- Home

- »

- Automotive & Transportation

- »

-

On-demand Warehousing Market Size & Share Report, 2030GVR Report cover

![On-demand Warehousing Market Size, Share & Trends Report]()

On-demand Warehousing Market (2024 - 2030) Size, Share & Trends Analysis Report By Organization Size, By Industry Vertical (Manufacturing, Retail & E-commerce, Healthcare, Food & Beverage, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-439-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

On-demand Warehousing Market Summary

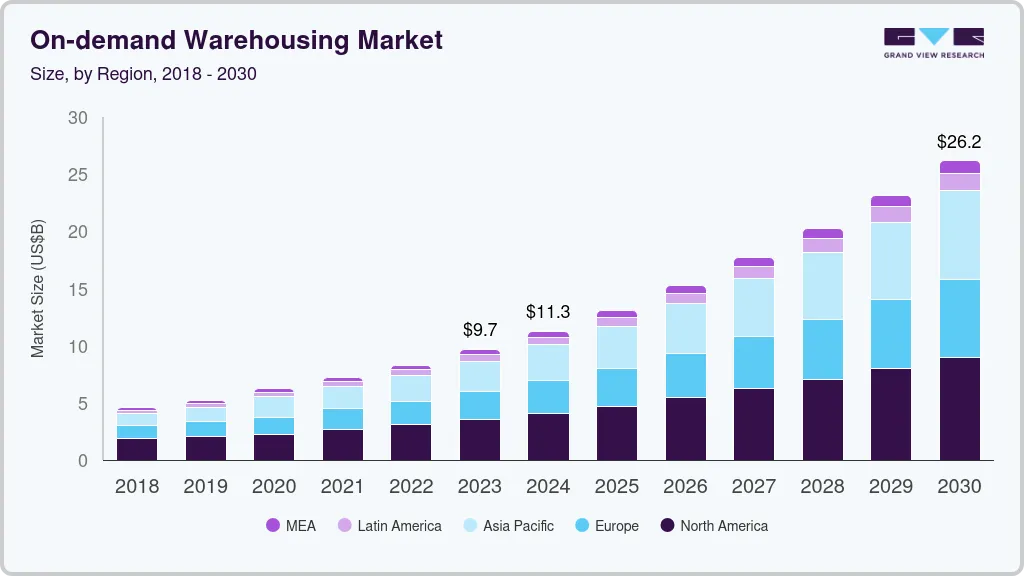

The global on-demand warehousing market size was estimated at USD 9,668.1 million in 2023 and is projected to reach USD 26,186.7 million by 2030, growing at a CAGR of 15.3% from 2024 to 2030. On-demand warehousing, also known as flexible or pop-up warehousing, is a logistics model that offers storage and fulfillment locations on a short-term, as-needed basis.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, U.S. is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, size small and medium businesses (smbs) accounted for a revenue of USD 9,668.1 million in 2023.

- Size Small and Medium Businesses (SMBs) is the most lucrative grade segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 9,668.1 million

- 2030 Projected Market Size: USD 26,186.7 million

- CAGR (2024-2030): 15.3%

- North America: Largest market in 2023

Unlike traditional warehousing, which typically involves long-term contracts and fixed capacities, on-demand warehousing offers flexibility in terms of space, duration, and locations provided.

This model leverages digital platforms that connect warehouse operators with businesses in need of storage and fulfillment locations. The locations provided in these warehouses can range from basic storage to more complex locations such as order fulfillment, inventory management, and transportation logistics. The market caters to a wide range of industries, including e-commerce, retail, manufacturing, and even healthcare, where companies face fluctuating demand and need storage solutions that can scale rapidly. It is especially valuable for small and medium-sized enterprises (SMEs) that may not have the resources to invest in their own warehousing facilities or those that face seasonal peaks in demand.

