- Home

- »

- Automotive & Transportation

- »

-

On-demand Trucking Market Size And Share Report, 2030GVR Report cover

![On-demand Trucking Market Size, Share & Trends Report]()

On-demand Trucking Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (One-time, Contractual), By Delivery Type, By Freight Type, By Vehicle Type, By Location, By Industry Vertical (Retail & E-commerce), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-416-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

On-demand Trucking Market Size & Trends

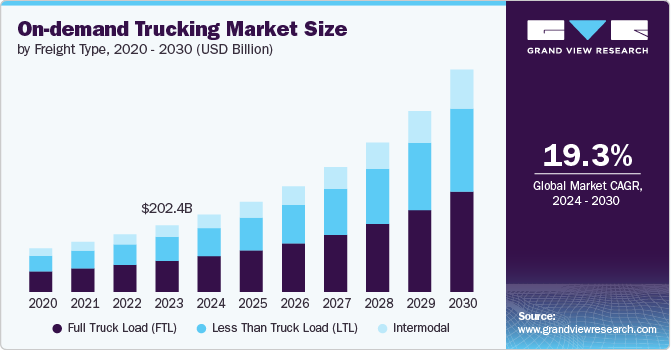

The global on-demand trucking market size was valued at USD 202.44 billion in 2023 and is expected to grow at a CAGR of 19.3% from 2024 to 2030. On-demand trucking, a segment of the broader transportation market, refers to the provision of trucking services through digital platforms that connect shippers directly with carriers. Unlike traditional freight transportation, where shipments are booked and scheduled in advance, on-demand trucking offers a more flexible and efficient solution by matching available trucks with immediate shipping needs. This model has gained significant traction in recent years, driven by technological advancements and evolving consumer demands.

In November 2022, Uber Freight's report on Market Update & Outlook highlighted a slowdown in the trucking market. Despite increased consumer spending, real retail sales have declined due to inflation. The supply of trucks and drivers has expanded, leading to increased competition and lower freight rates. Intermodal volumes are expected to decrease, and a mild recession is predicted for 2023. Internationally, volumes and demand are declining, with air freight rates falling sharply. In Mexico, truckload freight rates remain high but are starting to stabilize. The proposed ban on double-trailer trucks in Mexico could have negative effects on the transportation market. In Canada, the supply balance has stabilized, with rates becoming more predictable.

The market is experiencing a rapid evolution, driven by several key trends. Digitalization has transformed the industry, with the widespread adoption of online platforms and mobile applications streamlining the booking and tracking process for both shippers and carriers. Advanced tracking technologies, such as GPS and IoT, provide real-time visibility into shipment location and status, enhancing transparency and accountability.

Furthermore, on-demand platforms utilize data analytics to optimize load matching, ensuring efficient truck capacity utilization and minimizing empty miles. The growth of e-commerce and last-mile delivery has created a surge in demand for on-demand trucking services in urban areas, where traditional logistics models may struggle to keep up. Lastly, there is a growing emphasis on sustainable transportation practices, and on-demand trucking can contribute to reducing carbon emissions by optimizing routes and minimizing unnecessary travel.

The market operates within a complex regulatory framework. The Federal Motor Carrier Safety Administration (FMCSA) establishes safety standards for commercial motor vehicles and regulates driver hours of service. The Department of Transportation (DOT) oversees transportation-related regulations, including licensing requirements for carriers and drivers. The Environmental Protection Agency (EPA) sets emissions standards for commercial vehicles to safeguard air quality. Additionally, individual states and municipalities may impose specific regulations on trucking operations, such as permitting requirements or route restrictions.

The market is driven by several factors, including increased efficiency, cost savings, flexibility, and improved customer experience. On-demand platforms can enhance operational efficiency by reducing empty miles, optimizing routes, and streamlining the booking process. Additionally, by matching available trucks with immediate shipping needs, these platforms can help shippers and carriers achieve cost savings. The on-demand model offers greater flexibility compared to traditional freight transportation, allowing shippers to adjust their shipping plans based on changing needs.

Moreover, on-demand trucking can enhance the customer experience by providing real-time visibility, timely delivery, and improved communication. The market also presents several growth opportunities, such as expanding into new geographic regions, integrating with other logistics services, leveraging technological advancements, and prioritizing sustainable practices.

