Oil Free Air Compressor Market Size, Share & Trends Analysis Report By Product (Stationary, Portable), By Technology, By Power Rating, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-343-0

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Oil Free Air Compressor Market Trends

The global oil free air compressor market size was valued at USD 12.3 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.0% from 2024 to 2030. Oil-free air compressor demand is predicted to rise in the coming years as the prominence of energy recovery, energy efficiency, and CO2 emissions decreases. For instance, according to the International Energy Agency (IEA), in order to reduce energy waste and lower CO2 emissions, the Inflation Reduction Act of 2022 makes significant investments in energy efficiency. Furthermore, increased demand for value-added services is expected to fuel global market expansion over the forecast period.

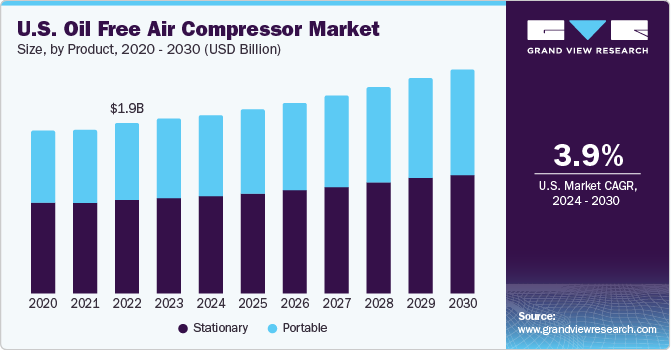

The demand for portable air compressors in the U.S. has been on the rise, driven by a confluence of factors. Industries such as construction, automotive, and manufacturing are increasingly recognizing the practical advantages of portable air compressors, which offer mobility and flexibility in various applications. The construction sector, in particular, relies heavily on these portable units for tasks such as pneumatic tool operation, powering air-driven machinery, and on-site inflation needs.

Additionally, the growing trend of do-it-yourself (DIY) projects among consumers has fueled the demand for portable air compressors for tasks like home improvement and automotive maintenance. Furthermore, advancements in technology have led to the development of compact and lightweight portable compressors with improved performance, making them an attractive choice for both professionals and hobbyists. The need for versatile and on-the-go compressed air solutions, coupled with the increasing awareness of the convenience and efficiency offered by portable air compressors, is contributing to the expanding market demand in the U.S.

The demand for oil free air compression in the U.S. is likely to grow in the forecast period, driven by a combination of environmental concerns, regulatory requirements, and the need for more efficient and reliable compressed air systems. Increasing investments and innovations in the air compressors industry have led to the adoption of new designs and materials that offer greater levels of performance, reliability, and sustainability.

The market players are constantly undertaking expansion initiatives such as mergers, acquisitions, partnerships, and product launches to expand their market footprint. For instance, In November 2022, Atlas Copco AB, a Swedish multinational industrial company, acquired Northeast Compressor, which sells air compressors, related services & equipment to wide range of industrial customers in New York, the U.S. The acquisition is expected to aid Atlas Copco AB in getting closer to customers and increase its coverage in upstate New York.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. Oil free air compressor market is characterized by a high degree of innovation owing to rapid technological advancements. The oil-free air compressor market exhibits several distinctive characteristics, shaped by the evolving needs of industries, technological advancements, and environmental considerations. Moreover, the increasing demand for oil-free air compressors stems from the heightened emphasis on environmental sustainability. Industries worldwide are adhering to stringent regulations that limit emissions and promote eco-friendly practices.

The market is characterized by a growing awareness of energy efficiency. Industries, including power generation, manufacturing, and chemicals, are increasingly adopting cost-effective manufacturing techniques. Oil-free air compressors, known for their energy-efficient operation, are sought after to enhance overall energy distribution and cost-effectiveness in various applications. This emphasis on energy efficiency not only aligns with sustainable practices but also addresses the economic considerations of businesses looking to optimize their operational costs.

Moreover, technological advancements play a pivotal role in shaping the oil-free air compressor market. Ongoing research and development efforts are focused on enhancing the performance, reliability, and durability of these compressors. Innovations such as advanced materials, improved sealing technologies, and digital control systems contribute to making oil-free compressors more reliable, efficient, and user-friendly. This continuous innovation is a key driver in sustaining the market growth, as businesses seek cutting-edge solutions that provide a competitive edge in their operations.

