Oilfield Equipment Rental Market Size, Share & Trends Analysis Report By Type (Drilling Equipment, Pressure & Flow Control), By Application (Onshore, Offshore), By Region (North America, Europe, Asia Pacific), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-353-9

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Oilfield Equipment Rental Market Trends

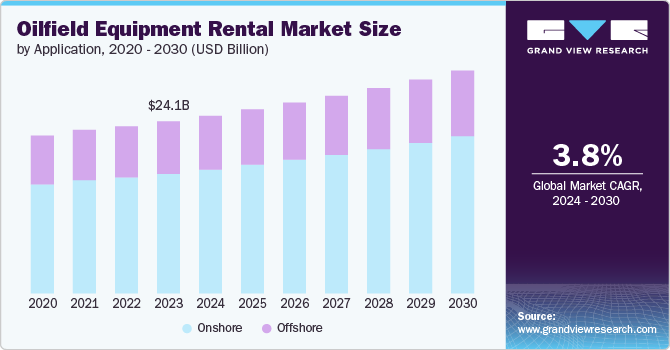

The global oilfield equipment rental market size was estimated at USD 24.13 billion in 2023 and is anticipated to grow at a CAGR of 3.8% from 2024 to 2030. Rising global investments in oil & gas exploration and production (E&P) activities are a major driver for the market. Crude oil and natural gas demand is increasing, leading operators to ramp up drilling and production.

Moreover, oil & gas operators increasingly favor rental over ownership of oilfield equipment. Renting provides flexibility, reduces upfront capital expenditure, and transfers maintenance responsibilities to the rental provider. Furthermore, oilfield equipment is becoming more advanced, enabling economical exploration of unconventional and deep hydrocarbon resources like shale, tight gas, and heavy oil. Technologies like horizontal drilling, deep drilling, and RFID circulation subs are being widely adopted. These aforementioned factors are anticipated to drive the demand for the market.

Drivers, Opportunities & Restraints

The oilfield equipment rental market is driven by increasing exploration and production (E&P) activities, technological advancements enabling economical extraction of unconventional resources like shale oil and gas using horizontal drilling and deep drilling techniques, and a shift towards rental models by operators to reduce upfront capital expenditure and gain flexibility. For example, the shale oil and gas boom in North America has fueled extensive drilling activities, creating significant demand for rental equipment. For instance, according to the Energy Institute Statistical Review of World Energy 2024 report oil production in North America increased from 1,109.6 million tons in 2019 to 1,207.5 million tons in 2023.

Growth opportunities exist in regions such as North America, Europe, and Asia Pacific. North America is expected to be the largest market due to the shale boom. Europe has major producers like Norway, Russia, Germany, and the UK investing in drilling to meet demand. Asia Pacific has enormous growth potential driven by infrastructure projects, energy demand, and population growth, with governments keen to reduce oil and gas imports. Deepwater drilling is also expanding in regions like Brazil, Norway, and the UK, enabled by subsea technology advancements.

Volatility in global oil prices impacts E&P investments, with prolonged low prices leading to project delays and cancellations. The increasing complexity of drilling, with the need for specialized equipment for unconventional reserves, puts additional strain on rental providers as demand varies by well. For example, the search for new reserves and the depletion of existing ones has necessitated the use of new extraction techniques and increased drilling complexity.

Application Insights

“The demand for onshore application segment is expected to grow at a CAGR of 4.0% from 2024 to 2030 in terms of revenue”

The onshore application segment led the market and accounted for 69.5% of the global revenue share in 2023. The market is expected to witness robust growth driven by rising investments in unconventional oil & gas production, particularly shale and coal seam gas. Countries like the U.S., Canada, China, and Australia have huge onshore shale and coal seam gas reserves that are being actively developed using advanced drilling technologies. For example, extensive shale oil and gas mining is being carried out in the U.S. and Canada using sophisticated drilling rigs, and horizontal drilling equipment, fueling demand for rental oilfield equipment.

Moreover, the offshore segment is expected to grow at a notable CAGR from 2024 to 2030. This is due to the expansion of deepwater and ultra-deepwater drilling in regions like Brazil, Norway, the UK, and the U.S. Gulf of Mexico. Advancements in subsea technology and equipment are enabling operators to explore deeper waters, creating opportunities for rental service providers. For instance, in the U.S. Gulf of Mexico, the rising number of deepwater and ultra-deepwater wells is driving demand for rental equipment like blowout preventers (BOPs), valves, manifolds, and other specialized tools to handle the challenges of high-pressure, high-temperature offshore wells. As operators continue to push the boundaries of offshore drilling technology, the need for reliable and efficient rental equipment will remain a key driver of the offshore market.

