OLED Market Size, Share & Trends Analysis Report By Product (OLED Display, OLED Lighting), By Technology (AMOLED, PMOLED), By Panel Type (Rigid, Flexible, Others), By Display Size, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-303-3

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

OLED Market Size & Trends

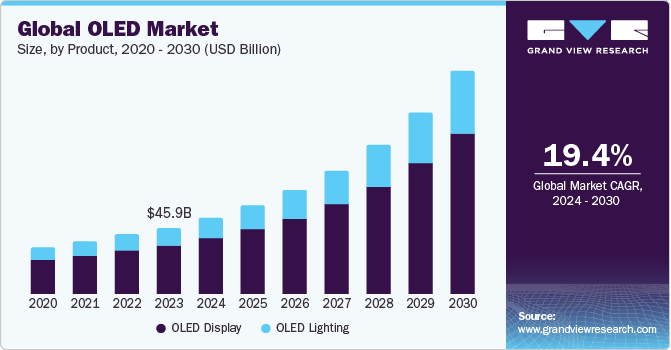

The global OLED Market size was estimated at USD 45.95 billion in 2023 and is expected to register a CAGR of 19.4% from 2024 to 2030. The market represents a significant sector in consumer electronics and display technology, providing advanced display solutions for various applications. The organic light-emitting diode (OLED) technology involves the use of organic compounds that emit light in response to an electric current, enabling the creation of high-quality, energy-efficient displays with superior contrast ratios and vibrant colors. This technology is widely adopted in various consumer electronics applications, such as smartphones, tablets, televisions, and wearable devices, as well as in automotive displays and lighting solutions.

The market growth is driven by factors, such as high demand for high-resolution displays, advancements in flexible & foldable screen technology, adoption of smart devices, and the need for energy-efficient & environmentally friendly display options. In addition, continuous innovation in OLED materials and manufacturing processes is expected to accelerate market growth further, enhancing both the performance and affordability of OLED display products. The rapid adoption of OLED displays in smartphones has been a key driver in the market growth. Smartphone manufacturers are increasingly turning to OLED technology due to its numerous advantages over traditional LCD screens, such as higher contrast ratios, faster response times, and better color reproduction. OLED displays also offer thinner and more flexible designs, allowing for innovative smartphone form factors and improved durability.

Furthermore, there is a high demand for better viewing experiences, particularly from smartphone and television consumers. Consumers expect high-quality displays that deliver vibrant colors, sharp images, and smooth motion. OLED technology meets these expectations by offering superior picture quality and an immersive viewing experience. The deep blacks and rich colors produced by OLED displays make content come alive, whether it's watching movies, playing games, or browsing photos. The demand for better viewing experiences is further fueled by the increasing popularity of high-resolution content, such as 4K and HDR video. OLED displays are well-suited to showcase these formats, providing crisp detail, enhanced contrast, and vivid colors that elevate the viewing experience to new heights.

As consumers become more discerning about display quality, OLED technology is expected to meet and exceed their expectations. Moreover, the rise of OLED displays in smart wearables, automotive displays, and AR/VR headsets is contributing to market growth. These devices require high-performance displays that are energy-efficient and offer excellent visibility in various lighting conditions, all of which are strengths of OLED technology. The versatility of OLED displays makes them ideal for a wide range of applications, driving their adoption across different industries. Overall, the rapid adoption of OLED displays in smartphones and the high demand for better viewing experiences are key factors driving the market growth.

Market Concentration & Characteristics

The degree of innovation in the OLED market is high. Manufacturers continually introduce advancements, such as flexible, transparent, and foldable OLED displays to meet evolving consumer demands for sleeker, more adaptable devices. Research efforts focus on enhancing color accuracy, brightness, and energy efficiency, resulting in vibrant displays with deeper blacks and extended battery life. Beyond traditional applications, OLEDs find use in lighting and wearable electronics, showcasing the market's innovative trajectory. Integration of AI further drives innovation, enhancing picture clarity, color refinement, and audio quality for immersive viewing experiences. Gaming-focused OLED TVs feature high refresh rates, NVIDIA G-SYNC certification, and AMD FreeSync compatibility, ensuring smooth gameplay. AI-powered personalization and accessibility enhancements cater to diverse consumer preferences, highlighting the market's commitment to innovation. For instance, in May 2024, LG Electronics introduced its latest lineup of AI-powered televisions featuring OLED and QNED technology, ranging from 43-inches to 97-inches. These TVs boast advanced AI features for improved picture quality and sound, gaming innovations, personalized user experiences, and enhanced accessibility and connectivity options, catering to a wide range of consumers. Thus, the market continues to evolve with ongoing technological advancements and AI integration, shaping the future of display technology.