Moreover, the market exhibits a diversification of applications across industries. Oil-free air compressors find utility in power generation, petroleum, chemicals, and manufacturing for a range of tasks, including pneumatic tool operation, air-driven machinery, and various production processes. The versatility of these compressors makes them indispensable in environments where oil contamination poses risks to product quality, machinery, or the overall process.

Product Insights

Stationary product led the market and accounted for 57.6% of the global revenue in 2023. Stationary air compressors are intended to remain in one location and connected to a building's electrical circuit. Stationary air compressors typically have a capacity ranging from 60 to 240 gallons. These compressors are ideal for use in manufacturing plants, industrial plants, and auto repair shops. The larger tanks have a greater capacity for air delivery and allow more air storage. They are intended for difficult, more complex, and larger jobs, such as gas turbines or chemical plants. These air compressors are available in a variety of configurations, including climate control, base-mounted, and electric. Stationary air compressors provide the high volume of air necessary for powering production and automotive air tools.

Portable air compressors offer numerous benefits and find extensive applications across various industries. Their inherent mobility and compact design make them invaluable for on-the-go tasks, particularly in construction sites where pneumatic tools, such as nail guns and paint sprayers, require a readily available compressed air source. Additionally, portable compressors play a crucial role in automotive maintenance, allowing for efficient tire inflation and powering air tools for repairs. Furthermore, advancements in technology have led to the development of lightweight yet powerful portable compressors, enhancing their usability and making them an essential tool for professionals and hobbyists alike across a spectrum of applications.

Technology Insights

Rotary/screw technology led the market in 2023. Rotary/screw oil-free compressors, with their efficient and reliable operation, have become pivotal in meeting this demand. The technology's ability to provide a continuous and clean air supply, eliminating the risk of oil contamination, not only enhances the overall efficiency of industrial processes but also aligns with the growing emphasis on environmental sustainability. As businesses seek reliable and high-performance compressed air solutions, the demand for rotary/screw oil-free air compressors is expected to continue its upward trajectory.

The demand for centrifugal oil-free air compressors is experiencing a notable surge, propelled by the imperative for clean and uncontaminated compressed air in critical industrial applications. Industries such as pharmaceuticals, electronics, and aerospace, where air quality is paramount, are increasingly adopting centrifugal compressors due to their oil-free operation and exceptional reliability. These compressors utilize advanced technology to ensure a contaminant-free air supply, making them ideal for applications demanding high purity. With a focus on energy efficiency and adherence to stringent environmental standards, the demand for centrifugal oil-free air compressors is expected to persist and expand across various sectors seeking optimal performance and reliability in compressed air systems.

Power Rating Insights

15 - 55 kW power rating led the market in 2023. The market for units in the range of 15-55kW is highly competitive and rapidly evolving. These compressors are commonly used in automotive, aerospace, and medical device manufacturing industries, where the quality of compressed air is critical to the production process. One of the significant trends in this market is the increasing adoption of digitalization and the Internet of Things (IoT) technologies in air compressors. Many manufacturers are now integrating digital sensors, cloud-based analytics, and remote monitoring capabilities into their compressors, enabling users to optimize performance, reduce downtime, and improve overall efficiency.

The escalating demand for oil-free air compressors with a power rating exceeding 160kW can be attributed to the evolving needs of large-scale industrial operations. Industries such as petrochemicals, power generation, and heavy manufacturing, where high-volume and continuous compressed air is indispensable, are increasingly opting for these robust and powerful compressors. Moreover, the efficiency and reliability of over 160kW oil-free air compressors make them integral to optimizing industrial productivity, meeting growing energy demands, and adhering to stringent regulatory requirements, driving their increased adoption across diverse sectors.

Application Insights

Automotive application led the market's global revenue in 2023. The automotive industry is witnessing a notable surge in the demand for oil-free air compressors, driven by a combination of quality requirements, technological advancements, and environmental considerations. As automotive manufacturing processes become more sophisticated, the need for clean and oil-free compressed air is critical, particularly in applications such as paint spraying, pneumatic tools, and precision machining. Oil-free air compressors ensure that no contaminants compromise the integrity of finished products or the efficiency of manufacturing equipment. As the automotive industry continues to evolve, the demand for oil-free air compressors is expected to persist, driven by the pursuit of high-quality production, operational efficiency, and adherence to stringent environmental standards.

