Operational Technology Market Size, Share & Trends Analysis Report By Component (Functional Safety, Computer Numerical Control), By Connectivity (Wired, Wireless), By Deployment (Cloud, On-premises), By Enterprise Size, By Industry, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-110-4

- Number of Report Pages: 118

- Format: PDF

- Historical Range: 2017 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

Operational Technology Market Trends

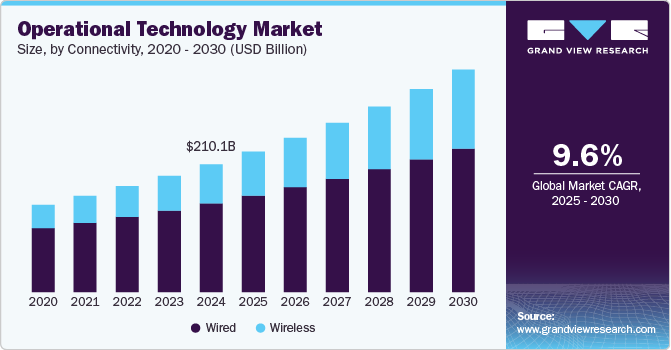

The global operational technology market size was estimated at USD 210.06 billion in 2024 and is expected to grow at a CAGR of 9.6% from 2025 to 2030. The Operational Technology (OT) industry is experiencing significant growth due to its vital role in managing critical infrastructure such as power grids, water treatment plants, and manufacturing facilities. This expansion is driven by the increasing adoption of Industry 4.0, which relies on advanced technologies such as AI, big data, and IoT, necessitating real-time data collection and analysis capabilities of OT systems. Furthermore, emphasizing industrial automation to enhance efficiency and safety in manufacturing processes contributes to the market's growth.

As industrial control systems become more complex, the demand for secure and reliable OT systems has also surged, ensuring these intricate networks' protection and proper functioning. For instance, in July 2023, Stellar Cyber introduced XDR for Operational Technology (OT) environments. This new feature enhances their Open XDR Platform, offering organizations a unified solution to detect, analyze, and respond to threats across IT and OT networks. The platform includes OT-specific threat detection rules, provides visibility into OT networks and devices, and offers response tools such as automated playbooks and manual remediation actions. This development is the key to securing interconnected IT and OT networks, safeguarding against cyberattacks in the evolving environment.

The rising adoption of digital technologies in the industrial sector is fueling the need for OT security. OT security aims to safeguard industrial control systems from unauthorized access, disruption, and potential damage. As digital technologies interconnect OT systems with IT networks and cyber threats become more sophisticated, the demand for operational technology security is on the rise. Protecting OT systems is essential to prevent cybercriminals from exploiting vulnerabilities and ensuring the continuity and safety of critical industrial processes such as manufacturing, power generation, and water treatment.

The COVID-19 pandemic had a positive impact on the OT market due to several factors. The increased demand for remote monitoring and control solutions led to an increased demand for remote monitoring and control solutions, which allow organizations to monitor and control their operational technology systems from anywhere in the world. The pandemic also raised awareness about the significance of OT security, leading to a higher demand for OT security solutions. Additionally, the acceleration of digital transformation in various industries created new opportunities for OT vendors to cater to evolving needs and requirements in the market.

The future of operational technology is characterized by agility, automation, and service-oriented delivery, with a strong emphasis on cybersecurity. Organizations are already implementing agile development methodologies, automated solutions for predictive maintenance, service-oriented architectures, and various cybersecurity measures to shape the future of operational technology . These advancements will lead to more innovative, secure, and efficient OT solutions in the coming years. As the OT systems become more complex and the threat of cyberattacks grows, the need for agility, automation, and service-oriented delivery will become more important.

Component Insights

The Computer Numerical Control (CNC) segment led the market in 2024, accounting for over 33% share of the global revenue. The high share can be attributed to the surging demand for CNC machines in diverse manufacturing, automotive, and aerospace industries. CNC machines automate complex parts and product production, enhancing efficiency and productivity. The growth of the CNC segment is propelled by several key factors, including the rising need for automation in manufacturing, the increasing adoption of Industry 4.0 technologies, the growing demand for precision components, and the expansion of the automotive and aerospace sectors.

