- Home

- »

- Medical Devices

- »

-

On-body Injectors Market Size, Share & Growth Report, 2030GVR Report cover

![On-body Injectors Market Size, Share & Trends Report]()

On-body Injectors Market Size, Share & Trends Analysis Report By Technology (Spring-based, Motor Driven), By Application (Oncology, Diabetes), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-395-4

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

On-body Injectors Market Size & Trends

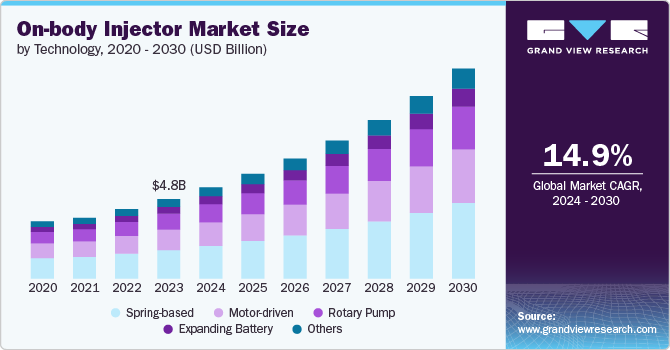

The global on-body injectors market size was estimated at USD 4.8 billion in 2023 and is projected to grow at a CAGR of 14.9% from 2024 to 2030. This can be attributed to the increasing prevalence of chronic diseases, technological advancements in injectors, growing focus on home healthcare, increasing concerns about needlestick injuries, and a wide range of applications of on-body injectors. Chronic diseases such as diabetes, cancer, asthma, Alzheimer's disease, Parkinson's disease, and others often require frequent injections, and on-body injectors offer a convenient and manageable solution. According to the International Diabetes Federation, 537 million adults aged between 20 - 79 had diabetes in 2021, which is expected to increase to 643 million in 2030.

The global demography is witnessing a significant shift with the increasing geriatric population. For instance, according to WHO, the global population aged above 60 is expected to reach 2.1 billion by 2050. This elderly population base is significantly vulnerable to chronic conditions and is more prone to developing chronic diseases that require regular monitoring and medication with their increasing age. For instance, according to the Commentary on Chronic Disease Prevention Report 2022, around 60% of the country’s adult population had at least one chronic disease. Moreover, around 40% of the adults were suffering from multiple chronic conditions. This elderly population prefers to receive care in the comfort of their own homes rather than in healthcare facilities. This is expected to increase the demand for on-body injectors as they allow older adults to manage their conditions at home without need.

Needlestick injuries are a major occupational hazard for healthcare workers, leading to safety concerns and demand for advanced devices. As a result of the safety concerns, there has been a shift towards using more automated and hands-free drug delivery devices such as on-body injectors. According to a study published by the National Institute of Health in February 2022, an intravenous cannula (33.0%) and a hypodermic needle (18.7%) were the two most common devices responsible for needlestick injuries. The on-body injectors offer an advanced alternative to these needles and can reduce the risk of needlestick injuries during administration, which is expected to increase their demand over the forecast period.

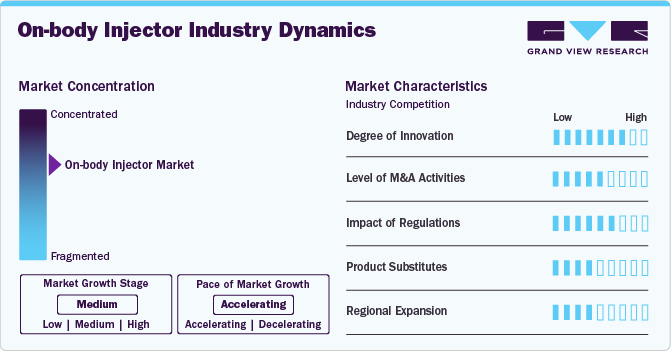

Market Concentration & Characteristics

The on-body injectors industry is characterized by the increasing prevalence of chronic diseases, the development of advanced solutions by the market players, a wide range of applications of on-body injections, increasing preference for home care coupled with an aging population, focus on reducing the burden on healthcare organizations, and efforts to reduce needle stick injuries.

The market exhibits a high degree of innovation, driven by the increasing efforts of market players to develop solutions addressing different patient needs, convenience, and safety. For instance, in May 2021, Gerresheimer introduced SensAIR, a first-of-its-kind platform for on-body drug delivery to administer high-viscosity drugs such as monoclonal antibodies. Developing such innovative products to address different patient needs increases the degree of innovation in the market.

