- Home

- »

- Consumer F&B

- »

-

Olive Market Size, Share & Growth, Industry Report, 2030GVR Report cover

![Olive Market Size, Share & Trends Report]()

Olive Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Olive Oil, Table Olive), By Application (Food & Beverage, Pharmaceuticals, Personal Care & Cosmetics), By Region (Europe, APAC, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-485-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Olive Market Summary

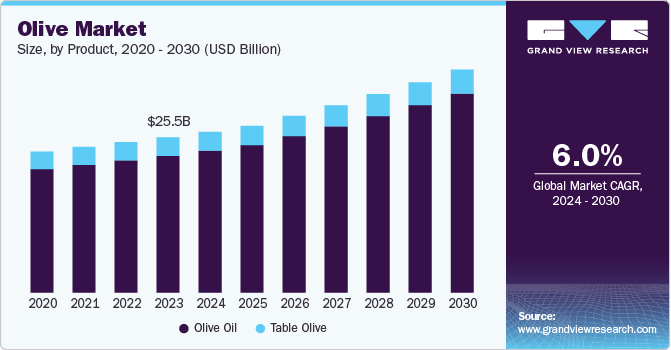

The global olive market size was estimated at USD 25.5 billion in 2023 and is projected to reach USD 38.4 billion by 2030, growing at a CAGR of 6.0% from 2024 to 2030. The increasing consumer awareness regarding health benefits associated with olives and olive oil is a key growth driver.

Key Market Trends & Insights

- Europe was the largest olive market, with a revenue of USD 11.5 billion in 2023.

- By product, the olive oil segment is expected to reach USD 34.40 billion in 2030.

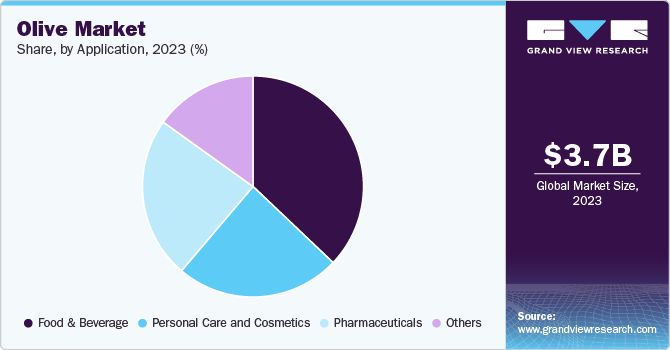

- By application, food and beverage was the largest application segment with a market revenue exceeding USD 10 billion in 2023.

Market Size & Forecast

- 2023 Market Size: USD 25.5 Billion

- 2030 Projected Market Size: USD 38.4 Billion

- CAGR (2024-2030): 6.0%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

Olives are rich in antioxidants and healthy fats, which support heart health and overall wellness. This shift towards healthier dietary choices has led to a surge in demand for olive oil, particularly in non-European countries that are traditionally not associated with Mediterranean diets. As consumers become more informed about nutrition, they are increasingly aware of the health benefits associated with olive oil, particularly extra virgin olive oil (EVOO). Studies have shown that EVOO is rich in monounsaturated fats and antioxidants, which can lower bad cholesterol (LDL) while raising good cholesterol (HDL) levels. This has led to a heightened interest in incorporating olive oil into daily diets as a healthier fat alternative.

Olive oil has been linked to anti-inflammatory effects due to its high content of oleic acid and antioxidants such as oleacein and oleocanthal. These properties are believed to play a role in reducing inflammation-related diseases such as arthritis, heart disease, and certain cancers. As awareness of chronic inflammation grows, so does the appeal of olive oil as a preventive measure.

The globalization of food culture has also played a crucial role. The rise of Mediterranean cuisine, characterized by dishes that prominently feature olives, has led to an increased number of Mediterranean restaurants worldwide. Countries such as the U.S., UAE, and Singapore have seen a notable increase in such establishments, further driving demand for olives as essential ingredients in various culinary applications. Olives are celebrated for their versatility in cooking, making them a staple in many Mediterranean dishes.

The incorporation of olives into popular menu items enhances flavor profiles and aligns with health-conscious dining trends, further promoting their use in both casual and fine dining settings. As more consumers dine out and explore new cuisines, Mediterranean restaurants introduce them to olives and their culinary applications. This exposure not only increases immediate sales but also encourages consumers to incorporate olives into their home cooking, thereby boosting retail demand. Mediterranean restaurants often highlight the health benefits associated with olives and olive oil, such as heart health and antioxidant properties. This marketing strategy aligns with the growing consumer trend towards healthier eating, further driving interest in olive-based products.

