Open Banking Market Size, Share & Trends Analysis Report By Services (Banking & Capital Markets, Digital Currencies), By Deployment (Cloud, On-premise), By Distribution Channel (Bank Channels, App Markets), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-973-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Open Banking Market Size & Trends

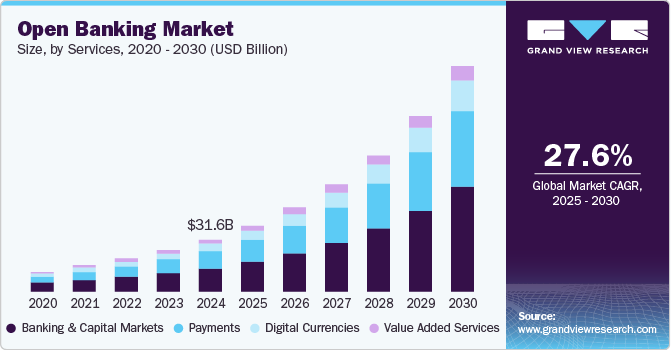

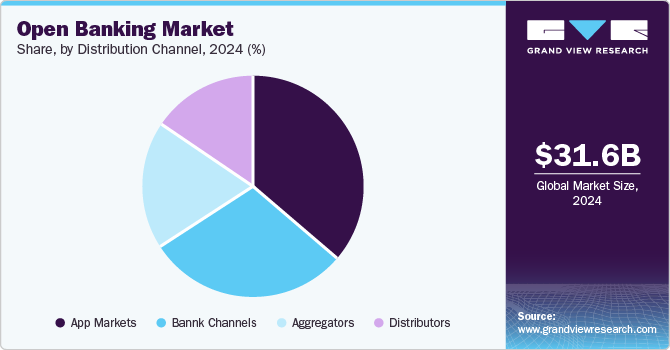

The global open banking market size was estimated at USD 31.61 billion in 2024 and is projected to grow at a CAGR of 27.6% from 2025 to 2030. Open banking allows third-party financial service providers to open access to transactions and other financial data from bank and non-bank financial institutions by using APIs. Access to a wider range of financial services, a better experience, and increased control and security of financial data are some of the key benefits of open banking, which are significantly contributing to the market’s growth over the forecast period.

The changing payment ecosystem and the rising adoption of Application Programming Interfaces (APIs) bode well for the market’s growth. For instance, according to Visa’s Open Banking Consumer Survey conducted in April 2022, around 87% of the consumers in the U.S. are using open banking to link finance accounts with third parties. However, only 34% of these consumers in the U.S. are aware that these services are enabled by open banking. Furthermore, the growing internet penetration and better broadband connectivity are also anticipated to drive the market’s growth over the forecast period.

The rapid digitization and rising adoption of technologies, including artificial intelligence, machine learning, and big data analytics in the industry worldwide, are anticipated to drive the growth of the open banking market. Big data analytics is used in the industry to tailor the services and boost the user experience, which is anticipated to attract more customers. Furthermore, the improved security of APIs is another major factor fueling the market's growth. In addition, the growing e-commerce and online shopping trends worldwide bode well for the growth of the industry.

The growing adoption of open banking has drawn the attention of venture capital firms, driving investments in the market. For instance, in May 2023, Tarabut Gateway, an open banking platform based in MENA, announced that it raised USD 32 million through a Series A funding round led by Pinnacle Capital. Tarabut Gateway expanded its footprint across the Kingdom of Saudi Arabia market with this funding. Furthermore, the growing strategic initiatives and new product launches by the key companies are also expected to fuel the market's growth over the forecast period.

Although the industry is anticipated to grow over the forecast period, it faces challenges such as concerns regarding growing cyberattacks and online fraud. Open banking encourages the sharing of critical customer information, which raises concerns over data security and privacy protection. However, various firms pursue different strategic initiatives to ensure that critical data is shared securely and consensually. Fintech firms also conform to regulations drafted by various governments worldwide to govern the terms under which consumers grant access to their data.

