Open RAN Market Size, Share & Trends Analysis Report By Component, By Unit, By Deployment, By Network, By Frequency, By Region (North America, Europe, Asia Pacific, Latin Americ, MEA) And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-117-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2019 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Open RAN Market Size & Trends

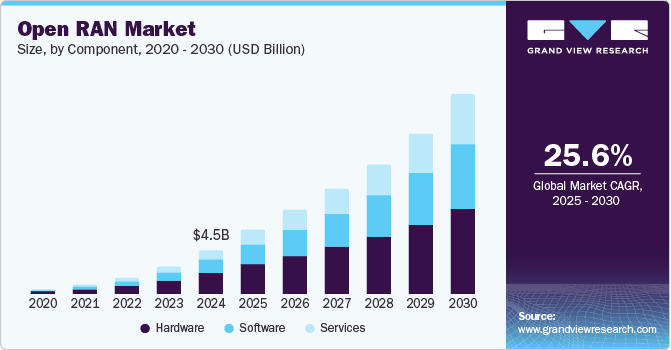

The global open RAN market size was estimated at USD 4.51 billion in 2024 and is projected to grow at a CAGR of 25.6% from 2025 to 2030. An open radio access network, or O-RAN, is a nonproprietary version of the radio access network (RAN) that allows interoperation between cellular network equipment provided by different vendors. Open RAN enables operators to choose hardware and software solutions from various vendors, which can lead to reduced equipment and operational costs. The vendor diversity, cost reduction, and flexibility offered by open RAN are anticipated to drive the market's growth over the forecast period. In February 2018, China Mobile, AT&T Inc., Deutsche Telekom, Orange, and NTT DOCOMO, founded the O-RAN ALLIANCE.

The ALLIANCE aims to reshape the RAN industry toward more open, intelligent, and virtualized fully interoperable mobile networks. O-RAN-based mobile network improves network operators' operational efficiency. In addition, the forum set O-RAN specifications that enable a more vibrant and competitive RAN supplier ecosystem with quicker innovations to improve user experience. The O-RAN ALLIANCE plays a central role in developing the Open Radio Access Network (O-RAN) market. Open RAN enables operators to choose different hardware and software components from various vendors per their budgetary constraints. This freedom of choice regarding components and vendors translates into a cost-effective and flexible ecosystem compared to the traditional RAN architecture.

In addition, the implementation and maintenance costs associated with network deployment also decrease due to this flexibility. This inherently drives the competition in the market, pushing vendors to drive down prices even further. Thus, the cost-effective and flexible nature of O-RAN is expected to drive its adoption over the forecast period. In addition to reducing the overall cost, network operators can opt for components from various vendors and fine-tune their networks to deliver optimal performance. It allows operators to tailor their offerings to accommodate accelerated data speeds, increased service reliability, and thus improved customer experience.

Regulatory support and geopolitical considerations are also driving the Open RAN market forward. Governments, particularly in the U.S. and Europe, are increasingly viewing Open RAN as a strategic approach to enhancing network security and reducing dependency on specific vendors, especially in light of concerns about potential security risks associated with certain foreign suppliers. This endorsement from regulators not only promotes competition but also encourages local and smaller technology vendors to enter the telecom space, fostering innovation and strengthening regional technology ecosystems. As a result, Open RAN is emerging as a crucial component of next-generation telecommunications infrastructure, aligning with broader priorities for security, cost-effectiveness, and flexibility in global markets.

Furthermore, the collaboration between various equipment providers and network operators allowed by O-RAN makes it easier for operators to deploy new features and services. The open standards allow for more flexibility and customization, thus fostering innovation in the market. The open RAN is still in its nascent stages of development and still requires some standardization efforts. Network standardization is important to ensure that different components from different vendors can work together seamlessly. Security concerns arise in the market as new technology introduces new security risks. Open RAN networks need to be more secure to protect customer’s data. However, as the market matures over time, these hurdles will be overcome with the evolving technology and ecosystem of the O-RAN.

Component Insights

The hardware segment accounted for the largest share of 46.89% in 2024. Open RAN hardware specifically refers to the physical equipment and infrastructure of the radio access network in an open RAN architecture. Some of the common hardware components include baseband units (BBUs), remote radio units (RRUs), and virtualized RAN (vRAN) servers, among others. The O-RAN hardware allows operators to replace legacy 4G/3G/2G systems with fully virtualized Open RAN technology. Moreover, the hardware enables multiple technologies to run simultaneously on the same RRH to provide flexible and superior voice and data services to the end-users, driving the segment’s adoption and growth.

