- Home

- »

- Conventional Energy

- »

-

Oil And Gas Analytics Market Size & Share Report, 2030GVR Report cover

![Oil And Gas Analytics Market Size, Share & Trends Report]()

Oil And Gas Analytics Market (2024 - 2030) Size, Share & Trends Analysis Report By Offering (Hardware, Software, Service), By Deployment, By Application, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-272-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oil And Gas Analytics Market Summary

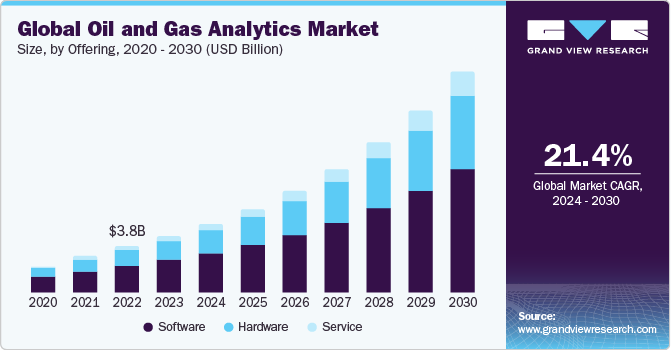

The global oil and gas analytics market size was estimated at USD 8.15 billion in 2023 and is projected to reach USD 31.68 billion by 2030, growing at a CAGR of 21.4% from 2024 to 2030. The major market growth drivers are the escalating demand for energy worldwide and the need for advanced tools to extract valuable insights from vast datasets.

Key Market Trends & Insights

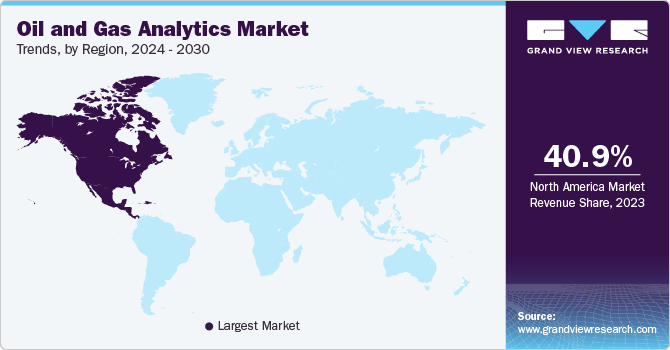

- North America accounted for the largest market share of 40.85% in 2023.

- By offering, the software segment dominated the market and accounted for the largest revenue share of 58.66% in 2023.

- By deployment, the cloud segment dominated the market and held the largest revenue share of 65.81% in 2023.

- By application, the upstream dominated the market and held the largest revenue market share of 45.15% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 8.15 Billion

- 2030 Projected Market Size: USD 31.68 Billion

- CAGR (2024-2030): 21.4%

- North America: Largest market in 2023

Companies engaged in the exploration, supply chain, and delivery of hydrocarbons are seeking solutions to reduce operational and maintenance costs, driving the adoption of oil and gas analytics. This technology leverages historical data and recent trends to enhance decision-making, reduce errors, and increase operational efficiency. By integrating workforce and data, analytics enable predictive actions, particularly in upstream applications involving exploration activities.

Despite the market growth facilitated by the increasing energy demand, challenges such as crude oil price volatility and stringent industry regulations act as market restraints. Key players in the market, including Hewlett-Packard, Hitachi, Oracle, and IBM, drive innovation through new product launches and strategic partnerships to enhance operational efficiency and decision-making processes within the oil and gas industry.

The market dynamics are influenced by factors such as the rising demand for oil and gas, increasing competition, financial capital, and public scrutiny. Moreover, adopting analytics-powered programs enables companies to gather valuable insights about exploration activities, production processes, and market trends. The market is witnessing a shift towards integrating AI and ML technologies to navigate uncertainties and streamline operations. As oil and gas companies focus on improving production efficiency, reducing costs, and embracing digital technologies, the oil and gas analytics industry presents significant growth opportunities for enhancing decision-making processes and driving innovation within the sector.