The growing vegan population is another significant factor contributing to the olive market's expansion. As more individuals adopt plant-based diets, they seek alternatives to animal products. Olives provide a nutritious option that is high in healthy fats and vitamins, making them appealing to those looking to replace dairy and meat products in their diets. Favorable government policies promoting olive cultivation have also bolstered market growth. For instance, countries like Egypt are aiming to become major players in olive production through partnerships with established producers such as Spain. Such initiatives are likely to enhance production capabilities and increase global supply.

The demand for table olives is rising significantly in emerging markets outside Europe, including Asia-Pacific nations such as China and India. As consumers in these regions become more aware of the health benefits of olives, they are increasingly incorporating them into their daily diets. This trend is further supported by urbanization and the expansion of fast-food chains that utilize olives in their offerings.

There is a growing inclination towards organic food products globally. Consumers are becoming more discerning about food quality and safety, leading to increased demand for organic olives free from pesticides. This trend aligns with the broader movement towards healthier eating habits.

The olive market faces several restraints that could hinder its growth potential in the coming years. One significant challenge is the seasonal nature of olive production, which leads to fluctuations in supply and pricing. Olives are primarily harvested in the fall, and variations in climatic conditions can cause substantial year-on-year differences in crop yields. This unpredictability complicates supply chain management for producers and retailers alike, making it difficult to maintain consistent product availability and pricing stability.

Another critical issue is the high cost of olive oil compared to alternative oils. As consumers become more price-sensitive, they may turn to less expensive options such as canola or sunflower oil, which offer similar nutritional benefits at a lower price point. This shift in consumer preference can limit the market's growth, particularly as these alternative oils often require less investment to produce. In addition, the concentration of olive production in European countries, which account for about 75% of global output, creates a dependency on a limited number of suppliers. This concentration can lead to increased prices and reduced market competitiveness.

Product Insights

The olive oil market was valued at USD 22.58 billion in 2023 and is expected to reach USD 34.40 billion in 2030. The growth of the olive oil market is being driven by a confluence of factors that reflect changing consumer preferences and increasing health consciousness. One of the primary drivers is the surging demand for health-oriented products, as olive oil is widely recognized for its numerous health benefits, including heart health support and anti-inflammatory properties. This awareness is prompting consumers to seek healthier cooking alternatives, leading to a notable uptick in olive oil consumption across various demographics, including those traditionally outside the Mediterranean region, such as the USA, China, and Australia.

In addition, the rising popularity of the Mediterranean diet, which emphasizes the use of olive oil as a staple ingredient, is significantly contributing to market growth. As more individuals adopt this diet for its health benefits, the demand for high-quality olive oil, particularly extra virgin varieties, has increased. This trend is further supported by the proliferation of cooking shows and food blogs that highlight olive oil's versatility in culinary applications, thereby enhancing its appeal among home cooks and professional chefs alike.

Moreover, government initiatives aimed at promoting olive cultivation and production are playing a crucial role in expanding the market. Countries like Egypt are actively working to increase their olive production capabilities through strategic partnerships with established producers in Mediterranean countries. This expansion into new regions not only diversifies supply sources but also caters to growing local and international demand.

The market is also witnessing a shift towards premium products, with consumers increasingly willing to pay more for high-quality olive oil. This trend is bolstered by an emphasis on organic and sustainably produced goods, aligning with broader consumer values around health and environmental responsibility. As a result, new product launches focusing on premium offerings are becoming essential for vendors looking to establish long-term relationships with consumers.

New product launches play a pivotal role in the growth of the olive market by enhancing consumer engagement, diversifying product offerings, and meeting evolving consumer preferences. As the demand for olive oil and olives continues to rise, manufacturers are increasingly introducing innovative products that cater to health-conscious consumers. For instance, the introduction of olive oils enriched with health-promoting compounds, such as soluble hydroxytyrosol, reflects a trend towards functional foods that offer additional health benefits beyond traditional uses. This innovation not only attracts health-focused consumers but also allows brands to differentiate themselves in a competitive market.

