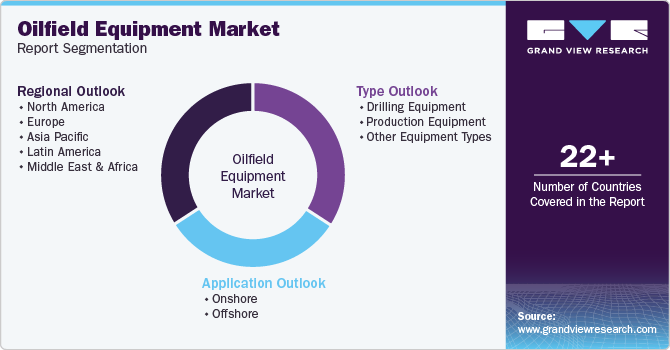

Oilfield Equipment Market Size, Share & Trends Analysis Report By Type (Drilling Equipment, Production Equipment, Others), By Application (Onshore, Offshore), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-173-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Oilfield Equipment Market Size & Trends

The global oilfield equipment market size was valued at USD 126.91 billion in 2023 and is expected to expand at a CAGR of 3.1% from 2024 to 2030. This growth is attributable to increasing energy demand, technological advancement in oilfield equipment, rising investment in exploration and production, regulatory frameworks & environmental concerns, and geopolitical factors. Volatility in the political situation in major oil-producing countries poses a risk to supply chains and production capabilities. Such factors as geopolitical risks affect the supply of oil and the prices, which in turn affects the need to spend more on ensuring business continuity by acquiring better equipment.

The growing global population and rapid industrialization, especially in emerging economies, have increased energy demand. Due to the countries' energy demand, there is a high emphasis on the exploration and production of oil and gas, leading to the increased demand for oilfield equipment. Moreover, technological advancements in drilling techniques, including horizontal drilling and hydraulic fracturing, have highly boosted the effectiveness of oil extraction procedures. These advancements also lower operating expenses while increasing recovery rates from the current fields, thereby driving the need for advanced oilfield equipment.

With fluctuating crude oil prices, companies invest heavily in exploration and production activities to discover new reserves and enhance production from existing fields. Many countries emphasize self-dependency for energy to avoid uncertainties and economic losses, leading to exploration driving the demand for sophisticated oilfield equipment to support these operations. Governments worldwide are implementing stricter regulations regarding environmental protection and safety standards in the oil and gas sector. This has increased demand for advanced equipment that complies with these regulations while minimizing ecological impact.

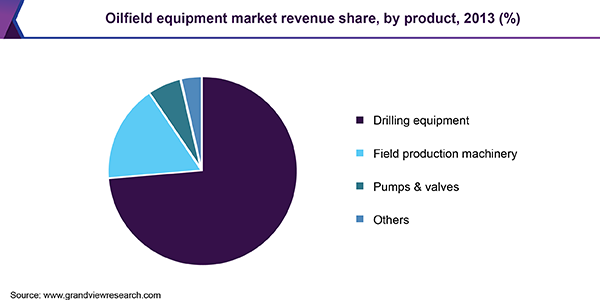

Type Insights

The production equipment segment dominated the market and accounted for a revenue share of 43.9% in 2023. Production equipment refers to the tools used after the drilling phase, which include separators, pumps, compressors, storage tanks, and flow lines. An increase in energy consumption worldwide propels demand for enhanced production capabilities. Moreover, many existing production facilities require upgrades or replacements due to wear over time, driving demand for new production technologies and adopting advanced recovery methods, which increases the need for specialized production equipment capable of handling complex extraction processes.

The drilling equipment segment is expected to grow at a significant CAGR from 2024 to 2030 due to increased exploration activities, technological advancement, rising oil prices, and regulatory compliances. As global energy demands rise, companies invest in exploration activities in new regions, necessitating advanced drilling technologies. Innovations such as horizontal drilling and hydraulic fracturing have increased efficiency and reduced costs, driving demand for modern drilling rigs and associated equipment. Stricter regulations regarding safety and environmental protection rise demand for advanced & efficient drilling technologies.

