Onychomycosis Market Size, Share & Trends Analysis Report By Type (Distal Subungual, White Superficial, Proximal Subungual Onychomycosis), By Treatment (Oral, Topical), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-031-4

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Onychomycosis Market Size & Trends

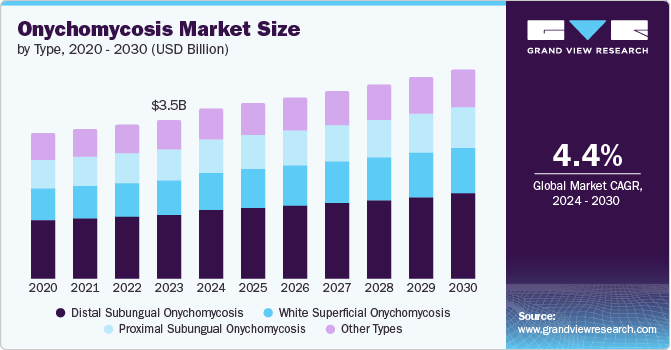

The global onychomycosis market size was estimated at USD 3.52 million in 2023 and is expected to grow at a CAGR of 4.4% by 2030. The market is witnessing growth due to factors such as the rising incidence of onychomycosis, growing awareness about the treatment, rising R&D pertaining to the development of novel drugs, and the growing geriatric population and diabetic population.

The awareness of fungal diseases increases public awareness and contributes to early detection and understanding about the impact of fungal infections, such as onychomycosis. For instance, from September 18th to 22nd , 2023, the CDC observed Fungal Disease Awareness Week (FDAW). Annually, the CDC and its partners allocate FDAW to engage in activities and outreach to boost public awareness about fungal infections. In the lead-up to FDAW in 2023, various events showcased the escalating challenges, complexities, and profound consequences of fungal diseases.

A significantly large range of antifungal preparations, both oral and topical agents such as tablets, creams, sprays, and injections are commercially available for treatment of this condition. The rising R&D investments offer significant opportunities for the market growth. For instance, in August 2023, Moberg Pharma AB announced that MOB-015 obtained national approval for the Sweden market. The approval pertained to treating benign-to-medium fungal nail infections in adults. MOB-015 gained its first approval in Ireland, followed by Sweden. However, Sweden was the first country to approve MOB-015 for OTC use.

Aging causes a gradual decrease in the functionality of immune system. Therefore, cognitive and physical changes usually make the elderly people more susceptible to acquiring infections such as onychomycosis.Therefore, increasing geriatric population globally is expected to drive demand for onychomycosis treatment. According to WHO, 1 in every 6 people around the world are expected to be over 60 years by 2030, which equals to 1 billion in 2020 increasing to 1.4 billion in 2030. The number of elderly people is expected to grow at the fastest rate in Eastern and South-Eastern Asia with a two-fold increase estimated in a population aged 65 & above, followed by Central and Southern Asia, reaching 328.1 million by 2050.

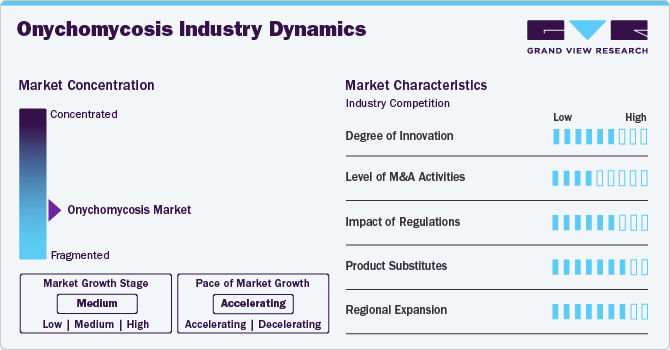

Industry Dynamics

The industry is characterized by a growing degree of innovation. There are various advancements and developments aimed at improving treatment, and management of fungal nail infections. Keymarket players are actively involved in research and development to meet the growing demand for effective treatment solutions.

The market is characterized by low-to-moderate levels of M&A activities. The M&A endeavors aim to capitalize on emerging opportunities and drive innovation. For instance, in January 2018, NovaQuest Capital Management acquired Viamet Pharmaceuticals and its antifungal drug candidate VT-1161.

Regulations have a significant impact on the onychomycosis market, as it influences certain aspects such as product approvals, market growth, and innovation. Companies need to comply with the regulatory frameworks to ensure patient safety, support innovation, and establish trust among patients.

