Opioid Use Disorder Market Size, Share & Trends Analysis Report By Drug (Naltrexone, Buprenorphine, Methadone), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-353-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Opioid Use Disorder Market Size & Trends

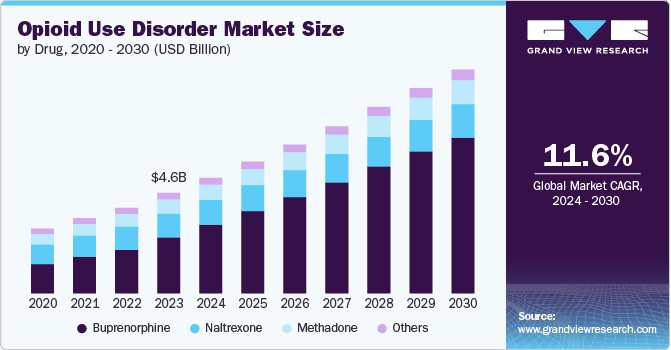

The global opioid use disorder market size was valued at USD 5.28 billion in 2024 and is projected to grow at a CAGR of 11.15% from 2025 to 2030. The expansion of the market is driven by the rising rates of substance use disorders, growing government efforts to address the crisis, and increased awareness of opioid use disorder treatments. These factors are anticipated to significantly boost market growth over the forecast period, fostering innovation and improving access to addiction care solutions.

The rising incidence of substance use disorders is a major factor driving the market for medications targeting conditions like opioid use disorder. As more individuals experience substance use issues, the demand for effective treatments grows, shaping market trends and stimulating advancements in addiction medicine. The 2023 National Survey on Drug Use and Health (NSDUH), published by the Substance Abuse and Mental Health Services Administration (SAMHSA), offers extensive data on substance use and mental health trends in the U.S. According to the survey, 59.0% of individuals aged 12 or elder engaged in the use of tobacco, vaped nicotine, alcohol, or illicit drugs in 2023, with 47.7 million having used illicit drugs within the past year, and marijuana being the most frequently used. Additionally, 48.5 million people were reported to have a substance use disorder (SUD), encompassing both alcohol and drug use disorders. The survey also found that 18.1% of adults experienced mental illness, and 18.1% of adolescents had a major depressive episode.

Furthermore, increasing government efforts are becoming key factors in the opioid use disorder market, as they boost awareness, accessibility, and affordability of addiction treatment globally. These efforts focus on broadening access to treatment and recovery services, improving public health measures, and intensifying law enforcement actions to curb illegal drug availability. They also stress the importance of education and awareness campaigns to avert substance misuse and encourage safe prescribing practices among healthcare professionals. Additionally, these initiatives involve enhancing collaboration among federal, state, and local authorities and integrating evidence-based approaches to tackle the multifaceted issues of opioid addiction in communities nationwide. For instance, in February 2023, in response to the ongoing opioid overdose crisis, the FDA outlined a comprehensive strategy. This includes implementing recommendations from the 2017 NASEM Report, enhancing transparency in opioid analgesic decision-making, and seeking additional congressional authorities. The FDA's Overdose Prevention Framework emphasizes evidence generation through initiatives such as the SOURCE simulation model and advisory committee meetings to evaluate long-term opioid efficacy.

In June 2024, an NIH-funded survey revealed significant public unawareness regarding primary care physicians' ability to prescribe medications for OUD, with 61% unaware and 13% holding incorrect beliefs. Targeted campaigns and integrating OUD treatment into primary care settings are recommended to bridge this knowledge gap and improve access to lifesaving medications. The survey suggests a potential market opportunity for pharmaceutical companies and healthcare providers to enhance education & integration efforts, thereby increasing demand for OUD treatments in primary care settings.

Moreover, recent developments and funding allocations, the OUD market is poised for significant shifts, driven by both governmental initiatives and emerging public health insights. For instance, on International Overdose Awareness Day in August 2023, the Biden-Harris administration announced over USD 450 million to combat the overdose epidemic, enhance prevention, treatment, and recovery services, and curb illicit drug trafficking. Initiatives include expanding CDC's OD2A grants, funding drug-free communities, and supporting rural communities with naloxone distribution & behavioral healthcare access.

