- Home

- »

- Communication Services

- »

-

Online Grocery Market Size & Share, Industry Report, 2033GVR Report cover

![Online Grocery Market Size, Share & Trends Report]()

Online Grocery Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type (Fresh Produce, Breakfast & Dairy, Snacks & Beverages, Staples & Cooking Essentials), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-184-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Online Grocery Market Summary

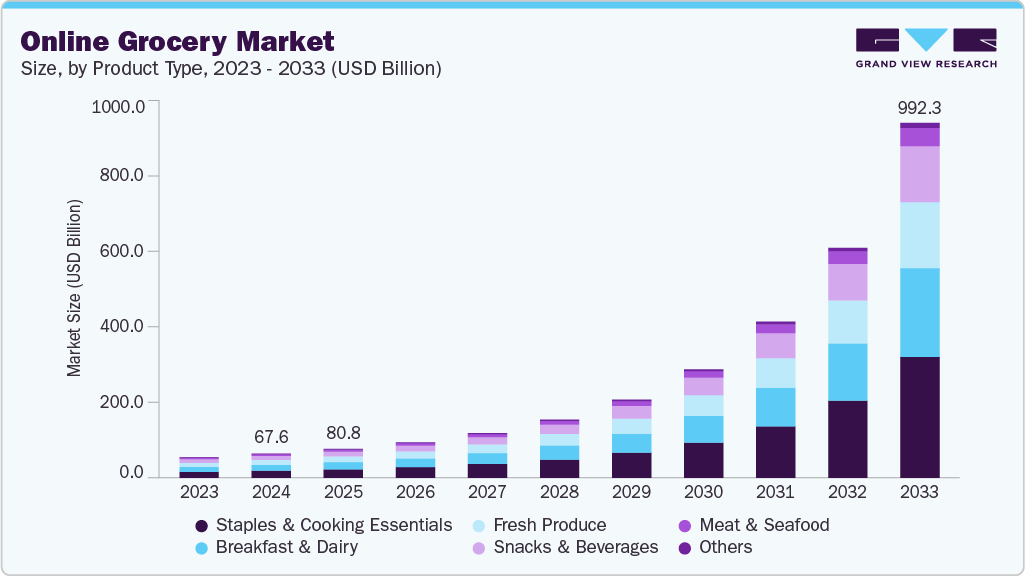

The global online grocery market size was estimated at USD 67.64 billion in 2024 and is projected to reach USD 992.35 billion by 2033, growing at a CAGR of 36.8% from 2025 to 2033. The increasing penetration of smartphones and internet connectivity across urban and semi-urban regions is the key growth driver.

Key Market Trends & Insights

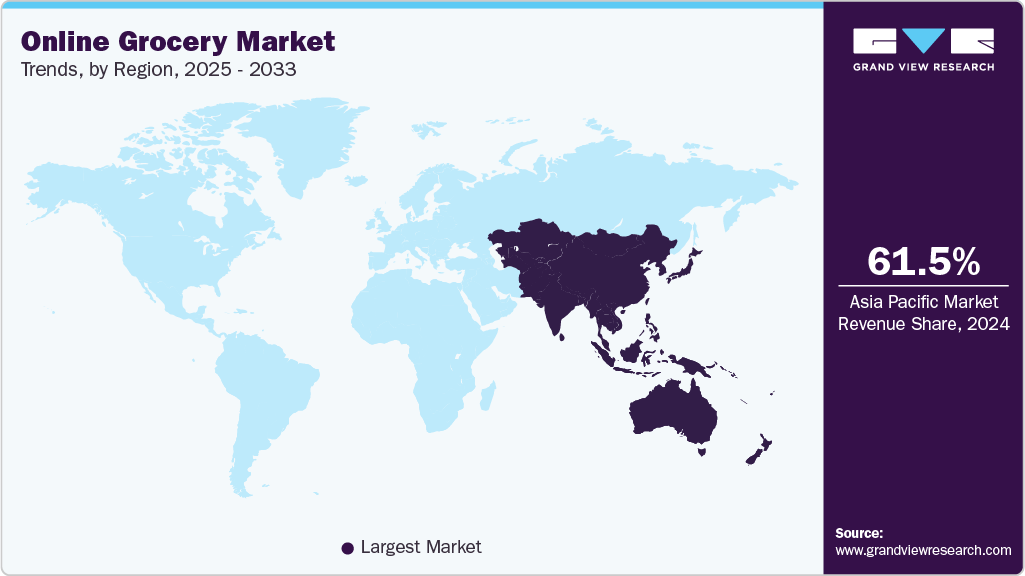

- The Asia Pacific online grocery dominated the global market with the largest revenue share of 61.5% in 2024.

- The online grocery industry in the U.S. is expected to grow significantly from 2025 to 2033.

