- Home

- »

- Medical Devices

- »

-

Ophthalmic Eye Dropper Market Size, Industry Report, 2030GVR Report cover

![Ophthalmic Eye Dropper Market Size, Share & Trends Report]()

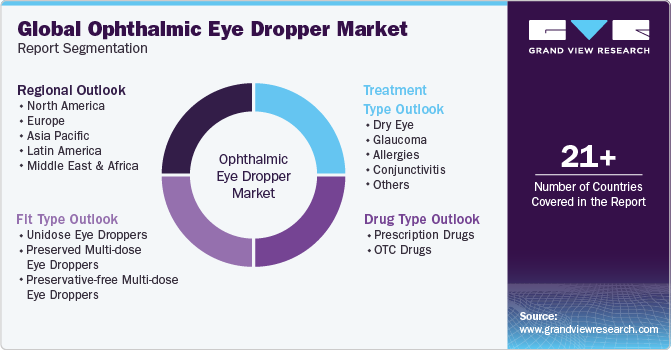

Ophthalmic Eye Dropper Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Unidose, Preserved, Preservative-free), By Drug Type (Prescription Drugs, OTC Drugs), By Treatment Type (Glaucoma, Allergies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-187-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ophthalmic Eye Dropper Market Summary

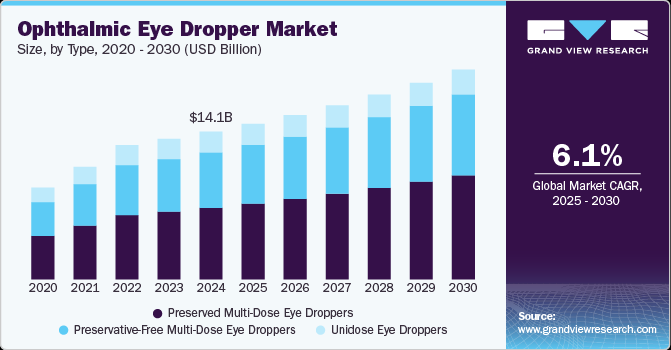

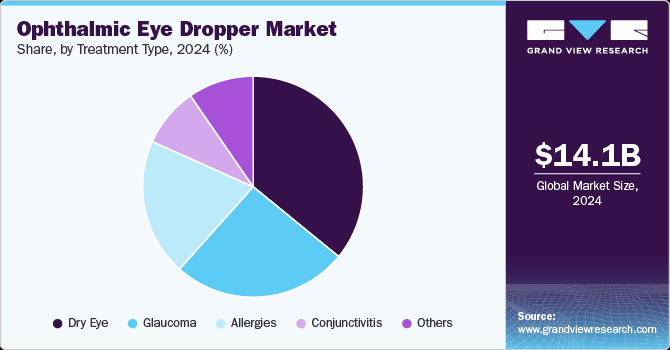

The global ophthalmic eye dropper market size was estimated at USD 14.1 billion in 2024 and is anticipated to grow at a CAGR of 6.1% from 2025 to 2030. Increasing R&D investments in ophthalmic treatments are driving advancements in more efficient and user-friendly eye droppers for various conditions.

Key Market Trends & Insights

- North America ophthalmic eye dropper market dominated the global market 44.75%in 2024.

- By type, the preserved multi-dose eye droppers segment accounted for the largest revenue share of 48.5% in 2024.

- By drug type, the prescription drugs segment accounted for the largest revenue share of 61.3% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 14.13 Billion

- 2030 Projected Market Size: USD 20.02 Billion

- CAGR (2025-2030): 6.1%

- North America: Largest market in 2024

Additionally, the growing aging population worldwide is contributing to a higher prevalence of eye disorders like glaucoma, cataracts, and age-related macular degeneration, boosting demand for ophthalmic eye droppers. In the U.S., around 12 million individuals aged 40 and older experience vision impairment, including one million with blindness. Globally, the situation is similar, with the World Health Organization reporting over 2.2 billion people affected by eye and vision problems, emphasizing the urgent need for effective ophthalmic treatments.

The incidences of eye infections are expected to escalate worldwide due to new pathogens, a surge in postoperative eye infections, and inadequate eye hygiene practices. Many common eye problems such as cataracts, glaucoma, dry eye issues, and allergies are becoming more widespread, increasing the demand for eye drops used in eye care. An aging global population majorly drives this heightened prevalence, amplifying the occurrence of these conditions. For instance, according to the 2023 Ministry of Health report, Glaucoma ranks as the second leading cause of blindness globally, with an estimated 60 million suspected cases worldwide. Therefore, there is a rise in the need for effective treatments such as eye drops to manage these amassed eye health issues.

