- Home

- »

- Conventional Energy

- »

-

Oil & Gas SCADA Market Size, Share & Trends Report, 2030GVR Report cover

![Oil & Gas SCADA Market Size, Share & Trends Report]()

Oil & Gas SCADA Market (2024 - 2030) Size, Share & Trends Analysis Report, Architecture (Hardware, Software, Services), Sector (Upstream, Downstream, Midstream), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-378-2

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oil & Gas SCADA Market Summary

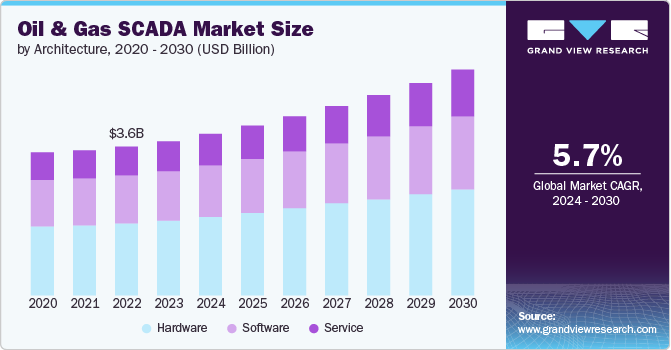

The global oil & gas SCADA market size was estimated at USD 3.73 billion in 2023 and is projected to reach USD 5.47 billion by 2030, growing at a CAGR of 5.7% from 2024 to 2030. The market is driven by several key factors that are expected to shape its growth trajectory over the next few years. One of the primary drivers is the increasing demand for real-time information and operational efficiency in the oil and gas industry.

Key Market Trends & Insights

- North America dominated the oil & gas SCADA market with the largest revenue share of 39.57% in 2023.

- The oil & gas SCADA market in the U.S. accounted for largest revenue share of 76.63% in North America in 2023.

- The China oil & gas SCADA market is anticipated to grow at the fastest CAGR over the forecast period.

- Based on architecture, the hardware segment led the market with the largest revenue share of 48.49% in 2023.

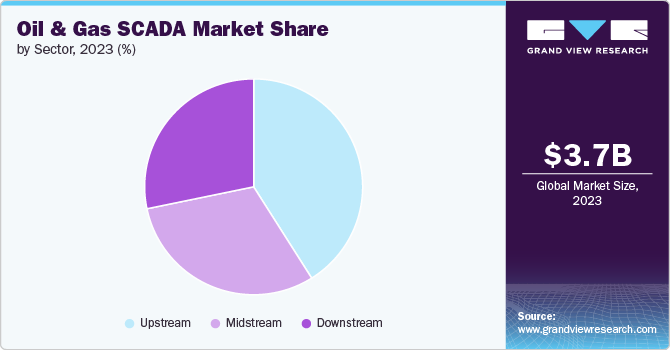

- Based on sector, the upstream segment led the market with the largest revenue share of 41.06% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 3.73 billion

- 2030 Projected Market Size: USD 5.47 billion

- CAGR (2024-2030): 5.7%

- North America: Largest market in 2023

- China: Fastest growing market

Another significant driver is the growing investments in refineries and pipelines, particularly in regions like the Americas, Africa, the Middle East, and Asia-Pacific. The exploration of new oil and gas fields and the expansion of existing infrastructure require advanced monitoring and control systems, which SCADA systems provide. This trend is expected to continue, driven by the need to meet increasing domestic oil consumption demands and to maintain export capabilities.

Drivers, Opportunities & Restraints

The market is driven by the increasing exploration and production (E&P) activities, both onshore and offshore. The need for efficient and safe E&P operations is driving the adoption of SCADA systems, which are critical for error reduction, automation, and crucial decision-making in the oil and gas sectors.

The increasing demand for real-time data and operational efficiency is driving the adoption of SCADA systems. The exploration of new oil and gas fields, along with growing investments in refineries and pipelines, particularly in regions like the Americas, Africa, the Middle East, and Asia-Pacific, is expected to fuel the market's expansion. The rising demand for remote management and cloud-based services is also a significant opportunity, as companies seek to reduce operational costs and improve efficiency.

The global market faces a few key restraints. The high deployment cost of SCADA systems and the need for highly qualified personnel to operate them can limit market growth. In addition, concerns over data security and the risk of cyberattacks on SCADA systems pose a significant challenge for the industry.