- By product type, the staples & cooking essentials segment held the largest revenue share of 29.1% in 2024, and is expected to grow significantly over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 67.64 Billion

- 2033 Projected Market Size: USD 992.35 Billion

- CAGR (2025-2033): 36.8%

- Asia Pacific: Largest market in 2024

With growing digital literacy and the widespread adoption of mobile apps, consumers are shifting toward more convenient shopping formats. Enhanced user interfaces, real-time inventory visibility, and secure payment gateways are facilitating a seamless grocery shopping experience, accelerating the digital transition in daily consumer behavior. The rising demand for convenience and time-saving solutions among working professionals and busy households is propelling the growth of online grocery platforms. The ability to avoid crowded stores, long checkout queues, and travel time, especially in metro cities, has driven consumers to opt for doorstep delivery of groceries. Features such as flexible delivery slots, quick reordering, and subscription models have further enhanced consumer engagement and retention.

For instance, in August 2024, Amazon.com, Inc. introduced a new annual grocery delivery subscription plan exclusively for Prime members and expanded its discounted subscription offering to include all Prime Access members. This move follows the positive response to the grocery subscription service, which launched in April. The plan provides unlimited grocery deliveries for orders over USD 35 from Amazon Fresh, Whole Foods Market, and a variety of local and specialty grocery retailers available on Amazon.com.

Changing lifestyle and consumption patterns, especially post-pandemic, have significantly influenced the online grocery sector. The growing awareness of hygiene and safety, preference for contactless transactions, and the habit formation of online ordering during COVID-19 have led to sustained usage. Consumers have also become more inclined to purchase fresh produce, dairy, organic, and health-focused items through online channels due to greater trust in quality assurance and traceability.

Product Type Insights

The staples & cooking essentials segment dominated the online grocery industry and accounted for a revenue share of 29.1% in 2024, due to the widening product assortment and regional customization. Online grocery platforms are expanding their catalog to include regional varieties of pulses, grains, and flours tailored to local cuisines and dietary preferences. This depth of assortment, which is often difficult to find in physical retail, appeals to a diverse customer base across geographies. Moreover, the availability of organic, gluten-free, and health-focused staples supports the growing demand from health-conscious and niche consumer segments.

The breakfast & dairy segment is anticipated to grow at a significant CAGR during the forecast period, due to the rising health awareness and the shift toward protein-rich diets. Consumers are increasingly opting for low-fat dairy, Greek yogurt, plant-based milk alternatives, and fortified breakfast items, which are often more easily accessible online than in physical stores. Online platforms also cater to a broader set of dietary preferences, such as vegan, lactose-free, or organic, offering product variety and personalization that enhances consumer satisfaction.

Regional Insights

The North America online grocery market held a significant share of the global market in 2024, driven by high internet penetration, widespread smartphone usage, and the integration of advanced technologies such as AI, machine learning, and voice assistants for personalized shopping experiences. Increasing investments in last-mile delivery infrastructure, particularly by major retailers and logistics providers, have enhanced delivery speed and reliability. Moreover, growing consumer preference for contactless transactions, especially among Gen Z and millennial demographics, is fostering digital grocery adoption.

U.S. Online Grocery Market Trends

The online grocery industry in the U.S. is expected to grow at a significant CAGR from 2025 to 2033, due to the rapid expansion of omnichannel retail strategies by traditional supermarkets and big-box retailers like Walmart and Kroger is significantly boosting online grocery sales. The availability of same-day and curbside pickup options, combined with loyalty rewards and digital coupons, is encouraging repeat purchases. Additionally, a rise in health-conscious eating habits and demand for specialty grocery items, including organic and non-GMO products, is prompting consumers to use online platforms for wider assortment access.

Europe Online Grocery Market Trends

The online grocery industry in Europe is anticipated to register considerable growth from 2025 to 2033, driven by strong regulatory support for digital transformation, increased urbanization, and sustainability-conscious consumer behavior. Eco-friendly packaging, carbon-neutral delivery options, and emphasis on traceability of fresh food items are resonating with environmentally aware shoppers. Moreover, the expansion of dark stores and micro-fulfillment centers is enabling faster deliveries and efficient inventory management, particularly in high-density urban areas.

The UK online grocery market is expected to grow rapidly in the coming years. Subscription-based delivery passes, personalized shopping lists, and integration with smart home devices are making online grocery shopping habitual for a large customer base. Moreover, the growing popularity of meal kits and pre-portioned breakfast or dinner bundles is encouraging online ordering for both convenience and meal planning.

The online grocery market in Germany held a substantial revenue share in 2024, due to the rise of discount-focused e-grocery platforms and an increased demand for locally sourced food products. Consumers are showing greater trust in regional and organic brands available online, especially in the dairy, bakery, and produce segments. In addition, demographic shifts, such as aging populations and dual-income households, are pushing demand for convenient home delivery services and bulk purchasing of cooking essentials.

Asia Pacific Online Grocery Market Trends

Asia Pacific dominated the global online grocery industry with the largest revenue share of 61.5% in 2024, due to a tech-savvy population, rapidly expanding urban middle class, and mobile-first digital ecosystem. Aggressive promotional strategies, live commerce integration, and gamified shopping experiences on mobile apps are capturing user engagement. In addition, local e-commerce giants and startups are investing heavily in warehouse automation, AI-powered supply chains, and hyperlocal delivery models to cater to diverse and densely populated markets.