Product Insights

Buprenorphine segment led the market and accounted for 59.58% of the global revenue in 2024 and is expected to grow at fastest CAGR over the forecast period. This is attributed due to its effective dual action as a partial opioid agonist, which helps alleviate withdrawal symptoms and cravings while minimizing euphoria and misuse risk. Its ceiling effect reduces overdose risk, and when combined with naloxone, it further deters abuse. A recent NIH-funded study from September 2024 indicates that adults with opioid use disorder who receive higher-than-recommended daily doses of buprenorphine may experience fewer behavioral health-related emergency department visits or inpatient services. These findings suggest that increased buprenorphine doses could enhance treatment outcomes, particularly for individuals using fentanyl, which significantly contributes to the ongoing overdose crisis. This research highlights the potential need to revisit dosing guidelines to better support effective management of opioid use disorder.

Naltrexone segment held the second largest revenue share of the market in 2024 due to its unique advantages. As a full opioid antagonist, naltrexone effectively blocks opioid receptors, preventing relapses by eliminating the euphoric effects of opioids. Its long-acting injectable form, Vivitrol, offers convenience with monthly dosing, improving patient adherence and reducing the risk of relapse. Naltrexone’s non-addictive nature and lack of abuse potential enhance its appeal compared to other treatments. Additionally, increasing awareness and expanding insurance coverage are likely to drive its adoption, contributing to its rapid market growth.

Route Of Administration Insights

Injectable route of administration dominated the market and accounted for 59.26% of the global revenue in 2024 and is expected to grow at fastest CAGR rate over the forecast period. Extended release injectables, like Vivitrol (naltrexone) and Sublocade (buprenorphine), offer prolonged, steady drug delivery, improving adherence and reducing the risk of relapse. These formulations require less frequent administration typically monthly compared to daily oral medications, which enhances patient convenience and engagement. Injectable treatments also eliminate the risk of medication misuse or diversion, as they are administered by healthcare professionals. Additionally, the growing emphasis on patient-centered care and innovations in drug delivery systems are driving the adoption of injectables, positioning them as a rapidly expanding segment in OUD therapy.

The oral administration segment held the second largest revenue share in 2024. It is the most convenient and non-invasive method, which increases patient adherence and compliance. Oral medications such as buprenorphine and naltrexone are easier to administer and manage, requiring no specialized equipment or procedures. They also allow for flexible dosing and straightforward integration into daily routines. Additionally, oral medications can be taken at home, reducing the need for frequent clinic visits, thus improving accessibility and patient comfort. The established track record of oral formulations in effectively managing OUD, combined with their broad availability and ease of use, solidifies their leading position in the treatment landscape.

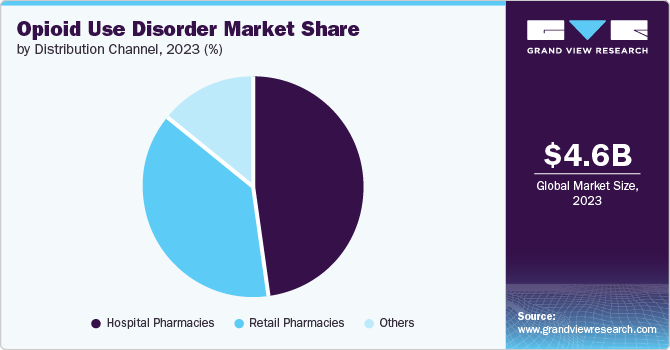

Distribution Channel Insights

Hospital pharmacies dominated the market with a market share of 47.90% in 2024 due to their integral role in managing complex and severe cases. They offer a controlled environment where medications can be administered under strict supervision, which is crucial for ensuring adherence and safety, particularly for injectable and high-risk treatments. Hospital pharmacies also provide comprehensive patient care, including counseling and monitoring, which enhances treatment efficacy and supports recovery. Their ability to manage and distribute specialized medications, such as methadone and extended-release formulations, and their capacity for coordinating care with other healthcare services, solidify their dominant role in the distribution of OUD treatments. This central role in patient management and safety drives their prominence in the distribution channel.