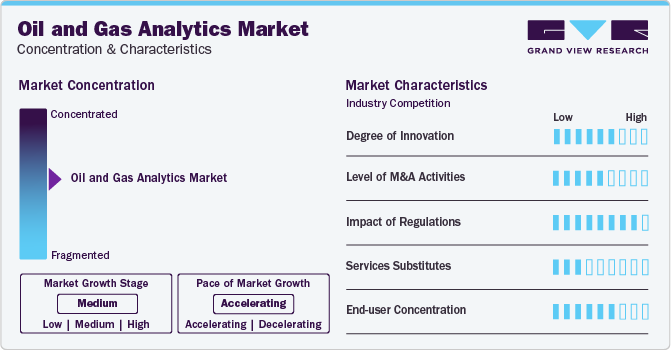

Market Concentration & Characteristics

The oil and gas analytics industry is characterized by a growing demand for advanced analytics solutions driven by the need for operational efficiency, production optimization, and strategic decision-making in the global energy market. Companies in this sector are increasingly leveraging analytics tools and advanced business intelligence to gain actionable insights from real-time data, minimize risks, and enhance operational performance.

Innovations are paramount in the growth of the oil and gas analytics market as they drive operational efficiency, cost reduction, and enhanced decision-making in the industry. Innovations such as advanced analytics solutions, artificial intelligence, machine learning, and the Internet of Things (IoT) are revolutionizing how oil and gas companies optimize production, forecast accurately, and streamline supply chain operations.

Mergers and acquisitions allow companies to leverage their technological expertise, global reach, and strong customer relationships to gain a competitive advantage. In addition, the market is witnessing a growing trend of startups entering the market and offering niche analytics solutions, further driving competition and innovation in the oil and gas analytics market. Overall, the competitive landscape of the global oil and gas analytics market is dynamic and driven by these merger and acquisition activities as companies seek to stay ahead of the curve and capitalize on the growing demand for advanced analytics solutions in the industry.

Offering Insights

Based on offering, the market is segregated into hardware, software, and service. The software segment dominated the market and accounted for the largest revenue share of 58.66% in 2023. The demand for oil & gas analytics software is experiencing a significant upsurge driven by the escalating complexity and scale of operations within the oil and gas industry. Companies involved in hydrocarbon exploration and production are increasingly turning to advanced analytics tools to extract valuable insights from vast datasets, aiming to enhance decision-making, reduce operational costs, and optimize asset performance.

Furthermore, the demand for oil & gas analytics hardware is driven by the increasing complexity and scale of operations within the oil and gas industry, necessitating advanced tools to extract valuable insights from vast datasets. Companies in the sector are increasingly adopting sophisticated hardware solutions to enhance operational efficiency, optimize production, and reduce costs. As companies strive to extract meaningful insights from the vast amounts of data generated by connected assets, the demand for cutting-edge hardware tools will continue to rise, enabling the oil and gas sector to operate more efficiently and competitively in the evolving market landscape.

Deployment Insights

Based on deployment, the market has been segmented into on-premises and cloud. The cloud segment dominated the market and held the largest revenue share of 65.81% in 2023. The demand for cloud-based solutions in the oil & gas analytics market is experiencing a significant surge due to their ability to streamline operations, enhance scalability, and reduce upfront costs. Cloud deployment allows oil and gas companies to access analytics tools remotely via the Internet, eliminating the need for extensive IT infrastructure investments. Cloud services provide improved network management, high application performance, enhanced bandwidth, and lower overhead costs, making them increasingly essential for oil and gas analytics.

The rise in cloud-based solutions is reshaping the oil & gas analytics landscape, offering efficient and cost-effective ways to manage data, drive operational efficiency, and navigate the evolving market dynamics. Moreover, the demand for on-premises oil & gas analytics solutions remains significant, offering companies direct control over their data and analytics processes, ensuring high security and compliance standards. This deployment model involves installing analytics software and infrastructure within the organization's premises, providing a tailored approach to data management.

Application Insights

Based on application, the market has been segmented into upstream, midstream, and downstream. Upstream dominated the market and held the largest revenue market share of 45.15% in 2023. The demand for upstream oil & gas analytics is witnessing substantial growth driven by the industry's focus on optimizing exploration and production activities. Upstream analytics, which encompasses reservoir analysis, drilling optimization, and production forecasting, is pivotal in enhancing operational efficiency and cost-effectiveness for oil and gas companies.

The downstream analytics segment is witnessing notable growth trends, emphasizing the importance of analytics in transforming downstream oil and gas operations. As the industry continues to evolve and embrace digital technologies, the demand for downstream oil & gas analytics solutions is expected to rise further, driving operational excellence and efficiency in the downstream sector.