The demand for oil free air compressors in the semiconductor and electronics industry is rapidly growing due to the requirement of high-quality compressed air for a range of processes, including chip manufacturing, wafer fabrication, and assembly. The semiconductor & electronics industries require high-purity compressed air because contamination can cause product defects. Oil free air compressors deliver clean, dry, contaminant-free compressed air, making them an excellent choice for these applications. These aforementioned factors are anticipated to propel the demand for market in the coming years.

Regional Insights

Europe region dominated the market and accounted for 30.8% share in 2023. The demand for oil free air compressors in Europe has been increasing in recent years due to various factors such as environmental concerns, health and safety regulations, and the need for higher quality compressed air across industries such as food & beverage, pharmaceuticals, and electronics. As a result, many industries in Europe are switching to oil free air compressors to meet their compressed air needs while also addressing environmental and safety concerns. Some of the leading manufacturers of oil free air compressors in Europe include Atlas Copco AB, Ingersoll Rand, and Kaeser Kompressoren AG.

The market players have to constantly undertake initiatives such as mergers, partnerships, and acquisitions to stay ahead in the highly competitive market. For instance, in February 2022, M.R. Organization, a provider of compressor equipment, accessories, and parts, announced the acquisition of Standard Air Limited, an air compressor component manufacturer based in the UK. The acquisition will enable M.R. Organization to expand their global footprint and capture a new customer base.

Asia Pacific region has several countries with emerging economies, including China, India, and some Southeast Asian countries. These countries are witnessing tremendous growth in many businesses such as construction, infrastructure development, manufacturing, etc. The oil free air compressors play a key role in these industries and their demand is expected to grow in these developing regions in the coming years. Asia Pacific has a growing healthcare industry with increasing demand for medical facilities. Oil free air compressors are commonly used in medical applications and pharmaceutical companies, including in medical air systems, dental clinics, and laboratories, which may drive demand for oil free air compressors in the region.

Key Oil Free Air Compressor Company Insights

Some of the key players operating in the market include Atlas Copco AB,ELGi and Ingersoll Rand.

-

Atlas Copco AB specializes in the innovation, development, and manufacturing of oil free compressor technologies. The company's oil free compressors are certified ISO Class 0, and it is the first company to receive the certification. It also rents, services, manufactures, and develops assemble systems, construction systems, and industrial tools. It majorly operates across four segments namely, industrial technology, power technology, vacuum technology, and compressor technology.

-

Ingersoll Rand is a multinational corporation that provides solutions and services to increase industrial efficiency and productivity through a diverse range of mission-critical and innovative medical, energy, fluid, and air technologies. The company's products are sold under more than 40 market-leading brands, including Gardner Denver and Ingersoll Rand, which are globally recognized in their respective end markets and are known for superior customer service, product efficiency, reliability, and quality.

-

Zen Air Tech Private Limited, Frank Technologies Pvt Ltd., and FS Elliot Co., LLC are some of the emerging market participants in the market.

-

Zen Air Tech Private Limited is a well-known exporter and manufacturer of air dryers, vacuum pumps, booster compressors and air compressors, as well as their accessories and spare parts. The company has high functional competence with low relevant horsepower, and its products are available in a variety of operational parameters to meet market demands. In its early stages of inception, the company began manufacturing its products under the brand "JK Pneumatics" for various types of vacuum pumps, air compressors, and spare parts ranging from 1 to 20 HP.

-

Frank Technologies Pvt Ltd. is an exporting and manufacturing firm providing the industry with high quality products since its inception in 2015. The company's product portfolio includes dental compressors, air compressors, and piston compressors. Its air compressors have various features such as low-cost service life, hassle-free performance, durability, corrosion resistance, and antivibratory construction. Frank Technologies Pvt Ltd. products are mainly used in industry applications such as pumps, automobile, and engineering industries.

