- Home

- »

- Drilling & Extraction Equipments

- »

-

Oil & Gas Drill Bits Market Size, Share, Industry Report, 2030GVR Report cover

![Oil & Gas Drill Bits Market Size, Share & Trends Report]()

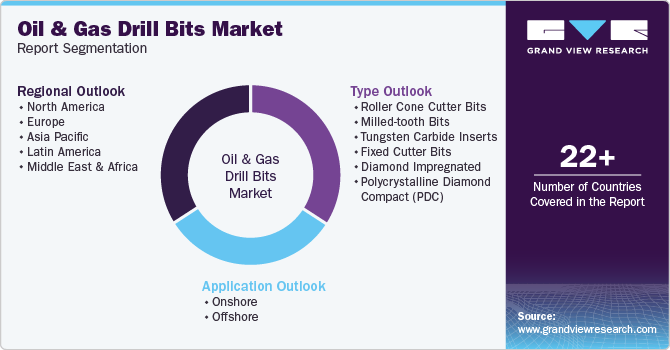

Oil & Gas Drill Bits Market (2024 - 2030 ) Size, Share & Trends Analysis Report By Type (Roller Cone Bits, Milled-tooth Bits, Tungsten Carbide Inserts, Diamond Impregnated), By Application (Onshore, Offshore), By Region, And Segment Forecasts

- Report ID: 978-1-68038-550-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oil & Gas Drill Bits Market Summary

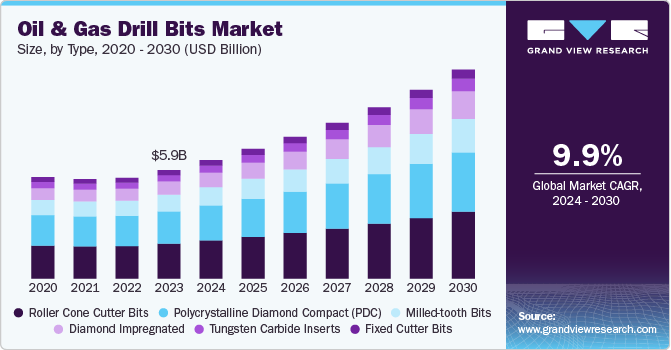

The global oil & gas drill bits market size was valued at USD 5.9 billion in 2023 and is projected to grow at a CAGR of 9.9% from 2024 to 2030. The high rate of fossil fuel extraction to meet the surging global energy demand has been a major market driver.

Key Market Trends & Insights

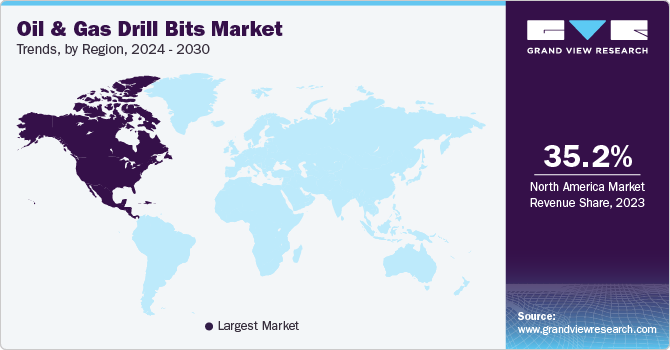

- North America dominated the global market and accounted for the largest revenue share of 35.2% in 2023.

- By type, the roller cone cutter bits dominated the market with a share of 32.3% in 2023.

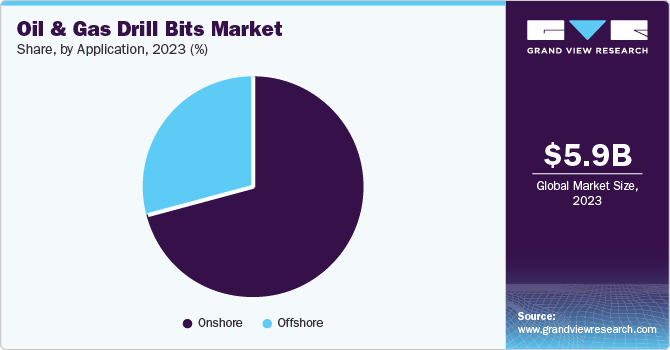

- By application, the onshore segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 5.9 Billion

- 2030 Projected Market Size: USD 11.3 Billion

- CAGR (2024-2030): 9.9%

- North America: Largest market in 2023

Large-scale drilling and E&P in both onshore and offshore oilfields, particularly in the Middle East and the U.S., have led to significant requirements for drill bits. Additionally, depleting conventional oil & gas wells has led E&P companies to extract hydrocarbons from unconventional reserves such as shale, CBM, and tight blocks. Hydrocarbon extraction from these unconventional reserves requires special techniques and equipment that have enhanced longevity and durability.