Service Insights

The one-time segment dominated the market in 2023 and accounted for 64.2% share of global revenue. This dominance can be attributed to its flexibility and suitability for ad-hoc shipping needs, making it a preferred option for businesses with irregular or unpredictable transportation requirements. However, the contractual segment is experiencing rapid growth, driven by the increasing preference for long-term partnerships and guaranteed capacity among shippers. As businesses seek to optimize their supply chains and reduce transportation costs, contractual arrangements offer stability and cost certainty, making them an attractive option for those with consistent and predictable shipping needs.

The contractual segment is projected to expand at a faster growth rate during the forecast period 2024 to 2030. This segment is particularly appealing to large enterprises that require consistent and reliable transportation services. By entering into contractual agreements, shippers can secure capacity, negotiate favorable rates, and establish stable partnerships with carriers. This can lead to improved supply chain visibility, reduced transportation costs, and enhanced customer satisfaction.

Delivery Type Insights

The first mile and last mile delivery segment dominated the market in 2023, accounting for a significant portion of overall revenue. This dominance can be attributed to the growing demand for efficient and reliable transportation solutions for the final leg of the delivery journey, particularly in urban areas. As e-commerce continues to expand and consumers expect faster and more convenient delivery options, the first mile and last mile delivery segment is experiencing substantial growth.

The same-day delivery segment is projected to expand at a faster growth rate during the forecast period 2024 to 2030, driven by the increasing demand for fast and efficient delivery of goods, especially in urban areas. As consumers seek convenience and immediacy, same-day delivery options are becoming increasingly popular. This segment is particularly attractive to businesses that need to deliver products quickly to customers, such as retailers, e-commerce companies, and restaurants.

Freight Type Insights

The full truck load (FTL) segment dominated the market in 2023. This dominance can be attributed to its efficiency and cost-effectiveness in transporting large quantities of goods. FTL shipments allow for direct transportation between origin and destination, minimizing handling and reducing transit times. However, the LTL segment is experiencing rapid growth, driven by the increasing demand for smaller shipments and the need for more flexible transportation options.

The intermodal segment is projected to grow at the fastest rate during the forecast period 2024 to 2030, due to its ability to accommodate smaller shipments and offer greater flexibility compared to FTL. This segment is particularly attractive to businesses with irregular or smaller shipping volumes, as it allows them to share truck capacity with other shippers, reducing transportation costs. LTL carriers consolidate shipments to optimize truck utilization and provide efficient transportation solutions for a wide range of businesses.

Vehicle Type Insights

The medium-duty trucks segment dominated the market in 2023, accounting for a substantial portion of overall revenue. These trucks offer a balance between payload capacity and maneuverability, making them suitable for a wide range of delivery applications. Medium-duty trucks are commonly used for transporting goods within urban areas, as well as for regional and intercity deliveries.

The light-duty trucks segment is projected to expand at the fastest rate during the forecast period 2024 to 2030, driven by the increasing demand for smaller and more agile vehicles, particularly for last-mile delivery and urban transportation. Light-duty trucks, such as vans and pickup trucks, are more maneuverable and fuel-efficient than medium-duty trucks, making them ideal for navigating congested urban areas and delivering smaller packages. As the demand for last-mile delivery services continues to rise, the light-duty truck segment is expected to play a significant role in the market.

Location Insights

The domestic segment dominated the market in 2023. This dominance can be attributed to the concentration of businesses and industries within domestic borders, making domestic transportation the primary focus for many shippers. However, the international segment is experiencing rapid growth, driven by increased globalization and the expansion of international trade.

The international segment is projected to witness the fastest growth from 2024 to 2030, due to the increasing interconnectedness of the global economy. As businesses expand their operations into new markets and engage in international trade, the demand for cross-border transportation services is rising. International shipments often involve complex logistics, customs clearance, and regulatory compliance, making on-demand trucking a valuable solution for businesses seeking efficient and reliable transportation across borders.

