- Home

- »

- Medical Devices

- »

-

Ophthalmic Photocoagulator Market Size, Share Report 2030GVR Report cover

![Ophthalmic Photocoagulator Market Size, Share & Trends Report]()

Ophthalmic Photocoagulator Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Diabetic Retinopathy, Glaucoma, Macular Edema), By Wavelength, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-489-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ophthalmic Photocoagulator Market Trends

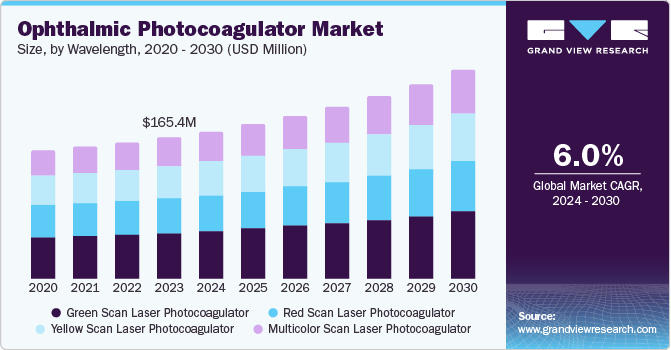

The global ophthalmic photocoagulator market size was valued at USD 165.4 million in 2023 and is expected to grow at a CAGR of 6.0% from 2024 to 2030. The growth is attributed to factors such as the emergence of eye diseases, aging population, sophisticated treatment options, rising incidences of diabetes-related blindness, and the technological development of photocoagulation is relevant to this expansion. The demand for ophthalmic photocoagulators is expected to grow as patients and healthcare professionals become more aware of the benefits and potential of these devices in the treatment of various retinal diseases.

Advancements in laser design and treatment methods are expected to drive the ophthalmic laser market. These advances offer fast, safe, and customized treatments for various eye diseases. Additionally, increasing research and development, emphasis on vision health, and a rise in ophthalmic facilities contribute to market expansion.

The rising prevalence of age-related macular degeneration (AMD) increases the demand for effective retinal treatments. AMD is becoming more common in the geriatric population, fueling the need for advanced photocoagulation technologies. The increasing adoption of minimally invasive procedures, which ophthalmic photocoagulators support by offering less invasive treatment options compared to traditional surgical methods.

The growing trend of personalized medicine, where treatments are tailored to individual patient needs, also spurs demand for sophisticated photocoagulation systems capable of delivering precise, customized therapy. Furthermore, the healthcare infrastructure in emerging markets contributes to market growth by improving access to advanced ophthalmic care and increasing the availability of photocoagulation treatments. However, potential vision loss during procedures, device handling errors, training requirements for new techniques, limited diagnostics in developing nations, and high equipment costs may hinder market growth.

Application Insights

The diabetic retinopathy segment accounted for the largest share of 28.4% in 2023. For patients with diabetic retinopathy, laser photocoagulation can significantly improve vision. The prevalence of diabetic retinopathy is expected to increase during the forecast period. This is poised to augment the demand for advanced photocoagulation devices to treat diabetic retinopathy.

Age-related macular degeneration (AMD) held a significant share in 2023. The market for macular degeneration therapy is anticipated to be driven by the increasing age of the population, the rising prevalence of retinal issues, and higher spending on research & development. Growing incidences and increased rates of early diagnosis and management of retinal diseases accounted for market growth. The growing public awareness and annual eye check-ups are leading to the early detection of AMD for effective photocoagulation treatments.

Wavelength Insights

The green scan laser photocoagulator segment dominated the market and held a share of 32.5% in 2023. This is attributed to accuracy in retaining the tissues of the retina which results in better treatment of diseases such as diabetic retinopathy and AMD. Moreover, with other factors such as excellent absorption and a wide range of uses, the green laser wavelength (532 nm) is considered a standard laser. Additionally, the green scan laser used in ophthalmology has high versatility and the ability to control damage to the surrounding tissue, which is why it is more popular among healthcare personnel. Furthermore, better beam quality and compatibility with automation systems are also driving the market growth of green lasers due to better efficacy and convenience of the green laser.

The multicolor scan laser photocoagulator segment is expected to grow at the fastest CAGR of 6.5% during the forecast period. The multicolor scan laser allows the selection of multiple wavelengths in one versatile machine, making it easier for the surgeons. 577 nm yellow, 532 nm green, and 647 nm red are the most often used wavelengths and combinations of any two or all three wavelengths at the same time. Yellow scanning laser therapy (577 nm) is considered the safest. Yellow lasers represent a paradigm shift in treating diabetic retinopathy, as they are more effective and safer than traditional green lasers.

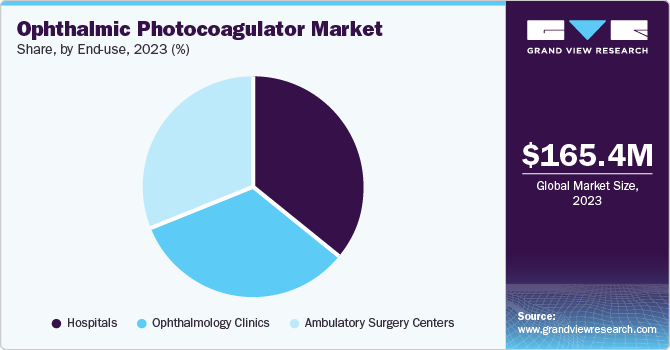

End-use Insights

Hospitals held a market share of 36.1% in 2023 due to the extensive use of ophthalmic lasers in hospital settings. This is attributed to the growing need for hospitals to provide effective solutions with the least invasive and high accuracy to treat eye disorders such as diabetic retinopathy and age-related macular degeneration. Additionally, the increasing number of patients requiring treatment of vision abnormalities is anticipated to drive the demand for ophthalmic photocoagulator lasers in hospitals. Furthermore, the availability of skilled ophthalmologists and supporting personnel in the hospital has led to the growing penetration levels of ophthalmic lasers.