Moreover, the expansion of product lines into new categories, such as flavored olive oils or ready-to-use olive oil sprays for cooking and dressing, caters to the growing interest in convenience and culinary experimentation among consumers. Such products appeal to a broader audience, including millennials and Gen Z, who are seeking healthier and more versatile cooking options. The recent introduction of olive oil-infused coffee.

There is a marked shift towards healthier eating habits, with consumers increasingly seeking natural and nutritious food options. Table olives are rich in healthy fats, antioxidants, and anti-inflammatory properties, making them an appealing choice for health-conscious individuals. This trend is further supported by the rising popularity of the Mediterranean diet, which emphasizes the consumption of olives as a staple ingredient. Additionally, the growing vegan population is driving demand for plant-based foods, including table olives. As more people adopt vegan lifestyles, they look for alternatives that provide healthy fats and essential nutrients. Olives fit this profile perfectly, offering a rich source of monounsaturated fats and vitamins while being versatile in various culinary applications.

The increased integration of table olives into everyday diets across non-European countries such as China, Japan, and Brazil is also noteworthy. Consumers in these regions are becoming more aware of the health benefits associated with olives, leading to higher demand and incorporation into local cuisines. Moreover, the expansion of the food service sector has significantly contributed to the growth in table olive sales. As Mediterranean cuisine gains traction in restaurants and catering services worldwide, the use of table olives as toppings or ingredients in dishes like pizzas, salads, and tapas has surged. This trend is particularly pronounced among millennials who favor flavorful and healthy dining options.

New product innovations are enhancing consumer interest in table olives. Manufacturers are launching a variety of products, including stuffed olives and flavored options, which cater to diverse taste preferences and snack trends. This innovation not only attracts new customers but also encourages existing consumers to explore different uses for table olives in their meals.

Application Insights

Food and beverage were the largest application for olives and market revenue exceeded USD 10 billion in 2023. One of the primary drivers is the increasing demand for healthier food options. As consumers become more health-conscious, they are seeking out products that offer nutritional benefits, such as olives, which are rich in monounsaturated fats, antioxidants, and anti-inflammatory properties. This trend aligns with the rising popularity of the Mediterranean diet, which emphasizes the consumption of olives as a staple ingredient.

In addition, the expansion of the food service sector, particularly Mediterranean restaurants and quick-service restaurants (QSRs), significantly boosts olive consumption. These establishments often incorporate olives into a variety of dishes, such as pizzas, salads, and pastas, thus driving demand for both table olives and olive oil. The rise in urbanization and disposable income in regions such as North America and Asia Pacific has led to an increase in dining out, further enhancing the need for olive-based ingredients in food preparation.

Moreover, product innovation plays a crucial role in expanding the market for olives. Manufacturers are introducing new varieties and formats of table olives, such as stuffed olives and flavored options, catering to diverse consumer tastes and preferences. This innovation not only attracts new customers but also encourages existing consumers to experiment with different uses for olives in their cooking. The growing trend of home cooking, especially during the COVID-19 pandemic, has also contributed to increased sales of olives. As consumers sought to recreate restaurant-style meals at home, they turned to versatile ingredients like olives that can enhance flavor and nutrition in various dishes. This shift has led to a sustained interest in purchasing olives for home use.

Marketing efforts that highlight the culinary versatility of olives further drive their adoption in food and beverage applications. Campaigns promoting olives as convenient snacks or as essential components in gourmet cooking help raise awareness and encourage trial among consumers.

The growth of pharmaceutical applications for olives is driven by several factors that highlight their therapeutic potential and versatility. Olive oil and its extracts, particularly polyphenolic compounds such as oleuropein and hydroxytyrosol, are increasingly recognized for their health benefits, including anti-inflammatory and antioxidant properties. These compounds have been shown to enhance cardiovascular health, lower blood pressure, and improve overall well-being, making them appealing for incorporation into dietary supplements and pharmaceutical formulations. In addition, olive oil serves as an effective excipient in drug delivery systems, enhancing the stability and bioavailability of active pharmaceutical ingredients (APIs) due to its compatibility with various drugs. This capability positions olive oil as a valuable carrier in both oral and topical applications. Furthermore, the rising consumer awareness of natural and plant-based ingredients in healthcare products is fueling demand for olives in the pharmaceutical sector, as they align with the growing trend towards holistic health solutions.