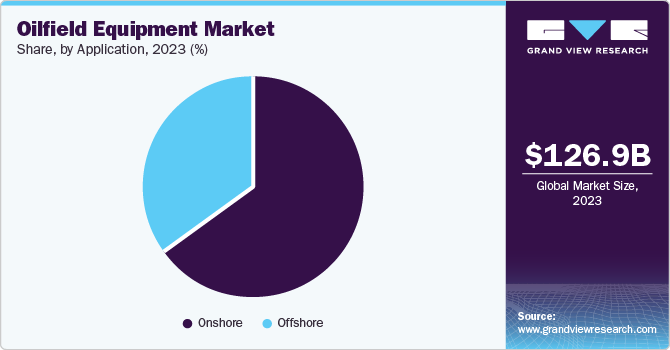

Application Insights

The onshore segment dominated the market and accounted for the largest revenue share in 2023. Onshore oilfield exploration mainly comprises drilling and producing crude oil and natural gas from onshore fields. Some of the equipment used in these operations include drilling rigs, well-completion tools, production equipment, and transportation equipment. For instance, using enhanced technologies such as hydraulic fracturing and horizontal drilling techniques has significantly improved the effectiveness of onshore oil extraction. At the same time, the rate of production and cost of operations have gone considerably down.

The offshore segment is expected to grow at the fastest CAGR during the forecast period. As onshore reserves depleted, companies increasingly turn to offshore fields with vast untapped resources, particularly in deep-water regions where advanced technology is required. In addition, advancements in subsea technology and floating production systems have made it feasible to extract oil from deeper waters more efficiently, driving investment into offshore projects. While offshore drilling poses environmental challenges, advancements in safety protocols and spill-prevention technologies drive market growth.

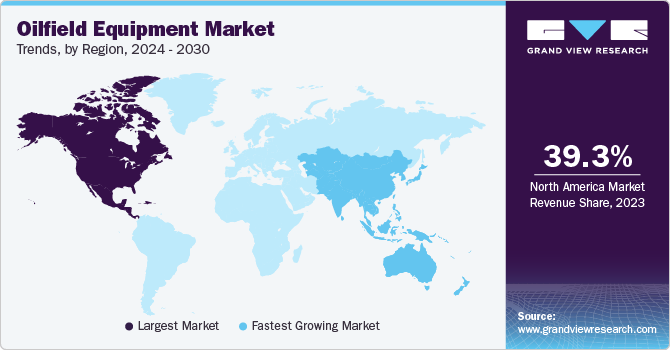

Regional Insights

North America oilfield equipment market held the largest largest revenue share of 39.3% in 2023 due to growing demand for energy, increasing exploration & production activities, technological advancement, and geopolitical factors that impact imports. The resurgence of oil prices following periods of volatility has increased exploration and production activities. Companies are investing heavily in drilling new wells and enhancing existing operations to maximize output. This trend is particularly evident in regions such as the Permian Basin, where technological advancements have made previously uneconomical reserves viable.

U.S. Oilfield Equipment Market Trends

The U.S. oilfield equipment market held a significant market share in North America in 2023, owing to technological advancement, economic conditions, and geopolitical dynamics. The oilfield equipment market has seen considerable innovation over the years. Advances in drilling technologies, such as hydraulic fracturing (fracking) and horizontal drilling, have increased the efficiency and productivity of oil extraction. In addition, automation and digitalization in operations enhance operational efficiency and reduce costs. The economy's overall health plays a crucial role in determining investment levels within the oil sector. The U.S. is a developed country that ensures technological and financial support.

Europe Oilfield Equipment Market Trends

Europe oilfield equipment market held a significant revenue share in 2023. European countries are increasingly adopting stringent environmental regulations aimed at reducing carbon emissions and promoting sustainable practices within the oil and gas sector. This shift has led to investments in eco-friendly equipment and technologies that comply with these regulations. For instance, the European Union’s Green Deal aims for net-zero greenhouse gas emissions by 2050, prompting operators to invest in cleaner technologies. Despite a global push towards renewable energy sources, there remains a significant demand for oil and gas exploration in Europe due to geopolitical tensions and energy security concerns. Countries like Norway continue to explore new offshore fields, which drives demand for specialized drilling equipment and services. For Instance, The Norwegian Ministry of Energy has awarded 62 new production licenses on the Norwegian continental shelf in the APA 2023 licensing round, an increase from last year’s 47 licenses.

Russia oilfield equipment market held a substantial market share in 2023. Russia has been focusing on increasing its domestic oil production to meet both local demand and export needs. In Russia, crude oil production reached approximately 10.8 million barrels per day in 2023, with projections indicating a steady increase due to new field developments and enhanced recovery techniques.