The on-demand warehousing market is experiencing rapid growth, driven by several key trends. E-commerce expansion has fueled the demand for flexible storage solutions, especially since the COVID-19 pandemic. Technology advancements, such as AI and IoT, are transforming the industry. Digital platforms streamline operations, improve efficiency, and offer real-time insights. Sustainability is also a growing concern. On-demand warehousing can reduce waste and optimize transportation, contributing to a greener supply chain. Businesses are increasingly seeking providers that prioritize sustainability and adopt eco-friendly practices.

On-demand warehousing operates within a complex regulatory landscape. Safety, labor, environmental, and data protection regulations vary by region. Warehouse operators must comply with occupational safety and health standards, especially in sensitive industries like pharmaceuticals and food. Data protection is crucial, particularly with digital platforms. Regulations like GDPR mandate secure data handling. Environmental regulations are also gaining importance. Warehousing providers must balance compliance with these regulations while maintaining operational efficiency and sustainability. Adhering to regulations can be challenging but also provides opportunities to differentiate and build trust.

The market growth is driven by several factors. Demand volatility, especially in retail and e-commerce, requires flexible solutions. On-demand warehousing offers scalability and adaptability. The gig economy and asset-light models encourage outsourcing non-core functions. Digital platforms simplify the process of finding warehousing space. Globalization and international trade necessitate flexible solutions. On-demand warehousing allows businesses to expand into new markets quickly and cost-effectively.

Opportunities in the on-demand warehousing market are abundant, particularly as technology continues to evolve. The integration of AI and machine learning in warehousing operations offers the potential for significant improvements in efficiency and cost-effectiveness. These technologies can be used to optimize inventory management, predict demand, and enhance the overall customer experience. Additionally, as sustainability becomes increasingly important, there is an opportunity for on-demand warehousing providers to differentiate themselves by offering green warehousing solutions that meet the environmental goals of their clients. Moreover, the growing trend toward omnichannel retailing presents a significant growth opportunities. On-demand warehousing offers the flexibility needed to manage these operations efficiently, making it an attractive option for retailers looking to enhance their omnichannel capabilities.

Organization Size Insights

The large businesses segment dominated the market in 2023 and accounted for more than 66% share of global revenue. Large businesses, characterized by their substantial size, complex supply chains, and significant inventory volumes, are a dominant force in the on-demand warehousing market. These organizations often have specific storage needs, such as temperature-controlled facilities, hazardous materials handling, and advanced inventory management systems. On-demand warehousing provides them with the flexibility to scale their storage capacity to meet seasonal fluctuations or unexpected demand surges. Additionally, large businesses can benefit from the cost-effectiveness of on-demand warehousing compared to long-term leases for dedicated warehouses. The ability to optimize inventory levels and reduce warehousing costs is a major driver for large businesses to adopt on-demand warehousing solutions.

The small and medium businesses (SMBs) segment is projected to grow at a faster CAGR during the forecast period 2024 to 2030. SMBs often face challenges with limited storage space, fluctuating inventory levels, and high real estate costs. On-demand warehousing offers them a cost-effective and scalable solution to meet their storage needs without the long-term commitment of a traditional lease. Moreover, SMBs can benefit from the value-added services provided by on-demand warehousing providers, such as pick and pack, inventory management, and kitting. As SMBs continue to expand their operations and explore new markets, the demand for on-demand warehousing is expected to increase significantly.