Growing awareness regarding the importance of maintaining optimal eye health and adhering to regular eye check-ups has sparked a surge in the demand for ophthalmic eye drops. This budding awareness has led to a higher demand for eye drops used in eye care. People now recognize the early signs of eye problems better, prompting them to seek help and treatment earlier. This increased understanding not only helps individuals get timely treatment but also creates greater opportunities for eye doctors and manufacturers of eye care products, such as eye drops. For instance, Johnson & Johnson launched a program called "Vision Made Possible" in October 2023, aiming to educate people about eye health such as childhood myopia, presbyopia, and cataracts as well. These efforts show a growing focus on taking proactive steps for better eye health, which means more chances for improving eye health through accessible treatments like eye drops.

Moreover, advancements in drug delivery systems and formulation technologies have led to innovative ophthalmic eye drops. These developments mark a big step forward in making eye drop treatments more effective, safer, and easier for patients to stick to, which in turn is boosting the growth of the eye drop industry. Especially the introduction of preservative-free eye drops, and novel drug delivery techniques has enhanced therapeutic outcomes. For instance, Alcon's launch of Systane Complete Preservative-Free Lubricant Eye Drops in Europe in January 2022 demonstrates its ongoing efforts to improve its range of products for dry eyes. These eye drops come in an easy-to-use bottle that can be used for multiple doses, making it simpler for patients who need preservative-free options. These advancements highlight the diligent approach toward making eye care better by providing eye drops that are more effective and easier for patients to use.

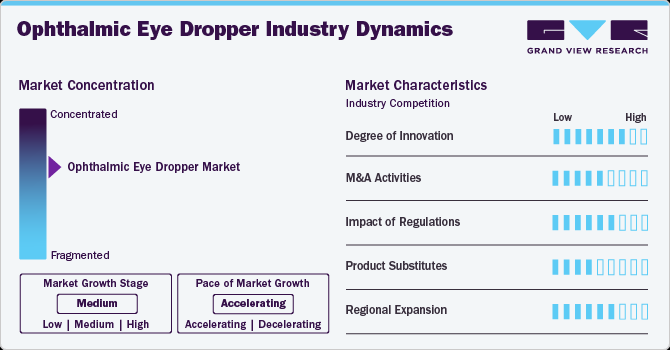

Market Concentration & Characteristics

The market growth stage is medium, and the pace is identified as accelerating owing to several factors, such as advancements in technology, formulations, and delivery systems for ophthalmic eye drops, which have significantly contributed to this growth. The increasing demand for more efficient, safer, and patient-friendly eye drop solutions has fueled the growth of the ophthalmic eye dropper market. These advancements have improved the effectiveness, safety, and patient compliance of eye drops, driving the growth.

In October 2024, NTC, a Milan-based pharmaceutical company, partnered with Silgan Dispensing Systems to introduce Imperial, a new preservative-free multidose eye drop line featuring Silgan’s Iridya technology. This innovation enhances NTC’s dry eye portfolio, improving patient compliance and satisfaction. The Imperial line integrates key advantages of existing multidose preservative-free devices, offering precise drop control, an elongated tip for accuracy, and an ergonomic, low-squeeze bottle. NTC will showcase the Imperial line at CPhI in Milan, highlighting its advanced design and effectiveness in ophthalmic care.

Regulations in the ophthalmic eye dropper devices industry ensure patient safety, product efficacy, and quality control. Regulatory bodies like the FDA in the U.S. and EMA in Europe mandate strict guidelines for preservative-free multidose eye droppers, focusing on sterility, material safety, and dispensing accuracy. Compliance with Good Manufacturing Practices (GMP) and ISO standards is essential for global market entry. As demand for innovative drug delivery systems rises, regulatory frameworks continue evolving to support safer, more effective ophthalmic treatments.

Mergers and acquisitions (M&A) in the ophthalmic eye dropper industry are growing swiftly as companies seek to enhance their technological expertise and expand their market presence. In December 2024, Tenpoint Therapeutics and Visus Therapeutics completed their merger to advance ophthalmic therapeutic innovations targeting age-related vision decline. This merger combines Visus’ late-stage presbyopia-correcting eye drop, BRIMOCHOL PF, which is set for NDA filing in the first half of 2025, with Tenpoint’s pipeline of cutting-edge ophthalmic treatments, strengthening their market position.