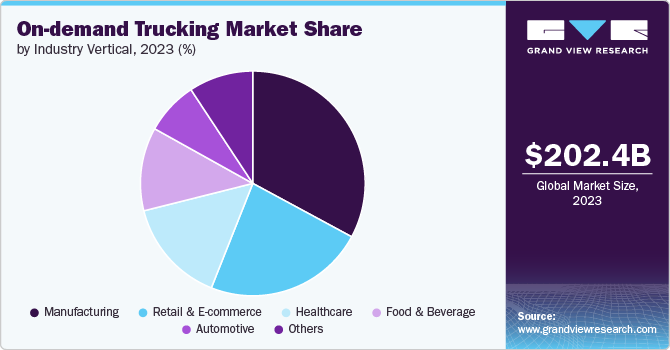

Industry Vertical Insights

The manufacturing segment dominated the market in 2023. This dominance can be attributed to the reliance of manufacturing businesses on efficient transportation for raw materials, components, and finished goods. Manufacturing operations often involve large-scale shipments and require timely and reliable transportation solutions to support production processes and meet customer demands. However, the retail and e-commerce segment is experiencing rapid growth, driven by the booming e-commerce industry and the need for fast and efficient delivery of products to consumers.

The retail and e-commerce segment is projected to grow at the fastest growth rate during the forecast period 2024, due to the increasing popularity of online shopping and the demand for fast and efficient delivery services. As e-commerce continues to expand, the need for on-demand trucking to support last-mile delivery and meet consumer expectations will become even more critical. Retailers and e-commerce companies require transportation solutions that can handle a variety of shipment sizes, ensure timely delivery, and provide tracking capabilities to meet customer demands.

Regional Insights

North America On-demand Trucking Market Trends

The on-demand trucking market in North America is expected to witness steady growth from 2024 to 2030, driven by factors such as increasing e-commerce activity, urbanization, and a focus on improving supply chain efficiency. The region's well-developed transportation infrastructure and advanced technology ecosystem provide a favorable environment for the growth of on-demand trucking platforms. Additionally, the increasing emphasis on sustainability and reducing carbon emissions is driving the demand for more efficient and environmentally friendly transportation solutions.

U.S On-demand Trucking Market Trends

The U.S. on-demand trucking market is expected to grow at a significant CAGR from 2024 to 2030. The country's vast geographic area, diverse industries, and large population create a strong demand for transportation services. The increasing adoption of digital technologies, coupled with the focus on improving supply chain efficiency and reducing costs, is driving the growth of on-demand trucking platforms in the U.S.

Asia Pacific On-demand Trucking Market Trends

The on-demand trucking market in Asia Pacific dominated in 2023 and accounted for a 41.4% share of the global revenue. This dominance can be attributed to the region's rapid economic growth, increasing industrialization, and growing e-commerce market. As businesses expand their operations and logistics needs increase, the demand for on-demand trucking services is rising significantly. Additionally, the region's large population and diverse economic landscape create a favorable environment for the growth of on-demand trucking platforms.

India on-demand trucking market is expected to grow at the fastest CAGR from 2024 to 2030, driven by its large population, expanding economy, and increasing urbanization. The country's growing e-commerce sector, coupled with the development of transportation infrastructure, is creating a favorable environment for the adoption of on-demand trucking services. Indian businesses are increasingly seeking efficient and cost-effective transportation solutions to meet the growing demand for goods and services, making India a lucrative market for on-demand trucking platforms.

Europe On-demand Trucking Market Trends

The on-demand trucking market in Europe is expected to grow at a significant CAGR from 2024 to 2030, driven by factors such as increasing urbanization, e-commerce expansion, and a focus on sustainability. As cities become more densely populated and businesses seek to reduce their environmental footprint, on-demand trucking offers a flexible and efficient solution for last-mile delivery and transportation needs. Additionally, the region's well-developed transportation infrastructure and regulatory framework provide a conducive environment for the growth of on-demand trucking platforms.

France on-demand trucking market is expected to grow at a significant CAGR from 2024 to 2030, driven by its strong economy, developed transportation infrastructure, and increasing adoption of digital technologies. The country's focus on sustainability and efforts to reduce carbon emissions are also driving the demand for on-demand trucking services. French businesses are seeking more efficient and environmentally friendly transportation solutions, making France an attractive market for on-demand trucking platforms.