Services Insights

The banking & capital markets segment accounted for the largest share of 45.7% in 2024. The growing demand for managing finances effectively among millennials is expected to drive the segment’s growth. Shifting focus from traditional investment methods to advanced investment solutions is expected to generate lucrative opportunities for the segment. The increasing adoption of advanced AI-enabled platforms that can suggest investment options as per customer needs through the integration of algorithms and analytics is expected to propel segment growth.

The payments segment is expected to grow at a significant CAGR during the forecast period. The attributes of the growth are increased internet penetration across the world and a surge in the utilization of various platforms for online payments. Such developments occurred as an opportunity for banks to gain a competitive edge and strengthen their market position by collaborating or partnering with such platform providers. Furthermore, the rise in the launches of payment services by industry players also bodes well for the growth of the segment. For instance, in September 2022, PCI Pal, a financial services company, announced the launch of the Pay By Bank open banking solution for contact centers. As a result of this launch, the company enabled merchants to lower transaction costs and provide instant refunds, along with reduced fraud risk and chargeback costs.

Deployment Insights

The on-premise segment held the largest market share of 51.0% in 2024. It enables easy accessibility for customers, serving their needs better. The segment’s growth is also attributed to BFSI companies offering their APIs, which enable third parties and banks to offer cutting-edge services. In addition, a platform for open banking applications invites users to interact with their financial data in unconventional ways.

The cloud segment is expected to register the fastest CAGR of 28.5% during the forecast period. Cloud deployment service allows banks to collect, analyze, and provide customized services by leveraging an unprecedented amount of consumer data. In addition, cloud technology provides the highest standards of security. Moreover, the cloud enables scalability, flexibility, and real-time processing, which is expected to generate new opportunities for segment growth.

Distribution Channel Insights

The app market segment dominated the industry in 2024. The dominance can be attributable to the proliferation of smartphones globally. The growing adoption of mobile applications for buying and selling products and services is expected to drive the segment’s growth. Moreover, rising awareness regarding the utilization of bank-related services through mobile devices also bodes well for the segment’s growth.

The distributors segment is projected to grow at the fastest CAGR of 28.8% over the forecast period. The growth is ascribed to the fact that in a distributor model, banks function as service or product providers by processing what is eventually sold by a third-party provider. The customer interface is owned by a third-party provider, which is expected to offer unique opportunities for the segment’s growth.

Regional Insights

North America open banking market held a significant share in 2024. The market is driven by consumer demand for seamless digital experiences, prompting banks to invest in APIs and collaborate with fintech firms to enhance innovation and competitiveness.

U.S. Open Banking Market Trends

The U.S. open banking market held a dominant position in 2024. The market is marked by a surge in fintech adoption, driven by regulatory reforms and consumer demand for personalized financial services, fostering a dynamic ecosystem of banking innovation.

Europe Open Banking Market Trends

Europe open banking market was identified as a lucrative region in 2024. Regional market growth can be ascribed to the increasing need to improve online payment security in the region. Government directives for banks to compel the opening of APIs are promoting market expansion in this region. The presence of numerous prominent companies in the region is further expected to fuel the regional market growth.

The U.K. open banking market is expected to grow rapidly in the coming years. The regional market is characterized by rapid innovation in fintech, supported by regulatory mandates such as PSD2, leading to increased competition and customer-centric financial services.

Germany open banking market held a substantial market share in 2024.The landscape of the German market is evolving with a focus on data security and privacy, driving the adoption of digital solutions and fostering collaboration between traditional banks and fintech startups.

Asia Pacific Open Banking Market Trends

Asia Pacific open banking market is anticipated to grow at a CAGR of 29.4% during the forecast period. The regional market growth can be attributed to the growing awareness of the benefits offered by open banking systems among countries such as China, India, and Japan. According to India’s Ministry of Finance, the UPI transaction volume surged from USD 920 million to USD 83.75 billion from 2018 to 2023. This rapid development of digital payment services in Asia Pacific countries is also expected to contribute significantly to the growth of the regional market.