Personal care and cosmetics application for olive is expected to grow at a CAGR of 6.4% over the forecast period. The growth of olives in personal care and cosmetic applications is largely driven by their rich moisturizing and nourishing properties, particularly with olive oil and olive squalane. These ingredients are highly valued for their ability to hydrate the skin, enhance elasticity, and provide a protective barrier against environmental stressors. Olive oil contains essential fatty acids and antioxidants that help combat oxidative stress, making it a popular choice for anti-aging formulations. In addition, olive squalane, derived from olives, is celebrated for its lightweight texture and non-greasy finish, making it ideal for various cosmetic products such as creams, serums, and hair conditioners. The increasing consumer demand for natural and organic ingredients in beauty products further fuels this growth, as olives align with the trend towards clean beauty. As a result, the incorporation of olive-based ingredients into personal care products continues to expand, reflecting a broader shift towards holistic health and wellness in the cosmetics industry.

Regional Insights

Europe was the largest market for olives and accounted for a market revenue of USD 11.5 billion in 2023. One of the primary drivers is the increasing popularity of the Mediterranean diet, which emphasizes the consumption of olives and olive oil as essential components. Countries such as Spain and Italy are at the forefront, with Spain being the largest producer and consumer of olives, accounting for approximately 31% of total European consumption. In addition, Cyprus leads in per capita consumption, with about 4.4 kg per person annually, highlighting a strong cultural affinity for olives.

Furthermore, there is a growing awareness of the health benefits associated with olives, including their anti-inflammatory properties and heart health advantages. This has led to a surge in demand for both table olives and olive oil across various demographics. The trend towards organic and sustainably produced products is also gaining traction, particularly in countries such as France, where consumers are increasingly seeking organic options. This shift aligns with broader movements towards health-conscious eating and environmental sustainability.

In addition, the expansion of the food service sector in regions such as Germany and the United Kingdom has contributed to increased olive consumption. As Mediterranean cuisine becomes more mainstream, restaurants are incorporating olives into a variety of dishes, further driving demand.

Countries such as Saudi Arabia are witnessing a heightened focus on health and wellness, leading to greater adoption of olive oil as a healthier cooking alternative. In addition, the growing popularity of Mediterranean cuisine across the region is contributing to increased olive consumption, as dishes featuring olives and olive oil become more mainstream.

Moreover, rising disposable incomes in emerging economies such as South Africa and Egypt are enabling consumers to seek higher-quality food products, including premium olive oils. This trend is further supported by the expansion of retail channels, including online platforms, which make it easier for consumers to access a variety of olive products. In Egypt, ambitious plans to become the world's largest table olive producer are also driving local consumption and production efforts, reflecting a commitment to enhancing the olive industry within the country.

Furthermore, the integration of olives into personal care products is gaining traction in markets such as South Africa, where consumers increasingly prefer natural ingredients in cosmetics. This diversification into personal care applications not only boosts demand but also positions olives as versatile ingredients in both food and beauty sectors.

Asia Pacific Olive Market Trends

Asia Pacific is expected to remain the fastest growing market for olives and is expected to grow at a CAGR of 7.6% from 2024 to 2030. The growth of the olive market in Asia is driven by several key factors that reflect changing consumer preferences and increasing health awareness. One major driver is the rising demand for healthy cooking oils, particularly extra virgin olive oil, which is gaining popularity in countries such as China and India. As consumers become more health-conscious, they are increasingly incorporating olive oil into their diets due to its numerous health benefits, including heart health and antioxidant properties. The booming economy and rising disposable incomes in these countries further facilitate this shift towards premium food products.

In addition, the expansion of Mediterranean cuisine in urban areas is contributing to increased olive consumption. Countries such as Japan and South Korea are seeing a growing number of Mediterranean restaurants, which feature olives and olive oil as essential ingredients in their dishes. This culinary trend not only raises awareness but also encourages consumers to experiment with olives at home.

Moreover, the growth of fast-food chains across the region is driving demand for olives as key ingredients in popular dishes such as pizzas and wraps. As urbanization continues to rise, particularly in countries such as Vietnam and Indonesia, the convenience of ready-to-eat meals that incorporate olives is appealing to busy consumers. Lastly, the increasing availability of imported olives from major producers such as Spain and Greece supports market growth, as these countries account for a significant share of olive imports in Asia.

Key Olive Company Insights

The competitive landscape of the olive market is characterized by a diverse array of players and strategic initiatives aimed at capturing market share across various regions. In Europe, prominent companies such as Deoleo SA, Farchioni Ollii SPA, and De Cecco di Filippo SPA dominate the olive oil segment, leveraging their extensive product portfolios and strong brand identities to maintain competitive advantages. These companies are actively expanding their sales footprints through innovative product launches and marketing strategies that emphasize the health benefits of olive oil, particularly in countries like Spain and Italy, which are major producers.