The market experiences a high level of product launches, with manufacturers constantly introducing new and innovative offerings to meet consumer demand. These launches often showcase advancements in display technology, such as improved picture quality, enhanced brightness, and increased resolution. In addition, manufacturers frequently unveil new form factors, including flexible, foldable, and transparent OLED displays, expanding the range of applications for OLED technology. Product launches in the market also focus on incorporating cutting-edge features like AI integration, advanced sound processing, and gaming-specific enhancements to cater to diverse consumer needs and preferences. Major players in the industry regularly announce updates to their product lineups, introducing models with larger screen sizes, sleeker designs, and enhanced functionality. The competitive nature of the target market drives continuous innovation, prompting manufacturers to strive for excellence in product development and launch.

The impact of regulation in the market can be classified as Moderate. While OLED technology is subject to certain regulations related to safety standards and environmental considerations, these regulations do not significantly hinder innovation or market growth. However, compliance with standards, such as Restriction of Hazardous Substances (RoHS), and energy efficiency requirements may influence manufacturing processes and product design to some extent. In addition, regulations regarding patents and intellectual property rights play a role in shaping competition and market dynamics within the OLED industry. While regulations exist in the market, their impact is moderate, allowing for continued innovation and development in the sector.

The impact of product substitutes in the target market can be classified as low. OLED technology offers unique advantages, such as superior picture quality, energy efficiency, and flexibility, making it difficult for alternative display technologies to compete directly. While Liquid Crystal Display (LCD) and LED displays exist as substitutes, they often lack OLED's depth of color, contrast, and thinness. In addition, OLED's versatility in applications, such as lighting and wearable electronics, further reduces the impact of substitutes. While emerging technologies, such as MicroLED, could pose some competition in the future, their widespread adoption and commercialization still need to be improved compared to OLED. Overall, the low impact of substitutes highlights OLED's dominance and continued preference in the display market.

The end-user concentration in the OLED market can be classified as HIGH. Major electronics manufacturers such as Samsung Electronics, LG Electronics, Sony Corporation, and Panasonic Corporation heavily dominate the market, accounting for a significant portion of OLED display sales globally. These companies produce a wide range of OLED products, including televisions, smartphones, and tablets, catering to various consumer segments. Furthermore, the concentration is evident in the dominance of certain industries like consumer electronics and entertainment, where OLED displays are widely used in premium devices and high-end entertainment systems. Despite efforts by smaller players to enter the market, the established brands maintain a stronghold due to their extensive research, development, and marketing capabilities.

Product Insights

The OLED display segment dominated the market and accounted for the largest revenue share of 73.2% in 2023. The OLED display offers superior display quality, including deep blacks, vibrant colors, and high contrast ratios, which makes it highly desirable for consumer electronics. OLED technology is widely adopted in high-end smartphones, televisions, and wearable devices, driving significant demand. The flexibility and thinness of OLED panels allow for innovative device designs, such as foldable and curved screens, further increasing their appeal. Energy efficiency is another key factor, as OLEDs consume less power than traditional LCDs, extending battery life in portable devices. In addition, major investments by manufacturers in OLED production capabilities have expanded availability and reduced costs.

Continuous advancements in OLED technology and increasing consumer preference for premium displays solidify OLED's dominant market position. For instance, in June 2023, Samsung Electronics launched the Odyssey OLED G9 Gaming Monitors, featuring a 49-inch Dual QHD OLED screen with a 0.03ms response time, 32:9 ratio, and 240Hz refresh rate enabled by the Neo Quantum Processor Pro for advanced gaming and cinematic experience. These monitors offer superior visual quality, AI upscaling, and smart features like Smart TV Apps, IoT Hub, and Voice Assistance, enhancing both gaming and entertainment. The OLED lighting segment is expected to register the highest CAGR of 20.0% from 2024 to 2030.

