Online Casino Market Size, Share & Trends Analysis Report By Type (iSlots, iTable, iDealer), By Device (Desktop, Mobile), By Region (North America, Asia Pacific, Middle East & Africa, Latin America), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-478-3

- Number of Report Pages: 160

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Online Casino Market Size & Trends

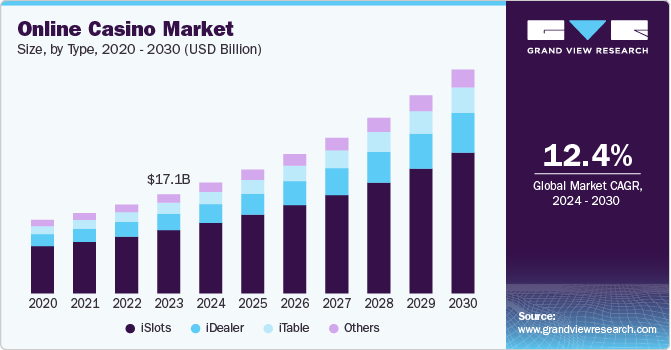

The global online casino market size was valued at USD 17.13 billion in 2023 and is expected to grow at a CAGR of 12.4% from 2024 to 2030. The market growth is driven by technological advancements, regulatory changes, and evolving consumer preferences. The widespread adoption of mobile technology has made it easier for players to access online casinos from anywhere, increasing the convenience and appeal of online gambling. Moreover, the legalization and regulation of online gambling in various regions have created new opportunities for market expansion.

The market growth is being further propelled by the development of advanced gaming platforms and software that have enhanced the user experience, making online casinos more engaging and enjoyable. These technological advancements offer players a more immersive experience with high-quality graphics, realistic animations, and innovative gameplay features. Additionally, the integration of social features and multiplayer options has created a sense of community and interaction among players. Furthermore, the continuous development of new games and the ability to access a wide variety of casino games from a single platform have further fueled the growth of the online casino market.

The growing popularity of mobile devices and the availability of mobile casino games have further fueled market growth. The widespread adoption of smartphones and tablets, coupled with the development of advanced mobile technology, has made it convenient for players to access and enjoy online casino games. The availability of a wide range of mobile casino games, including slots, table games, and live dealer games, has further contributed to the market expansion.

The market is poised for growth in the coming years with the introduction of innovative features such as live dealer games and virtual reality casinos that have created new opportunities to attract and retain customers. Virtual reality casinos, on the other hand, provide a fully immersive experience, transporting players to a virtual casino environment. For instance, in March 2024, Bally’s Corporation launched virtual casino games in Rhode Island. The iGaming app allows players to communicate with dealers through a chat function. These developments are attracting a wider range of players, contributing to the overall expansion of the market.

Type Insights

The iSlots segment captured the largest revenue share of over 63% in 2023. The unique combination of traditional slot gameplay and interactive storylines is driving the demand for iSlots, driving segmental growth. Unlike standard slot machines, iSlots provide a more engaging experience by integrating skill-based elements and narratives that evolve as the game progresses. This interactive feature appeals to a broader audience, particularly younger players who enjoy immersive and dynamic gaming experiences. Furthermore, the rise of mobile gaming has made iSlots more accessible, allowing players to enjoy these games and further contributing to segmental growth.

The iDealer segment is expected to record a significant CAGR of nearly 13% from 2024 to 2030. The rising demand for iDealer due to its ability to provide a more interactive and authentic gaming experience is favoring the segment growth. iDealer technology, which involves live human dealers streaming games in real time, appeals to players seeking a more engaging and immersive experience. This segment is further boosted by advancements in video streaming and mobile technologies, allowing users to participate in live dealer games from anywhere. Additionally, the growing demand for personalized gaming experiences and real-time interaction is accelerating the segment growth further.