Furthermore, technological advancements in drill bit design and materials have played a significant role in driving the market. Innovations such as polycrystalline diamond compact (PDC) bits and diamond-impregnated bits have improved drilling efficiency and durability, allowing for deeper and more complex drilling operations. These advancements have reduced operational costs and increased the lifespan of drill bits, making them more attractive to oil and gas companies. Furthermore, profound analysis of complex drilling parameters such as circulating medium, rock strength, drilling systems, and bottom hole environment have led to highly optimized operations.

Furthermore, increasing requirements for optimized drilling performance with the growing concern of E&P companies to reduce operating costs owing to the recent slump in crude oil prices has forced OEM manufacturers to improvise the bit designs. Companies including SLB have developed a rolling polycrystalline diamond cutter to increase overall performance and durability in extreme operating conditions.

Moreover, the exploration of unconventional reserves such as shale gas, tight gas, and coal bed methane has further fueled the demand for specialized drill bits. Unconventional reserves require advanced drilling techniques and equipment to access, and the development of drill bits capable of handling these challenging environments has been crucial. North America, in particular, has seen a significant increase in shale gas exploration, driving the demand for high-performance drill bits in the region.

Type Insights

Roller cone cutter bits dominated the market with a share of 32.3% in 2023, owing to their low costs and suitability for soft and conventional formations. Roller cone cutter bits are a low-cost drilling option for areas consisting of soft and medium rock formations. In addition, technological innovations such as improved bearing systems, advanced materials, and optimized cutting structures have increased the efficiency and lifespan of these bits. These advancements reduce downtime and operational costs, which makes them a favorable option for oil and gas companies. Furthermore, the versatility of roller cone cutter bits aids in the market growth as they are utilized for both onshore and offshore drilling operations.

Diamond-impregnated drill bits are expected to emerge as the fastest-growing segment with a CAGR of 11.3% over the forecast period owing to increased demand for energy globally leading to a surge in oil and gas exploration activities. As conventional oil reserves deplete, there is a growing need to explore unconventional reserves, such as shale gas and tight oil, which require advanced drilling technologies. Diamond-impregnated drill bits are particularly effective in these challenging environments due to their durability and ability to drill through hard rock formations. Furthermore, major companies have invested in research and development to improve the performance and durability of these drill bits with improved designs for better performance and reduced operational costs.

Application Insights

The onshore segment dominated the market in 2023 owing to the rising exploration activities of oil and gas reserves due to increased demand for oil and gas resources. The market witnessed a heightened need for efficient drilling technologies to access onshore oil and gas reserves. Onshore drilling has remained a significant part of the energy sector due to its cost-effectiveness and accessibility compared to offshore drilling. Furthermore, major companies have launched technologically advanced and enhanced drill bits, such as PDC bits and diamond-impregnated bits, to improve the performance of drilling operations.

The offshore segment is projected to grow at a CAGR of 10.8% during the forecast period. The market growth is attributable to the rising exploration of deepwater and ultra-deepwater reserves. These reserves often require specialized drilling techniques and equipment capable of handling challenging drilling conditions, such as high pressures and temperatures. The development of drill bits that can efficiently penetrate hard rock formations and withstand extreme conditions is crucial for successful offshore drilling. Moreover, directional and horizontal drilling techniques have become more prevalent in offshore operations, further boosting the demand for high-performance drill bits. These techniques allow for more precise targeting of oil and gas reservoirs, increasing the efficiency of extraction processes.

Regional Insights

The oil and gas drill bits market in North America dominated the global market and accounted for the largest revenue share of 35.2% in 2023. The region’s abundant shale reserves have led to a surge in shale gas and tight oil exploration, driving the demand for advanced drill bits that can efficiently penetrate hard rock formations and resist high temperatures and pressure. In addition, increased crude oil and natural gas demand, along with large reserves in the Gulf of Mexico and Canada, are expected to drive exploration projects in both offshore and onshore reserves.

U.S. Oil & Gas Drill Bits Market Trends

The U.S. oil and gas drill bits market dominated the North American market and accounted for a revenue share of 76.5% in 2023. This growth is driven by rising exploration and drilling activities to cater to the rising demand for oil and gas resources. Furthermore, increased investments by major companies to explore new locations for extraction of oil and gas resources have led to increased demand for drill bits and other drilling equipment in the country.