Asia Pacific Oilfield Equipment Market Trends

The Asia Pacific oilfield equipment market is expected to grow at the fastest CAGR from 2024 to 2030. The rapid economic growth in countries such as China and India have led to an unprecedented increase in energy demand. According to the International Energy Agency (IEA), Asia Pacific is projected to account for nearly 80% of international oil trade by 2040. This rising demand necessitates enhanced exploration and production activities, thereby driving the need for advanced oilfield equipment. Governments in several Asia Pacific countries are actively promoting investments in their oil and gas sectors through favorable policies and incentives. For instance, initiatives like “Make in India” aim to boost domestic manufacturing capabilities, including oilfield equipment production.

India oilfield equipment market is expected to grow significantly during the forecast period. India is one of the fastest-growing economies in the world, leading to a surge in energy demand. This rising demand for energy directly correlates with increased investments in oilfield equipment as companies seek to enhance production capabilities. The liberalization of FDI policies in India’s oil and gas sector has attracted significant foreign investment, which is crucial for enhancing infrastructure and technology transfer.

MEA Oilfield Equipment Market Trends

The MEA oilfield equipment market is expected to grow significantly during the forecast period. The Middle East remains one of the largest producers of crude oil globally. Countries like Saudi Arabia, Iraq, and the United Arab Emirates continuously invest in new exploration projects to enhance their production capabilities. The governments in this region are promoting investments in infrastructure development related to the production and processing of oil. Saudi Vision 2030 aims to diversify economies from oil dependency while enhancing production capabilities through modernized equipment and facilities.

Key Oilfield Equipment Company Insights:

Some of the key companies in the oilfield equipment market include SLB, Baker Hughes Company, Halliburton, Weatherford, Sinopec Oilfield Equipment Corporation, and others. Organizations are focusing on innovative and efficient trail running shoe offerings to increase the consumer base. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

SLB, formerly Schlumberger, is a global technology company specializing in oilfield services and equipment. It provides a comprehensive range of products and services for the oil and gas industry, including drilling, production, and reservoir management. SLB’s expertise in oilfield equipment encompasses well construction, production systems, and pressure control.

-

Sinopec Oilfield Equipment Corporation, formerly Kingdream Public Limited Company, is a China-based company specializing in researching, developing, manufacturing, and distributing petroleum engineering equipment and tools. Their offerings include drilling equipment, oil and gas engineering tools, ground construction equipment, and energy-saving technologies. Sinopec Oilfield Equipment Corporation provides comprehensive solutions to enhance efficiency and safety in oil and gas extraction and production.

Key Oilfield Equipment Companies:

The following are the leading companies in the oilfield equipment market. These companies collectively hold the largest market share and dictate industry trends.

- SLB

- Baker Hughes Company

- Halliburton

- Weatherford

- NOV

- TechnipFMC plc

- Saipem

- Sinopec Oilfield Equipment Corporation

- China Oilfield Services Limited

- Aker Solutions

- Petrofac Limited

- Nabors Industries Ltd.

- Tenaris

- Subsea7

Recent Developments

-

In April 2024, SLB entered into an agreement to acquire ChampionX, a Texas, U.S.-based pumps and pumping equipment company. The primary aim of this acquisition is to enhance SLB's position in the production space by integrating ChampionX's expertise in production chemicals and artificial lift technologies with SLB's extensive international presence and advanced technology portfolio.

-

In August 2023, Halliburton PTT Exploration and PTT Exploration and Production Public Company Limited signed a Memorandum of Understanding (MoU) to market and co-innovate digital transformation solutions for the energy sector in Thailand, Malaysia, and Vietnam. In collaboration both companies are expected to develop advanced digital solutions to enhance operational efficiency. Initial solutions include PTTEP’s WellSafvy, Well Delivery Process, and APEX, built on Halliburton’s DecisionSpace 365 suite.

Oilfield Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 130.64 billion |

|

Revenue forecast in 2030 |

USD 156.50 billion |

|

Growth rate |

CAGR of 3.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, Application, and Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Norway, Russia, France, Netherlands, China, India, Australia, Malaysia, Brazil, Argentina, Saudi Arabia, UAE and Kuwait |

|

Key companies profiled |

SLB; Baker Hughes Company; Halliburton; Weatherford; NOV; TechnipFMC plc; Saipem; Sinopec Oilfield Equipment Corporation; China Oilfield Services Limited; Aker Solutions; Petrofac Limited; Nabors Industries Ltd.; Tenaris and Subsea7 |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Oilfield Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oilfield equipment market report based on type, application, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Drilling Equipment

-

Production Equipment

-

Other Equipment Types

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Norway

-

Russia

-

France

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Australia

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."