- Home

- »

- Petrochemicals

- »

-

Oilfield Chemicals Market Size, Share & Trends Report, 2030GVR Report cover

![Oilfield Chemicals Market Size, Share & Trends Report]()

Oilfield Chemicals Market Size, Share & Trends Analysis Report By Product (Rheology Modifiers, Inhibitors), By Application (Production) By Location (Onshore), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-683-7

- Number of Report Pages: 175

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Oilfield Chemicals Market Size & Trends

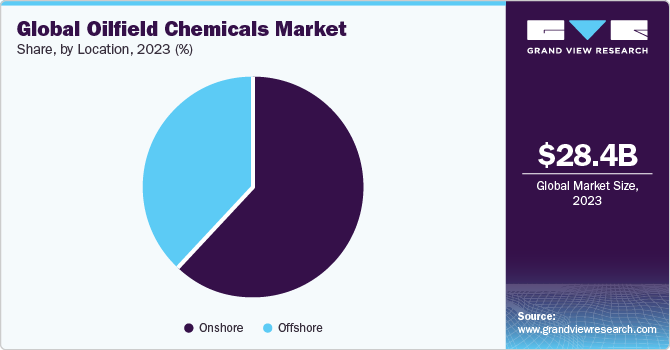

The global oilfield chemicals market size was valued at USD 28.43 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 3.2% from 2024 to 2030. This growth is attributed to the renewed robustness in oil exploration & production activities due to the shale gas revolution and technological developments to explore oil & gas from mature and aged wells. Oilfield chemicals play a crucial role in various stages of crude oil production, contributing to the efficiency, safety, and environmental sustainability of oilfield operations.

According to RIMPRO India, chemicals designed for use in oil drilling and gas exploration enhance the efficiency and productivity of these operations. They play a pivotal role in safeguarding equipment and pipes against corrosion and facilitating the separation of oil and water, preventing the formation of emulsions during the oil drilling process. Thus, the advancing demand for oil & gas is anticipated to drive the product demand in the region over the forecast period.

However, the increasing adoption of renewable energy sources, such as solar and wind power, aims to reduce reliance on fossil fuels. As countries and industries transition to cleaner energy alternatives, there may be a decrease in the demand for traditional oil & gas exploration and production activities. This, in turn, is expected to limit the need for certain oilfield chemicals used in these activities. Moreover, the renewable energy transition may result in a decline in oil & gas exploration activities. With a reduced emphasis on expanding oil & gas reserves, there could be a decrease in the demand for oilfield chemicals related to exploration, such as drilling fluids and reservoir assessment chemicals.

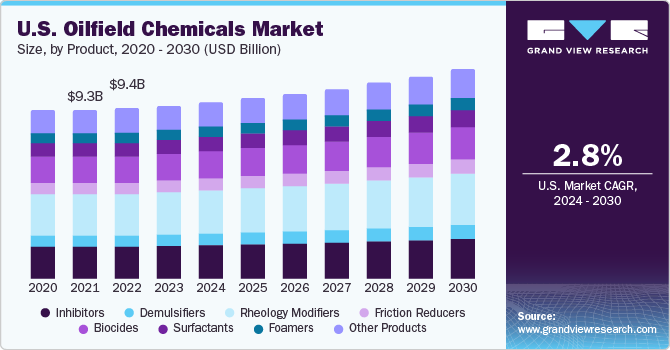

The U.S. is a major consumer of the product in North America with a revenue share of 80.7% in 2023. According to the U.S. Energy Information Administration (EIA), the country is the top producer of oil products in the world with an average production of 12.3 million barrels of oil per day witnessed in 2022. Presently, most oil produced in the country is derived from unconventional oil drilling activities as the conventional deposits have been tapped to a large extent. New technologies have enabled firms to increase offshore oil extraction activities that require drilling at increased depths under the ocean bed. Thus, the advancing demand for deep drilling activities in the U.S. is anticipated to drive the product demand over the forecast period.

Product Insights

Rheology modifiers segment dominated the market with a revenue share of 24.7% in 2023. This is attributed to the fact that rheology modifiers work to alter the rheological properties of an oil well by acting as an additive in synthetic-based drilling fluid as well as water and oil emulsions. Rheology deals with the deformation and flow of materials when enough stress or force is applied to them. The rheological properties of an oil well deal with its key characteristics such as yield, stress, viscosity, compliance toward change, and relaxation time taken by the oilwell.

