- Home

- »

- Next Generation Technologies

- »

-

Oil And Gas Security And Service Market Size Report, 2030GVR Report cover

![Oil And Gas Security And Service Market Size, Share & Trends Report]()

Oil And Gas Security And Service Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Solution, Services), By Security (Physical Security, Network Security), By Services, By Operation, By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-389-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

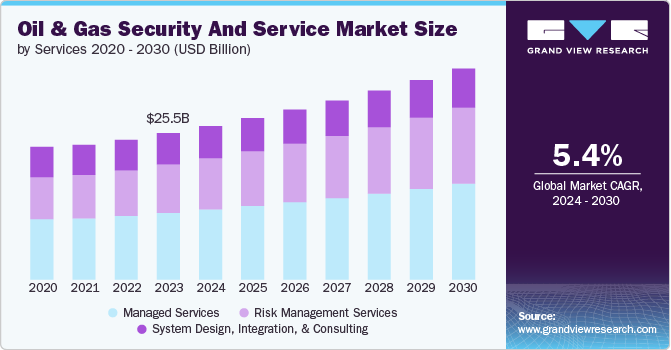

The global oil and gas security and service market size was estimated at USD 25.51 billion in 2023 and is expected to expand at a CAGR of 5.4% from 2024 to 2030. Various factors such as technologies and security threats, rising regulatory compliance, Growing adoption of advanced technologies, and focus on operational safety are driving the growth of the market. The oil and gas industry is a target for various security threats, including terrorism, piracy, theft, and sabotage. As these threats become more advanced, oil and gas companies are investing more in security measures to protect their assets and personnel.

The surge in the use of cloud technologies in the oil and gas sector has increased its exposure to cyber threats. Historically, industry has managed to protect data and ensure privacy by segregating networks and bolstering outer defenses. However, the introduction of cloud computing presents both a challenge and an opportunity for the sector to enhance and renew its security measures through the adoption of cyber security practices. One of the hurdles is that many firms lack the necessary expertise, funds, and in-house servers, pushing them toward cloud solutions for better data security.

Stringent government regulations and policies concerning energy security and environmental preservation require the oil and gas industry to implement robust security measures. Furthermore, the growing adoption of advanced technology like surveillance, access control, and intrusion detection systems is driving the market growth. Companies are proactively pouring resources into security solutions to mitigate risk and protect essential infrastructure. Additionally, the development of new exploration and production opportunities, especially in offshore and hard-to-reach areas, has created a need for specialized security services to address distinct challenges. These factors collectively are driving the growth and development of the security and services market in the oil and gas sector.

Component Insights

The solution segment led the market in 2023, accounting for over 78.0% share of the global revenue. The oil and gas industry are a prime target for cybercriminals due to its critical infrastructure and valuable data. High-profile cyberattacks in recent years have highlighted the need for advanced security solutions to protect against evolving threats. Moreover, the industry faces diverse threats apart from cyberattacks. Physical security solutions like advanced surveillance systems with AI capabilities, access control systems with biometric authentication, and perimeter security measures are crucial for safeguarding personnel, assets, and facilities against theft, sabotage, and terrorism.

The services segment is predicted to foresee the fastest growth in the coming years. The nature of security threats in the oil and gas industry is constantly evolving. Companies need specialized expertise to keep up with the latest cyberattacks, physical security breaches, and other emerging threats. Security service providers offer this expertise through services including risk assessments, vulnerability testing, and penetration testing to identify and address potential weaknesses.

Security Insights

The physical security segment accounted for the largest revenue share in 2023. Oil and gas facilities are prime targets for terrorist attacks and sabotage attempts. Physical security solutions like access control systems, perimeter security with intrusion detection, and security guards are crucial for deterring and mitigating these threats. Oil and gas assets are valuable, making them vulnerable to theft and pilferage. Physical security measures like CCTV cameras with advanced analytics, robust fencing, and asset tracking systems can help deter and detect these activities.

The network security segment is anticipated to exhibit the fastest CAGR over the forecast period.The oil and gas industry is rapidly embracing digital technologies like automation and internet-connected devices (IoT). This digital transformation creates numerous vulnerabilities to cyberattacks that can disrupt operations, steal sensitive data, or cause physical damage. Network security solutions like firewalls, intrusion detection systems (IDS), and data encryption become essential to safeguard critical infrastructure. Moreover, cybercriminals are constantly refining their tactics, targeting oil and gas companies due to their reliance on operational technology (OT) systems and the potential for high financial gain. Robust network security solutions are crucial to defend against these evolving threats.