The building management system segment is anticipated to grow at the fastest CAGR during the forecast period. This growth can be attributed to the increasing demand for energy-efficient and sustainable buildings, the rising popularity of smart buildings with remote-controllable BMSs, and the widespread adoption of IoT and digital technologies in the construction industry. BMSs play a crucial role in monitoring and controlling various building systems, such as HVAC, lighting, and security, leading to improved energy efficiency, reduced operating costs, and enhanced occupant comfort and safety. The surge in energy-efficient construction projects further boosts the demand for BMSs as they contribute to automating and optimizing building systems to conserve energy based on occupancy and weather conditions.

Connectivity Insights

The wired segment led the market in 2024. The growth is attributed to its reliability and security compared to wireless alternatives, making it indispensable for critical infrastructure applications. Its resistance to interference and hacking ensures the protection and stability of essential systems. Additionally, the scalability of wired networks allows for easy expansion to accommodate new devices and applications without compromising performance. Furthermore, wired technology's cost-effectiveness, requiring less infrastructure and simpler maintenance, is anticipated to maintain its growth trajectory in the foreseeable future.

The wireless segment is anticipated to grow at the fastest CAGR during the forecast period. The increasing demand for remote monitoring and control of industrial assets is a significant driver as businesses seek more flexible and efficient solutions. Additionally, the development of new wireless technologies, particularly 5G, with higher bandwidth and lower latency, will further fuel the expansion of wireless applications in critical areas such as Supervisory Control and Data Acquisition (SCADA), Distributed Control Systems (DCS), Human-Machine Interfaces (HMI), industrial sensors, and predictive maintenance. These advancements are expected to propel the wireless segment's prominence as businesses embrace the benefits of reliable and innovative wireless solutions.

Deployment Insights

The on-premises segment led the operational technology industry in 2024. The high market share can be attributed to organizations prioritizing on-premises solutions due to the need for greater control over their OT security systems, enabling enhanced protection and customization tailored to their specific requirements. Additionally, concerns surrounding security and privacy when storing data in the cloud fueled the demand for on-premises deployments. As many operational technology (OT) systems are not designed for internet connectivity, it adds an extra layer of difficulty for potential hackers, making on-premises solutions a favored choice for businesses seeking robust and secure operational technology solutions and thus boosting the segment's prominence.

The cloud segment is expected to grow at the fastest CAGR during the forecast period. Cloud-based solutions offer scalability and flexibility, allowing businesses to easily adjust their systems as needed without being constrained by physical location. Moreover, the rising concern for security in OT systems is addressed by cloud-based solutions, as they offer robust protection in secure data centers. Additionally, the growing adoption of IoT devices in operational technology systems fuels the demand for cloud-based solutions that efficiently manage and utilize the vast amounts of data generated, ultimately leading to enhanced operational efficiency and safety. This confluence of factors drives the adoption of cloud-based solutions in the OT market.

Enterprise Size Insights

The large enterprises segment led the market in 2024. The high share can be attributed to their complex and critical OT environments and greater resources for investing in OT security and compliance. The segment's growth was fueled by the increasing convergence of OT and IT infrastructure, rising demands for OT security and compliance, and the escalating number of cyber threats targeting operational technology systems. Businesses opted for OT solutions to achieve real-time visibility into their operations, facilitating quicker problem identification and operational efficiency improvements. These solutions also empowered better decision-making by providing valuable operational data and bolstering safety and security measures, particularly in high-risk industries.

The SMEs segment is expected to grow at the fastest CAGR during the forecast period. OT solutions enable SMEs to enhance efficiency and productivity by automating tasks and processes and reducing costs. Real-time data provided by OT solutions empower better decision-making, optimizing resource utilization and maintaining a competitive edge. Additionally, SMEs benefit from improved visibility and control over operations, swiftly addressing issues and reducing risks. Enhanced customer service is another advantage, as OT solutions provide real-time data on customer interactions, facilitating quicker issue resolution and improved customer service quality.

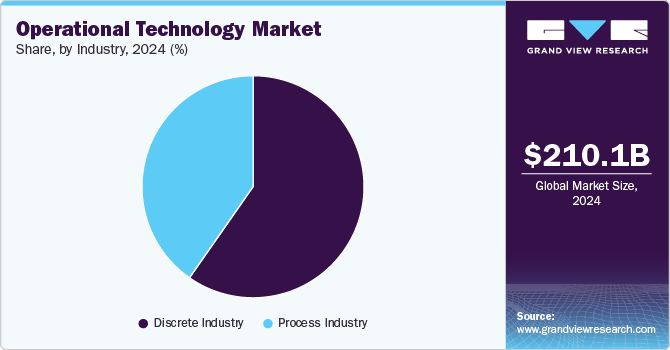

Industry Insights

The discrete industry segment held the largest revenue share in 2024. This growth can be attributed to the segment's diverse industries, including mining & metals, oil & gas, energy & power, chemicals, pulp & paper, and pharmaceuticals, which rely heavily on operational technology. Adopting operational technology enables these industries to automate processes and gather valuable data for optimizing their operations. Moreover, the increasing adoption of automation and digitization, the pressing need to enhance operational efficiency and productivity, adherence to safety regulations, and the importance of data collection and analysis for informed decision-making is driving the segment's growth in the market.