In the ophthalmic eye dropper devices industry, product substitutes include single-dose vials, spray-based ocular drug delivery, and sustained-release drug implants. Single-dose vials offer a preservative-free alternative, reducing contamination risks. Spray technology enhances patient compliance by eliminating the need for precise drop instillation. Sustained-release implants, such as punctal plugs or intraocular inserts, provide long-term medication delivery, reducing the frequency of administration. Innovations in gel-based and nano-formulated eye drops also offer improved bioavailability and longer-lasting effects. These alternatives are gaining traction due to their convenience, efficacy, and potential to improve patient adherence in managing conditions like dry eye and glaucoma.

The ophthalmic eye dropper devices industry is witnessing significant regional expansion, particularly in North America, Europe, and Asia-Pacific. In North America, the growing prevalence of eye disorders and advancements in medical technology drive market growth. Europe benefits from strong healthcare infrastructure and a high demand for eye care. Asia-Pacific, led by countries like China and India, is seeing rapid growth due to increasing healthcare awareness, rising aging populations, and expanding access to healthcare. These regions are adopting advanced ophthalmic solutions, fueling market expansion and improving access to quality eye care.

Type Insights

The preserved multi-dose eye droppers segment accounted for the largest revenue share of 48.5% in 2024. This is due to their established familiarity among consumers and healthcare providers. Multi-dose eye droppers are convenient, cost-effective, and widely available for eye care. Their easy-to-use design is preferred over single-use ampoules, especially by people with dexterity issues. For instance, back in September 2020, Nemera a world-leading drug device combination solutions specialist received much awaited approval from ANVISA, Brazilian Health Regulatory Agency for its preservative-free Novelia multi-dose eye dropper, designed for CLILON, a nonsteroidal anti-inflammatory drug generally prescribed or used to treat moderately severe post-surgery pain and inflammation in eye care treatments. This achievement signifies the continuous evolution and entry of multi-dose eye droppers in essential eye care treatments.

The preservative-free multi-dose eye dropper segment is accompanied by the fastest CAGR from 2025 to 2030, owing to increased awareness of preservative-induced irritation and inflammation, especially in patients diagnosed with dry eye syndrome. This awareness is driving the demand for gentler alternatives. Furthermore, the aging population, with a higher susceptibility to eye dryness and increased healthcare spending is fueling the demand for premium range eye care products like preservative-free multi-dose droppers.

Drug Type Insights

The prescription drugs segment accounted for the largest revenue share of 61.3% in 2024 and is expected to attain the fastest CAGR from 2025 to 2030. The increased occurrence of eye-related conditions requiring specialized prescription treatments has surged the demand for these drugs administered through eye droppers. Conditions like glaucoma, infections, and dry eye syndrome require precisely formulated medicines accessible only by prescription. Advances in pharmaceutical research have led to precise and efficient prescription drugs for eye issues, driving up demand in this category. For instance, innovative prescription eye drops, such as Allergan's FDA-approved Vuity in October 2021 for presbyopia treatment, have significantly contributed to expanding the prescription drugs segment.

The OTC drugs segment is showing lucrative growth due to increasing consumer preference for self-care, and easy to acess remedies for common eye conditions such as minor irritations, redness, or allergies drive the demand for OTC eye droppers. Additionally, advancements in formulations and manufacturing processes have facilitated the development of effective OTC eye drop solutions that relieve various eye issues without requiring a prescription.

Treatment Type Insights

The dry eye segment accounted for the largest market share in 2024, due to prolonged digital device use, environmental factors, and an aging population, which has heightened the need for specific treatments administered via eye droppers. For instance, according to a January 2023 research paper in Environmental Research and Public Health, Dry Eye Disease (DED) is one of the most common eye conditions impacting millions worldwide. The prevalence of this condition varies globally, ranging from 5% to 50% based on geographic location. This rising prevalence highlights the greater demand for treatments delivered through eye droppers to address the challenges posed by dry eye syndrome.

The allergies segment is expected to gain the fastest CAGR from 2025 to 2030. The rise in prevalence of eye allergies due to various environmental factors, including pollen, dust, and pollutants, has surged the demand for specialized eye drop treatments. Additionally, advancements in formulations and technologies have led to the development of more effective and targeted eye drops to alleviate allergy-related symptoms such as itching, redness, and swelling. For instance, prominent companies like Alcon or Bausch + Lomb have introduced advanced formulations targeting different types of allergy-specific eye drops, thus driving the rapid growth observed in the allergies segment within the ophthalmic eye dropper market.

