- Home

- »

- Electronic & Electrical

- »

-

Oil Dispenser Bottle Market Size And Share Report, 2030GVR Report cover

![Oil Dispenser Bottle Market Size, Share & Trends Report]()

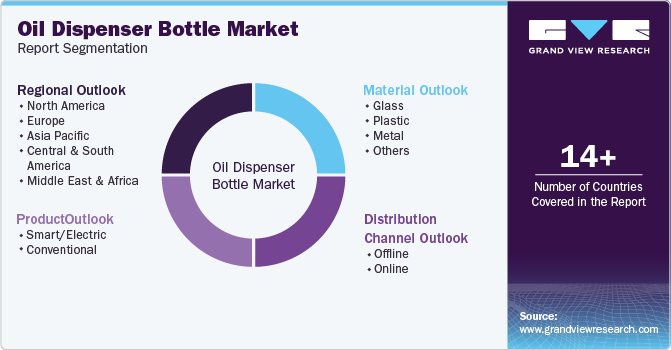

Oil Dispenser Bottle Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Smart/Electric, Conventional), By Material (Glass, Plastic, Metal), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-410-3

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Oil Dispenser Bottle Market Size & Trends

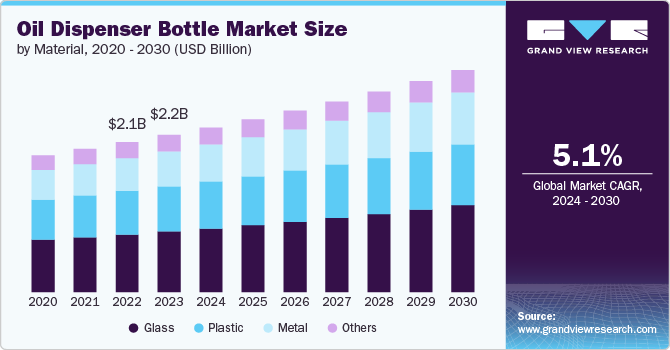

The global oil dispenser bottle market size was estimated at USD 2.22 billion in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. The market is mainly driven by increasing consumer awareness of health and wellness, leading to a preference for controlled portioning of oils and dressings. The rise in home cooking trends, spurred by the popularity of culinary shows and the growing interest in gourmet and healthy cooking, has also fueled demand. In addition, the shift towards sustainable and eco-friendly packaging solutions, coupled with the integration of smart technology in kitchen gadgets, has further propelled the market growth.

Consumer preferences have evolved, with a growing emphasis on kitchen aesthetics and functionality. Modern kitchens are not just places for cooking; they are also spaces where design and style are important. As a result, consumers are seeking products that not only serve a functional purpose but also enhance the overall look of their kitchen.

Oil dispenser bottles, especially those made of glass or stainless steel with sleek designs, are increasingly popular as they contribute to a clean and organized kitchen environment. For example, brands like OXO and Rachael Ray offer oil dispensers that are both practical and visually appealing, matching contemporary kitchen designs. This trend towards premium, well-designed kitchenware drives demand for oil dispenser bottles.

Smart oil dispensers, which can track oil usage and provide nutritional information via connected apps, are particularly popular among health-conscious consumers. For instance, brands like Emmeistar have introduced smart oil dispensers that integrate with mobile apps to monitor oil consumption, supporting consumers in making healthier choices.

The oil cruet industry is also benefiting from constant innovation in product design and technology. Manufacturers are introducing new features, such as non-drip spouts, easy-to-clean designs, and smart technology integration, to differentiate their products and meet the evolving needs of consumers.

Product Insights

The conventional segment led the market with the largest revenue share of 99.1% in 2023. The demand for conventional oil cruets is primarily driven by their affordability and widespread accessibility, making them a popular choice in both developed and emerging markets. Consumers in price-sensitive regions, such as Asia, Africa, and Latin America, often prefer these simpler, cost-effective options for daily cooking needs. In addition, their easy availability in local stores and online platforms, coupled with their practical functionality, ensures that they remain a staple in many households worldwide.