Others segment is projected to witness a significant growth rate over the forecast period. The other pharmacies plays a critical role in the Opioid Use Disorder (OUD) market by expanding access to essential medications and treatment options. Online pharmacies, specialty clinics, and independent pharmacies provide critical avenues for individuals seeking convenient, discreet, and efficient access to OUD therapies. This segment is particularly significant for patients who may face barriers in reaching traditional brick-and-mortar pharmacies, such as those in rural or underserved areas. Online platforms offer home delivery, ensuring consistent adherence to medication regimens and minimizing disruptions in care.

Regional Insights

North America opioid use disorder market accounted for 68.98% share in 2024 due to several key factors. The region has the highest prevalence of OUD, which drives significant demand for treatment solutions. North America benefits from advanced healthcare infrastructure, extensive research and development capabilities, and a well-established network of healthcare providers and treatment facilities. Additionally, robust regulatory frameworks and substantial funding for addiction treatment programs support the development and distribution of effective therapies. The presence of leading pharmaceutical companies and a strong focus on innovative treatment approaches further contribute to North America's leadership in the OUD treatment market.

U.S. Opioid Use Disorder Market Trends

The U.S. opioid use disorder market is experiencing substantial growth due to increased awareness among healthcare professionals about available treatments and a rise in the prevalence of the disease. The CDC reports that over 131,778,501 opioid prescriptions were dispensed in the U.S. in 2022, with approximately 145,000 new OUD diagnoses that year.

Europe Opioid Use Disorder Market Trends

The European opioid use disorder market is undergoing significant transformation, driven by healthcare reforms, research advancements, and patient-centered initiatives across various countries. The rising prevalence of OUD, fueled by an aging population and evolving lifestyles, is increasing the demand for effective and innovative treatment options throughout the continent.

The UK opioid use disorder market is experiencing growth due to the rising prevalence of substance use disorders and expanding government initiatives to address the crisis. In the UK, over 50% of individuals with OUD are actively receiving treatment, with most undergoing Medications for Opioid Use Disorder (MOUD) such as methadone, buprenorphine, or naltrexone in 2023.

The France opioid use disorder market is poised for growth due to increasing awareness, government support, and evolving treatment options. As France addresses rising OUD prevalence with enhanced healthcare policies and expanded access to effective therapies, the market is set to expand significantly, driven by these supportive factors.

The Germany opioid use disorder market is marked by comprehensive treatment strategies and robust healthcare infrastructure. Enhanced by progressive regulations and increased funding for addiction services, Germany’s focus on integrated care and innovative therapies is driving significant growth and improving outcomes for individuals with opioid use disorder.

Asia Pacific Opioid Use Disorder Market Trends

The Asia Pacific opioid use disorder market is growing due to rising awareness, expanding healthcare infrastructure, and increasing prevalence of OUD. Countries in the region are implementing enhanced treatment programs and government initiatives to address the crisis. Improved access to effective therapies and ongoing research is driving market expansion. Additionally, growing collaborations between international and local organizations are fostering innovation and better management strategies, contributing to the accelerated development of the market and improved patient outcomes across the Asia Pacific region.

The China opioid use disorder market is growing at a rapid pace due to increasing awareness, expanding healthcare initiatives, and rising OUD cases. Enhanced treatment options and government support are driving market expansion, alongside efforts to improve access to effective therapies and address the growing demand for comprehensive addiction care.

The Japan opioid use disorder market is driven by rising awareness of addiction issues, government initiatives to improve treatment access, and advancements in healthcare infrastructure. Japan's focus on integrating innovative therapies and expanding support services is driving market growth. Additionally, efforts to address the increasing prevalence of OUD contribute to the market's expansion.

Latin America Opioid Use Disorder Market Trends

The Latin America opioid use disorder market is expanding due to growing awareness, increased government and NGO support, and advancements in treatment options. Rising opioid abuse and the need for effective therapies are driving market growth. Enhanced access to medications and improved healthcare initiatives across the region are further contributing to the market’s development.

The Brazil opioid use disorder market is significantly growing due to rising opioid abuse, increased government funding, and enhanced treatment programs. Expanded access to effective therapies and heightened awareness are driving this growth, alongside improved healthcare infrastructure and support services across the country.