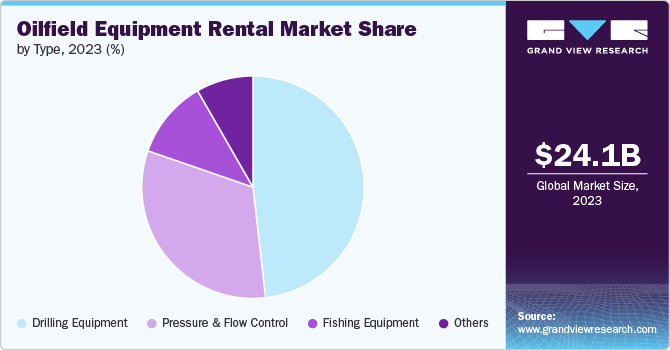

Type Insights

“The demand for fishing equipment type segment is expected to grow at a CAGR of 4.4% from 2024 to 2030 in terms of revenue”

The drilling equipment type segment led the market and accounted for 48.2% of the global revenue share in 2023. This segment is expected to dominate the market in the coming years, driven by the rising use of technologically advanced drilling equipment for onshore shale oil extraction, particularly in North America. Extensive shale mining is being carried out in the U.S. and Canada using sophisticated drilling rigs and associated equipment, fueling demand in the market. According to the International Institute of Sustainable Development (IISD), the oil & gas industry in Canada is anticipated to increase oil production by approximately 30% from 2020 to 2030. The growing investments in the oil & gas industry in Canada are expected to propel the market demand over the forecast period.

Fishing operations type segment is anticipated to experience growth at a significant CAGR from 2024 to 2030. These are commonly required to retrieve stuck drill pipes, tools, or other objects from the wellbore. The growing complexity of drilling, particularly in shale, is leading to more frequent fishing jobs. For example, in the U.S. Gulf of Mexico, the rising number of deepwater and ultra-deepwater wells is driving demand for advanced fishing equipment to handle the challenges of retrieving stuck tools from high-pressure, high-temperature wells. As operators continue to push the boundaries of drilling technology, the need for reliable and efficient fishing equipment will remain a key driver of the oilfield equipment rental market.

Regional Insights

“U.S. to witness fastest market growth at 3.8% CAGR”

The North America oilfield equipment rental market is expected to dominate the global market, driven by rising hydrocarbon production. The U.S. and Canada have huge onshore shale reserves that are being actively developed using advanced drilling technologies, fueling demand for rental equipment. Extensive shale oil & gas mining is being carried out in the region, driving the drilling equipment segment.

U.S. Oilfield Equipment Rental Market Trends

The oilfield equipment rental market in the U.S. is estimated to grow at a significant CAGR of 3.8% over the forecast period. The U.S. is the fastest-growing market for oilfield equipment rental in North America. Shale oil and gas production is booming in the country, with extensive use of horizontal drilling, deep drilling, and other advanced technologies. This has led to a surge in demand for rental drilling rigs, pressure & flow control equipment, and fishing equipment.

Europe Oilfield Equipment Rental Market Trends

Europe has major oil and gas producing countries like Norway, Russia, Germany, and the UK investing in drilling activities to meet the growing demand for hydrocarbons. Norway and the UK are ramping up deep water drilling in the North Sea, necessitating the rental of advanced subsea equipment. The region is expected to witness steady growth in the oilfield equipment rental market over the forecast period.

Asia Pacific Oilfield Equipment Rental Market Trends

Asia Pacific has enormous potential for growth in the oilfield equipment rental market driven by numerous infrastructure projects, massive energy demand, and a growing population in countries like China, India, and Indonesia. Governments in the region are keen to invest in exploring more oilfields to reduce dependence on oil and gas imports. Rising onshore drilling activities in countries like China and Australia are expected to drive demand for rental drilling equipment in the region.

Key Oilfield Equipment Rental Company Insights

Some key players operating in the market include Schlumberger, Baker Hughes, and GE Company among others.

-

Schlumberger Limited is a leading oilfield services company, offering production, drilling, and processing technology to the oil & gas industry worldwide. It operates through four divisions - Reservoir Characterization, Drilling, Production, and Cameron. Schlumberger supplies its products & services from exploration through production, including integrated pipeline solutions for hydrocarbon recovery. The company has an operational presence in North America, Latin America, Europe, Africa, the Middle East, and Asia. Schlumberger is headquartered in Texas, U.S., and has around 111,000 employees globally.