The smart oil segment is projected to grow at the fastest CAGR of 11.2% from 2024 to 2030, driven by the growing consumer focus on health, technology integration, and convenience. These advanced dispensers, often equipped with features like precise portion control, Bluetooth connectivity, and integration with health-tracking apps, appeal to tech-savvy and health-conscious consumers who seek to monitor and optimize their oil consumption.

Material Insights

Based on material, the glass segment led the market with the largest revenue share of 38.4% in 2023. The demand for glass oil dispenser bottles is driven by their aesthetic appeal, sustainability, and health-conscious qualities. Glass is favored by consumers for its non-reactive nature, ensuring that oils remain pure without any risk of chemical leaching, which is a concern with plastic alternatives. In addition, the growing trend towards eco-friendly and reusable products has led many consumers to choose glass over plastic, aligning with their desire to reduce environmental impact.

The metal segment is projected to grow at the fastest CAGR of 5.9% from 2024 to 2030. The demand for metal oil dispenser bottles is driven by their durability, premium appearance, and ability to protect oils from light exposure, which can degrade oil quality. Metal dispensers, particularly those made from stainless steel, are favored for their robust construction and long lifespan, making them an attractive choice for consumers seeking long-term value. The opaque nature of metal also offers the added benefit of protecting oils from light, preserving their freshness and quality, which is increasingly important to health-conscious consumers who prioritize the integrity of their cooking ingredients.

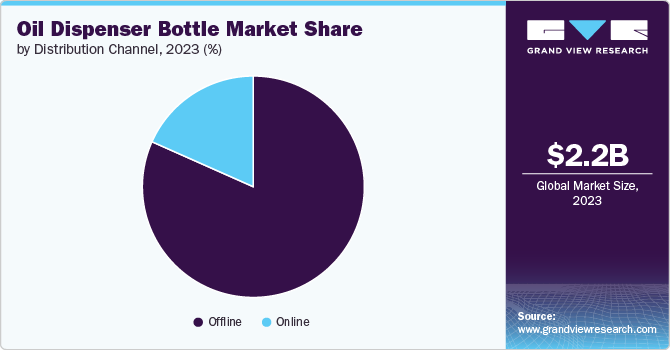

Distribution Channel Insights

Based on distribution channel, the offline segment led the market with the largest revenue share of 81.67% in 2023. The sales are mainly driven by the tactile shopping experience, immediate product availability, and trust in established retail outlets. Many consumers prefer to physically inspect products before purchasing, especially kitchenware, to assess quality, design, and functionality firsthand. This sensory experience is something online shopping cannot fully replicate. In addition, offline channels such as supermarkets, kitchen Convenience Stores, and department stores offer the convenience of immediate purchase and use, without the wait time associated with online orders.

The online segment is anticipated to grow at the fastest CAGR of 12.3% from 2024 to 2030 mainly driven by the convenience of home shopping, wider product variety, and access to customer reviews. Online platforms allow consumers to browse and compare a vast array of products from the comfort of their homes, often at competitive prices. This ease of access is particularly appealing in busy lifestyles and in regions with limited physical retail options. In addition, e-commerce sites like Amazon and specialty kitchenware websites offer detailed product descriptions, user reviews, and ratings, helping consumers make informed purchasing decisions.

Regional Insights

The oil dispenser bottle market in North America accounted for the revenue share of 26.20% in 2023. The market is primarily driven by the region's strong focus on kitchen innovation, health-conscious consumer behavior, and the popularity of gourmet cooking. The trend towards smart kitchens and connected home devices is particularly pronounced in North America, leading to increased demand for advanced oil dispensers with features like portion control and app integration. In addition, the growing awareness of healthy eating habits has spurred demand for products that help manage oil usage more effectively.

U.S. Oil Dispenser Bottle Market

The oil dispenser bottle market in the U.S. is projected to grow at the fastest CAGR of 4.6% from 2024 to 2030. In the U.S., the market is driven by a combination of health-conscious consumer trends, a strong emphasis on kitchen organization and design, and the growing popularity of smart home technology. Americans are increasingly focused on managing their oil consumption as part of a healthier lifestyle, leading to a higher demand for dispensers that offer portion control and precision pouring.