Microfibrillated cellulose (MFC) is one of the key rheological modifiers used in oilfield operations. It provides stabilization due to low shear rates and at the same time, is easier to pump than other solutions such as xanthan gum due to MFC’s high viscosity. MFC is also used to transport small particles beneath the reservoir surface in a fracturing liquid as it helps the particles flow in water while being suspended. Its ability to work in harsh conditions, as well as its being made of cellulose, a common natural polymer, makes it a viable alternative for safe usage in diverse environments.

Inhibitors is another product anticipated to witness growth over the forecast period. Corrosion is a major problem in oilfield exploration projects, damaging the equipment and infrastructure and inflicting a cost of over USD 1.3 billion worldwide in 2022, according to the Saudi Association of Corrosion Engineers (SACE). The extracted oil products contain impurities such as carbon dioxide, hydrogen sulfide, and others, which react with the metal surfaces of pipelines used to transport oil, resulting in corrosion. Hence, water-soluble inhibitors, including amides, long-chain amines, or imidazoline, are used to control the rate of corrosion by forming a thin layer on the metal surface.

Application Insights

Workover & completion application dominated the market with a revenue share of 40.9% in 2023. This is attributed to the fact that workover & completion chemicals are used by oil companies after the extraction of oil from the wells. Many of them are solid-free fluids used for drilling purposes and act to complete various tasks such as fracture stimulation, water shut-off, gravel packing, acid stimulation, cleanout of wax, gravel packing, and perforations.

Completion refers to the process of making a well ready for production after drilling. Chemicals are used in various stages of this process to enhance reservoir connectivity and ensure well integrity. Perforating fluids are used during perforation, where holes are formed in the casing and cement to connect the wellbore with the reservoir. Other chemicals such as fracturing fluids are used in the hydraulic fracturing process involving the injection of fluids to create fractures in the reservoir, thereby improving production rates.

Drilling is another segment anticipated to witness growth over the forecast period. Oilfield chemicals are applied in gas and oil exploration activities to improve the efficiency of drilling operations in a variety of ways such as separating water & oil and preventing corrosion in pipes and other equipment used in the project. Moreover, heavy equipment and pipes used during the drilling process are also susceptible to damage from corrosion caused by exposure to carbon dioxide, oxygen, or hydrogen sulfide. This leads to losses and high maintenance costs for organizations involved in drilling projects. Layers of corrosion inhibitors are used as a coating on equipment, and they react with corrosion agents such as oxygen to render them inactive.

Location Insights

Onshore location dominated the market with a revenue share of 61.3% in 2023. This is attributed to technological advancement, enhanced oil recovery techniques, and a surge in demand for oil products, which have contributed to an increase in onshore exploration activities around the globe, especially in developing economies. For instance, according to Brazil’s Oil and Gas Producers Association (ABPIP), Brazil’s small and medium-sized oil companies are expected to invest USD 7.74 billion in onshore fields by 2029.

The oil output from onshore basins in the country is expected to increase from 150,000 barrels in 2016 to 500,000 barrels by 2029, mainly due to the participation of private firms such as PetroReconcavo and Eneva. These companies led the initiative of acquiring oilfields from state-run firm, Petrobras, and invested in expanding the capacity of the already existing oil fields.

Onshore oil fields refer to the oil exploration sites located beneath land surfaces. Exploratory wells are drilled in the land surface to determine the presence of oil and the reservoir’s size as well as characteristics. The exploration activity follows a sequence of steps such as drilling, extraction, production, and completion processes. These steps involve the usage of chemicals to facilitate processes, improve efficiency, provide a safe environment, and protect equipment from corrosion.

Offshore is another segment anticipated to witness growth over the forecast period. Offshore oilfields are locations beneath the seabed that contain oil reserves. The exposure of oil exploration equipment to marine environment makes it susceptible to corrosion and therefore, necessitates the usage of oilfield chemicals as anti-corrosive agents. The chemicals are also used for other tasks such as separating water from oil, preventing the formation of hydrates, and maintaining the integrity of oilfield infrastructure.

Regional Insights

North America region dominated the market with a revenue share of 41.8% in 2023. This is attributed to the fact that North America is a key producer of oil and associated products owing to the presence of major oil-producing economies such as the U.S., Canada, and Mexico in the country. It is also home to some of the largest oil companies in the world, including Chevron Corporation, Exxon Mobil Corporation, Suncor Energy Inc., and Petroleos Mexicanos. These companies aim to enhance their market share by adopting the strategy of mergers & acquisitions. For instance, in June 2023, the U.S.-based firms, NexTier Oilfield Solutions and Patterson-UTI announced the decision to merge in an all-stock deal. The resultant firm from this merger is expected to become the second-largest oilfield services company in North America with a market value of USD 5.40 billion in 2023.