The ambulatory surgical centers are anticipated to register the fastest CAGR of 6.3% throughout the forecast period. The growing popularity of ambulatory surgery centers (ASCs) can be attributed to several factors, including enhanced patient convenience, closer proximity to patients' residences, and reduced costs for both patients and healthcare payers. Additionally, ASCs frequently boast faster scheduling compared to traditional hospital outpatient departments (OPDs), further contributing to an improved patient experience.

Regional Insights

The North America ophthalmic photocoagulation market held the largest revenue share of 33.4% in 2023. This is attributed to the high levels of stress and unhealthy lifestyles that are contributing to the rise in chronic eye disorders such as glaucoma, diabetic retinopathy, and age-related macular edema. The robust healthcare infrastructure and significant investments in advanced medical technologies drive market growth. The presence of leading research institutions and a strong emphasis on innovation drive the development and adoption of cutting-edge photocoagulation devices. Furthermore, the high prevalence of health insurance coverage facilitates access to advanced ophthalmic treatments, supporting market growth by making sophisticated photocoagulators more accessible to patients.

Asia Pacific Ophthalmic Photocoagulator Market Trends

Asia Pacific ophthalmic photocoagulator market growth is expected at a CAGR of 8.1% during the forecast period. There is a growing need for photocoagulation due to the rising prevalence of ocular illnesses such as diabetic retinopathy, age-related macular degeneration, and glaucoma. The expanding healthcare infrastructure and increasing investment in medical technologies are anticipated to drive market growth. Asian countries are significantly enhancing their healthcare facilities and increasing access to advanced treatments, including photocoagulation. Rising awareness and education about eye health and retinal diseases contribute to early diagnosis and treatment, driving demand for photocoagulators. The growing middle-class population with a higher disposable income focuses on expenditure on advanced medical care, further accelerating market growth in this region.

Key Ophthalmic Photocoagulator Company Insights

Some of the key players in the ophthalmic photocoagulator market are IRIDEX Corporation, Alcon Inc., NIDEK Co Ltd, Lumenis, and others. The market is fragmented with several large and small companies. Leading companies are developing photocoagulation devices with several options, including color configurations, laser consoles, dual-mode cavity lasers, slit lights, and automatic placement of scanning patterns in areas close to the photocoagulation process to increase the accuracy of treatment.

-

IRIDEX Corporation is a medical device company that designs, manufactures, and distributes ophthalmic lasers. Their product portfolio caters to various ophthalmic procedures, including glaucoma treatment and retinal procedures.

-

Lumenis Be Ltd., formerly Lumenis Ltd., is an Israeli medical device company. They design, manufacture, and sell energy-based medical devices for various surgical and ophthalmic applications.

Key Ophthalmic Photocoagulator Companies:

The following are the leading companies in the ophthalmic photocoagulator market. These companies collectively hold the largest market share and dictate industry trends.

- Lumenis Be Ltd.

- IRIDEX Corporation

- Alcon Inc.

- Lumibird Medical

- NIDEK CO., LTD.

- Johnson & Johnson Vision Care, Inc.

- TOPCON CORPORATION

- Bausch + Lomb

- Meridian Medical Group

Recent Developments

- Photo-mediated ultrasound therapy laser therapy is one of the significant developments in the ophthalmic photocoagulator market. According to Sage Journal, photo-mediated ultrasound therapy promotes cavitation activity in blood vessels to reduce blood perfusion. Further, the reduced perfusion effect in the eye potentially controls the development of eye diseases such as diabetic retinopathy and AMD.

Ophthalmic Photocoagulator Market Report Scope

Report Attributes

Details

Market size value in 2024

USD 172.4 million

Revenue forecast in 2030

USD 244.0 million

Growth rate

CAGR of 6.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, wavelength, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin Americas; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Lumenis Be Ltd.; IRIDEX Corporation; Alcon Inc.;Lumibird Medical; NIDEK CO., LTD.; Johnson & Johnson Vision Care, Inc.; TOPCON CORPORATION; Bausch+Lomb; Meridian Medical Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmic Photocoagulator Market Report Segmentation

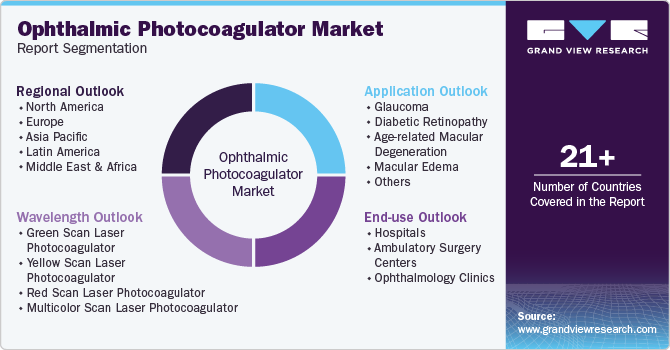

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global ophthalmic photocoagulator market report on the basis of application, wavelength, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Glaucoma

-

Diabetic Retinopathy

-

Age-related Macular Degeneration

-

Macular Edema

-

Others

-

-

Wavelength Outlook (Revenue, USD Million, 2018 - 2030)

-

Green Scan Laser Photocoagulator

-

Yellow Scan Laser Photocoagulator

-

Red Scan Laser Photocoagulator

-

Multicolor Scan Laser Photocoagulator

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgery Centers

-

Ophthalmology Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.