The Japan online grocery market is expected to grow rapidly in the coming years, driven by the need to cater to its aging population, who prefer home delivery of daily essentials due to mobility constraints. The integration of robotics and automation in fulfillment centers, combined with precision-based logistics, ensures timely and accurate deliveries. Cultural emphasis on food freshness and safety has also led to increased online orders from trusted platforms that provide detailed product sourcing and freshness guarantees.

The online grocery market in China held a substantial revenue share in 2024, due to the innovation-driven online grocery industry, with platforms offering ultra-fast deliveries supported by an advanced ecosystem of AI, IoT, and big data analytics. Integration with social commerce, livestream selling, and in-app grocery mini-programs through platforms such as WeChat and Douyin enhances consumer engagement. Moreover, community group buying is also a significant growth driver. This model leverages neighborhood-based WeChat groups or community leaders to aggregate orders from nearby households, enabling bulk discounts and low-cost last-mile delivery.

Key Online Grocery Company Insights

Key players operating in the online grocery industry are Walmart; Amazon.com, Inc.; Instacart; JD.com, Inc.; Alibaba.com; and The Kroger Co. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In June 2025, Supermarket Grocery Supplies Pvt. Ltd. (BigBasket) announced to launch of 10-minute food delivery services across India, aiming to strengthen its presence in the rapidly expanding quick-commerce sector. The company plans to rely on dark stores, localized fulfillment centers, to support the speedy deliveries.

-

In May 2025, Instacart announced the acquisition of Wynshop, a U.S.-based e-commerce solutions provider serving grocers and retailers such as Wakefern and Pattison, along with others across North America and internationally. This strategic move enhances Instacart's existing partnerships and underscores its commitment to delivering advanced tools and technologies that support retailer growth. By combining the strengths and industry relationships of both companies, Instacart aims to improve its enterprise offerings, helping retailers elevate their digital platforms and deepen customer engagement.

-

In May 2025, Alibaba launched a new fast-delivery service on its Taobao platform, aiming to enhance its local logistics capabilities. The upgraded service spans categories such as food, groceries, electronics, and clothing, and leverages the infrastructure of Alibaba’s food delivery arm, Ele.me, to fulfill orders more efficiently. This move marks a significant step in improving the speed and convenience of Taobao’s delivery offerings.

Key Online Grocery Companies:

The following are the leading companies in the online grocery market. These companies collectively hold the largest market share and dictate industry trends.

- AEON Next Co., Ltd.

- Alibaba.com.

- Amazon.com, Inc.

- Blink Commerce Private Limited

- Instacart

- JD.com, Inc.

- Nature’s Basket Limited.

- Ebates Performance Marketing Inc., d/b/a Rakuten Rewards

- Reliance Industries Limited (JioMart)

- Supermarket Grocery Supplies Pvt. Ltd.

- Target Brands, Inc.

- Tesco.com

- The Kroger Co.

- Walmart

Online Grocery Market Report Scope

Report Attribute

Details

Market size in 2025

USD 80.83 billion

Revenue forecast in 2033

USD 992.35 billion

Growth rate

CAGR of 36.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report enterprise size

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

AEON Next Co., Ltd.; Alibaba.com; Amazon.com, Inc.;

Blink Commerce Private Limited; Instacart; JD.com, Inc.; Nature’s Basket Limited; Ebates Performance Marketing Inc., d/b/a Rakuten Rewards; Reliance Industries Limited (JioMart); Supermarket Grocery Supplies Pvt. Ltd.; Target Brands, Inc.; Tesco.com; The Kroger Co.; Walmart

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Online Grocery Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the online grocery market report based on product type and region:

-

Product Type Outlook (Revenue, USD Billion, 2021 - 2033)

-

Fresh Produce

-

Breakfast & Dairy

-

Snacks & Beverages

-

Meat & Seafood

-

Staples & Cooking Essentials

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global online grocery market is expected to grow at a compound annual growth rate of 36.8% from 2025 to 2033 to reach USD 992.35 billion by 2033.

b. The staples and cooking essentials segment dominated the market and accounted for a revenue share of 29.1% in 2024 due to the widening product assortment and regional customization. Online grocery platforms are expanding their catalog to include regional varieties of pulses, grains, and flours tailored to local cuisines and dietary preferences.

b. Some key players operating in the online grocery market include AEON Next Co., Ltd., Alibaba.com, Amazon.com, Inc. Blink Commerce Private Limited, Instacart, JD.com, Inc., Natures Basket Limited, Ebates Performance Marketing Inc.d/b/a Rakuten Rewards, Reliance Industries Limited (JioMart), Supermarket Grocery Supplies Pvt. Ltd., Target Brands, Inc., Tesco.com, The Kroger Co., Walmart

b. Key factors that are driving the online grocery market growth include the increasing penetration of smartphones and internet connectivity across urban and semi-urban regions. With growing digital literacy and the widespread adoption of mobile apps, consumers are shifting toward more convenient shopping formats.

b. The global online grocery market size was estimated at USD 67.64 billion in 2024 and is expected to reach USD 80.83 billion by 2025.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.