Japan open banking market is expected to grow rapidly in the coming years.The regional market is gaining traction with regulatory reforms promoting interoperability, fostering a wave of partnerships between banks and fintech firms to deliver innovative financial products and services.

China open banking market held a substantial market share in 2024. The Chinese market is propelled by tech giants offering comprehensive financial ecosystems, integrating banking services with e-commerce, payments, and wealth management, reshaping the financial landscape.

Key Open Banking Company Insights

Some of the key companies in the open banking market include Banco Bilbao Vizcaya Argentaria, S.A., Crédit Agricole, Finastra, NCR Corporation, Jack Henry & Associates, Inc., and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Banco Bilbao Vizcaya Argentaria, S.A. provides financial and commercial banking services. Solutions offered by the company include treasury management, regulatory APIs, and a digital ecosystem. The company offers its API and open banking solutions through its BBVA API_Market. The company was recognized as the most innovative bank in 2020 and one of the pioneers in its commitment to APIs and open banking.

-

Finastra is a financial software solution company offering a range of digital banking services, such as knowledge services, support services, client advisory services, managed services, and collaborative design engagement, implementation, and delivery. The company’s solutions for open banking include digital banking, U.S. digital & retail banking, and international digital & retail banking.

Key Open Banking Companies:

The following are the leading companies in the open banking market. These companies collectively hold the largest market share and dictate industry trends.

- Banco Bilbao Vizcaya Argentaria, S.A.

- Crédit Agricole

- DemystData, Ltd.

- Qwist

- Finastra

- FormFree Holdings Corporation

- Mambu

- MineralTree, Inc.

- NCR Corporation

Recent Developments

-

In April 2025, Paysend, a fintech company, partnered with Tink, an open banking platform and Visa solution provider, to enhance and accelerate open banking-powered money transfers. By integrating Tink’s advanced open banking technology, Paysend enables customers in key markets, particularly across the EU, to authenticate and fund international transfers directly from their bank accounts, eliminating the need for manual data entry or multiple security steps. This results in a payment experience that is faster, more seamless, and highly secure, reducing the risk of errors and fraud.

-

In September 2023, Saxo Bank announced its partnership with Mastercard to integrate open banking payments into Saxo Bank’s investment platforms. Saxo Bank customers can seamlessly transfer money into their investment accounts without having to log in to a separate bank account to transfer funds into their investment accounts.

Open Banking Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 39.89 billion |

|

Revenue forecast in 2030 |

USD 135.17 billion |

|

Growth rate |

CAGR of 27.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Services, deployment, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, South Korea, Australia, Brazil, KSA, Kingdom of Bahrain, and South Africa |

|

Key companies profiled |

Banco Bilbao Vizcaya Argentaria, S.A.; Crédit Agricole; DemystData, Ltd.; Qwist; Finastra; FormFree Holdings Corporation; Jack Henry & Associates, Inc.; Mambu; MineralTree, Inc.; NCR Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Open Banking Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global open banking market report based on services, deployment, distribution channel, and region.

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Banking & Capital Markets

-

Payments

-

Digital Currencies

-

Value Added Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bank Channels

-

App Markets

-

Distributors

-

Aggregators

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

Kingdom of Bahrain

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global open banking market is expected to grow at a compound annual growth rate of 27.6% from 2025 to 2030 to reach USD 135.17 billion by 2030.

b. Europe dominated the open banking market with a share of 36.37% in 2024. The regional market growth can be ascribed to the increasing requirement for improving online payment security in the region.

b. Some key players operating in the open banking market include Banco Bilbao Vizcaya Argentaria, S.A., Crédit Agricole; DemystData, Ltd.; finleap connect; Finastra; FormFree Holdings Corporation; Jack Henry & Associates, Inc.; Mambu.; Mineral Tree, Inc.; and NCR Corporation.

b. Key factors that are driving the open banking systems market growth include the integration of big data analytics and AI into banking systems and the adoption of digitalization.

b. The global open banking market size was estimated at USD 31.61 billion in 2024 and is expected to reach USD 39.89 billion in 2025.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."