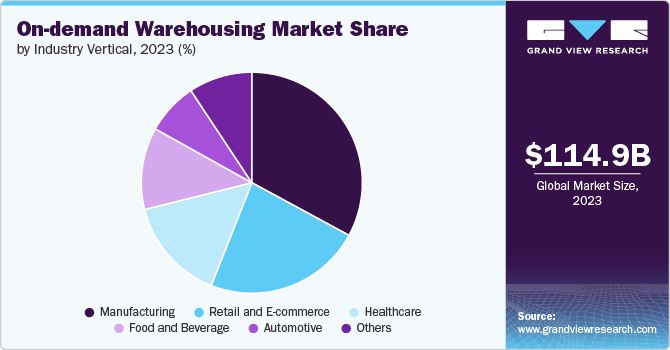

Industry Vertical Insights

The manufacturing segment dominated the market in 2023, reflecting the industry's need for extensive storage solutions to manage raw materials, work-in-progress goods, and finished products. Manufacturing companies rely heavily on warehousing to ensure the smooth flow of goods through their supply chains, from production to distribution. The dominance of this segment is further supported by the scale and complexity of manufacturing operations, which often involve large volumes of goods that require specialized storage conditions and handling. Additionally, the manufacturing industry's focus on cost optimization and efficiency has driven the adoption of on-demand warehousing solutions that offer flexibility and scalability without the need for long-term commitments or significant capital investment.

The retail and e-commerce segment is projected to grow at the fastest CAGR from 2024 to 2030, driven by the rapid growth of online shopping and the increasing importance of omnichannel retail strategies. Retailers and e-commerce companies face unique challenges related to inventory management, order fulfillment, and rapid delivery, making on-demand warehousing an attractive option for managing these complexities. The flexibility offered by on-demand warehousing allows retailers to scale their operations in response to seasonal peaks and fluctuating consumer demand, without the burden of maintaining excess warehouse space. Additionally, the rise in same-day and next-day delivery expectations has further accelerated the adoption of on-demand warehousing solutions, as businesses seek to position inventory closer to customers to reduce delivery times.

Regional Insights

Asia Pacific dominated the on-demand warehousing market in 2023 and accounted for a 41.4% share of the global revenue. The market's dominance is driven by rapid economic growth, urbanization, and the expansion of e-commerce. Countries like China, India, and Japan are leading this growth, supported by the increasing consumer demand for goods and the need for efficient logistics solutions. The region's dominance is also fueled by its position as a global manufacturing hub, necessitating extensive warehousing capabilities to manage the flow of goods in and out of production facilities. The rise of middle-class consumers, particularly in emerging markets, has further accelerated demand for fast and reliable delivery locations, making on-demand warehousing a critical component of supply chain strategies. Additionally, the adoption of digital technologies, such as AI and IoT, in logistics operations is enhancing the efficiency and scalability of on-demand warehousing in the region.

The on-demand warehousing market in India is expected to grow at a significant CAGR from 2024 to 2030, driven by the country's booming e-commerce industry, expanding retail sector, and rapidly growing consumer base. The Indian market is characterized by a young and tech-savvy population, increasing internet penetration, and rising disposable incomes, all of which contribute to the surge in online shopping and the subsequent need for efficient warehousing solutions. Additionally, the Indian government's push for infrastructure development, including initiatives like "Make in India" and the improvement of logistics networks, is further propelling the growth of on-demand warehousing. The complexity of India's logistics landscape, with its vast geography and diverse market conditions, has also led to increased demand for flexible and scalable warehousing options that can adapt to regional variations in demand.

North America On-demand Warehousing Market Trends

The on-demand warehousing market in North America is expected to grow at a significant CAGR from 2024 to 2030, driven by the region's advanced logistics infrastructure, high consumer expectations for fast delivery, and the dominance of e-commerce. The United States, in particular, plays a central role in this market, with companies increasingly turning to on-demand warehousing solutions to manage the complexities of modern supply chains. The proliferation of same-day and next-day delivery locations has heightened the need for flexible warehousing solutions that can support rapid order fulfillment and distribution. Additionally, the region's strong focus on innovation and technology adoption is enhancing the efficiency and scalability of on-demand warehousing, making it an attractive option for businesses seeking to optimize their logistics operations. The growing emphasis on sustainability and the shift towards more environmentally friendly logistics practices are also contributing to the market's growth, as companies seek to reduce their carbon footprint through smarter, more efficient warehousing solutions.