Regulatory bodies such as the FDA and EMA have established clear guidelines for approving and clearing on-body injectors as medical devices. The standardization of the regulatory pathways and increasing acceptance of these devices by authorities as viable drug delivery devices offering better patient care and improving patient care are significantly shaping the market's regulatory scenario.

Mergers and acquisitions (M&A) in the on-body injector industry are rising as companies seek to expand their market share, product portfolios, and technological capabilities. For instance, in June 2023, LTS LOHMANN Therapie-Systeme AG announced the acquisition of Sorrel's wearable injection device business to expand its existing portfolio by adding large-volume wearable injector technologies.

The market faces a moderate threat from product substitutes, primarily driven by the availability of established drug delivery methods and the emergence of innovative technologies. While on-body injectors offer enhanced patient convenience and adherence, traditional options such as oral medications and manual injections remain cost-effective and familiar alternatives. However, the demand for self-administration coupled with the increasing prevalence of chronic diseases strengthens the position of these devices over other alternatives.

The expansion strategies the market players use are driven by efforts to increase the customer base and grab the opportunities offered by emerging markets such as Asia Pacific and Latin America, which have developing healthcare sectors.

Technology Insights

The spring-based segment accounted for the largest market share of 40.89% in 2023. Spring-based on-body injectors are efficient devices that provide several advantages for patients and healthcare providers. They deliver medication with consistent pressure and speed, ensuring accurate dosing, which is crucial for treatments requiring precise amounts, such as insulin for diabetes or biologics for autoimmune conditions. This controlled delivery reduces the risk of human error with manual injections. In addition, these injectors are user-friendly, featuring automatic needle insertion and retraction, which significantly reduces discomfort and anxiety. This simplicity enhances patient compliance, as people are more likely to follow their medication regimen when the process is easy and less painful. Moreover, these devices allow patients to administer their doses with the simple press of a button, making them a preferred choice over a more complex delivery mechanism. The increasing innovation in these devices and their cost-effectiveness are expected to increase their demand over the forecast period.

The rotary pump segment is projected to experience the fastest CAGR of 15.1% over the forecast period. These pumps offer high control in dispensing medications by leveraging advanced fluid mechanics, minimizing the risk of dosing errors, and maximizing therapeutic efficacy. This increases their applicability in delivering drugs such as biologics where precise dosing is critical. Moreover, these devices can offer advanced functionalities such as wireless connectivity, customizable settings, & remote monitoring capabilities, which are further anticipated to drive their demand over the forecast period.

Application Insights

The diabetes segment accounted for the largest market share in 2023. This can be attributed to the high and growing prevalence of diabetes globally, particularly type 2 diabetes, which requires frequent insulin administration. According to the Centers for Disease Control and Prevention data updated in May 2024, around 38 million people in the U.S. are living with diabetes, with around 90% to 95% of them suffering from type 2 diabetes-such a high prevalence of diabetes requiring regular increases the demand for on-body injectors. Moreover, on-body injectors offer a convenient solution for diabetic patients to self-manage their condition, improving treatment adherence and glycemic control, which is further anticipated to fuel the segment's growth.

The autoimmune diseases segment in the on-body injectors market is projected to experience the fastest CAGR over the forecast period owing to the rising prevalence of chronic autoimmune conditions such as rheumatoid arthritis, multiple sclerosis, and Inflammatory Bowel Diseases (IBD). According to a study published by Crohn's & Colitis UK in March 2022, around 1 in every 123 people in the UK suffer from IBD. Patients suffering from these autoimmune disorders often require frequent, long-term administration of biologic drugs and immunotherapies, making on-body injectors an ideal delivery solution and driving segment growth.

End-use Insights

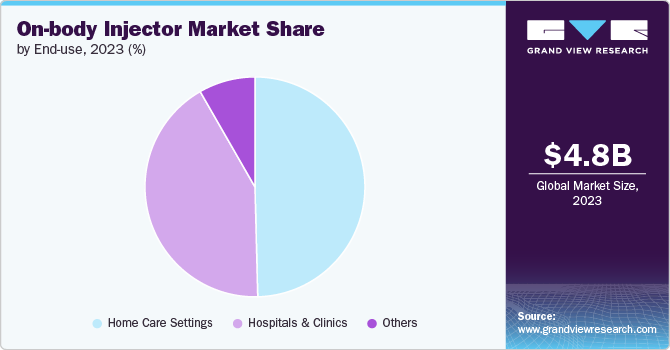

The home care settings segment accounted for the largest revenue share in 2023 and is expected to witness the fastest growth over the forecast period. This dominance is attributable to the growing preference for self-administration of medications and the increasing adoption of on-body injectors for managing chronic conditions such as diabetes, autoimmune disorders, and cancer. Several on-body injectors enable patients to conveniently administer their medications at home, eliminating the need for frequent visits to healthcare facilities. This convenience factor, coupled with the hands-free and discreet nature of on-body injectors, has made them the preferred choice for patients seeking to integrate their treatment seamlessly into their daily lives, contributing to the high demand for these devices in the homecare settings.