The services segment is anticipated to grow at a significant CAGR during the forecast period. The services segment is further bifurcated into consulting, deployment & implementation, and support & maintenance. Since O-RAN is a comparatively new technology, network operators need adequate support to ensure the efficiency and operability of the network. In addition, operators and vendors need to be trained on how to use the O-RAN for their maximum advantage. The growing demand for consulting, deployment & implementation, and support & maintenance services is anticipated to propel the segment’s growth over the forecast period.

Unit Insights

The radio unit segment dominated the market in 2024. The radio unit is an important component of the open RAN architecture. It transmits, receives, amplifies, and digitizes the radio frequency signals. The radio unit is near or integrated into the antenna. The radio unit holds significance in the O-RAN market as it enables wireless communication between the user device and the core network. The growing use of radio units to enhance network performance is driving the segment’s growth.

The distributed unit segment is expected to grow at a significant CAGR over the forecast period. The distribution unit converts a signal from one form to another and aggregates all data to be transmitted over a communication channel. The distribution unit takes the digitized radio signal from the radio unit and sends it into the network. The DU is used at the base station for computation, and it plays an important role in transmitting the radio signal, which is anticipated to drive the segment’s growth over the forecast period.

Deployment Insights

The hybrid cloud segment dominated the market in 2024. Open RAN's hybrid cloud deployment combines on-premises and cloud infrastructure, optimizing network performance while leveraging scalability and cost efficiency. According to the survey results published by Mavenir regarding adopting O-RAN among enterprises, 78% of the surveyed organizations preferred hybrid or other cloud models for deploying O-RAN. Hybrid cloud deployment offers the public cloud's flexibility while providing the private cloud's security. Thus, the amalgamation of the two provided by hybrid cloud deployment is contributing to the segment's growth.

The private cloud segment is anticipated to grow significantly over the forecast period. Open RAN's private cloud deployment involves utilizing dedicated cloud infrastructure for enhanced network control and security. The private cloud deployment segment's growth can be attributed to the growing need for tailored solutions, data privacy compliance, and optimal resource utilization. Private cloud deployment offers efficient network management while addressing specific operational requirements of the organization, which is anticipated to drive the adoption of the private cloud segment over the forecast period.

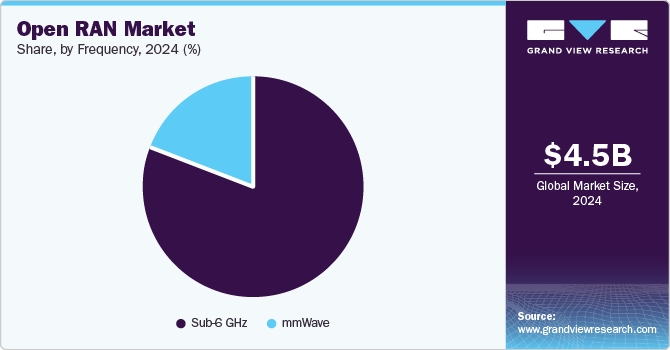

Frequency Insights

The sub-6 GHz segment dominated the market in 2024. The sub-6 GHz frequency enables expansive coverage and better penetration through dense urban areas and rural areas where network connectivity is otherwise slow/poor. Hence, the sub-6 GHz frequency is better suited for urban as well as rural applications. It provides efficient data transmission improved user experience, and fulfills open RAN’s aim to enhance connectivity and accessibility. These benefits are anticipated to drive the market’s growth over the forecast period.

The mmWave segment is expected to grow at a significant CAGR over the forecast period. The growth of the mmWave segment can be attributed to its ability to bring ultra-fast speeds and high data capacity. Even though mmWave offers network connectivity over a shorter range, the ultra-fast speeds provided by the frequency are driving its adoption in the O-RAN market. Moreover, as 5G expands, mmWave's role within O-RAN becomes more crucial for delivering the high-speed, high-capacity performance users expect in various environments, thus propelling the segment’s growth.

Network Insights

The 5G segment dominated the market in 2024. The majority of network operators and telecom equipment providers are focusing on creating a robust 5G ecosystem. The majority of the countries have already released 5G networks. The shift from 4G to 5G networks is driving open RAN network operators and providers to opt for 5G networks, which is driving the segment’s growth.