The process industry segment is estimated to grow at the fastest CAGR during the forecast period. The segment's growth is driven by the wide array of industries encompassed within the process industry, including food and beverages, oil and gas, energy and power, chemicals, and pharmaceuticals. These industries rely heavily on operational technology to control and monitor their operations. Moreover, the adoption of operational technology in the process industry segment is further fueled by its ability to enhance resource utilization, minimize downtime, and enable data-driven decision-making. As these industries continue to expand and innovate, the demand for advanced operational technology solutions is anticipated to witness substantial growth, contributing to the overall progression of the operational technology market.

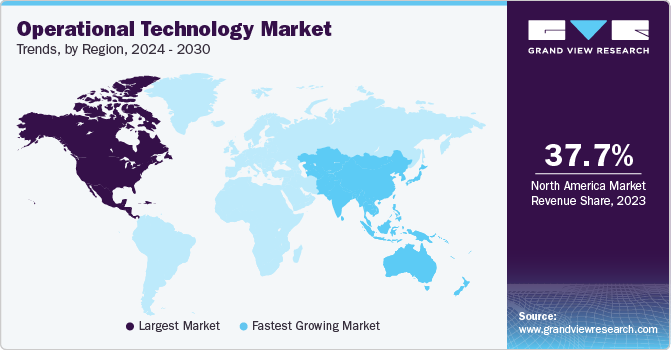

Regional Insights

North America operational technology market dominated the in 2024, accounting for a revenue share of over 36%. The region boasts a well-developed industrial base, particularly in automotive manufacturing. This existing infrastructure provides a foundation for the adoption of new operational technology solutions. For instance, in November 2024, Rockwell Automation, Inc. announced the integration of NVIDIA Omniverse APIs into its Emulate3D software. This strategic move aims to improve factory operations by leveraging AI and physics-based simulation technology.

U.S. Operational Technology Market Trends

The U.S. operational technology market is anticipated to exhibit a significant CAGR over the forecast period. Reshoring efforts in the U.S. are driving the need for investments in modern operational technology solutions to enhance manufacturing efficiency. Simultaneously, the evolving energy sector, driven by the increased use of renewables and grid modernization, requires advanced operational technology solutions to manage and optimize complex energy systems effectively.

Europe Operational Technology Market Trends

The Europe operational technology market is expected to witness significant growth over the forecast period. The increasing emphasis on sustainability and energy transition in Europe, with a growing focus on renewable energy and energy efficiency, is propelling the demand for advanced operational technology solutions. This trend particularly drives the development of operational technology solutions dedicated to grid management and optimization. Moreover, the European Union (EU) has implemented specific regulations, such as the NIS Directive and the Cybersecurity Act, to address cybersecurity concerns in critical infrastructure.

Asia Pacific Operational Technology Market Trends

The Asia Pacific operational technology industry is anticipated to register the highest CAGR over the forecast period. The active adoption of industry 4.0 principles, merging IT and operational technology systems, is promoting increased automation and improved resource utilization across various industries. Moreover, the region's focus on energy transition and sustainability is driving the demand for advanced operational technology solutions, especially in effective grid management, seamless integration of renewable energy sources, and real-time monitoring for optimized energy usage.

China operational technology market dominated the regional market in 2024. The growing awareness of cybersecurity threats in critical infrastructure further propels the adoption of robust operational technology security solutions, safeguarding against cyberattacks and ensuring the safe and reliable operation of industrial processes in China. As industries in China increasingly integrate IoT devices and solutions into their operations, there is a parallel surge in the demand for operational technology to manage and optimize these interconnected systems. For instance, in 2024, China's rapid industrial internet growth spurred huge demand for operational technology cybersecurity solutions, as noted by Kaspersky, highlighting the increasing awareness of cybersecurity threats in critical infrastructure.

Key Operational Technology Company Insights

Some key companies in the operational technology industry are ABB, Emerson Electric Co., IBM Corporation, and Honeywell International Inc.

