- Home

- »

- Petrochemicals

- »

-

Opacifiers Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Opacifiers Market Size, Share & Trends Report]()

Opacifiers Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Titanium Dioxide, Zinc Oxide), By Application (Paints & Coatings, Plastics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-340-7

- Number of Report Pages: 201

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Opacifiers Market Size &Trends

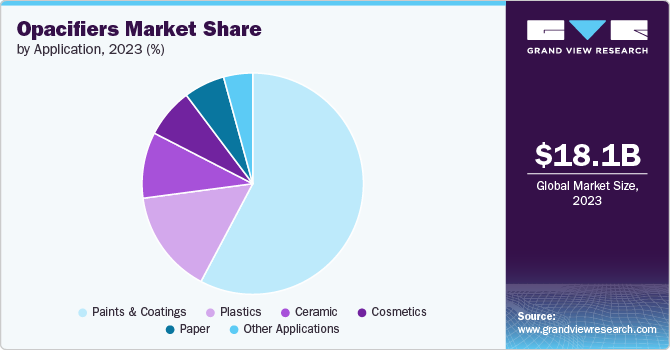

The global opacifiers market size was estimated at USD 18.1 billion in 2023 and is expected to grow at a CAGR of 6.1% from 2024 to 2030. The market growth is driven by the increasing demand for opacifiers from various industries, such as ceramics, paints, coatings, plastics, and personal care. These industries require opacifiers to enhance opacity, hiding power, and visual appeal in their products. The opacifier market presents opportunities for manufacturers to develop innovative opacifier products that meet the specific needs of different industries. The growing demand for environmentally friendly and sustainable opacifiers provides an opportunity for the development of eco-friendly alternatives. The increasing focus on research and development activities in the market opens doors for technological advancements and improved product performance.

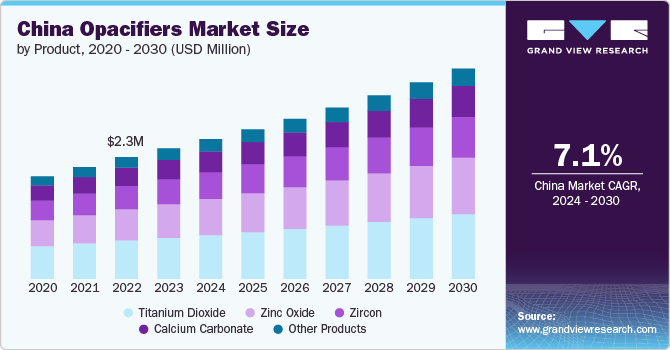

The opacifier market in China is expected to continue growing due to increasing industrialization and rising usage in paints and coatings, ceramics, and other industries. The demand for opacifiers in personal care products is also contributing to market growth. Additionally, the use of opacifiers in the production of eco-friendly and low-VOC (volatile organic compounds) products is influencing the market, as there are stringent regulations regarding the use of such products.

The opacifier market is experiencing significant demand globally, driven by various factors and applications. One of the key drivers of market growth is the increasing demand for opacifiers in the paints and coatings industry. Opacifiers, such as titanium dioxide (TiO2), are widely used in architectural coatings and automotive coatings to provide opacity, durability, UV resistance, and improved appearance. The construction sector's need for long-lasting and weather-resistant coatings contributes to the demand for opacifiers.

In addition to the paints and coatings industry, opacifiers are also extensively used in other sectors such as ceramics, plastics, personal care products, and detergents. The ceramics industry utilizes opacifiers to enhance the whiteness, opacity, and appearance of ceramic products. The personal care industry incorporates opacifiers in various skincare and haircare products to improve their texture, appearance, and performance.

Product Insights

The titanium dioxide segment dominated the market with a revenue share of 31.50% in 2023 owing to the demand for titanium dioxide opacifiers growing steadily. Titanium dioxide is widely used as an opacifier in various industries, including paints, coatings, plastics, ceramics, and cosmetics. The increasing demand for high-quality cosmetic products, the booming construction industry, and the rising automotive production are driving the demand for titanium dioxide opacifiers.

Zinc oxide is used as an additive in ceramic applications, where it contributes to opacity and enhances the visual appeal of ceramic products. The increasing demand from industries such as automotive, electronics, energy, and medical is driving the growth of zinc oxide in ceramics. In the rubber industry, zinc oxide is used in the production of various products such as hoses, belts, matting, flooring, and medical gloves. The growing demand for rubber products in industries like automotive, packaging, manufacturing, and construction is fueling the demand for zinc oxide.

Zircon is widely used as an opacifier in the ceramics industry, where it enhances the visual appeal and opacity of ceramic products. The demand for zircon in the ceramics industry is driven by the need for high-quality ceramic products with improved aesthetics. The growth of the ceramics industry, along with the increasing demand for visually appealing ceramic products, is contributing to the growth of the zircon opacifier market.

Application Insights

The paints & coatings segment dominated the market with a revenue share of 57.75 in 2023, owing to the demand for opacifiers in the paints and coatings industry is significant. Opacifiers, such as titanium dioxide (TiO2) and zinc oxide, are commonly used in paints and coatings to enhance hiding power and opacity, resulting in a consistent and vibrant color finish.

The booming construction industry, rising automotive production, and the growing preference for high-quality cosmetic products are driving the demand for TiO2 opacifiers in the paints and coatings industry. Additionally, the strong presence of the automotive, construction, and packaging industries in regions like Europe and the Asia Pacific further supports the demand for opacifiers.