OLED lighting provides unique advantages over traditional lighting technologies, such as energy efficiency and less power consumption, while providing high-quality light diffusion, which is particularly appealing in residential and commercial settings. Its thin, flexible nature and low weight allow for innovative and aesthetically pleasing lighting designs that cannot be achieved with conventional lighting. OLED lights also produce minimal heat and no UV emissions, making them suitable for sensitive environments like museums and galleries. The growing emphasis on sustainable and eco-friendly lighting solutions drives the adoption of OLED lighting.

The advancements in manufacturing processes are reducing costs and improving the performance of OLED lighting, further accelerating its market growth. Furthermore, OLED lighting is utilized in the automotive industry to create innovative and customizable lighting solutions for exterior and interior applications, enhancing aesthetics, visibility, and safety in vehicles. For instance, in May 2024, AUDI AG announced the launch of the Audi Q6 e-tron2, installed with second-generation digital OLED lighting technology with active digital light signatures, offering unprecedented customization, improved road safety, and enhanced vehicle communication through innovative lighting designs. This new lighting technology allows up to eight personalized light signatures via the myAudi app and MMI, making the Q6 e-tron2's lighting dynamic, interactive, and uniquely Audi.

Technology Insights

The AMOLED segment dominated the target market and accounted for the largest revenue share of 78.2% in 2023. The AMOLED segment is also expected to record the fastest CAGR of 19.8% from 2024 to 2030. The AMOLED displays offer superior image quality with vibrant colors and high contrast ratios, making them highly sought after for consumer electronics, such as smartphones, tablets, and televisions. In addition, AMOLED technology allows for flexible and curved displays, enabling innovative and sleek device designs that captivate consumers. The widespread adoption of AMOLED displays in flagship smartphones from leading manufacturers further solidifies its dominance in the market.

For instance, in July 2021, Samsung Electronics introduced the Galaxy F22, which featured a 6.4" Super AMOLED display with a 90Hz refresh rate and 6000mAh battery, catering to the needs of young consumers seeking all-around performance. Moreover, advancements in AMOLED manufacturing processes have led to cost reduction and increased production efficiency, making them more accessible to a broader range of consumers. Furthermore, the rising demand for energy-efficient displays has propelled the adoption of AMOLED technology, as it consumes less power than traditional LCDs. The PMOLED segment is expected to register a significant CAGR of 17.8% from 2024 to 2030.

The PMOLED technology offers cost-effectiveness and simplicity in manufacturing, making it highly attractive for a variety of applications. These displays are particularly well-suited for small, low-resolution screens used in devices like wearables, medical instruments, and industrial equipment. The growing demand for wearable technology, such as fitness trackers and smartwatches, significantly boosted the PMOLED market. In addition, advancements in PMOLED technology have improved their performance and extended their lifespan, making them more viable for diverse uses. The increasing trend of compact, efficient display solutions in various industries further accelerated their adoption. Thus, the combination of affordability, improved capabilities, and expanding application areas has driven the segment growth.

Panel Type Insights

The rigid panel type segment held the largest share of 45.4% in 2023 due to its well-established usage in a wide range of consumer electronics, such as smartphones, laptops, televisions, and tablets. Rigid OLED displays are known for their superior image quality, including vibrant colors and high contrast ratios, which have made them the preferred choice for many high-demand applications. In addition, the manufacturing processes for rigid OLED displays are more mature and cost-effective compared to flexible OLEDs, leading to lower production costs and higher returns. The durability and stability of rigid OLED displays make them suitable for everyday devices that require robust performance. The strong demand for high-quality visual experiences in both personal and professional settings has further driven the adoption of rigid OLEDs.

The flexible segment is expected to register the fastest CAGR of 19.9% from 2024 to 2030 due to its innovative design capabilities, allowing for the creation of bendable, foldable, and rollable displays that enhance user experience and device functionality. This technology has enabled the production of cutting-edge devices, such as foldable smartphones and curved monitors, which have garnered significant consumer interest. Moreover, flexible OLEDs offer advantages in durability and weight, making them ideal for portable electronics. The surge in demand for these versatile displays in various applications, including automotive, wearable tech, and consumer electronics, has further driven their market growth. Technological advancements and increased investment in flexible OLED manufacturing have also reduced costs and improved yield rates.