Regional Insights

North America ophthalmic eye dropper market dominated the global market 44.75%in 2024. This is due to the high healthcare expenditure, which facilitates widespread access to advanced eye care treatments and products like eye droppers. Additionally, the increasing prevalence of eye disorders and a growing aging population have fueled the demand for ophthalmic solutions, driving market growth in the region. Moreover, continuous technological advancements, with significant investments in research and development, have resulted in the introduction of innovative eye care products and treatments. Companies like Johnson & Johnson, Alcon have contributed to market growth by introducing advanced eye dropper technologies or innovative formulations.

U.S. Ophthalmic Eye Drops Market Trends

The U.S. accounted for the largest share of the North America market in 2024 due to its extensive healthcare infrastructure and widespread access to advanced eye care treatments and products, including eye droppers. Moreover, the rising prevalence of eye-related conditions, attributed to rising digital device usage and an aging population, has surged the demand for ophthalmic solutions. Additionally, the U.S. remains at the forefront of innovation and research in the healthcare sector, continuously introducing advanced technologies and formulations in eye care.

Europe Ophthalmic Eye Drops Market Trends

The European ophthalmic eye drops market is the second largest globally in 2024, driven by an aging population, high prevalence of eye diseases, and advanced healthcare infrastructure. Increased awareness of eye health, along with strong demand for both prescription and over-the-counter eye care products, supports market growth.

UK ophthalmic eye drops market is influenced by a demographic shift toward an aging population, technological innovations in diagnostics and treatments, increasing awareness of eye health, and regulatory changes ensuring quality standards & access to vision care services.

Ophthalmic eye drops market in France is expanding, supported by substantial healthcare spending that guarantees access to quality, patient-focused services. In 2021, France allocated approximately 12.31% of its GDP to healthcare, according to World Bank data. Its robust healthcare infrastructure promotes the adoption of ophthalmic eye drops.

Germany ophthalmic eye drops market is expected to expand in the foreseeable future as people become more aware of potential issues linked to eye care, like infections or discomfort. This growing awareness has resulted in a stronger focus on ensuring the quality and dependability of vision correction products.

Asia Pacific Ophthalmic Eye Drops Market Trends

The ophthalmic eye drops market in Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2030. The rising population base and increasing awareness about eye health drive the demand for effective eye care solutions, including eye droppers. Moreover, the rising prevalence of eye disorders among the aging population, lifestyle changes, and increased exposure to digital devices contribute to the surge in demand for ophthalmic treatments.

The ophthalmic eye drops market in Japan held the largest regional revenue share in 2024. This can be attributed to Japan's advanced healthcare infrastructure that provides robust support for the manufacturing and distribution of ophthalmic eye drops. Additionally, the country experiences a high occurrence of ophthalmic conditions among its elderly population, thereby stimulating the demand for these eye drops. Moreover, Japanese culture also places considerable importance on personal hygiene and cleanliness, which leads to a preference for preservative-free eye drops.

China ophthalmic eye drops market is driven by a rapidly aging population, a rising middle class with higher disposable income, and increasing awareness about the importance of eye health. The market is observing growth in demand for various products, such as contact lenses, dropper, and vitamins, due to the harmful effects of digital screens on eye health and government initiatives like the National Eye Health Program. With China having the world's largest population and a significant portion suffering from vision problems, the potential for ocular health products is vast, further amplified by the country's rapid economic growth and urbanization.

India ophthalmic eye drops market is rapidly growing, driven by an increasing awareness about eye health, growing prevalence of myopia & cataracts, and rising government initiatives to improve access to eye care services through programs such as the National Programme for Control of Blindness and Visual Impairment.

Latin America Ophthalmic Eye Drops Market Trends

The Latin American ophthalmic eye drops market is primarily driven by Brazil and Argentina. The geriatric population in Latin America is increasing, leading to a higher demand for healthcare services & products. For instance, according to the World Bank, the adult population aged 65 and above in the Latin America and Caribbean region was around 9% of the total population in 2023, which is anticipated to double by 2050.

Middle East & Africa Ophthalmic Eye Drops Market Trends

The Middle East and Africa ophthalmic eye drops market is driven by the increasing prevalence of Age-related Macular Degeneration (AMD) and amblyopia, especially in the geriatric population, and rising disposable income leading to better access to healthcare services. Government initiatives focusing on health awareness and investment in modern diagnostic tools & surgical equipment are also significant drivers.