U.S. On-demand Warehousing Market Trends

The on-demand warehousing market in the U.S. is expected to grow at the fastest CAGR from 2024 to 2030, driven by the country's large and diverse economy, advanced logistics networks, and the rapid expansion of e-commerce. The U.S. market is characterized by high consumer expectations for quick and reliable delivery, leading to increased demand for flexible warehousing solutions that can support fast order fulfillment and distribution. The rise of omnichannel retailing has also contributed to the growth of on-demand warehousing, as retailers seek to manage inventory across multiple channels and ensure seamless customer experiences. The U.S. market is further supported by a strong focus on technological innovation, with companies adopting advanced technologies such as automation, AI, and data analytics to enhance the efficiency and scalability of their warehousing operations. The ongoing shift towards sustainability in the logistics sector is also driving the growth of on-demand warehousing, as companies look for ways to reduce their environmental impact while maintaining high levels of Organization Size.

Europe On-demand Warehousing Market Trends

The on-demand warehousing market in Europe is expected to witness steady growth from 2024 to 2030, driven by the region's mature economy, high levels of e-commerce penetration, and increasing focus on sustainability. The European market is characterized by a well-developed logistics infrastructure, with advanced transportation networks and a strong emphasis on efficiency and reliability. The growth of e-commerce across Europe has led to increased demand for flexible warehousing solutions that can support fast and efficient order fulfillment, particularly in urban areas where space is limited. Additionally, the European Union's focus on sustainability and reducing carbon emissions is driving the adoption of greener logistics practices, including the use of on-demand warehousing to optimize storage and reduce transportation-related emissions. The region's diverse market conditions, with varying levels of demand and infrastructure across different countries, have also contributed to the growth of on-demand warehousing, as businesses seek adaptable solutions that can meet their specific needs.

The on-demand warehousing market in Italy is expected to grow at a significant CAGR from 2024 to 2030. The Italian market is characterized by a dynamic retail sector, with a strong focus on fashion, food, and luxury goods, all of which require specialized warehousing and logistics capabilities. The growth of e-commerce in Italy has been particularly pronounced in recent years, leading to increased demand for warehousing solutions that can support fast and efficient order fulfillment. Additionally, Italy's diverse geography, with a mix of urban and rural areas, presents unique logistics challenges that are driving the adoption of flexible and scalable warehousing options. The Italian government's focus on improving infrastructure and supporting the digital transformation of businesses is also contributing to the market growth.

Key On-demand Warehousing Company Insights

The competitive landscape of the on-demand warehousing market is characterized by a dynamic mix of established logistics providers, emerging tech-driven startups, and specialized warehousing companies. Key players in the market are increasingly leveraging advanced technologies such as artificial intelligence (AI), machine learning, and the Internet of Things (IoT) to enhance their Organization Size offerings and improve operational efficiency. Established logistics companies, such as DHL, XPO Logistics, and Ryder, have expanded their locations to include on-demand warehousing, capitalizing on their extensive networks and infrastructure to meet the growing demand for flexible and scalable storage solutions. Meanwhile, startups like Flexe, Inc. and Stord, Inc. are disrupting the market with innovative platforms that connect businesses with available warehousing space on a pay-per-use basis, providing greater flexibility and transparency.

The market is also witnessing increased collaboration between tech companies and traditional logistics providers, aiming to offer integrated solutions that combine warehousing, transportation, and last-mile delivery locations. Additionally, as the demand for sustainable logistics solutions grows, companies are focusing on developing eco-friendly warehousing options, such as energy-efficient facilities and green supply chain practices. The competitive environment is further intensified by the entry of e-commerce giants like Amazon, which are building extensive in-house warehousing networks to support their fulfillment operations. Overall, the market is evolving rapidly, with competition driving innovation, improved Organization Size quality, and increased market penetration across various industries.

