Online Survey Software Market Size, Share & Trends Analysis Report By Product (Enterprise Grade, Individual Grade), By Deployment, By Enterprise Size, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-470-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Online Survey Software Market Size & Trends

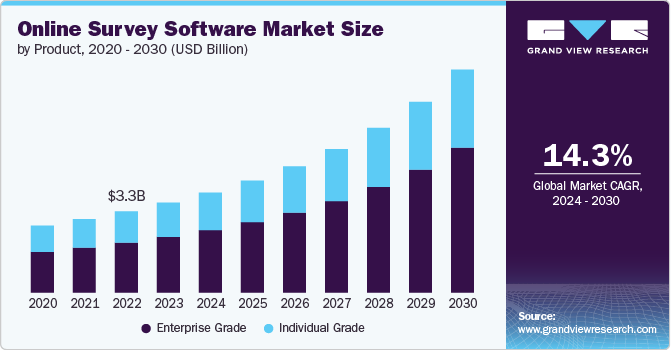

The global online survey software market size was estimated at USD 3.61 billion in 2023 and is projected to grow at a CAGR of 14.3% from 2024 to 2030. The market growth is attributed to the increasing adoption of digital tools for data collection and market research. With businesses prioritizing data-driven decision-making, online survey software provides an efficient, scalable, and cost-effective way to gather customer insights, employee feedback, and market data. This surge in demand is particularly prominent in sectors such as retail, healthcare, and education, where understanding customer and stakeholder preferences is crucial for long-term success.

The rapid globalization of businesses and the surge in e-commerce are major growth drivers for the online survey software market. As companies expand their operations across borders, they need efficient tools to gather insights from a diverse, global customer base. Online survey software offers a scalable solution that enables businesses to conduct research and collect feedback from different regions with ease. This capability is especially crucial for e-commerce platforms, which operate in highly competitive environments where understanding customer preferences, shopping behavior, and satisfaction levels is key to staying ahead of the competition.

The proliferation of mobile devices is another critical factor driving growth in the online survey software market. With billions of people worldwide now accessing the internet through smartphones and tablets, businesses need survey tools to reach end-users on these platforms. Mobile-friendly online survey software enables companies to engage with respondents wherever they are, ensuring higher response rates and broader reach. This is particularly relevant for e-commerce businesses, which rely heavily on mobile traffic and need agile, accessible solutions for gathering feedback from customers.

However, as online survey software increasingly handles vast amounts of sensitive data, including customer information, purchase history, and personal preferences, data security has become a paramount concern. The growing demand for data security improvements is a significant driver of the market, as businesses seek solutions that not only facilitate seamless data collection but also protect that data from potential breaches or misuse. With tightening data privacy regulations such as GDPR in Europe and CCPA in California, companies are prioritizing survey platforms that offer robust security features, including encryption, data anonymization, and compliance with international standards.

Product Insights

The enterprise grade segment accounted for the largest market share of 62.1% in 2023 due to the rising emphasis on data-driven decision-making across various industries. Enterprises are leveraging survey tools to gather large volumes of customer, employee, and market feedback, which is then used to optimize business strategies, improve product offerings, and enhance customer experiences. These organizations require sophisticated survey platforms capable of handling extensive data, offering customizable surveys, and integrating with other enterprise systems like customer relationship management (CRM) and business intelligence (BI) tools.

The individual grade segment is anticipated to grow at a significant CAGR over the forecast period. This segment includes individuals, freelancers, independent researchers, and small business owners who are increasingly adopting online survey tools for personal or small-scale research. One of the primary growth drivers is the accessibility and affordability of these tools. With the rise of user-friendly and cost-effective platforms, individuals without technical expertise or large budgets can now easily create and distribute surveys.

Deployment Insights

Thecloud segment accounted for the largest market share of 73.3% in 2023 due tothe rising demand for scalability and customization. Cloud-based survey software allows businesses to easily scale their operations, whether conducting small, targeted surveys or large, global campaigns. The cloud infrastructure enables survey platforms to handle large volumes of responses without compromising performance, making it an attractive solution for organizations of all sizes.