Key Oil Free Air Compressor Companies:

The following are the leading companies in the oil free air compressor market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these oil free air compressor companies are analyzed to map the supply network.

- Atlas Copco AB

- FS Elliot Co., LLC

- Hanwha Power Systems CO., LTD.

- Ingersoll Rand

- Sullair, LLC.

- Kaeser Kompressoren SE

- Doosan Portable Power

- Sullivan-Palatek Inc.

- ELGi

- Zen Air Tech Private Limited

- Frank Technologies Pvt Ltd.

- Hitachi Industrial Equipment Systems Co., Ltd.

- CIASONS Industrial Inc.

- Aerzen

- ANEST IWATA Corporation

Recent Developments

-

In April 2023, Atlas Copco AB completed the acquisition of Shandong Bozhong Vacuum Technology Co., Ltd, an innovator and manufacturer of vacuum systems and pumps. The acquired business will become a part of the industrial vacuum division in the vacuum technique business segment of Atlas Copco AB.

-

In April 2023, Atlas Copco AB announced the acquisition of the compressed air business division of Asven S.R.L., a specialist in service, installation, and sales of compressed air systems.

-

In January 2023, Ingersoll Rand announced the acquisition of the Air Treatment Business Division of SPX Flow, a provider of processing solutions. The Air Treatment division expands Ingersoll Rand's core compressor products with a highly complementary product portfolio of cost-effective compressed air filters, dryers, and other consumables with a high attachment rate.

-

In August 2022, Ingersoll Rand announced the acquisition of three companies namely, Holtec Gas Systems LLC, Shanghai Hanye Air Purifying Technology Co., Ltd, and Hydro Prokav Pumps (India) Private Limited for a cash price of USD 35 million. These acquisitions will help expand and enhance Ingersoll Rand's air treatment solutions portfolio.

Oil Free Air Compressor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 12.8 billion |

|

Revenue forecast in 2030 |

USD 17.2 billion |

|

Growth rate |

CAGR of 5.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, power rating, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan; Australia; South Korea; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

Atlas Copco AB; FS Elliot Co., LLC; Hanwha Power Systems CO., LTD.; Ingersoll Rand; Doosan Portable Power; Sullivan-Palatek Inc.; ELGi; Zen Air Tech Private Limited; Frank Technologies Pvt Ltd.; Hitachi Industrial Equipment Systems Co., Ltd.; CIASONS Industrial Inc.; Aerzen; ANEST IWATA Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Oil Free Air Compressor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the oil free air compressor market report based on product, technology, power rating, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Stationary

-

Portable

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Reciprocating

-

Rotary/Screw

-

Centrifugal

-

-

Power Rating Outlook (Revenue, USD Million, 2018 - 2030)

-

Below 15kW

-

15-55kW

-

55-160kW

-

Above 160 kW

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Pharmaceutical

-

Semiconductor & electronics

-

Chemical

-

Oil & Gas

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global oil free air compressor market size was estimated at USD 12.3 billion in 2023 and is expected to be USD 12.8 billion in 2024.

b. The global oil free air compressor market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.0% from 2024 to 2030 to reach USD 17.2 billion by 2030.

b. Europe region dominated the market and accounted for 30.8% share in 2023. The demand for oil free air compressors in Europe has been increasing in recent years due to various factors such as environmental concerns, health and safety regulations, and the need for higher quality compressed air across industries such as food & beverage, pharmaceuticals, and electronics. As a result, many industries in Europe are switching to oil free air compressors to meet their compressed air needs while also addressing environmental and safety concerns.

b. Some of the key players operating in the oil free air compressor market include Atlas Copco AB, FS Elliot Co., LLC, Hanwha Power Systems CO., LTD., Ingersoll Rand, Sullair, LLC., Kaeser Kompressoren SE, Doosan Portable Power, Sullivan-Palatek Inc., ELGi, Zen Air Tech Private Limited, Frank Technologies Pvt Ltd., Hitachi Industrial Equipment Systems Co., Ltd., CIASONS Industrial Inc., Aerzen, ANEST IWATA Corporation.

b. Oil free air compressors demand is predicted to rise in the coming years as the prominence of energy recovery, energy efficiency, and CO2 emissions decreases.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."