- Home

- »

- Distribution & Utilities

- »

-

Oil And Gas Security Market Size And Share Report, 2030GVR Report cover

![Oil And Gas Security Market Size, Share & Trends Report]()

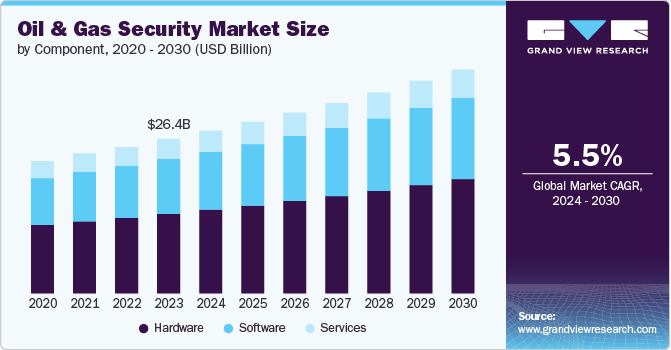

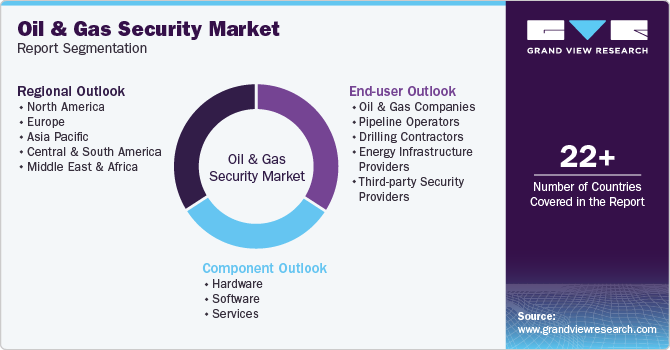

Oil And Gas Security Market Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By End User (Oil & Gas Companies, Pipeline Operators, Drilling Contractors), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-434-8

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

Oil And Gas Security Market Size & Trends

The global oil and gas security market size was estimated at USD 26.4 billion in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. The persistent threat of terrorism and cyber-attacks targeting oil and gas infrastructure is driving the demand for oil & gas security, thus fueling the growth of the market. Given the strategic importance of these assets to national economies and energy security, they remain attractive targets for malicious actors. For instance, the 2021 Colonial Pipeline ransomware attack in the U.S. highlighted the vulnerability of critical energy infrastructure to cyber threats, leading to increased investment in cybersecurity measures across the industry.

Another significant factor propelling the market growth is the expanding exploration and production activities in remote and high-risk areas. As easily accessible oil and gas reserves become depleted, companies are venturing into more challenging environments, often in politically unstable regions or offshore locations. These operations require robust security systems to protect personnel, assets, and operations from various risks, including piracy, civil unrest, and sabotage. The development of offshore oil fields in the Gulf of Guinea, for example, has necessitated enhanced maritime security measures to combat piracy threats.

Moreover, regulatory compliance and government mandates also play a crucial role in driving the market growth. In the wake of major incidents and evolving threat landscapes, governments worldwide have implemented stricter regulations concerning the security of critical energy infrastructure. These regulations often require companies to implement comprehensive security measures, including physical security systems, cybersecurity protocols, and emergency response plans. The EU's Network and Information Security (NIS) Directive, which includes specific provisions for operators in the energy sector, exemplifies this trend and has spurred investments in security solutions across European oil and gas facilities.

Component Insights

Based on component, the market is segmented into hardware, software, and services. The hardware segment registered the largest revenue share of over 51.0% in 2023. The hardware segment in oil & gas security includes physical equipment such as surveillance cameras, access control systems, perimeter intrusion detection systems, and communication devices. These components form the foundational infrastructure for securing oil and gas facilities against physical threats and unauthorized access.

Software solutions in this market encompass cybersecurity programs, video management systems, data analytics platforms, and integrated security management software. The rising number of cyberattacks targeting critical energy infrastructure is a primary driver for software solutions. The growing complexity of digital systems in oil and gas operations and the need for real-time threat intelligence and rapid incident response capabilities are also boosting demand. Furthermore, the increasing adoption of IoT devices and cloud-based systems in the industry creates new vulnerabilities that require advanced software protection.

