady growth. In November 2024, NHS England (NHSE) began the phased integration of advanced OCT scans into the post-DES treatment and monitoring pathway. This move is expected to save tens of thousands of hospital appointments annually.

The optical coherence tomography (OCT) market in Franceis expanding, driven by key advancements. The CALIPSO trial demonstrated that OCT could guide percutaneous coronary intervention (PCI) for moderate to severe calcified lesions, comparing OCT-guided PCI with angiography-based methods. Additionally, the National Eye Institute hosted a scientific symposium in March 2024, highlighting the significant impact of OCT in vision health and research. These developments further support the growing adoption of OCT technology in clinical settings, contributing to market growth in France.

The German optical coherence tomography market is primarily driven by a multi-center study involving 2,500 patients, exploring OCT’s use in percutaneous coronary intervention (PCI). The study revealed that OCT delivers high-resolution images of heart vessel walls, aiding in the detection of blockages and damage, thus advancing market growth.

Asia Pacific Optical Coherence Tomography Market Trends

The Asia Pacific region is anticipated to see strong growth in the optical coherence tomography market during the forecast period. The rapid growth of this region can be attributed to various factors, such as the rising prevalence of chronic disorders, rising adoption of advanced technologies, presence of a large geriatric population pool, increasing reimbursement for surgical procedures, and high preference for minimally invasive procedures over traditional methods. Furthermore, the increasing awareness levels regarding eye disorders are also anticipated to propel the market growth in this region during the forecast period. In July 2021, Canon Singapore launched Xephilio OCT-S1, an Innovative-field swept source OCT that can capture images up to 23*20 mm in a single scan.

Theoptical coherence tomography market in Japan is expanding due to increasing adoption of advanced OCT technology in healthcare. This growth is supported by innovations in imaging techniques and a rising demand for early diagnosis of ocular diseases, contributing to enhanced market penetration and improved patient outcomes.

China optical coherence tomography market is expected to grow rapidly, driven by TowardPi's advancements in OCT technology. In 2023, TowardPi launched new features for its OCT devices, such as BMizar, which offers a scanning speed of 400,000 scans per second and a depth of 6 mm. Additionally, the Yalkaid device provides a depth of 14 mm for the anterior segment and 12 mm for the posterior segment, enhancing diagnostic capabilities and supporting the expansion of OCT adoption in the region. These innovations contribute to the market's growth and improve clinical applications.

The optical coherence tomography market in India is experiencing significant growth. In May 2022, Chhattisgarh state introduced its first OCT-based advanced technology, performing 3D OCT-guided coronary angioplasty on three patients at the Advance Cardiac Institute. Additionally, in August 2020, the Department of Cardiology in south Karnataka implemented OCT image-guided angioplasty, aiding doctors in visualizing coronary artery blockages.

Latin America Optical Coherence Tomography Market Trends

The Latin American optical coherence tomography market is growing rapidly, due to increased adoption of advanced diagnostic technologies in ophthalmology and cardiology. Rising awareness of retinal diseases, glaucoma, and heart conditions is driving the demand for OCT devices. Brazil, Mexico, and Argentina are key markets, with healthcare improvements and growing medical infrastructure supporting the market growth. The introduction of cost-effective OCT solutions and government healthcare programs also plays a role in boosting market penetration. As demand for accurate, non-invasive imaging increases, the OCT market is expected to continue its growth trajectory across the region in the coming years.

The optical coherence tomography market in Saudi Arabia is expanding due to increasing healthcare investments, advancements in medical technology, and rising awareness of eye-related diseases such as glaucoma and diabetic retinopathy. The Saudi government’s Vision 2030 plan, which includes enhancing healthcare infrastructure and promoting advanced diagnostic tools, is further driving the adoption of OCT systems.