Display Size Insights

The below 6-inch display size segment held the largest share of 37.6% in 2023 due to the widespread adoption of OLED displays in smartphones, which are predominantly below 6 inches in size. The high demand for smartphones with superior display quality, including vibrant colors and high contrast ratios, has driven the growth of this segment. In addition, the compact size of these displays makes them ideal for other portable devices, such as smartwatches and fitness trackers, further expanding their market reach. The rapid advancement in OLED technology has enabled manufacturers to produce smaller displays with better energy efficiency and durability, meeting consumer expectations for high-performance devices.

Moreover, the economies of scale achieved through mass production of below 6-inch OLED panels have reduced costs, making these displays more affordable and accessible. The proliferation of mobile devices in both developed and emerging markets continues to fuel the demand for below 6-inch OLED displays. The 6- to 20-inch display size segment is expected to register the fastest CAGR of 20.0% from 2024 to 2030 due to the diverse application of these displays in devices, such as tablets, laptops, monitors, and automotive displays. This size range is increasingly popular for portable electronics and personal computing devices, which are seeing heightened demand as remote work and digital learning become more prevalent.

In addition, OLED technology offers superior display quality, including better color accuracy, contrast, and energy efficiency, which enhances the user experience in these devices. A rise in consumer preference for high-quality visual experiences in mid-sized screens has driven manufacturers to adopt OLED displays more broadly in this segment. Technological advancements have made it easier and more cost-effective to produce larger OLED panels, increasing their availability and adoption. The automotive industry’s shift toward advanced infotainment systems and digital dashboards has also contributed to the rapid growth of OLED displays in this size range. Overall, the combination of growing application scope and improving production efficiencies has propelled the segment growth.

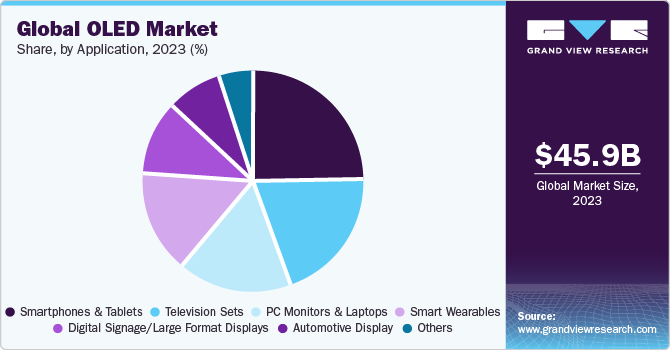

Application Insights

The smartphones and tablets segment dominated the market with a revenue share of 24.8% in 2023 due to the high demand for superior display quality in portable devices. OLED technology offers vibrant colors, deep blacks, and energy efficiency, making it highly desirable for smartphones and tablets. Manufacturers, such as Samsung Electronics and Apple, have widely adopted OLED displays in their flagship models, boosting market penetration. For instance, in October 2023, Samsung Electronics announced the launch of the Galaxy S23 FE in the Indian market, which featured an Exynos 2200 SoC and a 6.3-inch OLED display. The increasing consumer preference for high-resolution screens and immersive viewing experiences in handheld devices has driven the demand for OLED displays.

In addition, the flexibility and thinness of OLED panels enable innovative design possibilities, such as foldable and curved screens, further enhancing their appeal. The rapid technological advancements and frequent product launches in the smartphone and tablet market have sustained the growth of OLED adoption. The television sets segment is expected to register the fastest CAGR of 20.0% from 2024 to 2030 due to the increasing consumer demand for high-quality viewing experiences. OLED technology provides superior picture quality with deep blacks, vibrant colors, and wide viewing angles, which have become highly sought after in premium TVs. Major TV manufacturers like LG Electronics, Sony Corporation, Samsung Electronics, and Panasonic have heavily invested in OLED technology, launching a variety of OLED TV models that have been well-received by the market.

The growing popularity of 4K and 8K content has also driven the demand for OLED TVs, as these displays showcase such high-resolution content with stunning clarity. For instance, in May 2024, Samsung Electronics launched the S85D 4K OLED TV series in the U.S., available in 55-, 65-, and 77-inch sizes, featuring 4K 120Hz OLED panels and the NQ4 AI Gen2 processor. In addition, Samsung Electronics has also expanded its S90D series with new 42-, 48-, and 83-inch models, all featuring 144Hz OLED panels and enhanced gaming capabilities. Furthermore, the trend towards larger TV screens has benefited OLED technology, which can deliver consistent quality even at larger sizes. The advancements in OLED manufacturing processes have also helped in reducing costs, making OLED TVs more accessible to a broader range of consumers.