The 4G segment is anticipated to grow significantly over the forecast period. The market has witnessed 4G network deployments primarily due to their established infrastructure and widespread adoption across the globe. The dominant share of the 4G network can be attributed to the compatibility of open RAN solutions with the existing 4G setups. Moreover, the mature technology of 4G has led to significant deployments of Open RAN on the 4G network. Key players are focusing on enhancing and modernizing these networks while maintaining operational efficiency, thus boosting the segment’s growth.

Regional Insights

North America open RAN market dominated the industry and accounted for the largest share of 41.2% in 2024. The regional growth can be attributed to several factors, including the presence of prominent key players, such as AT&T, Inc., and the region's technological inclination toward early adoption of advanced solutions. Moreover, the region is witnessing significant investment in telecommunication infrastructure, creating significant growth opportunities for adopting O-RAN. The convergence of these factors has propelled North America to the forefront of Open RAN expansion, fostering the regional market’s growth and development in the market.

U.S. Open RAN Market Trends

The open RAN market in U.S. held a dominant position in 2024. The Open RAN market in the U.S. continues to witness significant growth, driven by the demand for more flexible and cost-effective network solutions. Major telecom players are actively adopting Open RAN technologies to diversify their network infrastructure and enhance operational efficiency.

Europe Open RAN Market Trends

The Europe Open RAN market was identified as a lucrative region in 2024. In Europe, the Open RAN market is experiencing rapid expansion fueled by the continent's push towards 5G adoption and the desire for more flexible network architectures. Governments across Europe are investing in improving their networking infrastructure. For instance, the European Commission committed public funding of more than EUR 700 million through the Horizon 2020 program to support 5G opportunities in the region. The investments are necessary to support the 5G traffic volume expected by 2025. Such initiatives are expected to drive the market’s growth from 2024 to 2030.

The UK Open RAN market is burgeoning as telecom operators embrace this technology to drive network innovation and efficiency. Leading players such as BT Group (including EE) and Vodafone UK are at the forefront of Open RAN trials and deployments across the country. For example, BT Group has launched several initiatives to pilot Open RAN solutions, aiming to enhance network flexibility and reduce vendor lock-in.

The Germany Open RAN Market held a substantial market share in 2024 as major players such as Deutsche Telekom and Vodafone Germany are actively exploring Open RAN solutions to drive network agility and efficiency. For instance, Deutsche Telekom has initiated various pilot projects and collaborations to test Open RAN technology, aiming to leverage its potential for cost reduction and vendor diversification.

Asia Pacific Open RAN Market Trends

Asia Pacific open RAN market is anticipated to register significant growth over the forecast period. The region's growth can be attributed to the increasing demand for advanced telecommunication infrastructure, a growing mobile subscriber base, and favorable government regulations. Countries, such as Japan, South Korea, and India, are at the forefront of regional growth due to their technological prowess and growing emphasis on fostering a robust digital ecosystem. All these factors are contributing to the growth of the regional market.

The Japan Open RAN industry is expected to grow rapidly in the coming years. Favorable government initiatives and strategic initiatives by the major providers to boost 5G connectivity are benefiting the growth of the Open RAN market in Japan. Japanese telecom operators are taking initiatives to develop and deploy 5G RAN solutions nationwide. For instance, in January 2023, KDDI CORPORATION, a Japan-based telecom company, collaborated with Samsung, a South Korea-based company, and Fujitsu, a Japan-based company, to deploy 5G Open Virtual Radio Access Network (Open vRAN) sites in Japan.

The open RAN industry in India is experiencing rapid growth. Leading players such as Bharti Airtel, Reliance Jio, and Vodafone Idea are actively investing in Open RAN technologies to drive network efficiency and innovation. For instance, Reliance Jio has been at the forefront of Open RAN adoption, deploying it in its nationwide 4G network and preparing for 5G rollout to enhance scalability and cost-effectiveness.

Key Open RAN Company Insights

Some of the key companies in the Open RAN market include Samsung Electronics Co., Ltd., NEC Corporation, Fujitsu Limited, and others. Telefonaktiebolaget LM Ericsson and Nokia, two European telecom giants, are prominent in regions such as Europe, North America, and parts of Asia, where they provide advanced standalone 5G solutions and benefit from government-backed support in 5G infrastructure development.

-

Samsung Electronics Co., Ltd. specializes in providing telecommunications equipment. The company has been actively involved in the development and implementation of open RAN solutions, leveraging its expertise in telecommunications and network infrastructure. Besides, Samsung Electronics has a vast global footprint, with subsidiaries, manufacturing facilities, and sales offices in numerous countries. The company distributes its products worldwide with a significant presence in key markets such as the U.S., Europe, China, and emerging markets in Asia, Africa, and Latin America. Samsung Electronics Co., Ltd. invests heavily in research and development to maintain its position as a technology leader.