Architecture Insights

Based on architecture, the hardware segment led the market with the largest revenue share of 48.49% in 2023. The hardware market is driven by the increasing investment in oil and gas infrastructure, which escalates the adoption of sensors and equipment crucial for data collection. The hardware segment dominates the market, accounting for a substantial share due to its critical role in acquiring real-time data from oil wells and monitoring pipelines.

Companies seek to reduce operational costs and improve efficiency by leveraging SCADA services for real-time data monitoring and control. The market is expected to grow as oil and gas companies invest in digitalization and automation to optimize their operations.

Software solutions assist in monitoring and controlling oil and gas processes, providing automatic notifications and alerts for issues. The market is expected to grow as companies invest in digitalization and automation to optimize operations, leveraging cloud-based services for data transmission and analysis.

Sector Insights

Based on sector, the upstream segment led the market with the largest revenue share of 41.06% in 2023. The upstream market is driven by the critical role of SCADA systems in monitoring and controlling upstream operations. SCADA provides real-time data on parameters like pressure, flow, and well conditions, enabling operators to optimize production and respond quickly to issues. The upstream segment accounts for a significant share of the overall market, as SCADA is essential for managing complex exploration and production activities, from wellhead monitoring to pipeline management. Investments in new oil and gas fields, particularly in regions like North America, the Middle East, and Asia-Pacific, are expected to further drive the adoption of SCADA solutions in the upstream sector.

SCADA systems enable operators to optimize production, reduce energy consumption, and ensure compliance with safety and environmental regulations in the downstream segment. The growing investments in refinery upgrades and expansions, particularly in regions like Asia-Pacific and the Middle East, are expected to fuel the demand for SCADA solutions in the downstream oil and gas industry.

Regional Insights

North America dominated the oil & gas SCADA market with the largest revenue share of 39.57% in 2023. The North America market is driven by the increasing investments in pipeline infrastructure and the growing adoption of cloud-based SCADA services in the region. The rise in spending on refinery upgrades and the exploration of new oil and gas fields in the United States and Canada are further fueling the demand for SCADA solutions in the downstream and upstream segments. The North American market is expected to dominate the global market due to the region's focus on operational efficiency, real-time monitoring, and environmental compliance.

U.S. Oil & Gas SCADA Market Trends

The oil & gas SCADA market in the U.S. accounted for largest revenue share of 76.63% in North America in 2023. The U.S. market is driven by investments in refinery upgrades and pipeline infrastructure. The growing adoption of SCADA solutions in the upstream and downstream segments, particularly for optimizing production and ensuring compliance, is fueling the market's growth in the U.S.

Europe Oil & Gas SCADA Market Trends

The oil & gas SCADA market in Europe is driven by the growing investments in pipeline infrastructure and the adoption of cloud-based SCADA services for real-time monitoring and control. The need for operational efficiency, environmental compliance, and safety in the upstream, midstream, and downstream sectors is fueling the demand for SCADA solutions across the region.

The UK oil & gas SCADA market is also characterized by the adoption of artificial intelligence (AI) and machine learning (ML) technologies. Large volumes of sensor data gathered from SCADA systems can be analyzed by AI and ML algorithms to find trends, forecast equipment failures, and enhance production procedures. AI and ML-powered predictive maintenance enables proactive maintenance scheduling, cutting down on unscheduled downtime and prolonging the life of expensive assets.

The oil & gas SCADA market in Russia is driven by the increasing demand for real-time monitoring and control of oil and gas operations across the upstream, midstream, and downstream sectors. The market is expected to grow due to investments in pipeline infrastructure and the adoption of cloud-based SCADA services, which improve remote monitoring, analysis, and accessibility. Cloud-based solutions enable oil and gas companies to scale their infrastructure and adapt to changing operational needs without significant upfront investments.

Asia Pacific Oil & Gas SCADA Market Trends

The oil & gas SCADA market in Asia Pacific is characterized by several key trends and drivers. The upstream segment dominates the market, driven by the region's increasing oil and gas production to meet growing energy demand. Countries like China, India, and Indonesia are investing heavily in upstream exploration and production activities, which is fueling the adoption of SCADA systems for real-time monitoring and control of wellhead operations, pipeline management, and other critical upstream processes.