Key Optical Coherence Tomography Company Insights

The competitive scenario in the optical coherence tomography market is highly competitive, with key players such as Carl Zeiss Meditec AG., Topcon Corporation. and others. Strategic partnerships with local distributors and region-based type variations are some of the initiatives adopted by global players. Major companies are investing in R&D for the development and launch of new products to serve industry demand. In May 2021, Abbott announced the launch of the artificial intelligence OCT coronary imaging platform powered by Ultreon 1.0 Software in Europe. The software detects calcium-based blockages automatically and measures the diameter of the vessel, thereby enhancing the precision of the physician’s decision marking at the time of coronary stenting procedures. In November 2020, Abbott announced the first OCT virtual reality product used for the training of cardiologists. In 2019, TOPCON Canada Inc. announced the launch of 3D Maestro2, which is a spectral domain OCT system with optional OCT angiography.

Key Optical Coherence Tomography Companies:

The following are the leading companies in the optical coherence tomography market. These companies collectively hold the largest market share and dictate industry trends.

- Agfa - Gevaert Group

- Carl Zeiss Meditec AG

- Heidelberg Engineering GmbH

- Imalux Corp.

- Michelson Diagnostics

- Novacam Technologies, Inc.

- OPTOPOL Technology S.A.

- Metall Zug AG

- Topcon Corporation

- Thorlabs, Inc

- Abbott

Recent Developments

-

In February 2024, the Advanced Research Projects Agency for Health (ARPA-H) announced a USD 20 million initiative to develop a compact, affordable optical coherence tomography (OCT) device. This project aims to enhance early detection and intervention for eye diseases, potentially preventing severe visual impairments.

-

In October 2024, Bristol-based health tech start-up Siloton has secured USD 1,066,400 to advance its Akepa OCT chip technology, aimed at combating age-related macular degeneration (AMD), the UK’s leading cause of sight loss. The funding will support commercial roll-out, with plans to capture the first chip-based OCT image by year-end and release a research version in 2025.

-

In May 2024, Palleos Healthcare GmbH, an oncology-focused CRO, and OCT Global SA, operating under OCT Clinical, have merged to create a stronger force in clinical research. The merger, supported by Swiss XlifeSciences AG, marks a significant milestone, fostering collaboration and growth in the clinical research field.

Optical Coherence Tomography Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.5 billion |

|

Revenue forecast in 2030 |

USD 5.3 billion |

|

Growth rate |

CAGR of 15.9% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; and MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

Agfa - Gevaert Group; Carl Zeiss Meditec AG; Heidelberg Engineering GmbH; Imalux Corp.; Michelson Diagnostics; Novacam Technologies Inc.; OPTOPOL Technology S.A.; Metall Zug AG; Topcon Corporation; Thorlabs Inc.; Abbott |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Optical Coherence Tomography Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the optical coherence tomography market report based on technology, type, application and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Time Domain OCT (TDOCT)

-

Frequency Domain OCT (FD-OCT)

-

Spatial Encoded Frequency Domain OCT

-

Fourier Domain OCT (FDOCT)

-

Others

-

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Catheter based OCT Devices

-

Doppler OCT Devices

-

Handheld OCT Devices

-

Tabletop OCT Devices

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Ophthalmology

-

Cardiovascular

-

Oncology

-

Dermatology

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global optical coherence tomography market size was estimated at USD 2.2 billion in 2024 and is expected to reach USD 2.5 billion in 2025.

b. The global optical coherence tomography market is expected to grow at a compound annual growth rate of 15.9% from 2025 to 2030 to reach USD 5.3 billion by 2030.

b. North America dominated the optical coherence tomography market with a share of 34.1% in 2024. This is attributable to increasing investments in R&D, faster adoption of medical devices, and expansion of laboratories & hospitals.

b. Some key players operating in the optical coherence tomography market include Agfa - Gevaert Group; Carl Zeiss Meditec AG; Heidelberg Engineering GmbH; Imalux Corp.; Michelson Diagnostics; Novacam Technologies Inc.; OPTOPOL Technology S.A.; Metall Zug AG; Topcon Corporation; Thorlabs Inc.; Abbott

b. Constant innovation and development of newer technologies, higher demand for new biomedical applications such as drug delivery, rising demand for early diagnosis of the disease, and rising prevalence of eye disorders are expected to drive the OCT market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."