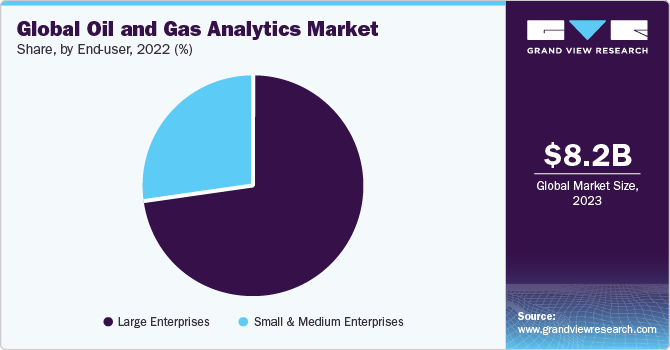

End-user Insights

Based on end-user, the market has been segmented into small & medium enterprises and large enterprises. Large enterprises dominated the market and accounted for the largest revenue market share of 72.74% in 2023. Large enterprises in the oil & gas industry increasingly invest in advanced analytics solutions to optimize operations, reduce costs, and enhance decision-making processes. The significant volume of data generated in large enterprises necessitates sophisticated analytics tools to extract valuable insights and drive strategic initiatives. These companies leverage machine learning, artificial intelligence, and cloud-based analytics services to improve production forecasting, maintenance optimization, and supply chain management.

By embracing analytics, SMEs in the oil & gas sector can streamline operations, enhance decision-making processes, and stay competitive in a rapidly evolving industry. The growth of the oil & gas analytics market presents SMEs with opportunities to leverage advanced technologies and data-driven insights to drive operational excellence and achieve sustainable growth in the dynamic oil and gas landscape.

Regional Insights

The oil and gas analytics market in North America accounted for the largest market share of 40.85% in 2023. With the evolution of the North American shale sector and the changing dynamics of global energy markets, the demand for analytics tools has surged. Investors seek comprehensive data and insights to understand competition, activity, and the sector's impact on oil and gas supply/demand balances. The market offers a complete workflow solution for investors to assess market conditions, identify opportunities for repositioning, and gain valuable insights for investment strategies.

U.S. Oil and Gas Analytics Market Trends

The oil & gas analytics market in the U.S. accounted for the largest share of 62.14% in North America in 2023. The United States is a key market player, with a robust demand driven by the country's significant oil and gas production activities. The adoption of advanced analytics solutions in the U.S. oil and gas sector is propelled by the industry's focus on operational efficiency, cost optimization, and regulatory compliance.

Asia Pacific Oil And Gas Analytics Market Trends

The oil & gas analytics market in the Asia Pacific is driven by several factors, including the growing demand for data analysis required during the exploration of oil sources, increasing investments in the oil and gas industry, and the rapid adoption of cloud services in the region. The region is also home to many software companies that provide analytics platforms for oil and gas companies, contributing to the market's growth. In addition, the increasing number of oil and gas projects in the region, particularly in countries such as China and India, is also driving the demand for oil and gas analytics.

The China oil and gas analytics market accounted for the largest share of 44.00% in Asia Pacific. The oil and gas analytics demand in China is on the rise, driven by its significant presence in the global energy market and its focus on operational efficiency and technological advancements. With the increasing demand for oil and gas resources and growing competition and financial influences, the need for advanced analytics solutions is becoming more pronounced in the Chinese market.

The oil and gas analytics marketin South Korea is also expected to grow at a CAGR of 24.5%. The oil and gas analytics demand in South Korea is experiencing growth and transformation, driven by increasing energy consumption, government initiatives to enhance energy security, and technological advancements in exploration and production techniques.

Europe Oil And Gas Analytics Market Trends

Several factors, including the increasing demand for energy, the need for improved operational efficiency, and the growing adoption of digital technologies, drive the growth of the Europe market for oil & gas analytics. The market is also influenced by the rising focus on environmental sustainability and the need for companies to reduce their carbon footprint.

The Russia oil and gas analytics market accounted for largest share of 49.68% in Europe. The country's vast refining capacity and substantial oil and gas reserves position it as a key supplier in the global market. Russia's role in global energy markets is underscored by its status as one of the top three crude producers worldwide, alongside Saudi Arabia and the United States.

The oil and gas analytics market in Norway is also expected to grow at a significant CAGR. The demand for oil and gas analytics in Norway is driven by a dynamic energy market landscape characterized by a mix of traditional oil and gas production and a growing emphasis on alternative energy sources.

