- Home

- »

- Medical Devices

- »

-

Open MRI Systems Market Size And Share Report, 2030GVR Report cover

![Open MRI Systems Market Size, Share & Trends Report]()

Open MRI Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Field Strength (Low-Field, Mid-Field, High-Field), By Application (Vascular, Abdominal), By End-use (Hospitals, Ambulatory Surgical Centers), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-690-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Open MRI Systems Market Size & Trends

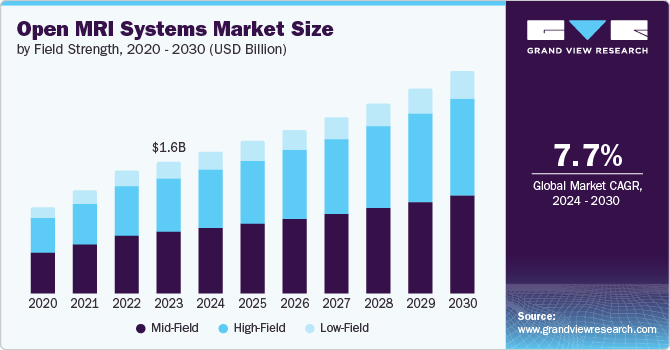

The global open MRI systems Market size was valued at USD 1.63 billion in 2023 and is projected to grow at a CAGR of 7.7% from 2024 to 2030. The growing incidence of age-associated chronic diseases, changing lifestyles, and high demand for safe & accurate diagnostic methods are among the major factors expected to drive the overall market growth. As per the news published by World Federation of Neurology in October 2023, neurological disorders is the second highest cause of death and disability in the world.

A study by Global Burden of Disease (GBD) shows that the number of people suffering from brain diseases might double in number by 2050. The increasing need for early and accurate diagnostics tools is expected to impact growth during the forecast period positively.

Open MRI systems pose less risk of panic attacks and claustrophobia, leading to wide acceptance of these systems by patients suffering from these conditions. Open systems are largely preferred for scanning infants and can accommodate obese & stockier patients. Hospitals and diagnostic centers prefer purchasing open systems as they allow diagnostic imaging of various conditions.

The growth of this open MRI systems market can be attributed to the increasing geriatric population and the rising prevalence of cancer globally. According to the Union for International Cancer Control (UICC), about 53% of cancer patients are 65 years old or older. Moreover, cancer penetration is faster in the later stage of life. The geriatric population is estimated to rise to 1.6 billion by 2050. The availability of effective therapeutic methods and increasing life expectancy are expected to fuel the need for repetitive diagnostic scans for effective disease management, thus boosting demand.

Increasing application of MRI in various diagnostic imaging techniques is expected to boost the demand for these devices, which is expected to contribute to growth over the forecast period. According to the Diagnostic Imaging Dataset Statistical Release, 43.4 million imaging tests were reported in England from February 2022 to January 2023. Total of 3.41 million imaging tests were reported in January 2023 alone, out of which 0.31 million were MRI tests.

The increasing trend of preventive healthcare and high demand for early diagnosis are some of the major factors expected to fuel the market growth during the forecast period. Most of the major players are focusing on developing advanced open systems with high strength and image quality. This is expected to boost the demand for open MRI systems, which is in turn expected to boost the market.

Field Strength Insights

The mid-field segment dominated the market and accounted for a share of 46.8% in 2023. This includes devices with 0.3T to 1 T strength. This high percentage can be attributed to frequent research and the launch of mid-field open MRI devices. For instance, in July 2024, FUJIFILM Holdings Corporation launched APERTO Lucent (a mid-field open MRI system) in the U.S. This system has multiple advantages over traditional MRI systems.