The China oil & gas SCADA market is anticipated to grow at the fastest CAGR over the forecast period. The increasing complexity and scale of oil and gas operations in China has led to a growing need for remote monitoring and control capabilities, which SCADA systems can provide. In addition, the focus on environmental monitoring and compliance, as well as the adoption of modular and scalable SCADA architectures, are key trends shaping the China market. However, the interconnectedness of SCADA systems with legacy systems makes them vulnerable to cyberattacks, requiring strong security measures and periodic updates to maintain operational resilience.

The oil & gas SCADA market in India is poised for growth, driven by several key trends that reflect the country's increasing focus on energy efficiency, technological innovation, and regulatory reforms.India's government has launched several initiatives to promote Software metering as part of its efforts to modernize the energy sector. Programs such as the Software Meter National Program (SMNP) aim to deploy Software meters across the country to improve energy efficiency, reduce losses in distribution, and enhance financial viability for utilities. These initiatives are supported by regulatory frameworks that encourage utilities to adopt Software metering solutions.

Central & South America Oil & Gas SCADA Market Trends

The oil & gas SCADA market in Central & South America is witnessing the integration of advanced technologies like artificial intelligence and machine learning to optimize oil and gas production processes. However, the high deployment cost of SCADA systems and the need for highly qualified personnel to operate them can limit market growth in the region. Additionally, concerns over data security and the risk of cyberattacks on SCADA systems pose a significant challenge for the industry.

Middle East & Africa Oil & Gas SCADA Market Trends

The oil & gas SCADA market in the Middle East and Africa is characterized by significant investments in pipeline infrastructure to meet the growing energy demand in the region. Countries like Saudi Arabia, the UAE, and Iran are focusing on enhancing their oil and gas production capacities, driving the adoption of SCADA systems for real-time monitoring and control of upstream, midstream, and downstream operations.

Key Oil & Gas SCADA Companies:

The following are the leading companies in the oil & gas scada market. These companies collectively hold the largest market share and dictate industry trends.

- General Electric

- ABB

- Schneider Electric SE

- Rockwell Automation, Inc.

- Siemens

- Mitsubishi Electric Corporation

- Larsen & Toubro Limited

- Yokogawa Electric Corporation

- Emerson Electric Co.

- Honeywell International Inc.

Recent Developments

-

In May 2024, Honeywell and Weatherford announced partnership to deliver comprehensive emissions management solution designed oil & gas industry with Weatherford's CygNet SCADA platform

-

In February 2023, Berkana Resources partnered with Pipecom to offer SCADA operational technology projects to Oil & Gas Midstream industry in anada, the United States, and South America

Oil & Gas SCADA Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.91 billion

Revenue forecast in 2030

USD 5.47 billion

Growth rate

CAGR of 5.7% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Architecture, sector, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

General Electric, ABB, Schneider Electric SE, Rockwell Automation, Inc., Siemens, Mitsubishi Electric Corporation , Larsen & Toubro Limited, Yokogawa Electric Corporation, Emerson Electric Co., Honeywell International Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oil & Gas SCADA Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented oil & gas SCADA market report based on architecture, sector and region:

-

Architecture Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Sector Outlook (Revenue, USD Million, 2018 - 2030)

-

Upstream

-

Downstream

-

Midstream

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global oil & gas SCADA market was estimated at USD 3.73 billion in 2023 and is projected to reach USD 3.91 billion in 2024.

b. The global oil & gas SCADA market is expected to witness a compound annual growth rate of 5.7% from 2024 to 2030 to reach USD 5.47 billion by 2030.

b. Hardware held the market with the largest revenue share of 48.49% in 2023. The hardware segment dominates the market, accounting for a substantial share due to its critical role in acquiring real-time data from oil wells and monitoring pipelines.

b. Some of the key players operating in the oil & gas SCADA market include General Electric, ABB, Schneider Electric SE, Rockwell Automation, Inc., Siemens AG, Mitsubishi Electric Corporation, among others.

b. One of the primary drivers is the increasing demand for real-time information and operational efficiency in the oil and gas industry. One of the primary drivers is the increasing demand for real-time information and operational efficiency in the oil and gas industry.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.