The hospitals and clinics segment is projected to grow significantly over the forecast period. This growth is driven by the rising prevalence of chronic diseases, such as cancer, diabetes, and autoimmune disorders, which require the administration of biologics and specialty medications. The on-body injectors offer healthcare providers in hospital and clinical settings a convenient and reliable solution to administer these complex therapies, improving patient outcomes and reducing the burden on healthcare facility staff.

Regional Insights

North America on-body injector market dominated the overall global market and accounted for the 33.17% revenue share in 2023. This can be attributed to the increasing prevalence of chronic diseases, the presence of key market players, the growing focus on home care, and better access to advanced on-body injectors. The North American region is witnessing a significant increase in the demand for home care owing to the region’s aging population and chronic diseases. For instance, according to Statistics Canada, 18.9% of Canada’s population was aged 65 or above in January 2023. This high share of the adult population, coupled with increasing chronic diseases and demand for home care, drives the demand for on-body injectors in the North American region.

U.S. On-body Injector Market Trends

The on-body injector market in the U.S. held a significant share of North America's market in 2023. This can be attributed to the increase in healthcare spending, supportive regulatory framework, and increasing R&D initiatives from market players in the country. The companies operating in the market are developing innovative solutions to meet the evolving market needs. Similarly, the FDA supports the innovation of on-body injectors to enhance the quality of care and utilize self-administration offered by on-body injectors. For instance, in October 2023, Apellis Pharmaceuticals, Inc. announced the U.S. FDA approval of the EMPAVELI injector. This injector is designed to enhance self-administration of EMPAVELI and is approved for adults suffering from paroxysmal nocturnal hemoglobinuria (PNH). The development of such innovative solutions coupled with a supportive regulatory framework is anticipated to drive the market growth of the country.

Europe On-body Injectors Market Trends

The on-body injectors market in Europe is witnessing growth, driven by the increasing geriatric population base in developed countries of the region, such as the UK, Germany, France, and Italy, the rising prevalence of chronic diseases, increasing demand for patient-centric medication options, and the increasing development of advanced on-body injectors in the region. According to the IDF Diabetes Atlas, around 61 million people in Europe will be living with diabetes in 2021, and this is expected to increase to approximately 67 million in 2030. This increasing prevalence of chronic diseases, with increasing access to advanced on-body injectors, is expected to drive market growth in the region.

The UK on-body injectors market is witnessing significant growth due to the increasing focus on improving patient care, reducing the risk of needle stick injuries, and increasing the availability of advanced injectors in the country. Needle stick injuries pose safety risks to healthcare workers in the UK and can lead to costly treatments and lawsuits. The Health and Safety (Sharp Instruments in Healthcare) Regulations 2013 emphasize the prevention of sharps injuries in the healthcare sector. Wearable injectors help mitigate these risks by eliminating the need for manual needle injections.

The on-body injectors market in France is witnessing significant growth owing to the growing homecare sector in the country, the increasing prevalence of chronic diseases, a supportive regulatory framework, and increasing awareness about the use of on-body injectors over traditional means of medication delivery. The benefits offered by on-body injectors, such as convenience, accuracy, and better safety, significantly increase the preference towards these devices for medication delivery, thereby driving the market growth.

Germany on-body injectors market is experiencing notable growth owing to the increasing acceptance of self-injectors, increasing geriatric population base, and focus on home care. Germany has a rapidly aging population with a high prevalence of chronic diseases such as diabetes, heart disease, and cancer. According to the World Bank, the number of people aged 65 and above in Germany has significantly increased from 17.1 million in 2015 to over 19.2 million in 2023. This growing geriatric population base, coupled with increasing chronic disease prevalence, is driving the market growth in Germany.

Asia Pacific On-body Injectors Market Trends

The on-body injectors market in Asia Pacific is witnessing significant growth driven by rising healthcare investments, an expanding elderly population, the increasing prevalence of chronic respiratory diseases, and increasing government initiatives to prioritize and promote healthcare reform and increase home care in the region’s healthcare facilities to decrease the burden of the large patient pool from the healthcare sectors.