The high-field segment is expected to grow at the fastest CAGR of 9.0% over the forecast period, owing to remarkable research bringing revolutionary advancements in the imaging sector. Companies are actively launching open MRI with high field strength in the market to benefit patients and healthcare providers through high-quality imaging. According to the article published by OpenGov Asia, in August 2023, India launched its first indigenous high-field next-generation Magnetic Resonance Imaging (MRI) Scanner. This movement reduced the cost of MRI significantly, thereby increasing the adoption in coming years to propel the market growth.

Application Insights

Brain & Neurological segment dominated the market and accounted for a share of 22.6% in 2023. The growing elderly population and rising neurological conditions drive the demand for open diagnostic systems, particularly in brain and spine imaging, due to their significant benefits in detecting various anomalies and injuries. For instance, in February 2024, Koninklijke Philips N.V. introduced significant upgrades to its Image-Guided Therapy System—Azurion—by unveiling the new Azurion neuro biplane system. This system is engineered to boost productivity and support care teams in treating more patients, making quicker decisions, and securing superior outcomes. It is equipped with improved 2D and 3D imaging capabilities and offers greater flexibility in positioning the X-ray detector.

The breast segment is expected to grow significantly at a CAGR of 8.3% over the forecast period, owing to the increasing prevalence of breast cancer. This is fueling the need for open MRI systems for breast imaging. According to the World Health Organization (WHO), 2.3 million breast cancer cases were reported globally in 2022. Also, in the same year breast, cancer was the most common type of cancer among women in 157 countries out of 185.

End-use Insights

The hospitals segment dominated the market and accounted for a share of 37.2% in 2023. Several hospitals installed open MRI machines due to their advantages over traditional MRI machines. The increasing demand for access to new groundbreaking imaging technology through open MRI machines is attributable to the market's growth. Moreover, this demand is expected to increase in the coming years due to rising number of specialty hospitals. According to an article published by BioSpectrum in May 2023, India has more than 70,000 hospitals, and many of them do not have open MRI machines. To satisfy this increasing demand, many hospitals might install open MRI machines, which can rapidly increase market revenue.

The imaging centers segment is expected to grow at the fastest CAGR of 9.4% over the forecast period. Outpatient imaging centers are better than hospitals for MRI scans due to advantages such as quicker appointments, expertise, modern equipment, and cost-effectiveness. This makes them increasingly popular, and they are expected to grow in number and drive market expansion. According to an article published by Definitive Healthcare, LLC, there were more than 18,000 imaging centers in the U.S. as of April 2023.

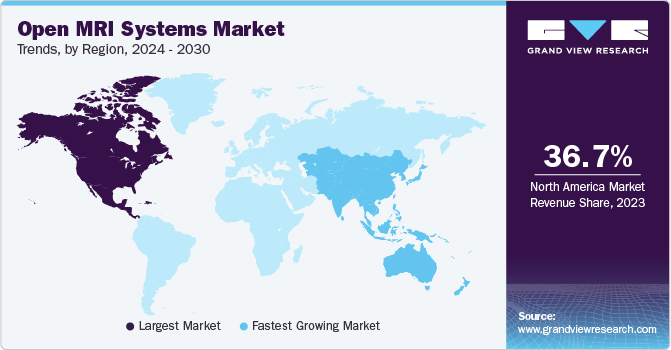

Regional Insights

North America accounted for the largest revenue share of 36.74% in the open MRI systems market in 2023, owing to many major market players and the high adoption of advanced diagnostic technologies. An increase in the application of MRI in the diagnosis of a wide range of diseases, favorable government policies, and a rise in the number of ambulatory diagnostic centers in the region are some of the major factors expected to drive growth during the forecast period.

U.S. Open MRI Systems Market Trends

The U.S. open MRI systems market dominated the North America with a share of 77.7% in 2023 due to various product approvals, favorable government initiatives, and rising demand for high quality imaging systems. For instance, in February 2022, Esaote S.p.A. received FDA approval for Magnifico Open MRI to provide customer-driven services. This system can be conveniently used for all patients, including large children and claustrophobic patients. Growing incidences of chronic diseases such as cancer and neurological disorders, increase awareness about MRI, thereby increasing the demand for advanced MRI systems to propel the market growth.