The ophthalmic eye drops market in Saudi Arabia is anticipated to expand in the forecast period, driven by increasing awareness of eye health, a rising aging population, and a higher prevalence of eye conditions like dry eye and glaucoma. Advancements in healthcare services further support market expansion.

Key Ophthalmic Eye Drops Company Insights

Some of the key players operating in the market include Alcon plc., Pfizer, Bausch & Lomb Incorporated, Novartis AG, and AptarGroup, Inc.

-

AptarGroup, Inc. is a key player in developing advanced dispensing solutions for precise and reliable medication delivery to address eye care needs. The company's innovative eye dropper technologies cater to pharmaceuticals and healthcare sectors.

-

Pfizer Inc., based in the U.S., is a pharmaceutical company, which was incorporated in 1849. The company manufactures products for the treatment of diabetes and immunological, cardiological, oncology, & dermatological ailments.

-

Bausch & Lomb Incorporated is a renowned eye health company known for its comprehensive range of eye care products, including ophthalmic eye droppers and innovative solutions for vision care.

-

Novartis AG is a global pharmaceutical company that pioneers cutting-edge ophthalmic treatments, including eye droppers, emphasizing innovation and research to provide innovative solutions for various eye conditions.

-

Silgan Dispensing Systems and AbbVie Inc are some of the emerging market players.

-

Silgan Dispensing Systems specializes in delivering innovative dispensing solutions across industries, including healthcare, providing advanced systems for precise product delivery, including in the field of ophthalmic eye droppers.

-

AbbVie is a prominent pharmaceutical company known for its diversified portfolio, including advancements in ophthalmic treatments and medications, aiming to address various eye health concerns with innovative solutions and therapies.

Key Ophthalmic Eye Drops Companies:

The following are the leading companies in the ophthalmic eye drops market. These companies collectively hold the largest market share and dictate industry trends.

- AptarGroup, Inc.

- Silgan Dispensing Systems

- Alcon

- Pfizer

- Bausch & Lomb Incorporated

- Novartis AG

- AbbVie Inc.

- Santen Pharmaceutical Co., Ltd.

- Johnson & Johnson Vision

- Similasan Corporation

Recent Developments

-

In September 2023 FDA approved RYZUMVlTM (Phentolamine Ophthalmic Solution) 0.75% Eye Drops. These drops are intended to treat pharmacologically induced mydriasis, which is brought on by parasympatholytic drugs (like Tropicamide) or adrenergic agonists (like Phenylephrine).

-

In May 2023, Bausch + Lomb Corporation received FDA approval for MIEBO (perfluorohexyloctane ophthalmic solution, formerly known as NOV03). This makes it the first FDA-approved medication in the U.S. that is specifically intended to treat the symptoms and signs of dry eye disease (DED).

-

In April 2022, Sandoz, a Novartis AG subsidiary, introduced a new generic brimonidine tartrate/timolol maleate eye drop in the US, broadening treatment choices for ocular hypertension patients and reinforcing its presence in the ophthalmic market.

Ophthalmic Eye Dropper Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.86 billion

Revenue forecast in 2030

USD 20.02 billion

Growth rate

CAGR of 6.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, drug type, treatment type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AptarGroup, Inc.; Silgan Dispensing Systems; Alcon plc.; Pfizer; Bausch & Lomb Incorporated; Novartis AG; AbbVie Inc., Santen Pharmaceutical Co., Ltd., Johnson & Johnson Vision; Similasan Corporation

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ophthalmic Eye Dropper Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ophthalmic eye dropper market report based on type, drug type, treatment type, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Unidose eye droppers

-

Preserved multi-dose eye droppers

-

Preservative-free multi-dose eye droppers

-

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription drugs

-

OTC drugs

-

-

Treatment Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dry Eye

-

Glaucoma

-

Allergies

-

Conjunctivitis

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America dominated the ophthalmic eye dropper market with a share of 44.7% in 2024. This is attributable to the high awareness of eye disorders, increasing R&D investments, and technical advances.

b. The global ophthalmic eye dropper market is expected to grow at a compound annual growth rate of 14.1% from 2024 to 2030 to reach USD 20.02 billion by 2030.

b. The global ophthalmic eye dropper market size was estimated at USD 14.1 billion in 2024 and is expected to reach USD 14.86 billion in 2025.

b. Some key players operating in the ophthalmic eye dropper market include Alcon plc., Pfizer, Bausch & Lomb Incorporated, Novartis AG, and AptarGroup, Inc., Silgan Dispensing Systems and AbbVie.

b. Key factors that are driving the ophthalmic eye dropper market growth include increasing eye disorders and supportive government regulations.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.