Product substitutes include complementary and alternative therapies such as tea tree oil and certain herbal and ayurvedic medicines. Additionally, laser therapy is also a common treatment choice for the fungal infection making it a potential substitute for onychomycosis market.

Companies are expanding into new regions and taking efforts to enter untapped geographies to reach a broader population. The strategies for expansion are aimed towards increasing market penetration, capturing new customers, and capitalizing on emerging opportunities.

Type Insights

Distal subungual onychomycosis (DSO) segment held the largest share of 40.4% of the market in 2023. The large market share is attributed to the increasing prevalence and number of generic approvals by FDA to meet the rising demands. In addition, rising number of pipeline products to meet the heightened demands of effective drugs. For instance, in March 2020, NovaBiotics Ltd., a UK-based, clinical-stage biotechnology company, presented new clinical data on Novexatin's safety and efficacy. The developed NP213 (Novexatin), is a new antifungal peptide to treat patients with severe DSO. In Feb 2021, in Japan and Europe, NP213 has been licensed to an undisclosed company. In 2022, the firm expects to market its product with the support of its partner through direct-to-consumer healthcare channels such as retail pharmacies.

White superficial onychomycosis segment is expected to grow at a rapid growth rate over the forecast period. The condition only affects toenails, and the fungus colonizes the nail plate's surface, resulting in many white friable patches of the nail plate. Treatment for white superficial onychomycosis always necessitates a systemic approach.T. mentagrophytes cause superficial white onychomycosis, which is a dermatophyte infection. Strategic collaborations and product launches by mature players drive advancements in WSO treatment. In November 2021 , Moberg Pharma AB and Allderma AB forged a collaborative agreement to introduce MOB-015, a novel solution for nail fungus, to the Swedish market. This strategic partnership outlined Allderma's role in managing distribution, marketing, and sales. The shared objective of reaching a market-leading position highlights the significance of this collaboration in advancing the landscape of fungal nail infection treatments, including the specific subtype of WSO.

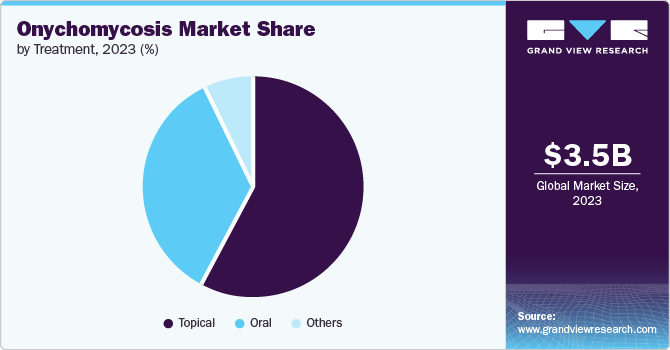

Treatment Insights

Topical segment held the largest share of 57.7% of the market in 2023. Topical treatments have fewer severe side effects, but they also have lower cure rates and require much longer treatment periods. New topical formulations are also being researched as faster-acting alternatives to already available topical therapies. However, topical formulations have low cure rates and are ineffective since they are unable to penetrate the nail plate to reach the diseased nail bed in sufficient concentrations to kill the fungus, thus debridement of the nail plate may be required before administration. For instance, in December 2021, Bausch Health Companies Inc. received the American Podiatric Medical Association (APMA) seal of approval for JUBLIA, a topical solution of efinaconazole for the treatment of onychomycosis.

The oral segment is expected to show the fastest growth over the forecast period. This growth is attributed to better treatment cure rates and shorter treatment times than topical antifungals, but they come with serious adverse effects such as hepatotoxicity and medication interactions. The most common therapy for the fungal infection is oral Terbinafine hydrochloride (Lamisil).Several generic manufacturers are launching oral therapies to address the growing onychomycosis prevalence. For instance, in June 2021, Glenmark Pharmaceuticals received the U.S. FDA approval for their bioequivalent and therapeutically equivalent, Theophylline extended-release tablets, 300 mg, and 450 mg, of Alembic Pharmaceuticals.