Services Insights

The managed services segment accounted for the largest market share in 2023. The oil and gas industry often faces a shortage of in-house cybersecurity professionals with the skills and knowledge to manage complex security threats. Managed security service providers (MSSPs) offer access to a pool of skilled professionals, allowing companies to bridge this expertise gap. Oil and gas companies may have limited budgets dedicated to IT security. Managed security services offer a cost-effective way to access advanced security solutions and expertise without the need for significant upfront investments in infrastructure and personnel.

The risk management services segment is anticipated to exhibit the fastest CAGR over the forecast period. The oil and gas industry faces a diverse range of security threats, including cyberattacks, physical security breaches, theft, sabotage, and terrorism. Risk management services help companies identify, assess, and prioritize these threats, allowing them to develop effective mitigation strategies.Governments are implementing stricter regulations on safety and security in the oil and gas industry. Risk management services help companies comply with these regulations by providing guidance on developing and implementing robust security programs.

Operation Insights

The midstream segment accounted for the largest market share in 2023. The projected increase in global energy demand necessitates the expansion of midstream infrastructure, such as pipelines and storage facilities. This expansion creates a growing need for security solutions to protect these critical assets. The growing role of natural gas and Liquefied Natural Gas (LNG) in the energy mix necessitates robust security measures for transportation and storage infrastructure. Moreover, midstream operations are becoming increasingly digitized, introducing new cybersecurity vulnerabilities. Security services are crucial for protecting pipelines, storage facilities, and control systems from cyberattacks that could disrupt operations or cause physical damage.

The downstream segment is anticipated to exhibit the fastest CAGR over the forecast period. Downstream facilities like refineries and storage terminals are increasingly reliant on automation and digital technologies. This digitalization creates vulnerabilities to cyberattacks that can disrupt operations, manipulate product quality, or cause safety hazards. Security services like penetration testing and vulnerability assessments help identify and address these vulnerabilities. Moreover, downstream facilities handle large volumes of valuable products, making them targets for theft and pilferage. Security services provide solutions like access control systems, perimeter security with intrusion detection, and security guards to deter and mitigate these threats.

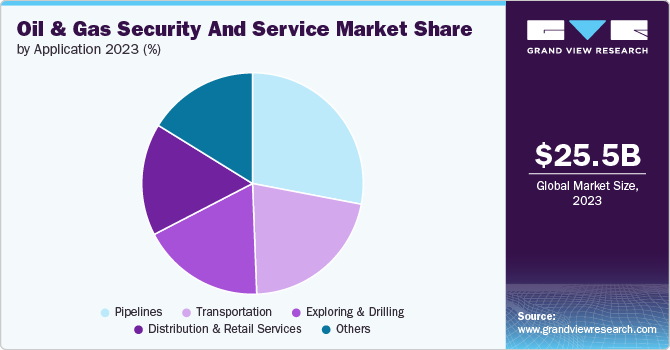

Application Insights

The pipelines segment accounted for the largest revenue share in 2023. As countries seek to diversify their energy sources, new pipelines are being built to transport natural gas and other products. Security solutions are crucial for safeguarding these pipelines throughout their lifecycles. Pipelines often traverse vast and remote areas, making them vulnerable to physical threats like sabotage, theft, and vandalism. Security services provide solutions like pipeline monitoring systems, leak detection technology, and security patrols to deter and mitigate these risks.

The exploring and drilling segment is anticipated to exhibit the fastest CAGR over the forecast period. The search for new oil and gas reserves is increasingly pushing exploration activities into remote and often unstable regions. Security services are crucial for providing physical security for personnel, equipment, and infrastructure in these challenging environments. Exploration activities in politically volatile regions necessitate robust security measures to mitigate risks associated with terrorism, piracy, and civil unrest. Security service providers with expertise in risk assessment and mitigation strategies can offer valuable support in such situations.

Regional Insights

North America dominated the oil and gas security and service market with a revenue share of over 33.0% in 2023. The North American oil and gas industry is a prime target for cyberattacks due to its reliance on critical infrastructure and operational technology. This necessitates robust security services like penetration testing, vulnerability assessments, and managed security services to identify, prevent, and respond to cyberattacks. Moreover, North American oil and gas assets, from pipelines to refineries, are spread across vast regions and can be vulnerable to physical security threats like theft, vandalism, and terrorism. Security services provide solutions like access control systems, security patrols, and video surveillance to mitigate these risks.

U.S. Oil And Gas Security And Service Market Trends

The U.S. market is anticipated to exhibit a significant CAGR over the forecast period. The U.S. oil and gas industry is a prime target for cyberattacks. Focus will be on services like penetration testing and vulnerability assessments, Managed security services (MSSPs), and focus on Industrial Control Systems (ICS) security.