Key Olive Companies:

The following are the leading companies in the olive market. These companies collectively hold the largest market share and dictate industry trends.

- Cargill, Incorporated (U.S.)

- Deoleo (Spain)

- Del Monte Foods, Inc. (U.S.)

- Gallo Worldwide (U.S.)

- Borges International Group, S.L.U. (Spain)

- Sovena (Portugal)

- Sun Grove Foods Inc. (U.S.)

- EU Olive Oil Ltd (UK)

- Artajo Oil (Spain)

- Salov Group (Italy)

- Aceites Sandúa (Spain)

- Tucan Olive Oil Company Ltd (UK)

- Domenico Manca S.p.a. (Italy)

- Les Huiles d'Olive Lahmar (Tunisia)

- Grampians Olive Co. (Australia)

- Victorian Olive Groves (Australia)

- Gourmet Foods Inc. (U.S.)

- Olive Line International S.L.

- Chrisnas Olives

- Agrotiki S.A

Olive Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.1 billion

Revenue forecast in 2030

USD 38.4 billion

Growth rate (Revenue)

CAGR of 6.0% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Cargill, Incorporated (U.S.), Deoleo (Spain), Del Monte Foods, Inc. (U.S.), Gallo Worldwide (U.S.), Borges International Group, S.L.U. (Spain), Sovena (Portugal), Sun Grove Foods Inc. (U.S.), EU Olive Oil Ltd (UK), Artajo Oil (Spain), Salov Group (Italy), Aceites Sandúa (Spain), Tucan Olive Oil Company Ltd (UK), Domenico Manca S.p.a. (Italy), Les Huiles d'Olive Lahmar (Tunisia), Grampians Olive Co. (Australia), Victorian Olive Groves (Australia), Gourmet Foods Inc. (U.S.), Olive Line International S.L., Chrisnas Olives, Agrotiki S.A

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Olive Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global olive market report on the basis of product, application, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Olive Oil

-

Table Olive

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverage

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global olive market was valued at USD 25.5 billion in 2023 and is expected to reach USD 27.1 billion in 2024.

b. The global olive market is expected to expand at a compound annual growth rate (CAGR) of 6.0% from 2024 to 2030 to reach USD 38.4 billion by 2030.

b. Food and beverage were the largest application for olives and market revenue exceeded USD 10 billion in 2023. One of the primary drivers is the increasing demand for healthier food options. As consumers become more health-conscious, they are seeking out products that offer nutritional benefits, such as olives, which are rich in monounsaturated fats, antioxidants, and anti-inflammatory properties. This trend aligns with the rising popularity of the Mediterranean diet, which emphasizes the consumption of olives as a staple ingredient.

b. Some key players operating in the olive market include Cargill, Incorporated (U.S.), Deoleo (Spain), Del Monte Foods, Inc. (U.S.), Gallo Worldwide (U.S.), Borges International Group, S.L.U. (Spain), Sovena (Portugal), Sun Grove Foods Inc. (U.S.), EU Olive Oil Ltd (UK), Artajo Oil (Spain), Salov Group (Italy), Aceites Sandúa (Spain), Tucan Olive Oil Company Ltd (UK), Domenico Manca S.p.a. (Italy), Les Huiles d'Olive Lahmar (Tunisia), Grampians Olive Co. (Australia), Victorian Olive Groves (Australia), Gourmet Foods Inc. (U.S.), Olive Line International S.L., Chrisnas Olives, Agrotiki S.A

b. A key driver behind the olive market's growth is the increasing consumer awareness regarding health benefits associated with olives and olive oil. Olives are rich in antioxidants and healthy fats, which support heart health and overall wellness. This shift towards healthier dietary choices has led to a surge in demand for olive oil, particularly in non-European countries that are traditionally not associated with Mediterranean diets. As consumers become more informed about nutrition, they are increasingly aware of the health benefits associated with olive oil, particularly extra virgin olive oil (EVOO). Studies have shown that EVOO is rich in monounsaturated fats and antioxidants, which can lower bad cholesterol (LDL) while raising good cholesterol (HDL) levels. This has led to a heightened interest in incorporating olive oil into daily diets as a healthier fat alternative.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.