-

ABB is a global technology company that specializes in electrification, robotics, automation, and motion technologies. In the realm of OT, ABB focuses on enhancing cybersecurity for industrial infrastructure through partnerships such as the one with Nozomi Networks, which integrates advanced OT and IoT security solutions to support digital transformation and operational resiliency in energy and process industries.

-

Honeywell International Inc. is a prominent player in the industrial automation sector, offering a range of Operational Technology solutions. Its OT cybersecurity portfolio includes advanced software-enabled solutions such as Honeywell Forge Cybersecurity+, which provides continuous monitoring and real-time threat detection to protect industrial control systems and assets. Honeywell's industrial automation technologies are used in various settings, including factories and refineries, to manage complex processes and ensure consistent results.

Key Operational Technology Companies:

The following are the leading companies in the operational technology market. These companies collectively hold the largest market share and dictate industry trends.

- Emerson Electric Co.

- General Electric

- Hitachi, Ltd.

- IMB Corporation

- Honeywell International Inc.

- OMRON Corporation

- Rockwell Automation

- Siemens.

- Schneider Electric

Recent Developments

-

In March 2025, Fortinet introduced substantial updates to its OT Security Platform, enhancing the protection of critical infrastructure from emerging cyber threats. These advancements, announced at the Gartner Digital Workplace Summit in Singapore, provide advanced visibility, segmentation, and secure connectivity solutions tailored for industries such as transportation, energy, and manufacturing.

-

In March 2025, TXOne Networks introduced Version 3.2 of its Stellar solution, significantly enhancing its capabilities in operational technology environments. This update expands Stellar's functionality from endpoint protection to comprehensive detection and response, facilitating more effective threat hunting and detection.

-

In March 2025, Armis, a company specializing in cyber exposure management and security, completed the acquisition of OTORIO, an expert in OT and Cyber-Physical Systems (CPS) security. This strategic move aims to strengthen Armis' capabilities in OT and CPS by incorporating OTORIO's Titan platform into Armis' Centrix cloud-based cyber exposure management platform.

Operational Technology Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 230.87 billion |

|

Revenue forecast in 2030 |

USD 364.74 billion |

|

Growth rate |

CAGR of 9.6% from 2025 to 2030 |

|

Actual data |

2017 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, connectivity, deployment, enterprise size, industry, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA |

|

Key companies profiled |

ABB.; Emerson Electric Co.; General Electric; Hitachi, Ltd.; IMB Corporation; Honeywell International Inc.; OMRON Corporation; Rockwell Automation; Siemens; Schneider Electric |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Operational Technology Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global operational technology market report based on component, connectivity, deployment, enterprise size, industry, and region:

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Supervisory Control and Data Acquisition (SCADA)

-

Programmable Logic Controller (PLC)

-

Remote Terminal Units (RTU)

-

Human-Machine Interface (HMI)

-

Others

-

-

Distributed Control System (DCS)

-

Manufacturing Execution System Market

-

Functional Safety

-

Building Management System

-

Plant Asset Management (PAM)

-

Variable Frequency Drives (VFD)

-

Computer Numerical Control (CNC)

-

Others

-

-

Connectivity Outlook (Revenue, USD Billion, 2017 - 2030)

-

Wired

-

Wireless

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

SMEs

-

Large Enterprises

-

-

Industry Outlook (Revenue, USD Billion, 2017 - 2030)

-

Process Industry

-

Oil & Gas

-

Chemicals

-

Pulp & Paper

-

Pharmaceuticals

-

Mining & Metals

-

Energy & Power

-

Others

-

-

Discrete Industry

-

Automotive

-

Semiconductor & Electronics

-

Aerospace & Defense

-

Heavy Manufacturing

-

Others

-

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global operational technology market size was estimated at USD 210.06 billion in 2024 and is expected to reach USD 230.87 billion in 2025.

b. The global operational technology market is expected to grow at a compound annual growth rate of 9.6% from 2025 to 2030 to reach USD 364.74 billion by 2030.

b. North America dominated the market in 2024, accounting for over 36.0% share of the global revenue. The region's prominent position in the operational technology market can be attributed to its thriving industrial sectors, including manufacturing, energy, and transportation.

b. Some key players operating in the operational technology market include ABB; Emerson Electric Co.; Fortinet, Inc.; Forcepoint; General Electric; Honeywell International Inc.; Huawei Technologies Co., Ltd.; IBM Corporation; Rockwell Automation; Schneider Electric.

b. Key factors driving the operational technology market growth include the growing demand for real-time data analysis and predictive maintenance and the surging adoption of cloud-based OT solutions.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."