Japanon-body injectors market is set for significant growth due to increasing concerns about patient safety and convenience and the country’s increasing geriatric population base. Japan has one of the fastest-aging populations globally. According to the World Bank, the elderly population in Japan has increased from 34.7 million in 2015 to around 37.4 million in 2023. This elderly population is further expected to increase the demand for on-body injectors in the country, thereby driving market growth.

Theon-body injectors market in China is expected to grow in the Asia Pacific in 2023. This can be attributed to the increasing adoption of on-body injectors, growing focus on developing country’s healthcare sector and decrease the burden on country’s healthcare sector. China is taking significant steps to develop its healthcare sector, which is anticipated to drive the country's demand for advanced medical devices such as on-body injectors.

India on-body injectors market is expected to grow significantly over the forecast period. Various factors, such as an increasing population base, high prevalence of chronic diseases, advancements in regulatory frameworks, and increasing availability of advanced medical devices, fuel the on-body injectors market in India. According to the India Diabetes (ICMR INDIAB) study published by the Indian Council of Medical Research in 2023, around 10.1 crore of the country’s population has diabetes. This high prevalence of diabetes is anticipated to increase the demand for advanced drug delivery solutions such as on-body injectors in the country, thereby driving the market growth.

Latin America On-body Injectors Trends

The on-body injectors market in Latin American is fueled by the increasing number of patients on self-health management, decreasing the burden on healthcare facilities, and growing awareness about the advantages of advanced medical devices for better health outcomes. Moreover, the countries in the region, such as Brazil and Argentina, are witnessing a rise in chronic diseases, which is further anticipated to contribute to market growth.

Saudi Arabia on-body injectors market is anticipated to expand in the forecast period. The growing geriatric population, which is highly susceptible to chronic diseases, is one of the major factors positively influencing the market growth in this country. For instance, according to the Saudi Arabian Monetary Agency (SAMA), the share of the Saudi Arabian population aged 60 years and above is expected to reach 25% of its total 40 million population in 2050. The country's increasing geriatric population base is expected to drive the market over the forecast period.

Key On-body Injectors Company Insights

The competitive scenario in the on-body injectors market is highly competitive, with key players such as West Pharmaceutical Services, Inc.; BD; Stevanato Group, Enable Injections and others. The major companies are undertaking various organic and inorganic strategies such as launches, partnerships, acquisitions, mergers, and regional expansion to serve their customers' unmet needs.

Key On-body Injectors Companies:

The following are the leading companies in the on-body injectors market. These companies collectively hold the largest market share and dictate industry trends.

- West Pharmaceutical Services, Inc.

- BD

- Stevanato Group

- Enable Injections

- Nemera

- Debiotech SA

- AbbVie, Inc.

- Coherus BioSciences, Inc.

- Gerresheimer AG

- E3D Elcam Drug Delivery Devices

Recent Developments

-

In February 2024, Coherus BioSciences, Inc. launched its UDENYCA ONBODY, a novel wearable injector for delivering pegfilgrastim, which reduces infection risk during chemotherapy. The device enhances patient convenience by minimizing hospital visits.

-

In October 2023, the U.S. FDA approved the Empaveli Injector, an on-body injector for the self-administration of pegcetacoplan. This device allows patients to administer their health irrespective of their location.

On-body Injectors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.5 billion

Revenue forecast in 2030

USD 12.7 billion

Growth rate

CAGR of 14.9% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

West Pharmaceutical Services, Inc.; BD; Stevanato Group; Enable Injections; Nemera; Debiotech SA; AbbVie, Inc.; Coherus BioSciences, Inc; Gerresheimer AG; E3D Elcam Drug Delivery Devices

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global On-body Injectors Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global on-body injectors market report based on technology, application, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Spring-based

-

Motor-driven

-

Rotary Pump

-

Expanding Battery

-

Other

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Diabetes

-

Cardiovascular Disease

-

Autoimmune Disease

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Home Care Settings

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global on-body injectors market was estimated at USD 4.8 billion in 2023 and is expected to reach USD 5.5 billion in 2024.

b. The global on-body injectors market is expected to grow at a compound annual growth rate of 14.9% from 2024 to 2030 to reach USD 12.70 billion by 2030.

b. North America dominated the won-body injectors market with a share of 33.2% in 2023. This is attributable to the rising prevalence of chronic & lifestyle-related diseases and the presence of sophisticated healthcare infrastructure.

b. Some key players operating in the on-body injectors market include West Pharmaceutical Services, Inc.; BD; Stevanato Group, Enable Injections and others.

b. Key factors that are driving the on-body injectors market growth include rising demand for round-the-clock monitoring, Increasing concern over the hazards related to needlestick injuries, and technological developments in wearable injectors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."