Europe Open MRI Systems Market Trends

Europe open MRI systems market was identified as a lucrative region in this industry and is anticipated to grow significantly in the coming years. Rapidly changing healthcare infrastructure and supportive regional government policies are expected to drive the segment growth. For instance, in March 2024, the Community Diagnostic Centre (CDC) in the UK received an investment of USD 2129.6 million for MRI and CT scans. There are 155 open CDCs in England and has delivered more than 7.0 million tests. In addition, presence of leading players, research and regulatory approvals, fuel the market growth. For instance, in February 2023, Hyperfine, Inc. received the CE mark approval for its Swoop imaging system from the European government. This approval can mark the significant geographic expansion of the company in the European region to boost market growth.

Asia Pacific Open MRI Systems Market Trends

The Asia Pacific is expected to grow at the fastest CAGR of 8.6% over the forecast period due to growing economies, including China and India. Increasing medical tourism in the region and intense competition among healthcare service providers are some factors expected to boost the demand for advanced MRI systems in the market.

India open MRI systems market is expected to grow rapidly in the coming years due to the huge population and alarming demand for medical facilities. According to the data published in 2023, India reportedly had around 4050 MRIs, equal to 3 MRI systems per million population. The country is actively planning strategic activities to bridge this gap. For instance, in May 2023, Siemens Healthineers AG inaugurated its Magnetic Resonance Imaging (MRI) machines manufacturing facility in India. The company made an investment plan of USD 15.5 million in this project till 2025. This strategy can make open MRI machines more affordable, thus increasing adoption to fuel market growth.

Latin America Open MRI Systems Market Trends

Latin America open MRI systems market was identified as a lucrative region in 2023 driven by the increasing prevalence of chronic diseases, such as cancer and neurological disorders, which require advanced imaging for accurate diagnosis and monitoring. Improved healthcare infrastructure and rising regional investments also contribute to the market's growth. Open MRI systems are also preferred for their patient-friendly design, accommodating claustrophobic, elderly, and obese patients, thus enhancing accessibility and comfort.

Brazil open MRI systems market is expected to grow rapidly in the coming years due to aging population, as older adults often experience conditions requiring frequent imaging. These systems are preferred due to their comfort, reduced claustrophobia, and accessibility for patients with mobility issues. This demographic trend significantly boosts the market's growth. According to the Brazilian Institute of Geography and Statistics (IBGE), the median age of Brazil's population rose by 6 years since 2010, reaching 35 years in 2022. The aging index increased from 30.7 in 2010 to 55.2 in 2022, showing 55.2 elderly persons for every 100 children aged 0-14. In 2022, women comprised 51.5% (104.5 million) of the population, while men comprised 48.5% (98.5 million), resulting in nearly 6 million more women than men.

Middle East & Africa Open MRI Systems Market Trends

Middle East & Africa open MRI systems market was identified as a lucrative region in 2023. Government initiatives to enhance healthcare infrastructure and technological advancements in MRI systems, such as drug coverage programs, are boosting demand. These measures improve access to cutting-edge diagnostic tools and encourage greater utilization of medical imaging services. The result is a significant increase in the adoption of advanced MRI systems. For instance, the UAE has a government-funded healthcare system regulated at federal and emirate levels. The Ministry of Health and Prevention is the federal health authority, and other regulatory authorities include the Dubai Health Authority (DHA), the Health Authority-Abu Dhabi (HAAD), and the Emirates Health Authority (EHA).