-

NEC Corporation is a global technology company, renowned for its contributions to various sectors, including IT, telecommunications, and electronics. Established in 1899, NEC Corporation has grown into a multinational corporation with a diverse portfolio of products and services. As for Open RAN, the company has been actively involved in this space. It has been developing open RAN solutions to enable mobile network operators to deploy more flexible and cost-effective radio access networks.

Key Open RAN Companies:

The following are the leading companies in the open radio access network (RAN) market. These companies collectively hold the largest market share and dictate industry trends.

- Mavenir

- NEC Corporation

- Fujitsu Limited

- Nokia Corporation

- Samsung Electronics Co., Ltd.

- Radisys Corporation (Reliance Industries)

- Parallel Wireless

- ZTE Corporation

- AT&T Inc.

- Casa Systems, Inc.

Recent Developments

-

In March 2024, ZTE Corporation unveiled a range of 5G-Advanced (5G-A) products at an event held during MWC 2024 in Barcelona, Spain. These products include mmWave products, MIMO products, UBR and FDD massive, and a base station for Non-Terrestrial Networks (NTN). By introducing these 5G-A products, ZTE Corporation aims to address various aspects of next-generation telecommunications networks, catering to the diverse needs of operators and consumers alike.

-

In February 2023, Fujitsu Limited announced a new 5G vRAN solution that combines Fujitsu Limited’s virtualized DU (vDU) and virtualized CU (vCU) with NVIDIA's GPU technology. Developed as part of the NTT DOCOMO-promoted 5G Open RAN Ecosystem (OREC) project, Fujitsu Limited offers the solution to customers such as global telecommunications carriers. The company also supports the worldwide expansion of open 5G networks in collaboration with telecom operators, such as NTT DOCOMO, facilitating the performance verification and evaluation tests for the solution.

Open RAN Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.53 billion |

|

Revenue forecast in 2030 |

USD 20.41 billion |

|

Growth rate |

CAGR of 25.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2019 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, unit, deployment, network, frequency, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; India; Japan; South Korea; Australia; Malaysia; Brazil; Mexico; KSA; UAE; South Africa |

|

Key companies profiled |

NEC Corporation; Fujitsu Limited; Nokia Corporation; Samsung Electronics Co.Ltd.; Radisys Corporation (Reliance Industries); Parallel Wireless; ZTE Corporation; AT&T Inc.; Casa Systems, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Open RAN Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented the global open RAN market report based on component, unit, deployment, network, frequency, and region.

-

Component Outlook (Revenue, USD Million, 2019 - 2030)

-

Hardware

-

Software

-

Services

-

Consulting

-

Deployment and Implementation

-

Support and Maintenance

-

-

-

Unit Outlook (Revenue, USD Million, 2019 - 2030)

-

Radio Unit

-

Distributed Unit

-

Centralized Unit

-

-

Deployment Outlook (Revenue, USD Million, 2019 - 2030)

-

Private

-

Hybrid Cloud

-

Public Cloud

-

-

Network Outlook (Revenue, USD Million, 2019 - 2030)

-

2G/3G

-

4G

-

5G

-

-

Frequency Outlook (Revenue, USD Million, 2019 - 2030)

-

Sub-6 GHz

-

mmWave

-

-

Regional Outlook (Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

India

-

Japan

-

Australia

-

South Korea

-

Malaysia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global open RAN market size was estimated at USD 4.51 billion in 2024 and is expected to reach USD 6.53 billion in 2025.

b. The global open RAN market is expected to grow at a compound annual growth rate of 25.6% from 2025 to 2030 to reach USD 20.41 billion by 2030.

b. North America dominated the market in 2022. The segment's growth can be attributed to several factors, including the presence of prominent key market players such as AT&T, Inc. and the region's technological inclination towards early adoption of advanced solutions.

b. Some key players operating in the open RAN market include NEC Corporation; Fujitsu Limited; Nokia Corporation; Samsung Electronics Co.Ltd.; Radisys Corporation (Reliance Industries); Parallel Wireless; ZTE Corporation; AT&T Inc.; Casa Systems, Inc.

b. Open RAN enables operators to choose hardware and software solutions from various vendors, which can lead to reduced equipment and operational costs. The vendor diversity, cost reduction, and flexibility offered by open RAN are anticipated to drive the market's growth over the forecast period.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."