-

In August 2024, Warehowz, an online platform for on-demand warehousing and locations, announced a strategic partnership with Nexterus, a leading provider of supply chain management and third-party logistics (3PL) locations. This collaboration aims to simplify the process of finding and securing warehouse space for Nexterus' clients. Through the partnership, Nexterus will be able to leverage Warehowz's extensive database of over 2500 properties to quickly identify suitable warehouse options based on their clients' specific needs.

-

In June 2024, Kinaxia Logistics launched a new on-demand warehousing Organization Size to cater to the growing need for flexible storage solutions. This Organization Size allows customers to store and dispatch goods based on their seasonal demand, without committing to long-term contracts. Organization Size is particularly beneficial for retailers, manufacturers, wholesalers, and importers who require flexibility in their supply chain operations.

-

In February 2023, Ware2Go, a UPS subsidiary, is expanding its warehouse footprint and fulfillment options for Amazon sellers through a partnership with e-commerce platform Whitebox. This collaboration will add three new Whitebox facilities in Baltimore, Las Vegas, and Memphis to Ware2Go's network of on-demand warehouses. Additionally, the partnership enables Ware2Go to offer new fulfillment solutions for Amazon merchants, including Fulfillment by Amazon prep and first-party inventory locations. This expansion is significant for Ware2Go, as over 20% of its client base consists of Amazon merchants utilizing its fulfillment locations.

Key On-demand Warehousing Companies:

The following are the leading companies in the on-demand warehousing market. These companies collectively hold the largest market share and dictate industry trends.

- Extensiv

- Flexe, Inc.

- Flowspace

- Red Stag Fulfillment

- ShipBob, Inc.

- Stord, Inc.

- Ware2Go Inc.

- Waredock Estonia LLC

- Wareflex

- ZhenHub Technologies Ltd.

On-demand Warehousing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 127.13 billion

Revenue forecast in 2030

USD 268.82 billion

Growth rate

CAGR of 13.3% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Organization size, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Extensiv; Flexe, Inc.; Flowspace; Red Stag Fulfillment; ShipBob, Inc.; Stord, Inc.; Ware2Go Inc.; Waredock Estonia LLC; Wareflex; ZhenHub Technologies Ltd

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global On-demand Warehousing Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global on-demand warehousing market based on organization size, industry vertical, and region:

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Small and Medium Businesses (SMBs)

-

Large Businesses

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Manufacturing

-

Retail and E-commerce

-

Healthcare

-

Food and Beverage

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global on-demand warehousing market size was estimated at USD 114.93 billion in 2023 and is expected to reach USD 127.13 billion in 2024.

b. The global on-demand warehousing market is expected to grow at a compound annual growth rate of 13.3% from 2024 to 2030, reaching USD 268.82 billion by 2030.

b. Asia Pacific dominated the on-demand warehousing market in 2023, accounting for a 41.4% share of global revenue. The market's dominance is driven by rapid economic growth, urbanization, and the expansion of e-commerce. Countries like China, India, and Japan are leading this growth, supported by the increasing consumer demand for goods and the need for efficient logistics solutions. The region's dominance is also fueled by its position as a global manufacturing hub, necessitating extensive warehousing capabilities to manage the flow of goods in and out of production facilities.

b. Some key players operating in the on-demand warehousing market include Extensiv, Flexe, Inc., Flowspace, Red Stag Fulfillment, ShipBob, Inc., Stord, Inc., Ware2Go Inc., Waredock Estonia LLC, Wareflex, and ZhenHub Technologies Ltd.

b. The on-demand warehousing market is experiencing rapid growth, driven by several key trends. E-commerce expansion has fueled the demand for flexible storage solutions, especially since the COVID-19 pandemic. Technology advancements, such as AI and IoT, are transforming the industry. Digital platforms streamline operations, improve efficiency, and offer real-time insights. Sustainability is also a growing concern. On-demand warehousing can reduce waste and optimize transportation, contributing to a greener supply chain. Businesses are increasingly seeking providers that prioritize sustainability and adopt eco-friendly practices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.