Regional Insights

The North America OLED market held a significant share of 28.1% in 2023. The market growth is driven by the increasing adoption of OLED displays in smartphones, tablets, and televisions. Major companies, such as Apple and Google, have integrated OLED displays into their flagship devices, boosting consumer awareness and demand. The automotive industry in North America is embracing OLED technology for applications, such as infotainment systems and digital instrument clusters, contributing to market growth. Furthermore, the growing demand for OLED displays in digital signage and lighting in commercial and residential sectors is driving market expansion. Furthermore, advancements in OLED technology, such as foldable and rollable displays, are generating excitement and driving adoption. The presence of key OLED manufacturers and suppliers in North America, such as Universal Display Corporation, is also driving market growth in the region.

U.S. OLED Market Trends

The OLED market in the U.S. is expected to witness considerable growth owing to increasing demand for high-quality displays in consumer electronics, such as smartphones, televisions, and wearable devices. The adoption of OLED technology in automotive displays and lighting is also contributing to this expansion. In addition, OLEDs are being increasingly used in digital signage, offering vibrant and energy-efficient displays for advertising and public information systems in commercial spaces. These advancements highlight the versatility and superior performance of OLED technology across various applications.

Asia Pacific OLED Market Trends

The Asia Pacific OLED market dominated the global industry in 2023 accounting for the largest revenue share at 34.9%. The region is also expected to register the fastest CAGR of 19.9% from 2024 to 2030. The region is home to major OLED manufacturers, such as Samsung Electronics and LG Electronics, which drive production and technological advancements. The high demand for consumer electronics, including smartphones and televisions, in countries, such as India, China, South Korea, and Japan, fuels market growth. In addition, the increasing adoption of OLED displays in various applications, such as automotive and wearables contributes significantly to market expansion. The substantial investments in R&D and manufacturing facilities in the region enhance production capabilities and innovation. Furthermore, the growing middle-class population with rising disposable incomes leads to higher consumption of advanced electronic devices. The presence of a robust supply chain and skilled workforce in the region ensures efficient production and distribution of organic light-emitting diode products.

The OLED Market in China held the largest share of 22.5% in 2023 due to its massive manufacturing capacity and the presence of leading OLED panel producers, such as Beijing BOE Display Technology Co., Ltd., and Tianma. The country's robust demand for advanced consumer electronics, including smartphones and televisions, drives the consumption of OLED displays. For instance, smartphone penetration in China has reached 72%, highlighting the extensive adoption of advanced display technologies in smartphones and tablets. In addition, supportive government policies and substantial investments in R&D and production facilities have strengthened China's position in the market.

Europe OLED Market Trends

The Europe OLED market is expected to register the second-fastest CAGR of 19.5% from 2024 to 2030 due to increasing demand for high-quality display technologies in consumer electronics, such as smartphones and televisions. Leading European countries, such as Germany and the UK, have shown significant growth in the adoption of OLED displays for premium devices. The automotive industry in Europe, with its emphasis on advanced display systems for vehicles, has also contributed to this growth. In addition, European consumers' preference for energy-efficient and high-contrast displays has driven the demand for OLED technology. The expansion of key players like LG Electronics and Samsung Electronics in the Europe OLED market has further accelerated this growth. Investments in R&D, the popular trend of smart homes, and the integration of AI and IoT devices using OLED screens have also played a significant role in regional market expansion.

The OLED market in Germany is experiencing significant growth, particularly in automotive displays, due to its strong automotive industry and focus on innovation. German automakers, such as Audi AG, BMW, and Mercedes-Benz, have been early adopters of OLED technology in their high-end vehicles, contributing to the country's dominance. The use of OLED displays in premium cars for features like instrument clusters, infotainment systems, and ambient lighting has propelled Germany to the forefront of OLED adoption in the automotive sector.

Key OLED Company Insights

Some of the key companies operating in the OLED Market include Samsung Electronics and LG Electronics, among others.