The on-premise segment is anticipated to grow at a significant CAGR over the forecast period.Companies operating in sectors with stringent regulatory requirements often prefer on-premise survey software, as it allows them to customize security protocols, manage data access internally, and ensure compliance with local laws. These compliance-related concerns are especially significant for enterprises operating in countries where data sovereignty rules mandate that data be stored locally.

Enterprise Size Insights

The SMEs segment accounted for the largest market share of 53.3% in 2023 due to the growing digitalization of business processes. With more SMEs transitioning to digital platforms, especially in sectors like retail, hospitality, and services, they increasingly use online surveys to capture real-time feedback across customer touchpoints, whether through mobile apps, websites, or email.

The large enterprises segment is anticipated to grow at the fastest CAGR over the forecast period. The demand for data-driven decision-making pushes large enterprises toward adopting sophisticated survey platforms that integrate seamlessly with other enterprise systems, such as customer relationship management (CRM) software and business intelligence (BI) tools. This integration allows for more comprehensive data analysis, providing enterprises with actionable insights that are essential for making strategic decisions.

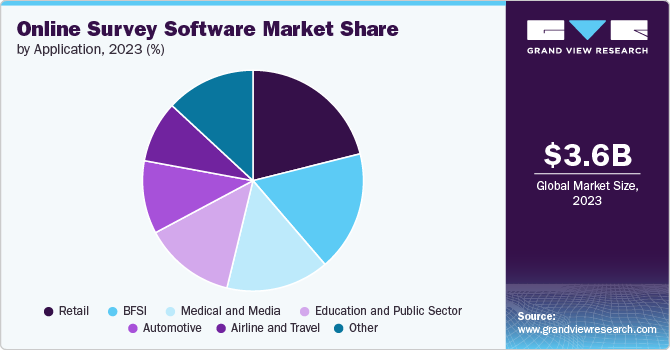

Application Insights

The retail segment accounted for the largest market share of 21.1% in 2023. As the retail industry undergoes a digital transformation, particularly with the rise of e-commerce and omnichannel strategies, survey software provides a valuable means of understanding customer behavior across both online and offline touchpoints. The shift towards mobile shopping is another significant factor driving the adoption of online survey software in the retail sector. As the increasing buying by consumers via smartphones and tablets, retailers need agile and mobile-friendly survey tools to gather feedback from on-the-go customers.

The airline and travel segment is anticipated to grow at the fastest CAGR over the forecast period. The increasing use of real-time feedback mechanisms is a significant growth driver. Airlines and travel companies are increasingly relying on real-time surveys to capture immediate customer sentiments during their journeys. This allows businesses to quickly address issues, such as in-flight discomfort or booking problems, before they escalate.Real-time data collection helps ensure that customer concerns are handled proactively, enhancing satisfaction and loyalty.

Regional Insights

The online survey software market in North America held a share of 32.0% in 2023. Artificial intelligence (AI) and automation are becoming integral features in online survey software. North American companies are adopting platforms that offer AI-driven insights, predictive analytics, and automated reporting to enhance the efficiency of data analysis. This trend is helping businesses save time by automating tasks such as sentiment analysis, response categorization, and generating real-time insights from survey data. AI integration is particularly important for large enterprises that handle vast amounts of survey responses and need advanced tools to process and make sense of this data quickly.

U.S. Online Survey Software Market Trends

The online survey software market in the U.S. is expected to grow significantly from 2024 to 2030.U.S. companies are increasingly looking for survey software that seamlessly integrates with their existing business analytics, customer relationship management (CRM), and marketing automation platforms. By connecting survey data to these systems, businesses can gain deeper insights into customer behavior, sentiment, and preferences, allowing for more personalized marketing strategies and improved customer experiences.

Europe Online Survey Software Market Trends

The online survey software market in Europe is growing significantly at a CAGR of 14.8% from 2024 to 2030.European businesses are looking for online survey software that can easily integrate with their existing systems, such as customer relationship management (CRM) platforms and data analytics tools. The ability to combine survey results with other business data is becoming increasingly important, allowing companies to create a more holistic view of customer behavior and preferences. This trend is particularly strong in retail, financial services, and hospitality sectors, where understanding customer journeys and personalizing experiences is key to maintaining competitiveness.