Europe Oil And Gas Security And Service Market Trends

The market in the European region is expected to witness significant growth over the forecast period. Europe's reliance on imported oil and gas necessitates a focus on security measures that ensure the uninterrupted flow of energy resources. Security services can offer solutions for securing critical infrastructure, preventing environmental incidents, and retrofitting existing infrastructure.

Asia Pacific Oil And Gas Security And Service Market Trends

The market in the Asia Pacific region is anticipated to register a significant CAGR over the forecast period. Rapid economic growth in countries like China and India is driving a surge in energy demand. This necessitates the expansion of oil and gas infrastructure, creating a demand for security solutions to protect these critical assets. Moreover, APAC countries are increasingly looking to diversify their energy sources, leading to investments in pipelines for transporting natural gas and other products. Security services will be crucial for securing this growing infrastructure.

Key Oil And Gas Security And Service Company Insights

Key oil and gas security and service companies include Huawei Technologies Co., Ltd., ABB, and Siemens. Companies active in the market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in April 2022, Oil India faced a cyberattack that disrupted its operations in Assam and was subsequently hit with a ransom demand of USD 75,000 by the attacker. After the incident was reported, a legal case was initiated under various sections of the Indian Penal Code as well as the Information Technology Act, 2000.

Key Oil And Gas Security And Service Companies:

The following are the leading companies in the oil and gas security and service market. These companies collectively hold the largest market share and dictate industry trends.

- Cisco Systems, Inc.

- Honeywell International Inc.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Microsoft

- NortonLifeLock Inc.

- Schneider Electric

- Siemens

- United Technologies Inc.

Recent Developments

-

In April 2024, Siemens launched Siemens Xcelerator, to automatically verify vulnerable production assets. Therefore, it is imperative for industrial firms to detect and mitigate potential security gaps within their systems. Siemens introduced a new cybersecurity software-as-a-service solution in response to the urgency of pinpointing cybersecurity in shop floor promptly,

-

In September 2023, Huawei Technologies Co., Ltd. launched intelligent architecture and intelligent Exploration & production (E&P) solution for oil and gas industry. Huawei Technologies Co., Ltd.'s intelligent architecture for the oil and gas sector is constructed around six smart components: connectivity, sensing, platform, application, AI models, and foundation. Each component is structured with hierarchical decoupling. This design is adaptable to widely used third-party frameworks and is capable of integrating with third-party platforms and data lakes, whether they are existing or newly established.

-

In September 2022, ABB introduced ABB Ability Cyber Security Workplace (CSWP), which integrates security solutions from ABB and other providers into a unified, comprehensive digital platform, enhancing the protection of critical industrial infrastructure. This platform enables engineers and operators to more swiftly identify and resolve issues, thereby reducing risk exposure by making cybersecurity data more accessible and easier to manage.

Oil And Gas Security And Service Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 26.78 billion

Revenue forecast in 2030

USD 36.81 billion

Growth Rate

CAGR of 5.4% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, security, services, operation, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, Australia, South Korea, Brazil, UAE, South Africa, KSA

Key companies profiled

ABB; Cisco Systems, Inc.; Honeywell International Inc.; Huawei Technologies Co., Ltd.; Intel Corporation; Microsoft; NortonLifeLock Inc.; Schneider Electric; Siemens; United Technologies Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oil And Gas Security And Service Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global oil and gas security and service market report based on component, security, services, operation, application, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Services

-

-

Security Outlook (Revenue, USD Billion, 2017 - 2030)

-

Physical Security

-

Network Security

-

-

Services Outlook (Revenue, USD Billion, 2017 - 2030)

-

Risk Management Services

-

System Design, Integration, and Consulting

-

Managed Services

-

-

Operation Outlook (Revenue, USD Billion, 2017 - 2030)

-

Upstream

-

Midstream

-

Downstream

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Exploring and Drilling

-

Transportation

-

Pipelines

-

Distribution and Retail Services

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global oil and gas security and service market size was estimated at USD 25.51 billion in 2023 and is expected to reach USD 26.78 billion in 2024.

b. The global oil and gas security and service market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 36.81 billion by 2030.

b. North America dominated the oil and gas security and service market with a share of 33.5% in 2023. The North American oil and gas industry is a prime target for cyberattacks due to its reliance on critical infrastructure and operational technology. This necessitates robust security services like penetration testing, vulnerability assessments, and managed security services to identify, prevent, and respond to cyberattacks.

b. Some key players operating in the oil and gas security and service market include ABB; Cisco Systems, Inc.; Honeywell International Inc.; Huawei Technologies Co., Ltd.; Intel Corporation; Microsoft; NortonLifeLock Inc.; Schneider Electric; Siemens; and United Technologies Inc.

b. Various factors such as technologies and security threats, rising regulatory compliance, growing adoption of advanced technologies, and focus on operational safety are driving the growth of the oil and gas security and service market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.