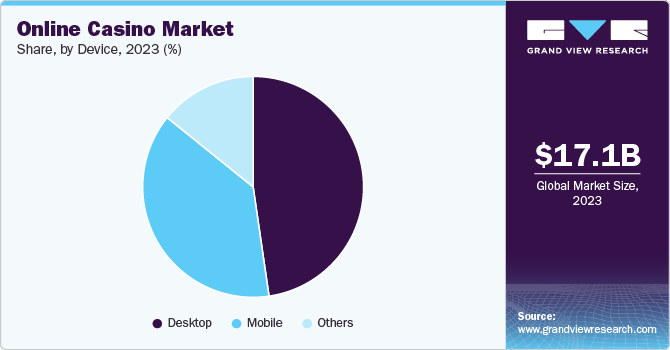

Device Insights

The desktop segment accounted for the largest revenue share in 2023. Desktop platforms offer a more immersive gaming experience with larger screens, better graphics, and smoother gameplay compared to mobile devices. Moreover, desktops provide better functionality for players engaging in complex games such as live dealer casinos, poker, or high-stakes slots, which require higher processing power and screen space. Several users also prefer desktops for secure financial transactions and for running multiple games simultaneously. Despite the rise of mobile gaming, the desktop remains a preferred choice for serious online casino players, which underlines the dominance of the segment.

The mobile segment is estimated to record the highest CAGR from 2024 to 2030, owing to the widespread adoption of smartphones and mobile internet access. Players increasingly prefer the convenience of mobile gaming, which allows them to access casino games anytime and anywhere. Moreover, the development of mobile-optimized apps and responsive websites with seamless user interfaces has enhanced the overall gaming experience. Innovations in mobile payment systems and the advent of digital wallets have also simplified transactions, offering convenience and flexibility, which makes mobile gaming a dominant driver in market growth.

Regional Insights

North America online casino market accounted for the largest revenue share of around 40% in 2023. The growth is attributed to the increasing legalization of online gambling in various U.S. states, such as New Jersey, which has created a robust regulatory environment that supports market expansion. Furthermore, technological advancements, including mobile gaming platforms and fintech innovations such as digital wallets, have enhanced the user experience, driving more players to online casinos. The integration of sports betting with online casinos, particularly during major sports seasons, has also positively influenced the market outlook.

U.S. Online Casino Market Trends

The online casino market in the U.S. is expected to record significant growth of over 11% in the coming years, owing to the increasing legalization of online gambling in states including New Jersey, Pennsylvania, and Michigan. The convenience of mobile gaming, combined with advancements in digital payment methods and enhanced user experiences through better technology, has attracted a larger audience. Moreover, the integration of online sports betting with casino platforms is further driving the market growth.

Asia Pacific Online Casino Market Trends

The online casino market in the Asia Pacific is expected to record the fastest growth rate of over 13% from 2024 to 2030 on account of various factors, including increasing internet penetration, growing digital payment infrastructure, and widespread smartphone adoption, which are enabling more people to access online casino platforms. Moreover, the rise of fintech solutions such as digital wallets and cryptocurrencies has made transactions faster and more secure. The region's growing middle class, coupled with changing consumer perception toward online gaming, is further contributing to the market growth.

Europe Online Casino Market Trends

The online casino market in Europe accounted for a notable revenue share of over 19% in 2023, owing to the widespread adoption of smartphones and high-speed internet, making online gambling accessible to a broader audience. Moreover, regulatory frameworks in countries such as the U.K. and Spain have established clear guidelines, allowing online casinos to operate legally and with consumer protection, boosting trust in the market. In addition, innovations such as live dealer games and advancements in payment methods, including cryptocurrencies, are enhancing user experiences and driving the growth of the regional online casino market.

Key Online Casino Company Insights

Some of the key players operating in the online casino market are Bet 365 Group Ltd., Evolve Plc, Betsson AB, and Entain Plc, among others.

-

Bet 365 Group Ltd. offers services in online gambling and on an online betting platform, which deals with American football, Australian rules, baseball, basketball, bowls, boxing, cricket, cycling, etc., and live casino games such as roulette, blackjack, baccarat, etc.

-

Evoke Plc, formerly 888 Holdings Plc, is an online gaming operator that offers virtual online gaming and entertainment solutions. The company also provides a range of online casinos, poker, skill games, and social & mobile gaming.

