Oil Spill Management Market Size, Share & Trends Analysis Report By Technology (Pre-oil Spill, Post-oil Spill), By Location (Onshore, Offshore), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-735-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Oil Spill Management Market Size & Trends

The global oil spill management market size was valued at USD 148.14 billion in 2023 and is projected to grow at a CAGR of 3.2% from 2024 to 2030. Increasing safety concerns coupled with rising oil spill incidents globally over the last few years are expected to drive the global market over the next nine years. A significant increase in the onshore and offshore drilling activities has led to oil & gas transportation growth. Growth in oil & gas transportation through tankers and pipelines and strict government safety guidelines are anticipated to impact the global oil spill management industry positively. Major industry players invest a considerable amount in R&D. This is expected to build tremendous opportunities and expand the sector over the forecast period.

Globally, numerous initiatives have been taken by governments and safety agencies, such as the Occupational Safety and Health Administration (OSHA), to control and monitor leakages and oil spills at the source or during oil and gas transportation. Some of the key requirements include the installation of pipeline leak detection sensors and double hulling of transportation carriers. Growing concern and stringent safety norms towards preventing on-site and transportation occupational hazards in petroleum facilities are anticipated to remain the key factors contributing to implementing pre-oil spill management techniques over the forecast period.

Major oil spill offshore locations include the Gulf of Alaska in North America, the Gulf of Mexico, the North Sea in Europe, and the Persian Gulf in the Middle East. Rising onshore and offshore oil spill incidents are expected to drive the market over the next nine years. Major onshore areas include Russia, the U.S., Azerbaijan, Canada, Indonesia, Australia, Kuwait, Saudi Arabia, Libya, Iraq, Nigeria, Venezuela, and Angola. Innovation and enhanced research and development efforts by multiple companies and institutes worldwide have also played crucial role in growth of this market in recent years. In January 2024, Bhuvnesh Bharti, an Associate Professor from LSU Chemical Engineering, and Jin Gyun, one of his former graduate students, received a patent for oil spill management technology. The newly developed technology is a significant advancement in environmental protection and spill response that involves a novel approach to managing and mitigating oil spills.

Technology Insights

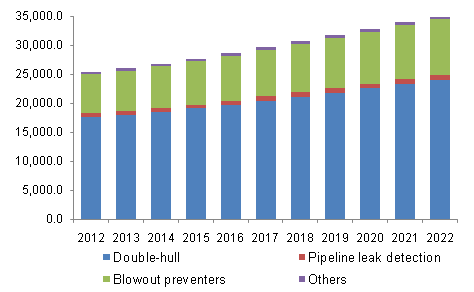

Based on technologies, the pre-oil spill segment dominated the global industry and accounted for a revenue share of 77.7% in 2023. The pre-oil spill management technology is further bifurcated into double-hull, pipeline leak detection, and blowout preventers. In recent years, the demand for double-hull technology has significantly increased. The marine trade holds a majority part of oil & gas product transportation. The rising demand for crude oil and petroleum products from the energy industries of Europe and the Asia Pacific region is anticipated to boost market growth over the next nine years. Rising concern regarding harmful environmental impacts from hull-breach incidents has urged international organizations and governments to standardize tanker design. This has also enhanced tanker protection against collisions and natural disasters. These factors are anticipated to boost the growth of double-hull technology over the forecast period.

Post oil spill segment is expected to experience a significant growth rate from 2024 to 2030. This technology has multiple dynamics, including mechanical containment & recovery, skimmers, chemical recovery, biological recovery, and more. The method involves the use of Containment booms, sorbents, and skimmers to clean up an oil spill. These response technologies are the most valuable practices for large-scale spills in near-shore and deep-sea areas. The technologies involve gelling and dispersant agents, naturally enhancing oil components' breakdown. The chemical dispersants allow the water and oil to bind chemically. This prevents slicks from spreading over the water surface and increases the surface area of an oil molecule. Various biological agents for oil spills break the oil into carbon dioxide and fatty acids. This recovery process is usually used for areas where spilled oil has reached the shore. However, this process has recently been applied as test cases in river systems. Phosphorous and nitrogen-based fertilizers are used in the process. These fertilizers are dropped into the water bodies or areas to increase the growth of microorganisms, which break down the sand-bound oil.