Asia Pacific Oil Dispenser Bottle Market

Asia Pacific dominated the oil dispenser bottle market with the largest revenue share of 44.37% in 2023. As urban areas expand and lifestyles become more fast-paced, there is a growing demand for practical and efficient kitchen solutions, including oil dispensers that offer precise pouring and ease of use. Higher disposable incomes enable consumers to invest in better-quality kitchenware, including stylish and durable oil dispensers. In addition, as health awareness increases, consumers are seeking products that help manage oil consumption and support healthier cooking practices.

Europe Oil Dispenser Bottle Market

The oil dispenser bottle market in Europe is projected to grow at a significant CAGR of 5.4% from 2024 to 2030. European consumers are highly attuned to eco-friendly products, leading to a strong demand for reusable and recyclable oil dispensers, particularly those made from glass or stainless steel. The trend towards elegant and functional kitchen design also boosts the appeal of aesthetically pleasing dispensers that complement modern European kitchens. In addition, European consumers are increasingly focused on precise oil measurement for healthier cooking, driving interest in both conventional and smart oil dispensers.

Key Oil Dispenser Bottle Company Insights

The competitive landscape of the oil dispenser bottle industry is marked by a diverse array of players ranging from established kitchenware brands to innovative startups. Major companies like OXO, Libbey, and IKEA lead with their extensive product lines and emphasis on functionality, design, and quality. These established brands are often known for their durable materials, user-friendly features, and stylish designs. Meanwhile, newer entrants and niche players are differentiating themselves through innovative features, such as smart technology integration and eco-friendly materials.

Key Oil Dispenser Bottle Companies:

The following are the leading companies in the oil dispenser bottle market. These companies collectively hold the largest market share and dictate industry trends.

- Libbey Inc.

- IKEA

- Tablecraft Products Company

- OXO International Ltd.

- Bormioli Rocco USA.

- Prepara

- Emmeistar

- Casabella

- Enriching Lifes Ltd (itsufirst)

- Harold Import Co., (EVO Sprayer)

Recent Developments

-

In September 2023, Kitchen Concepts Unlimited, maker of the Butterie and Better Dish flip-top butter dishes, launched the Better Drizzle, a drip-free oil dispenser with a flip-top cap to keep the oil fresh and counters clean.

Oil Dispenser Bottle Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.32 billion

Revenue forecast in 2030

USD 3.14 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

Libbey Inc.; IKEA; Tablecraft Products Company; OXO International Ltd.; Bormioli Rocco USA.; Prepara; Emmeistar; Casabella; Enriching Lifes Ltd (itsufirst); Harold Import Co.; (EVO Sprayer)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Oil Dispenser Bottle Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global oil dispenser bottle market report based on product, material, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Smart/Electric

-

Conventional

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass

-

Plastic

-

Metal

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global oil dispenser bottle market size was estimated at USD 2.22 billion in 2023 and is expected to reach USD 2.32 billion in 2024.

b. The global oil dispenser bottle market is expected to grow at a compounded growth rate of 14.9% from 2024 to 2030 to reach USD 3.14 billion by 2030.

b. Conventional oil dispenser bottles accounted for a market share of 99.1% of the global revenues in 2023. The demand for conventional oil cruets is primarily driven by their affordability and widespread accessibility, making them a popular choice in both developed and emerging markets.

b. Some key players operating in the oil dispenser bottle market include Libbey Inc., IKEA, Tablecraft Products Company, OXO International Ltd., Bormioli Rocco USA., Prepara, Emmeistar, Casabella, Enriching Lifes Ltd (itsufirst), Harold Import Co., (EVO Sprayer)

b. Key factors that are driving the oil dispenser bottle market growth include the increasing consumer awareness of health and wellness, leading to a preference for controlled portioning of oils and dressings. The rise in home cooking trends, spurred by the popularity of culinary shows and the growing interest in gourmet and healthy cooking, has also fueled demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.