-

Samsung Electronics is a global leader in technology, renowned for its innovations in consumer electronics, semiconductors, and telecommunications. The company is a major player in the market, providing cutting-edge OLED displays for smartphones, televisions, and other electronic devices

-

LG Electronics is a global leader in consumer electronics, home appliances, and mobile communications, headquartered in South Korea. LG Electronics has a strong presence in the market with a diverse range of products, including TVs, refrigerators, washing machines, smartphones, and air conditioners. The company also offers innovative display technologies, such as OLED TVs and ThinQ AI, which enhance the user experience and offer vibrant colors and superior image quality

TDK Corporation and Universal Display Corporation are among the emerging companies in the target market.

-

TDK Corporation, based in Tokyo, Japan, is a leader in electronic solutions and technological innovation. TDK Corporation's product portfolio includes components and devices essential for organic light-emitting diode technology, such as high-frequency and protection devices, as well as sensors. The company focuses on demanding markets like automotive, industrial, and consumer electronics

-

Universal Display Corporation (UDC) is a leading developer and manufacturer of OLED technologies and materials. UDC holds a broad portfolio of OLED patents and is a pioneer in phosphorescent OLED (PHOLED) technology, which significantly enhances the energy efficiency and performance of OLED displays and lighting. The company supplies its proprietary UniversalPHOLED materials to major display and lighting manufacturers worldwide, including Samsung, LG, and others

Key OLED Companies:

The following are the leading companies in the OLED market. These companies collectively hold the largest market share and dictate industry trends.

- Samsung Electronics

- LG Electronics

- Sony Corporation

- AU Optronics Corp

- BOE Display

- IPG Automotive

- Robert Bosch GmbH

- TDK Corporation

- Rit Display

- Visionox

- eMagin Corporation

- Universal Display Corporation

Recent Developments

-

In November 2023, Universal Display Corporation signed long-term OLED material supply and license agreements with BOE Technology Group, extending their partnership. Universal Display would be supplying its UniversalPHOLED phosphorescent organic light-emitting diode materials and technology to BOE for use in its OLED displays, further fueling the proliferation of OLEDs in consumer electronics

-

In May 2024, LG Electronics launched a new range of AI-driven smart TVs in India, including the world’s largest OLED TV at 97 inches. It features real-time upscaling, Dolby Vision gaming, and advanced sound technologies. The TVs also have features, such as webOS with individual profiles, support for Dolby Vision & Dolby Atmos, and compatibility with Apple AirPlay & Google Chromecast

OLED Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 52.84 billion |

|

Revenue forecast in 2030 |

USD 152.83 billion |

|

Growth rate |

CAGR of 19.4% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, panel type, display size, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Taiwan; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Samsung Electronics; LG Electronics; Sony Corp.; AU Optronics Corp.; BOE Display; IPG Automotive; Robert Bosch GmbH; TDK Corp.; Rit Display; Visionox; eMagin Corp.; Universal Display Corp. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global OLED Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the OLED Market report based on product, technology, panel type, display size, application, and region:

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

OLED Display

-

OLED Lighting

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

AMOLED

-

PMOLED

-

-

Panel Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Rigid

-

Flexible

-

Others

-

-

Display Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Below 6 Inches

-

6 to 20 Inches

-

21 to 50 Inches

-

More than 50 Inches

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Smartphones & Tablets

-

PC Monitors & Laptops

-

Television Sets

-

Digital Signage/Large Format Displays

-

Smart Wearables

-

Automotive Display

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Taiwan

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global OLED market size was estimated at USD 45.95 billion in 2023 and is expected to reach USD 52.84 billion in 2024.

b. The global OLED market is expected to grow at a compound annual growth rate of 19.4% from 2024 to 2030 to reach USD 152.83 billion by 2030.

b. OLED displays segment held the largest share of 73.2% in 2023, driven by their superior quality and widespread use in high-end smartphones, TVs, and wearables. Their appeal lies in deep blacks, vibrant colors, and energy efficiency, with innovations like foldable and curved screens supported by continuous technological advancements and increased production capabilities

b. Key players in the OLED Market include Samsung Electronics, LG Electronics, Sony Corporation, AU Optronics Corp, BOE Display, IPG Automotive, Robert Bosch GmbH, TDK Corporation, Rit Display, Visionox, eMagin Corporation, and Universal Display Corporation.

b. The OLED market is experiencing rapid growth due to the widespread adoption of OLED displays in smartphones, increasing demand for better viewing experiences from smartphone and television consumers, rising popularity of AMOLED displays in wearables, smartphones, and AR/VR headsets, and the continuous advancement of OLED technology.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."