Location Insights

The offshore application segment accounted for the largest revenue share of the global industry in 2023. The rising requirement for oil spill management technology in harsh environments, remote locations, and deep water is anticipated to drive product demand over the next nine years. Upcoming projects predominantly in the South China Sea and the Persian Gulf region and renewal of abandoned wells are anticipated to drive offshore E&P activity in upcoming years. Increased regulation, taxes, and fines related to post-oil spill containment pressurize upstream and midstream oil & gas companies to deploy safety equipment for uninterrupted operations. This equipment includes pipeline leak detection systems, blowout preventers (BOP), and other systems. Several ongoing pre-oil spill technology demands, especially in the U.S., Qatar, and Saudi Arabia, are expected to grow considerably over the forecast period.

Remote locations, such as Arctic regions, coastal islands, and others, mainly depend on the marine ecosystem for economic growth. Oil spills' increasing damage to seagrasses, feeding grounds, and coral reefs of marine species has a long-term impact on these coastal regions. Rising deep-water explorations and increasing energy demand are anticipated to boost offshore prospects in Arctic areas such as Alaska, the Russian Federation, and Norway.

Onshore oil spill management is anticipated to witness the fastest CAGR during the forecast period. Various incidents of good blowouts and pipeline failures, especially in the U.S., Canada, Norway, China, & Mexico, are the significant attributes of the extensive market penetration over the past few years. Rising incidences of spills, regulatory compliances of multiple countries and organizations, and technological advancements adopted by companies and service providers are expected to generate greater growth for this segment in the approaching years.

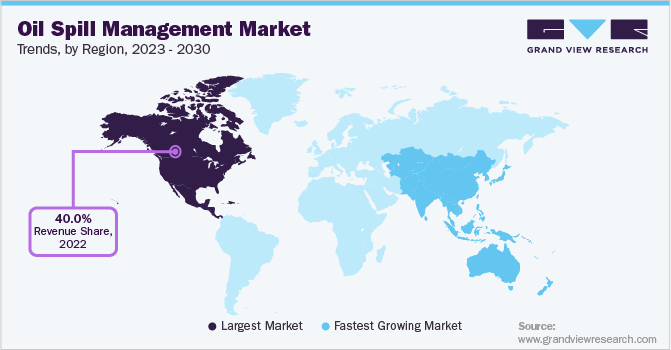

Regional Insights

North America was the largest oil spill management market, accounting for more than 40.6% in 2023. The region is anticipated to gain market share due to rising oil and gas E&P activities. Oil spill incidents in the area, such as Marathon Oil, Exxon Valdez, and Deepwater Horizon, have also resulted in the formulation of a stringent regulatory framework for onshore and offshore oil and gas production activities.

U.S. Oil Spill Management Market Trends

The U.S. oil spill management market held a significant regional industry share in 2023. This market is primarily driven by increasing oil and gas activities, regulations encouraging enhanced spill management practices, technological advancements, ease of availability, entry of multiple international organizations, and rising trade in the region. According to the Observatory of Economic Complexity, in May 2024, crude petroleum exports by the U.S. accounted for USD 10.80 billion. This increased by USD 2.10 billion from USD 8.72 billion in May 2023.

Europe Oil Spill Management Market Trends

Europe is identified as a lucrative region for the oil spill management market in 2023. This market is primarily driven by factors such as increasing incidents of oil spills in the area, an alarming need highlighted by multiple high-profile spill incidents, stringent government regulation, and a large amount of trade running through waters associated with Europe, such as the English Channel. The market is also influenced by technological advancements adopted by the key market participants present in the region. Growing offshore oil explorations are expected to generate greater demand for this market in approaching years.

The UK oil spill management market held a significant revenue share of the regional industry in 2023. This market is mainly influenced by rising oil spill incidents primarily caused by transport accidents or drilling operations, strict regulations associated with environmental standards, and the emergence and growing adoption of technologies such as remote sensing, drone technology, and advanced containment mechanisms. In addition, increasing investment by industry participants in spill management solutions is also expected to generate greater demand for this market during the forecast period.

Asia Pacific Oil Spill Management Market Trends

Asia Pacific oil spill management market is expected to grow at an anticipated CAGR of 4.1% from 2024 to 2030. Most oil and gas exploration and production activities in the region are centered in India, China, and South Korea. Encouraging government initiatives and regulations, such as tax benefits and other financial aid for discovering hydrocarbon reserves, is anticipated to push industry growth in these countries over the next nine years.