The services segment covers a range of offerings, including risk assessment, security consulting, system integration, managed security services, and employee training. These services help oil and gas companies implement, maintain, and optimize their security systems while ensuring compliance with industry regulations. The constantly evolving threat landscape and regulatory environment drive the need for specialized security services. Many oil and gas companies lack in-house expertise to manage complex security systems, leading to increased outsourcing of security functions. The need for regular security audits, employee training, and continuous improvement of security postures also contributes to the growth of the services segment of the market.

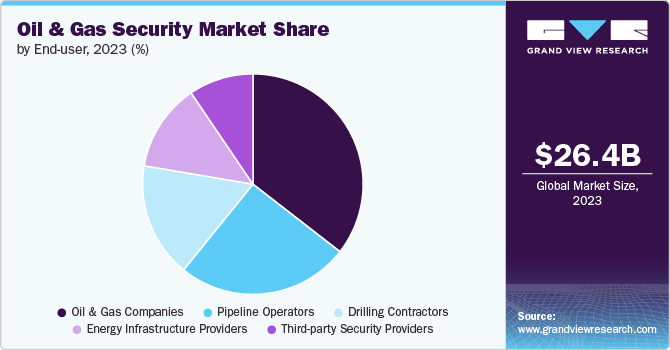

End User Insights

Based on end users, the market is segmented into oil and gas companies, pipeline operators, drilling contractors, energy infrastructure providers, and third-party security providers. The oil & gas companies end user segment held the largest revenue market share of over 35.0% in 2023. These are the major end users in the industry, including multinational corporations and national oil companies. They engage in exploration, production, refining, and distribution of oil and gas products. Oil and gas companies require comprehensive security solutions to protect their assets, personnel, and operations across the entire value chain.

The energy infrastructure providers segment includes companies that build and maintain energy-related infrastructure, such as refineries, storage terminals, and processing plants. They play a crucial role in the oil and gas supply chain. Key drivers for this segment include protecting critical assets from physical and cyber threats, ensuring the safety of personnel working in hazardous environments, and maintaining the integrity of energy infrastructure. They also focus on implementing security measures to prevent industrial espionage and sabotage.

Regional Insights

The North America oil & gas security market dominated globally in 2023 with the largest revenue share of over 33.0%. The region has a large and well-established oil and gas industry, with significant infrastructure and assets that require protection. The U.S. has become one of the world's largest oil producers in recent years due to the shale oil boom. This increased production has led to a greater need for security measures to safeguard critical infrastructure, including drilling sites, refineries, pipelines, and storage facilities. For example, the Colonial Pipeline cyberattack in 2021 highlighted the vulnerability of oil and gas infrastructure to digital threats and emphasized the need for robust cybersecurity measures.

U.S. Oil And Gas Security Market Trends

The rapid digitalization of the oil & gas industry, often referred to as smart oilfields, has created new security challenges. The integration of Internet of Things (IoT) devices, cloud computing, and automation technologies has increased efficiency but also expanded the attack surface for cyber threats. This has led to a growing demand for specialized security solutions that can protect both operational technology (OT) and information technology (IT) systems. Companies such as Chevron and ExxonMobil are investing in AI-powered security analytics and threat intelligence platforms to detect and respond to potential breaches in real time, further driving growth in the market.

Europe Oil And Gas Security Market Trends

The geopolitical tensions between Russia and the West, particularly following Russia's invasion of Ukraine in 2022, have highlighted Europe's vulnerability in terms of energy security. Many European countries have been heavily dependent on Russian oil and gas imports. This situation has prompted an urgent need for enhanced security measures across the entire oil and gas supply chain, from production facilities to transportation networks. For example, countries such as Germany, which relied heavily on Russian natural gas, are now investing in diversifying their energy sources and securing their infrastructure against potential disruptions.

Asia Pacific Oil And Gas Security Market Trends

The rise in cyber threats targeting critical infrastructure has become a significant concern for the oil and gas industry in the Asia Pacific region. Countries such as Japan and South Korea, which rely heavily on imported oil and gas, have been ramping up their cybersecurity measures to protect their energy supply chains. For instance, after a series of cyberattacks on its energy sector, Japan has implemented stricter regulations and increased investments in AI-powered threat detection systems for its oil and gas facilities. Similarly, Australia has been working closely with industry partners to develop robust cybersecurity frameworks specifically tailored for its rapidly growing liquefied natural gas (LNG) export industry.