Regional Insights

North America onychomycosis market held the largest share of 40.9% in 2023 and is expected to maintain its dominant position, in terms of share, throughout the forecast period. This can be attributed to the rising prevalence of target disease and favorable government initiatives. North America is one of the developed regions with high healthcare expenditures. The article published by the American Academy of Family Physicians in October 2021 estimated that the prevalence of onychomycosis in North America is up to 13.8% in adults. This high prevalence rate is inducing demand for efficient therapies in disease management.

U.S. Onychomycosis Market Trends

The onychomycosis market in the U.S. held largest share in North America due to an increase in understanding about the enormous potential of onychomycosis drugs. This has driven U.S.-based firms to make considerable investments for the development of these drugs.A study published by the National Library of Medicine in September 2022 estimated the prevalence of onychomycosis. According to the study, the disease prevalence ranges from 2% to 14% in the U.S.

Europe Onychomycosis Market Trends

The Europe onychomycosis market is expected to witness significant growth over the forecast period due to high prevalence of fungal infection, increasing geriatric population, rising adoption of disease-causing lifestyle, well developed healthcare infrastructure, and emphasis on effective treatment.The prevalence of onychomycosis is high at about 23% in Europe. Moreover, the region has several developing and developed countries like the UK, Germany, and France, which is expected to support market expansion across the region.

The onychomycosis market in UK is projected to expand, driven by factors like rising investments and developments in pharmaceuticals for treating onychomycosis. According to an article by John Wiley & Sons, Inc. published in December 2021, onychomycosis prevalence in the UK is about 2.7%.

Germany Onychomycosis Market is expected to grow over the forecast period. This growth is fueled by factors like rising geriatric population. According to the press release issued by the Statistisches Bundesamt (Destatis), a Federal Statistical Office, in December 2022, the number of individuals aged 67 or over in Germany will increase by around 4 million to at least 20.0 million until the middle of the 2030s. According to an article published by Sanhelios in May 2020, around 15% to 20% of individuals living in Germany have nail fungus.

The onychomycosis market in France is significantly influenced by rapidly aging population & increasing diabetes prevalence. According to the journal published by the British Association of Dermatologists in June 2023, the prevalence of onychomycosis in France is reported to be 20% to 30% in dermatology and general practice.

Asia Pacific Onychomycosis Market Trends

Asia Pacific onychomycosis market is estimated to show the fastest growth over the forecast period. This growth is attributed to high incidence of onychomycosis. This can be attributed to various factors such as poor access to healthcare facilities, a growing geriatric population, lack of hygiene, and large urbanization. Asia Pacific has a high incidence of onychomycosis which can be attributed to the humid and warm climate, promoting growth of onychomycosis. Moreover, key market players are focusing on developing new products. For instance, in March 2021, HUYABIO International in collaboration with its joint venture Tianjin Institute of Pharmaceutical Research submitted NDA for Jublia, efinaconazole for treatment of onychomycosis.

The onychomycosis market in China is expected to significantly grow, owing to the rising collaborations among industry participants to improve access to onychomycosis therapeutics and drugs. Companies are collaborating with leading players to increase the availability of drugs and therapeutics.

Japan Onychomycosis Market is expected to grow significantly owing to the rising geriatric population coupled with the rising focus of key players on developing and commercializing novel therapeutics.According to an article published by Eisai Co., Ltd. in July 2018, onychomycosis impacts 1 in every 10 Japanese individuals, with an estimated about 11 million people affected with the condition in Japan, and the incidence increases with age.

Latin America Onychomycosis Market Trends

Latin America onychomycosis market is witnessing growth due to various factors such as the high prevalence of fungal nail infections as a result of the high prevalence of diabetes and HIV. Increasing awareness about onychomycosis and its impact on health leads to a rising demand for effective treatments.

The onychomycosis market in Brazil is expected to significantly as several players, such as companies & research institutes, are focusing on the development of novel and effective therapeutics. These players undertake various initiatives, including R&D in onychomycosis treatments, to increase efficacy & safety and ultimately strengthen their national market position.

Middle East and Africa Onychomycosis Market Trends

MEA onychomycosis market depicts a significant growth opportunity owing to the diabetes epidemic. According to The Institute for Health Metrics and Evaluation article published in June 2023, the global diabetes epidemic impacts over half a billion people and is projected to double to 1.3 billion in the next 30 years.