Asia Pacific Online Survey Software Market Trends

Asia Pacific is growing significantly at a CAGR of 16.9% from 2024 to 2030 due to high social media penetration in countries such as India, China, and other Southeast Asian countries. Therefore, online survey tools in APAC are largely integrated with popular social media and messaging platforms. This allows businesses to engage users where they spend most of their time, ensuring higher response rates and reaching younger, tech-savvy consumers. This trend is growing, especially in consumer-facing industries such as e-commerce, hospitality, and entertainment, where customer feedback is critical for improving offerings.

Key Online Survey Software Company Insights

Key players operating in the online survey software market includeQualtrics, SurveyMonkey, Zoho Corporation Pvt. Ltd., Alchemer LLC, and Medallia Inc. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2024, Alchemer launched Alchemer Pulse, a tool designed to help businesses analyze open text feedback from customers. Alchemer Pulse consolidates free-form feedback from various sources-such as surveys, reviews, ratings from the App Store and Google Play, social media, and support tickets-enabling users to identify and quantify recurring themes quickly. Leveraging large language models (LLMs) and specialized artificial intelligence, Pulse analyzes responses in real time and delivers results through streamlined dashboards that provide detailed insights.

-

In April 2024, Checkbox Technology Pty Ltd unveiled its new AI-driven intake and matter management solution. This advancement marks a significant shift in how legal teams provide their services. The new feature enhances Checkbox's ‘Legal Services Hub,’ which combines intake, matter management, AI, and workflow automation, allowing in-house legal teams to oversee all aspects of their legal work, from intake to reporting.

-

In October 2023, SurveyMonkey announced the launch of Build with AI, a new feature that leverages technology from OpenAI. This capability, part of the SurveyMonkey Genius® suite of AI-enabled tools, allows users to create surveys simply by providing a written description, streamlining and expediting the survey creation process. Now available to all SurveyMonkey users for free, Build with AI enables anyone to generate customized surveys and forms in as little as 30 seconds by typing out their desired survey or feedback objectives.

Key Online Survey Software Companies:

The following are the leading companies in the online survey software market. These companies collectively hold the largest market share and dictate industry trends.

- Alchemer LLC

- Checkbox Technology Pty Ltd

- IdWeb Srl

- LimeSurvey GmbH

- Medallia Inc.

- Nicereply

- Outside Software Inc.

- Qualtrics

- QuestionPro Survey Software

- SurveyMonkey

- WorkTango

- Zoho Corporation Pvt. Ltd.

Online Survey Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 4.01 billion |

|

Revenue forecast in 2030 |

USD 8.95 billion |

|

Growth rate |

CAGR of 14.3% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Base Year |

2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, deployment, enterprise size, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; and South Africa |

|

Key companies profiled |

Alchemer LLC; Checkbox Technology Pty Ltd; IdWeb Srl; LimeSurvey GmbH; Medallia Inc.; Nicereply; Outside Software Inc.; Qualtrics; QuestionPro Survey Software; SurveyMonkey; WorkTango; Zoho Corporation Pvt. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Online Survey Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the online survey software market report based on product, deployment, enterprise size, application, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Enterprise Grade

-

Individual Grade

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-Premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retail

-

BFSI

-

Medical & Media

-

Education & Public Sector

-

Automotive

-

Airline & Travel

-

Other

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

U.A.E

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global online survey software market is expected to grow at a compound annual growth rate of 14.3% from 2024 to 2030 to reach USD 8.95 billion by 2030.

b. The online survey software market in North America held a share of 32.0% in 2023. Artificial intelligence (AI) and automation are becoming integral features in online survey software. North American companies are adopting platforms that offer AI-driven insights, predictive analytics, and automated reporting to enhance the efficiency of data analysis.

b. Some key players operating in the online survey software market include Alchemer LLC, Checkbox Technology Pty Ltd, IdWeb Srl, LimeSurvey GmbH, Medallia Inc., Nicereply, Outside Software Inc., Qualtrics, QuestionPro Survey Software, SurveyMonkey, WorkTango, Zoho Corporation Pvt. Ltd.

b. The growth of the market can be attributed to the increasing adoption of digital tools for data collection and market research. With businesses prioritizing data-driven decision-making, online survey software provides an efficient, scalable, and cost-effective way to gather customer insights, employee feedback, and market data.

b. The global online survey software market size was estimated at USD 3.61 billion in 2023 and is expected to reach USD 4.01 billion in 2024.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."