Moreover, Canada has a thriving offshore oil & gas industry. It is the fourth-largest producer of crude oil in the world. The country has large-scale oil-producing facilities in the states of Alberta with oil reserves of the order of 161.7 billion barrels and British Columbia, which produced 12,000 barrels of crude oil per day in 2021. The six offshore oil exploration sites in Canada are majorly based in the regions of Labrador and Newfoundland. Approximately 30% of all crude oil produced in the country is processed domestically while the remaining portion gets processed and purified at the refineries in the U.S. The presence of key oil & gas players in North America is estimated to contribute to the demand for oilfield chemicals in the region in the near future.

Europe is another region anticipated to witness growth over the forecast period. Europe is a key producer of crude oil in the world with countries such as Italy (4.8 million tons), Denmark (3.2 million tons), and Romania (3.2 million tons leading its annual oil production charts in 2021 according to the European Commission. In 2021, the refineries in the European Union (EU) produced 521 million tons of petroleum products, witnessing a 3.2% rise from the slump caused by the COVID-19 pandemic in 2020. The consumption of oil and petroleum products also increased in Europe by 4.4% to 400.6 megatons of oil in 2021 compared with that of 2020, indicating a major growth opportunity for the oil industry and its supplementary industries such as oilfield chemicals.

Key Companies & Market Share Insights

The oilfield chemicals market is moderately fragmented with companies entering into partnerships, expansions, and mergers and acquisitions in the oilfield chemicals industry. For instance, in June 2023, the U.S.-based firm, NexTier Oilfield Solutions and Patterson-UTI announced the decision to merge in an all-stock deal. The resultant firm from this merger became the second-largest oilfield services company in North America with a market value of USD 5.40 billion in 2023.

Key Oilfield Chemicals Companies:

- Nouryon

- BASF SE

- SMC Global

- Baker Hughes

- Halliburton

- The Lubrizol Corporation

- Aquapharm Chemical Pvt. Ltd.

- Clariant

- Solvay S.A.

- Thermax Chemical Divisio

Oilfield Chemicals Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 29.10 billion

Revenue forecast in 2030

USD 35.46 billion

Growth Rate

CAGR of 3.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, location, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Russia; Norway; China; India; Indonesia; Brazil; Argentina; Venezuela; Saudi Arabia; UAE; Algeria; Nigeria

Key companies profiled

Nouryon; BASF SE; SMC Global; Baker Hughes; Halliburton; The Lubrizol Corporation; Aquapharm Chemical Pvt. Ltd.; Clariant; Solvay S.A.; Thermax Chemical Division

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oilfield Chemicals Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oilfield chemicals market report based on product, application, location, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Inhibitors

-

Demulsifiers

-

Rheology Modifiers

-

Friction Reducers

-

Biocides

-

Surfactants

-

Foamers

-

Other Products

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Drilling

-

Production

-

Cementing

-

Workover & Completion

-

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Russia

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Indonesia

-

-

Central & South America

-

Brazil

-

Argentina

-

Venezuela

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Algeria

-

Nigeria

-

-

Frequently Asked Questions About This Report

b. The global oilfield chemicals market size was estimated at USD 28.43 billion in 2023 and is expected to reach USD 29.1 billion in 2024.

b. The global oilfield chemicals market is expected to grow at a compound annual growth rate of 3.2% from 2024 to 2030 to reach USD 35.46 billion by 2030.

b. North America dominated the oilfield chemicals market with a share of 41.8% in 2023. This is attributable to the fact that North America is a key producer of oil and associated products owing to the presence of major oil-producing economies such as the U.S., Canada, and Mexico in the country. It is also home to some of the largest oil companies in the world, including Chevron Corporation, Exxon Mobil Corporation, Suncor Energy Inc., and Petroleos Mexicanos.

b. Some key players operating in the oilfield chemicals market include Nouryon, BASF SE, SMC Global, Baker Hughes, Halliburton, The Lubrizol Corporation, Aquapharm Chemical Pvt. Ltd., Clariant, Solvay S.A., Thermax Chemical Division.

b. Key factors that are driving the market growth include the renewed robustness in oil exploration & production activities due to the shale gas revolution and technological developments to explore oil & gas from mature and aged wells.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."