Saudi Arabia open MRI systems market is expected to grow rapidly in the coming years due to the significant investments in healthcare infrastructure, including new hospitals and diagnostic centers. Increased private sector involvement also boosts investments in modern medical technologies, such as open MRI systems, enhancing the country's diagnostic capabilities. For instance, in 2023, Saudi Arabia was responsible for 60% of the healthcare spending among the Gulf Cooperation Council (GCC) countries, with the sector being a key focus area for the Saudi government. The kingdom allocated USD 50.4 billion to healthcare and social development, comprising 16.96% of its annual budget for that year, making it the second biggest area of spending following education. In addition, the Saudi government aimed to prioritize privatizing the healthcare sector.

Key Open MRI Company Insights

Some of the key companies in the open MRI systems market include GE Healthcare, Siemens Healthineers AG, Koninklijke Philips N.V., Hitachi, Ltd., CANON MEDICAL SYSTEMS CORPORATION, Esaote SPA, FUJIFILM Holdings Corporation, Neusoft Corporation, Alltech Medical Systems, and Shenzhen Anke High-tech Co., Ltd. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

GE Healthcare offers various healthcare products and services to enable better patient care. The company offers several imaging solutions under the product segment including Magnetic Resonance Imaging (MRI) Solutions.

-

Siemens Healthineers AG offers a vast product portfolio for treatment and diagnostic purposes. The company’s offerings also include support and documentation for the healthcare industry. It also offers huge number of products in the medical imaging segment such as medical resonance imaging devices.

Key Open MRI Systems Companies:

The following are the leading companies in the open MRI systems market. These companies collectively hold the largest market share and dictate industry trends.

- GE Healthcare

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- Hitachi, Ltd.

- CANON MEDICAL SYSTEMS CORPORATION

- Esaote SPA

- FUJIFILM Holdings Corporation

- Neusoft Corporation

- Alltech Medical Systems

- Shenzhen Anke High-tech Co., Ltd.

Recent Developments

-

In October 2023, Esaote S.p.A. launched S-scan Open magnetic resonance imaging (MRI) system to enhance image quality and reduce scan times. This update extended company’s established S-scan MRI platform.

-

In November 2021, the AeroDR Carbon Flat Panel Detector and the mKDR Xpress Mobile X-ray System were introduced by Konica Minolta Healthcare Americas Inc., which are highly efficient and even more extraordinary when combined

Open MRI Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.75 billion

Revenue forecast in 2030

USD 2.73 billion

Growth rate

CAGR of 7.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Field strength, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

GE Healthcare; Siemens Healthineers AG; Koninklijke Philips N.V.; Hitachi, Ltd.; CANON MEDICAL SYSTEMS CORPORATION; Esaote SPA; FUJIFILM Holdings Corporation; Neusoft Corporation; Alltech Medical Systems; Shenzhen Anke High-tech Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Open MRI Systems Market Report Segmentation

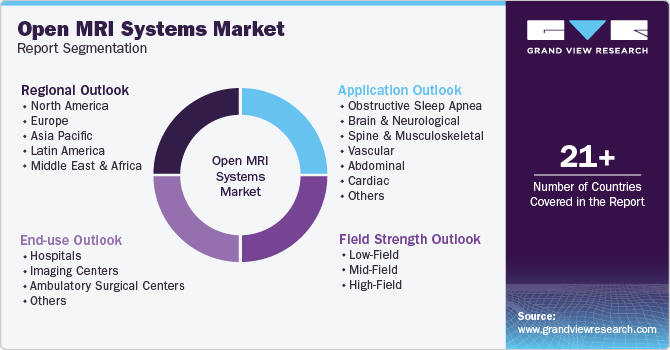

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global open MRI systems market report based on field strength, application, end-use, and region:

-

Field Strength Outlook (Revenue, USD Million, 2018 - 2030)

-

Low-Field

-

Mid-Field

-

High-Field

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Obstructive Sleep Apnea

-

Brain & Neurological

-

Spine & Musculoskeletal

-

Vascular

-

Abdominal

-

Cardiac

-

Breast

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 -2030)

-

Hospitals

-

Imaging Centers

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.