Key On-demand Trucking Company Insights

The competitive landscape of the market is highly dynamic and characterized by a mix of established players and emerging startups. Established logistics companies are expanding their offerings to include on-demand trucking services, leveraging their existing networks and infrastructure. Technology-driven startups are disrupting the market by introducing innovative platforms and leveraging data analytics to optimize operations.

Key factors driving competition include pricing, service quality, technological capabilities, geographic coverage, and customer experience. As the market continues to evolve, the competitive landscape is likely to become even more intense, with players focusing on differentiation, strategic partnerships, and continuous innovation to maintain their market position.

Key On-demand Trucking Companies:

The following are the leading companies in the On-demand Trucking market. These companies collectively hold the largest market share and dictate industry trends.

- Cargomatic Inc.

- Dropoff, Inc.

- Flexport Freight Tech LLC

- Freightos

- J.B. Hunt Transport, Inc.

- Loadsmart Inc.

- NEXT Trucking

- Ninjatruck, S.L. (Ontruck)

- Transfix

- Uber Freight

- uShip, Inc.

- Zinka Logistics Solutions Ltd. (Blackbuck)

Recent Developments

- In May 2024, Volvo Trucks launched a new leasing program called Volvo On Demand to help fleets transition to electric trucks more easily. The program offers flexible leasing options and includes all necessary services, charging hardware, and insurance. By eliminating upfront costs, Volvo aims to accelerate the adoption of electric trucks and contribute to decarbonizing the transportation industry.

On-demand Trucking Market Report Scope

Attribute

Details

Market size value in 2024

USD 234.70 billion

Revenue forecast in 2030

USD 675.72 billion

Growth rate

CAGR of 19.3% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Service, delivery type, freight type, vehicle type, location, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; United Arab Emirates (UAE); Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Cargomatic Inc.; Dropoff, Inc.; Flexport Freight Tech LLC; Freightos; J.B. Hunt Transport, Inc; Loadsmart Inc; NEXT Trucking; Ninjatruck, S.L. (Ontruck); Transfix; Uber Freight; uShip, Inc.; Zinka Logistics Solutions Ltd. (Blackbuck)

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global On-demand Trucking Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global on-demand trucking market based on service, delivery type, freight type, vehicle type, location, industry vertical, and region.

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

One-time

-

Contractual

-

-

Delivery Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

First Mile and Last Mile Delivery

-

Same-day Delivery

-

-

Freight Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Full Truck Load (FTL)

-

Less Than Truck Load (LTL)

-

Intermodal

-

-

Vehicle Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Medium-duty Trucks

-

Light-duty Trucks

-

Heavy-duty Trucks

-

-

Location Outlook (Revenue, USD Billion, 2017 - 2030)

-

Urban

-

Regional

-

Long Haul

-

-

Industry Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

Manufacturing

-

Retail and E-commerce

-

Healthcare

-

Food and Beverage

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

United Arab Emirates (UAE)

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global on-demand trucking market size was estimated at USD 202.44 billion in 2023 and is expected to reach USD 234.70 billion in 2024.

b. The global on-demand trucking market is expected to grow at a compound annual growth rate of 19.3% from 2024 to 2030, reaching USD 675.72 billion by 2030.

b. Asia Pacific dominated the on-demand trucking market in 2023 and accounted for a 41.4% share of the global revenue. This dominance can be attributed to the region's rapid economic growth, increasing industrialization, and growing e-commerce market. As businesses expand their operations and logistics needs increase, the demand for on-demand trucking services is rising significantly.

b. Some key players operating in the on-demand trucking market include Cargomatic Inc., Dropoff, Inc., Flexport Freight Tech LLC, Freightos, J.B. Hunt Transport, Inc, Loadsmart Inc, NEXT Trucking, Ninjatruck, S.L. (Ontruck), Transfix, Uber Freight, uShip, Inc., and Zinka Logistics Solutions Ltd. (Blackbuck).

b. The on-demand trucking market is experiencing a rapid evolution, driven by several key trends. Digitalization has transformed the industry, with the widespread adoption of online platforms and mobile applications streamlining the booking and tracking process for both shippers and carriers. Advanced tracking technologies, such as GPS and IoT, provide real-time visibility into shipment location and status, enhancing transparency and accountability. Furthermore, on-demand platforms utilize data analytics to optimize load matching, ensuring efficient truck capacity utilization and minimizing empty miles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.