Central & South America Oil And Gas Analytics Market Trends

The oil & gas analytics market is in Central and South America, primarily driven by the increasing number of offshore operations in the region, the rising demand for unconventional hydrocarbons like shale gas, and the need for efficient exploration and production activities.

The Brazil oil and gas analytics market accounted for largest share of 44.05% in 2023 in Central & South America. Brazil's oil and gas sector is characterized by a competitive landscape, focusing on operational efficiency, exploration activities, and production optimization. The market dynamics are influenced by market needs, competition, regulatory environment, and technological advancements.

Middle East & Africa Oil And Gas Analytics Market Trends

The oil & gas analytics market in the Middle East & Africa is primarily driven by the region's rich oil and gas deposits, leading to significant opportunities for the industry. The Middle East, in particular, has been home to majority of the world's refining capacity expansion, with a focus on refining projects.

The Saudi Arabia oil and gas analytics market accounted for the largest share of 61.30% in 2023 in Middle East & Africa. The market dynamics are influenced by factors such as OPEC+ production agreements, global oil price fluctuations, and the country's strategic position in the global energy market.

Key Oil And Gas Analytics Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new Product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share. Key companies in the market include Essar Oil, ExxonMobil, ConocoPhillips, Weatherford, EOG Resources, and others.

Key Oil And Gas Analytics Companies:

The following are the leading companies in the oil and gas analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Flywheel Energy

- Olimax Energy

- Rockcliff Energy

- Covey Park Energy

- Essar Oil

- ExxonMobil

- ConocoPhillips

- Weatherford

- EOG Resources

- Naftogaz

- XTO Energy

- Devon Energy

- National Energy Services Reunited Corp. (NESR)

- Hunt Oil Company

- Murphy Oil Corporation

Recent Developments

-

In January 2024, SLB and Nabors collaborated on automated drilling solutions for oil and gas operators. The collaboration will focus on drilling automation applications and rig operating systems to deliver efficiency.

-

In September 2023, Datagration and Origem Energia announced a collaboration to integrate energy analytics with machine learning and artificial intelligence in Brazil oil & gas industry.

-

In May 2023, Essar Oil and Gas Exploration and Production Ltd and Sensia announced a collaboration for digitalization of oil & gas field operations.

Oil And Gas Analytics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 9.89 billion

Revenue forecast in 2030

USD 31.68 billion

Growth rate

CAGR of 21.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, deployment, application, end-user, region

Regional Scope

North America; Europe; Asia Pacific; Central and South America; Middle East and Africa

Country scope

U.S.; Canada; Russia; Norway; UK; Italy; Turkey; China; India; Japan; South Korea; Indonesia; Brazil; Mexico; Argentina; Saudi Arabia; Iraq

Key companies profiled

Flywheel Energy; Oilmax Energy; Rockcliff Energy; Covey Park Energy; Essar Oil; ExxonMobil; ConocoPhillips; Weatherford; EOG Resources; Naftogaz; XTO Energy; Devon Energy; National Energy Services Reunited Corp. (NESR); Hunt Oil Company; Murphy Oil Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oil And Gas Analytics Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oil & gas analytics market report based on offering, deployment, application, end-user, and region:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Service

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Upstream

-

Midstream

-

Downstream

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & medium Enterprises

-

Large Enterprises

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Russia

-

Norway

-

UK

-

Italy

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

-

Central and South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

Iraq

-

-

Frequently Asked Questions About This Report

b. The global Oil & Gas Analytics market size was estimated at USD 8.15 billion in 2023 and is expected to reach USD 9.89 billion in 2024.

b. The global Oil & Gas Analytics market is expected to grow at a compounded annual growth rate of 21.4% from 2024 to 2030 to reach USD 31.68 billion by 2030.

b. The North America dominated the Oil & Gas Analytics market with the highest share of about 40.85% in 2023. This can be attributed through country's significant oil and gas production

b. Some key players operating in the Oil & Gas Analytics market include Flywheel Energy, Oilmax Energy, Rockcliff Energy, Covey Park Energy, Essar Oil, ExxonMobil, ConocoPhillips, Weatherford, EOG Resources and others

b. Key factors driving the Oil & Gas Analytics market growth which include the escalating demand for energy worldwide, coupled with the need for advanced tools to extract valuable insights from vast datasets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.