The demand for opacifiers in the plastics industry is significant, with opacifiers such as titanium dioxide, opaque polymers, and other substances being used to enhance opacity and hiding power in plastic materials. The growth of end-use industries, changing consumer preferences, and increasing awareness of personal care products are driving the demand for opacifiers in plastics.

The demand for opacifiers in the ceramic industry is significant, as opacifiers play a crucial role in achieving opacity and enhancing the visual appeal of ceramic products such as tiles and refractories. Opacifiers are substances added to transparent ceramic glazes to make them opaque, and they are used in various applications within the ceramic industry.

Regional Insights

The market in North America is also influenced by stringent regulations regarding the use of eco-friendly and low-VOC (volatile organic compounds) products. This has led to the adoption of advanced opacifiers that meet environmental standards.

Asia Pacific Opacifiers Market Trends

Opacifiers find applications in various industries such as paints and coatings, ceramics, plastics, personal care, and more. The increasing demand for opacifiers in these industries, driven by factors like infrastructure development, construction activities, and the growing automotive industry, is boosting the market in the Asia Pacific region.

The opacifiers market in China is a significant consumer of opacifiers. The demand for opacifiers in this sector is driven by factors such as infrastructure development, construction activities, and the growing automotive industry.

Europe Opacifiers Market Trends

Opacifiers are widely used in the paints and coatings industry, and this segment accounts for a significant portion of the market for opacifiers in the region. The demand for opacifiers in Europe is driven by the construction, automotive, aerospace, and electronics sectors.

Key Opacifiers Company Insights

Some of the key players operating in the market include Dow; Arkema SA; Ashland; Tronox Holdings plc; KRONOS Worldwide, Inc.; Indulor Chemie GmbH; OMNOVA Solutions Inc.; Venator Materials PLC; Quaternia; and Indulor Chemie GmbH.

-

Arkema SA is a global company that specializes in the production of specialty chemicals, advanced materials, and coating solutions. The company is headquartered in Colombes, France, and operates in over 55 countries worldwide. Arkema's products find applications in diverse sectors such as transportation, oil extraction, renewable energies, consumer goods, electronics, construction, coatings, water treatment, and more.

-

OMNOVA Solutions Inc. is a chemical manufacturing company that develops, produces, and sells emulsion polymers, specialty chemicals, and engineered surfaces. The company serves diversified applications in various end markets, including automotive, building and architecture, electronics and appliances, flooring, furniture, healthcare, industrial, and more.

Key Opacifiers Companies:

The following are the leading companies in the opacifiers market. These companies collectively hold the largest market share and dictate industry trends.

- Dow

- Arkema SA

- Ashland

- Tronox Holdings plc

- KRONOS Worldwide

- Indulor Chemie GmbH

- OMNOVA Solutions Inc.

- Venator Materials PLC

- Quaternia.

- Cristal

Recent Developments

-

In November 2023, the Miracare brand introduced a natural and biodegradable opacifier which can be used in use in laundry and other home care applications.

-

In April 2023, Dow and Avery Dennison collaborated to develop an innovative hotmelt label adhesive solution that facilitates the mechanical recycling of polyolefin filmic labels and polypropylene (PP) or polyethylene (PE) packaging in a single stream. This pioneering olefinic hotmelt adhesive, the first of its kind in the label market, is specifically designed for chilled food applications and has received approval from Recyclass for recycling in the HDPE colored stream in European markets.

-

In June 2022, Clariant introduced a natural-derived, readily biodegradable opacifier, Plantasens OP 95, to support personal care formulators in minimizing the environmental impact of shampoos, conditioners, handwashes, and other rinse-off shower and bath products on marine and river life.

Opacifiers Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.29 billion

Revenue forecast in 2030

USD 27.59 billion

Growth rate

CAGR of 6.1% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Dow; Arkema SA; Ashland; Tronox Holdings plc; KRONOS Worldwide, Inc.; Indulor Chemie GmbH; OMNOVA Solutions Inc.; Venator Materials PLC; Quaternia; Cristal

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Opacifiers Market Report Segmentation

This report forecasts revenue & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global opacifiers market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Titanium Dioxide

-

Zinc Oxide

-

Zirco

-

Calcium Carbonate

-

Other Products

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Plastics

-

Ceramic

-

Cosmetics

-

Paper

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global opacifiers market is valued at USD 18.1 billion in 2023 and is expected to reach USD 19.29 billion in 2024.

b. The global opacifiers market is anticipated to witness a substantial growth with CAGR of 6.1% from 2024 to reached USD 27.59 billion by 2030.

b. The Asia pacific region accounted for the highest revenue share of 36.14% in 2023. Opacifiers find applications in various industries such as paints and coatings, ceramics, plastics, personal care, and more. The increasing demand for opacifiers in these industries, driven by factors like infrastructure development, construction activities, and the growing automotive industry, is boosting the market in the Asia Pacific region.

b. Some of the key players operating in the market include Dow, Arkema SA, Ashland, Tronox Holdings plc, KRONOS Worldwide, Inc Indulor Chemie GmbH, OMNOVA Solutions Inc., Venator Materials PLC, Quaternia. Indulor Chemie GmbH.

b. The opacifier market is driven by the increasing demand from various industries such as ceramics, paints, coatings, plastics, and personal care. These industries require opacifiers to enhance opacity, hiding power, and visual appeal in their products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.