Key Oil And Gas Security Company Insights

Major players such as Honeywell International Inc., Siemens AG, ABB Ltd., Cisco Systems Inc., and Huawei Technologies Co., Ltd. dominate the market, driven by their strong portfolios and global presence. The market share is often influenced by strategic alliances, mergers, acquisitions, and advancements in technology. The market is fragmented, with regional players also vying for dominance, particularly in high-growth regions such as the Middle East and North America, where oil & gas infrastructure is heavily concentrated. Increasing cyber threats and stricter regulatory standards further intensify competition as companies invest in advanced solutions to ensure operational safety and security.

-

In August 2024, SLB and Palo Alto Networks announced an expansion of their collaboration aimed at enhancing cybersecurity within the energy sector. This partnership will integrate SLB's cloud and edge technologies with Palo Alto Networks' advanced cybersecurity solutions, including Precision AI-powered platforms such as Prisma and Cortex. The collaboration seeks to bolster SLB's security infrastructure and develop innovative solutions to address emerging cyber threats as the energy industry increasingly adopts digital technologies and AI.

-

In July 2024, Accenture acquired True North Solutions, a U.S.-based provider of industrial engineering solutions, to enhance its capabilities in helping clients in the oil, gas, and mining sectors produce and transport energy more safely and efficiently. This acquisition will expand Accenture's expertise in operational technology (OT), integrating it with enterprise IT systems to optimize equipment output and safety through real-time data analytics.

Key Oil And Gas Security Companies:

The following are the leading companies in the oil and gas security market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Cisco Systems Inc.

- Honeywell International Inc.

- Schneider Electric SE

- Siemens AG

- Waterfall Security Solutions Ltd.

- Parsons Corporation

- P2 Energy Solutions

- KBR, Inc.

- DuPont de Nemours, Inc.

- Huawei Technologies Co., Ltd.

- Shell Catalysts & Technology

- Baker Hughes Company

- Halliburton Company

- Symantec Corporation

Oil And Gas Security Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 27.76 billion

Revenue forecast in 2030

USD 38.27 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Component, end user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia

Key companies profiled

ABB Ltd.; Cisco Systems Inc.; Honeywell International Inc.; Schneider Electric SE; Siemens AG; Waterfall Security Solutions Ltd.; Parsons Corporation; P2 Energy Solutions; KBR, Inc.; DuPont de Nemours, Inc.; Huawei Technologies Co., Ltd.; Shell Catalysts & Technology; Baker Hughes Company; Halliburton Company; Symantec Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oil And Gas Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oil & gas security market report based on component, end user, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil and Gas Companies

-

Pipeline Operators

-

Drilling Contractors

-

Energy Infrastructure Providers

-

Third-party Security Providers

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global oil and gas security market was valued at USD 26.4 billion in 2023 and is expected to reach USD 27.76 billion in 2024.

b. The global oil and gas security market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030, reaching USD 38.27 billion by 2030.

b. The oil and gas end-user segment accounted for the highest revenue market share, over 35.0%, in 2023. These are the major end-users in the industry, including multinational corporations and national oil companies. They explore, produce, refine, and distribute oil and gas products.

b. Key players in the market include ABB Ltd.; Cisco Systems Inc.; Honeywell International Inc.; Schneider Electric SE; Siemens AG; Waterfall Security Solutions Ltd.; Parsons Corporation; P2 Energy Solutions; KBR, Inc.; DuPont de Nemours, Inc.; Huawei Technologies Co., Ltd.; Shell Catalysts & Technology; Baker Hughes Company; Halliburton Company, and Symantec Corporation.

b. The global oil and gas security market is increasing due to the persistent threat of terrorism. Cyber-attacks targeting oil and gas infrastructure are driving the demand for oil and gas security, thus fueling the growth of the market. Given the strategic importance of these assets to national economies and energy security, they remain attractive targets for malicious actors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."