-

Baker Hughes Company is the top-most energy technology company providing solutions for energy and industrial customers worldwide. The company operates through 4 segments - Oilfield Equipment, Oilfield Services, Turbomachinery & Process Solutions, and Digital Solutions. It offers a broad portfolio of technologies and services, including oilfield services, oilfield equipment, turbomachinery, and digital solutions. The company has a presence in more than 120 countries and employs around 57,000 people.

-

Halliburton Company is the products and services provider for the energy industry. It operates through two divisions - Completion and Production, and Drilling and Evaluation. It offers a range of services and products for oil and gas exploration, development, and production, including well construction, completion, and production. The company has a global presence and employs around 49,000 people worldwide. Halliburton is headquartered in Houston, Texas, U.S.

National Oilwell Varco and Worley are some emerging market participants in the market.

-

NOV Inc., formerly National Oilwell Varco, is a multinational corporation based in Texas, U.S. It is a global provider of equipment and components used in oil & gas production and drilling operations, oilfield services, and supply chain integration services to the upstream oil & gas industry. The company has its operations in more than 500 locations across six continents, operating through 3 reporting segments: Wellbore Technologies, Rig Technologies, and Completion & Production Solutions.

-

Worley is a global provider of project and asset services in the energy, chemicals, and resources sectors. The company provides expertise in engineering, procurement, and construction, and offers a wide range of consulting and advisory services. The company is headquartered in North Sydney, Australia. Worley's key business segments include Advisian, Energy & Chemical Services, and Major Projects & Integrated Solutions.

Key Oilfield Equipment Rentals Companies:

The following are the leading companies in the oilfield equipment rentals market. These companies collectively hold the largest market share and dictate industry trends.

- Schlumberger

- Baker Hughes

- GE company

- Halliburton

- Weatherford

- Technip

- Superior Energy Services

- Transocean

- BJ Services

- Petrofac

- COSL - China Oilfield Services Limited

- Worley

- McDermott International Inc.

- Bechtel Corporation

- National Oilwell Varco

Recent Developments

-

In May 2024, TAQA, a leading energy company, launched Threlix, an innovative drilling technology designed to minimize downtime and boost efficiency for oil & gas operators. Threlix addresses the challenges posed by drilling dysfunctions like vibration and torsional oscillations, which are commonly encountered when using Rotary Steerable Systems. By mitigating these issues, Threlix aims to enhance drilling reliability and reduce costs for operators.

Oilfield Equipment Rental Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 24.89 billion |

|

Revenue forecast in 2030 |

USD 31.22 billion |

|

Growth Rate |

CAGR of 3.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Russia; Norway; UK; Netherlands; Germany; Japan, China; India; Indonesia; Brazil; Argentina; Venezuela; Kuwait; Saudi Arabia; UAE; Nigeria; Iraq; Qatar |

|

Key companies profiled |

Schlumberger; Baker Hughes; GE company; Halliburton; Weatherford; Technip; Superior Energy Services; Transocean; BJ Services; Petrofac; COSL - China Oilfield Services Limited; Worley; McDermott International Inc.; Bechtel Corporation; National Oilwell Varco |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Oilfield Equipment Rental Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oilfield equipment rental market based on the type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Drilling Equipment

-

Drill Pipe

-

Drill Collar

-

Hevi-Wate

-

Others

-

-

Pressure & Flow Control

-

Blow Out Preventer

-

Valves & Manifolds

-

Others

-

-

Fishing Equipment

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Russia

-

Norway

-

UK

-

Netherlands

-

Germany

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

Venezuela

-

-

Middle East & Africa

-

Kuwait

-

Saudi Arabia

-

UAE

-

Nigeria

-

Iraq

-

Qatar

-

-

Frequently Asked Questions About This Report

b. The global oilfield equipment rental market size was estimated at USD 24.13 billion in 2023 and is expected to reach USD 24.89 billion in 2024

b. The oilfield equipment rental market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.8% from 2024 to 2030 to reach USD 31.22 billion by 2030

b. North America is expected to dominate the global oilfield equipment rental market, given growing unconventional hydrocarbon production in the region. The U.S. and Canada have huge onshore shale reserves that are being actively developed using advanced drilling technologies, fueling demand for rental equipment

b. Some of the key players operating in the oilfield equipment rental market include Schlumberger, Baker Hughes, GE company, Halliburton, Weatherford, Technip, Superior Energy Services, Transocean, BJ Services, Petrofac, COSL - China Oilfield Services Limited, Worley, McDermott International Inc., Bechtel Corporation, National Oilwell Varco

b. Rising global investments in oil & gas exploration and production (E&P) activities is a major driver for the oilfield equipment rental market. Crude oil and natural gas demand is increasing, leading operators to ramp up drilling and production

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."