The onychomycosis market in Saudi Arabia is expected to grow, owing to the rising prevalence of fungal infections, especially dermatophytosis and onychomycosis. Dermatological issues significantly impact diabetes patients, with fungal infections, especially tinea pedis, being a prevalent concern. According to an article published in December 2023 in Cureus, which is owned by Springer Nature Group, the risk of complications is heightened in diabetes patients, making proactive measures crucial.

Key Onychomycosis Company Insights

Keymarket players include Bausch Health Companies Inc., Abbott, Pfizer Inc., Bayer AG, and Novartis AG. The key players are constantly focusing on introducing and changing existing technologies that enhance patient outcomes and significantly increase the effectiveness and efficiency of healthcare. For Instance, in July 2021 , Almirall S.A. entered into licensing and distribution agreement with Kaken Pharmaceutical for development and commercialization of Efinaconazole, a topical formulation.

Cipla Inc. and Moberg Pharma AB are some of the emerging players. These players are involved in collaboration & partnerships with key participants and other players to enhance their presence. Additionally, efforts are undertaken for the development of strong product portfolios.

Key Onychomycosis Companies:

The following are the leading companies in the onychomycosis market. These companies collectively hold the largest market share and dictate industry trends.

- Bausch Health Companies Inc.

- GSK plc

- Abbott

- Pfizer Inc.

- Bayer AG

- Teva Pharmaceutical Industries Ltd.

- Cipla Inc.

- Merck & Co., Inc.

- Novartis AG

- Sun Pharmaceutical Industries Ltd.

Recent Developments

-

In August 2023, Moberg Pharma AB announced that MOB-015 received national approval for the company’s home market of Sweden. This approval is for treating adult patients with mild to moderate nail fungal infections.

-

In March 2023, Moberg Pharma AB applied for marketing authorization for MOB-015, a nail fungus treatment. The company applied in Europe using the decentralized process, hoping for market approval by 2023.

-

In July 2022, Zydus Lifesciencesreceived the U.S. FDA approval to market its antifungal Efinaconazole topical solution for treating patients with onychomycosis of the toenails.

Onychomycosis Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.81 billion |

|

Revenue forecast in 2030 |

USD 4.94 billion |

|

Growth rate |

CAGR of 4.4% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, treatment, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Bausch Health Companies Inc.; GSK plc; Abbott; Pfizer Inc.; Bayer AG; Teva Pharmaceutical Industries Ltd.; Cipla Inc.; Merck & Co., Inc.; Novartis AG; Sun Pharmaceutical Industries Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

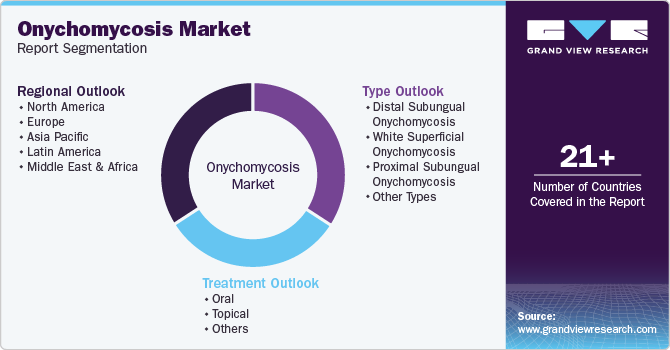

Global Onychomycosis Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the onychomycosis market based on thetype, treatment, and region

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Distal Subungual Onychomycosis

-

White Superficial Onychomycosis

-

Proximal Subungual Onychomycosis

-

Other Types

-

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Topical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018- 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global onychomycosis market size was estimated at USD 3.52 billion in 2023 and is expected to reach USD 3.81 billion in 2024.

b. The global onychomycosis market is expected to grow at a compound annual growth rate of 4.44% from 2024 to 2030 to reach USD 4.94 billion by 2030.

b. North America dominated the onychomycosis market with a share of 40.91% in 2023. This is attributable to better access to healthcare, presence of a wide target population, and high adoption of treatment.

b. Some key players operating in the onychomycosis market include Bausch Health Companies Inc., GSK plc, Abbott, Pfizer Inc., Bayer AG, Teva Pharmaceutical Industries Ltd., Cipla Inc., Merck & Co., Inc., Novartis AG, and Sun Pharmaceutical Industries Ltd.

b. Key factors that are driving the market growth include the increasing incidence of onychomycosis and chronic diseases aided by rising awareness about treatment, rising R&D pertaining to the development of novel drugs, and the growing geriatric population and diabetic population.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."