MEA Opioid Use Disorder Market Trends

The Middle East & Africa (MEA) opioid use disorder market is expanding due to increasing awareness, government initiatives, and improved access to treatment. Rising opioid use and the development of healthcare infrastructure are driving growth, along with efforts to enhance support services and treatment options in the region.

The Saudi Arabia opioid use disorder market is poised to grow due to rising awareness, government initiatives, and enhanced healthcare services. Efforts to improve treatment access and expand support for recovery are driving market expansion, alongside increased focus on effective therapies and integrated care solutions in the region.

Key Opioid Use Disorder Company Insights

Some of the leading players operating in the opioid use disorder market include Alkermes plc , Orexo AB, Indivior PLC and Camurus among others. These players dominate the market with their contributions to the development of new treatments. Furthermore, these companies focus on achieving funding support from government bodies and healthcare organizations aided with novel product launches to capitalize on untapped avenues.

Key Opioid Use Disorder Companies:

The following are the leading companies in the opioid use disorder market. These companies collectively hold the largest market share and dictate industry trends.

- Indivior PLC

- Teva Pharmaceutical Industries, Ltd.

- Pfizer, Inc.

- Collegium Pharmaceutical (BioDelivery Sciences International, Inc.)

- Alkermes, Inc.

- Orexo US, Inc. (a part of Orexo AB)

- Titan Pharmaceuticals, Inc.

- Omeros Corporation

- Camurus AB

- Hikma Pharmaceuticals PLC

Recent Developments

-

In July 2023, Titan Pharmaceuticals, Inc. entered into an Asset Purchase Agreement with Fedson, Inc. As part of this deal, Titan agreed to sell a portion of its ProNeura assets, including its portfolio of addiction treatment medications and other early-stage projects based on the ProNeura drug delivery technology. This portfolio included implant programs for Nalmefene and Probuphine.

-

In August, Alkermes plc and Teva Pharmaceuticals USA, Inc. reached a settlement agreement to conclude the parties' continuing patent action pertaining to VIVITROL (naltrexone for extended-release injectable suspension) in the U.S. District Court for the District of New Jersey.

-

In March 2023, Indivior PLC completed the acquisition of Opiant Pharmaceuticals, Inc., intending to improve the treatment of opioid addiction or overdose. This acquisition was anticipated to strengthen the company's position in the market.

Opioid Use Disorder Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.03 billion |

|

Revenue forecast in 2030 |

USD 10.24 billion |

|

Growth rate |

CAGR of 11.15% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Drug, route of administration, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE, Kuwait, and Saudi Arabia |

|

Key companies profiled |

Indivior PLC, Teva Pharmaceutical Industries, Ltd., Pfizer, Inc., Collegium Pharmaceutical (BioDelivery Sciences International, Inc.), Alkermes, Inc., Orexo US, Inc. (a part of Orexo AB), Titan Pharmaceuticals, Inc., Omeros Corporation, Camurus AB, Hikma Pharmaceuticals PLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Opioid Use Disorder Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global opioid use disorder market report based on drug, route of administration, distribution channel and region:

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Naltrexone

-

Buprenorphine

-

BELBUCA

-

Sublocade

-

Suboxone

-

Zubsolv

-

Others

-

-

Methadone

-

Others

-

-

Route Of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral Administration

-

Injectable Administration

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global opioid use disorder market size was valued at USD 5.28 billion in 2024 and is anticipated to reach USD 6.03 billion in 2025.

b. The global opioid use disorder market is expected to witness a compound annual growth rate of 11.15% from 2025 to 2030 to reach USD 10.24 billion by 2030.

b. North America was the largest revenue-generating region that accounted for 68.98% market share in 2024 due to new product launches and favorable government policies.

b. Some of the key players in the OUD market are Indivior PLC, Teva Pharmaceutical Industries, Ltd., Pfizer, Inc., Collegium Pharmaceutical (BioDelivery Sciences International, Inc.), Alkermes, Inc., Orexo US, Inc. (a part of Orexo AB), Titan Pharmaceuticals, Inc., Omeros Corporation, Camurus AB, Hikma Pharmaceuticals PLC

b. The major factors driving the market growth are the increasing government initiatives of combat the opioid epidemic and launch of new products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."