Some of the biggest oil spill incidents in the past few years include the Xingang Port spill in China, the ExxonMobil spill in Nigeria, the Lac-Megantic derailment in Canada, and the Trans-Israel pipeline. Stringent environmental regulations coupled with large-scale spillage are the major factors responsible for deploying post-oil spill management Technologies over the past few years.

Key Oil Spill Management Company Insights

Some key companies involved in the oil spill management market include (NOV) National Oilwell Varco, Inc., Ecolab, Oil Spill Response Limited, SkimOIL, LLC and others. To address the growing competition, key market participants in this industry have embraced strategies such as innovation backed new product launches, enhanced R & D effort, collaborations and partnerships with other organizations, improved customer engagements and more.

-

Ecolab is a prominent company in the technology and services industry associated with water, hygiene, and energy. It offers multiple spill management solutions, such as a Biohazard Spill Cleanup Kit, a Biohazard Response Spill Kit, an Adv. Floor Care Grease Beater Map, and others.

-

SkimOIL, LLC, a company that specializes in designing, custom manufacturing, and distributing industrial and marine pollution control systems and equipment, offers a wide range of products, including oil skimmers and water separators. These include floating weir oil skimmers, floating drum oil skimmers, belt oil skimmers, rope mop wringer oil skimmers, tube oil skimmers, and multiple other products.

Key Oil Spill Management Companies:

The following are the leading companies in the oil spill management market. These companies collectively hold the largest market share and dictate industry trends.

- National Oilwell Varco, Inc.

- Ecolab

- Oil Spill Response Limited

- SWS Environmental Services Ltd.

- American Pipeline Solutions

- SkimOIL, LLC

- OMNI Environmental Solutions

- Cameron International Corporation (SLB)

- Sorbcontrol

- American Green Ventures (US), Inc.

- Fender & Spill Response Services L.L.C

- Osprey Spill Control

Recent Developments

-

In January 2024, Ecolab, one of the major market participants in the sustainability and operational efficiency industry, opened its brand new manufacturing facility in Ho Nai Industrial Park, near Ho Chi Minh City, Vietnam. This newly developed facility, spanning 3,000 square meters, is equipped with an advanced laboratory, warehouse, and manufacturing unit.

Oil Spill Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 151.61 billion |

|

Revenue Forecast in 2030 |

USD 183.50 billion |

|

Growth rate |

CAGR of 3.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Technology, location, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Norway, Russia, China, India, Australia, Malaysia, Brazil, Argentina, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

National Oilwell Varco, Inc.; Ecolab; Oil Spill Response Limited; SWS Environmental Services Ltd.; American Pipeline Solutions; SkimOIL, LLC; OMNI Environmental Solutions; Cameron International Corporation (SLB); Sorbcontrol; American Green Ventures (US), Inc.;Fender & Spill Response Services L.L.C; Osprey Spill Control |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

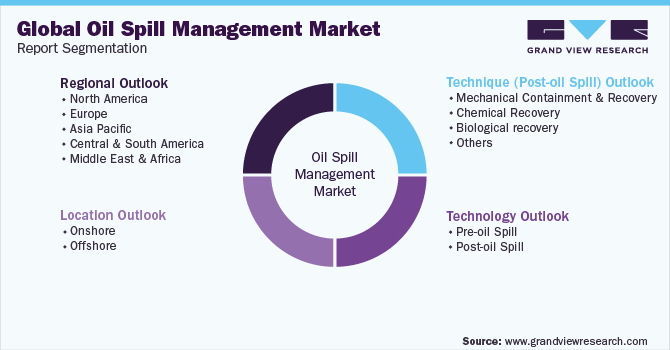

Global Oil Spill Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oil spill management market report based on technology, location, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Pre-oil spill Management

-

Double-hull

-

Pipeline leak detection

-

Blow-out preventers

-

Others

-

-

Post-oil spill Management

-

Mechanical

-

Chemical

-

Biological

-

Physical

-

-

-

Technique (Post-Oil Spill) Outlook (Revenue, USD Million, 2018 - 2030)

-

Mechanical containment and recovery

-

Containment booms

-

Hard booms

-

Sorbent booms

-

Fire booms

-

Others

-

-

Skimmers

-

Weir skimmers

-

Oleophilic skimmers

-

Non-oleophilic skimmers

-

Others

-

-

Sorbent

-

Others

-

-

Chemical recovery

-

Dispersing agents

-

Gelling agents

-

Others

-

-

Biological recovery

-

Others

-

-

Location Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Norway

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Australia

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."