-

Entain Plc is primarily engaged in the betting and gaming industry with its main activities including online and retail betting and gaming operations. The company provides a variety of products and experiences, leveraging its data insights and technology to create unique offerings for its customers. The company operates several well-known brands, including Coral, bwin, partypoker, PartyCasino, etc.

-

Betsson AB develops casinos, poker, sports, bingo, sports betting, and scratch card games. The company is engaged in the operational gaming business, such as gaming sites, platforms, technology, and product development. It operates in various verticals such as sports, Casinos, sportsbooks, and others through its 20 brands: betsafe, betsson, casinoeuro, casino winner, and casino.dk, europebet, etc.

Key Online Casino Companies:

The following are the leading companies in the online casino market. These companies collectively hold the largest market share and dictate industry trends.

- evoke plc

- Bally’s Corporation

- Bet 365 Group Ltd.

- Betsson AB

- Entain Plc

- Firekeepers

- Flutter Entertainment Plc

- Churchill Downs Inc.

- Kindred Group

- Ladbrokes Coral Group Plc

- Sky Betting & Gambling

- Sportech Plc

- The Stars Group Plc

- William Hills Limited

Recent Developments

-

In September 2024, Flutter Entertainment Plc acquired Snaitech S.p.A., an omni-channel operator in Italy, from a sub-division of Playtech plc, for an enterprise value of USD 2.6 billion. This strategic initiative comes as a part of the company’s aim to strengthen its position in international markets.

-

In June 2024, A subsidiary of Betsson AB obtained its local licenses for the newly regulated market of Peru for online casino and sports betting. Apart from the new licenses, the company also holds licenses in two other markets in the region, Argentina and Colombia.

-

In March 2024, Bally’s Corporation launched iGaming, an online casino experience in Rhode Island, which will allow customers to play table and slot games anywhere in the state, on a desktop or on an iOS mobile app. The online gaming product launch follows a four-day technical trial which involved selected guests who were invited to experience the new online gaming program.

Online Casino Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 19.13 billion |

|

Revenue forecast in 2030 |

USD 38.66 billion |

|

Growth Rate |

CAGR of 12.4% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, device, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

888 Holdings Plc; Bally’s Corporation; Bet 365 Group Ltd.; Betsson AB; Entain Plc; Firekeepers; Flutter Entertainment Plc; Churchill Downs Inc.; Kindred Group; Ladbrokes Coral Group Plc; Sky Betting & Gambling; Sportech Plc; The Stars Group Plc; William Hills Limited |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Online Casino Market Report Segmentation

This report forecasts and estimates revenue growth at the global, regional, and country levels and analyzes the latest market trends and opportunities in each one of the sub-segments from 2018 to 2030. For this study, Grand View Research has further segmented the global online casino market report based on type, device, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

iSlots

-

iTable

-

iDealer

-

Others

-

-

Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Desktop

-

Mobile

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global online casino market size was estimated at USD 17.13 billion in 2023 and is expected to reach USD 19.13 billion in 2024.

b. The global online casino market is expected to grow at a compound annual growth rate of 12.4% from 2024 to 2030 to reach USD 38.66 billion by 2030.

b. The iSlots segment captured the largest revenue share of over 63% within the online casino market in 2023. The unique combination of traditional slot gameplay and interactive storylines is driving the demand for iSlots, driving the segmental growth. Unlike standard slot machines, iSlots provide a more engaging experience by integrating skill-based elements and narratives that evolve as the game progresses. This interactive feature appeals to a broader audience, particularly younger players who enjoy immersive and dynamic gaming experiences.

b. Some of the key players operating in the online casino market include 888 Holdings Plc; Bally’s Corporation; Bet 365 Group Ltd.; Betsson AB; Entain Plc; Firekeepers; Flutter Entertainment Plc; Churchill Downs Inc.; Kindred Group; Ladbrokes Coral Group Plc; Sky Betting & Gambling; Sportech Plc; The Stars Group Plc; and William Hills Limited.

b. The market growth is driven by factors, including technological advancements, regulatory changes, and evolving consumer preferences. The widespread adoption of mobile technology has made it easier for players to access online casinos from anywhere, increasing the convenience and appeal of online gambling. Moreover, the legalization and regulation of online gambling in various regions have created new opportunities for market expansion.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."