Asia Pacific Oil & Gas Drill Bits Market Trends

The oil and gas drill bits market in the Asia Pacific is expected to grow at a CAGR of 10.6% over the forecast period. Population growth coupled with robust growth in the automotive industry is anticipated to spur oil consumption in the region. Moreover, development in countries such as China, India, and Japan has resulted in companies launching improved drill bits and drilling equipment to increase market penetration.

China oil and gas drill bits market is expected to experience significant growth over the forecast period. The country's increasing demand for oil products, driven by its large population and rapid economic development, is a major driver. China has been investing heavily in new oil refineries, often in partnership with companies from the Middle East and Africa, which is expected to boost further the growth of the oil and gas industry and the associated drill bits market. Additionally, China's efforts to explore and develop its domestic oil and gas reserves are contributing to the rising demand for drill bits.

The oil and gas drill bits market in India is expected to grow substantially over the forecast period. India's growing population and expanding economy have led to an increased demand for oil products, driving the need for more drilling activities and, consequently, drill bits. India's efforts to develop its oil refineries and explore new oil and gas reserves are also significant factors contributing to the market's growth. The availability of key manufacturers and the need for energy security in the face of the rising population are additional drivers of India's oil and gas drill bits market.

Europe Oil & Gas Drill Bits Market Trends

The Europe oil & gas drill bits market is expected to grow significantly over the forecast period, owing to the increasing energy demand. As Europe continues to seek energy security and reduce its reliance on external sources, there is a heightened need for efficient drilling technologies to access domestic oil and gas reserves. This demand is particularly strong in countries including Norway and the UK, which have significant offshore reserves in the North Sea. Furthermore, companies producing drill bits have aimed to improve their market expansion in this region by launching durable and efficient drill bits and drilling equipment.

Key Oil & Gas Drill Bits Company Insights

The global oil and gas drill bits market is highly consolidated. Some major companies are SLB, Atlas Copco, Baker Hughes Company, Halliburton Company, and NOV. These companies have increasingly focused on product differentiation and pioneering solutions. They have undertaken several strategic initiatives such as collaborations, mergers and acquisitions, and R&D efforts.

-

SLB, formerly Schlumberger, is a leading global technology company specializing in energy. It provides advanced digital solutions and technologies for oil and gas exploration, production, and processing. SLB operates through four main divisions: Digital and Integration, Reservoir Performance, Well Construction, and Production Systems. SLB is renowned for its innovative approaches to decarbonization and sustainable energy practices.

-

Atlas Copco is a Swedish multinational industrial company renowned for its innovative solutions. The company provides various products, including air treatment systems, compressors, vacuum solutions, industrial power tools, and assembly systems.

Key Oil & Gas Drill Bits Companies:

The following are the leading companies in the oil & gas drill bits market. These companies collectively hold the largest market share and dictate industry trends.

- SLB

- Atlas Copco

- Baker Hughes Company

- Halliburton Company

- NOV

- Varel International, Inc.

- Sandvik AB

- Torquato Drilling Accessories, Inc.

- Ulterra Drilling Technologies, LP

- Kingdream Public Limited Company

- Scientific Drilling International

- Western Drilling Tools Inc.

Recent Developments

-

In February 2024, Baker Hughes Company announced the contract with Petrobas for well construction services in Brazil. The integrated project is projected to commence in 2025. The services will include drill bits, drilling services, cementing, well clean-up, wireline, fishing, and more. According to the contract, the company has agreed to provide these services to three rigs.

-

In March 2023, Sandvik AB announced introducing an opt-out recycling program for the customers of drill bits made from carbide. The program was executed to transform the use of materials such as Tungsten, which is projected to become scarce in the upcoming years. The company aimed to collect 90% of its used drill bits by 2025, which it aimed to recycle and resell, aiding in the reduction of 64% of CO2 emissions.

Oil & Gas Drill Bits Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.4 billion

Revenue forecast in 2030

USD 11.3 billion

Growth rate

CAGR of 9.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Norway, Russia, France, Netherlands, China, India, Australia, Malaysia, Brazil, Argentina, Saudi Arabia, UAE, Kuwait

Key companies profiled

SLB; Atlas Copco; Baker Hughes Company; Halliburton Company; NOV; Varel International, Inc.; Sandvik AB; Torquato Drilling Accessories, Inc.; Ulterra Drilling Technologies, LP; Kingdream Public Limited Company; Scientific Drilling International; Western Drilling Tools Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oil & Gas Drill Bits Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oil & gas drill bits market report based on type, application, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Roller Cone Cutter Bits

-

Milled-Tooth Bits

-

Tungsten Carbide Inserts

-

Fixed Cutter Bits

-

Diamond Impregnated

-

Polycrystalline Diamond Compact (PDC)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Norway

-

Russia

-

France

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Australia

-

Malaysia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.