- Home

- »

- Medical Devices

- »

-

Offsite Sterilization Services Market Size, Share Report, 2030GVR Report cover

![Offsite Sterilization Services Market Size, Share & Trends Report]()

Offsite Sterilization Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Service (Ethylene Oxide Sterilization, Gamma Sterilization, Electron Beam Sterilization), By End-use (Hospitals, Clinics, Medical Device Companies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-424-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Offsite Sterilization Services Market Summary

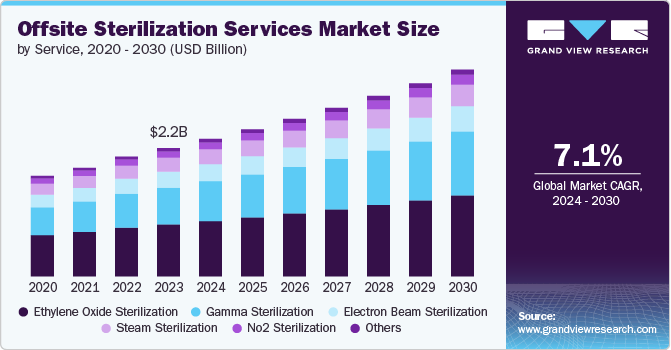

The global offsite sterilization services market size was estimated at USD 2.15 billion in 2023 and is projected to reach USD 3.47 billion by 2030, growing at a CAGR of 7.05% from 2024 to 2030. There is an increasing demand for advanced sterilization technologies, stringent regulatory requirements, and a growing emphasis on patient safety.

Key Market Trends & Insights

- North America dominated the offsite sterilization services market with a revenue share of 39.54% in 2023.

- The UK offsite sterilization service market is anticipated to grow at the fastest CAGR during the forecast period.

- Based on service, the ethylene oxide (EtO) sterilization segment led the market with the largest revenue share of 40.50% in 2023.

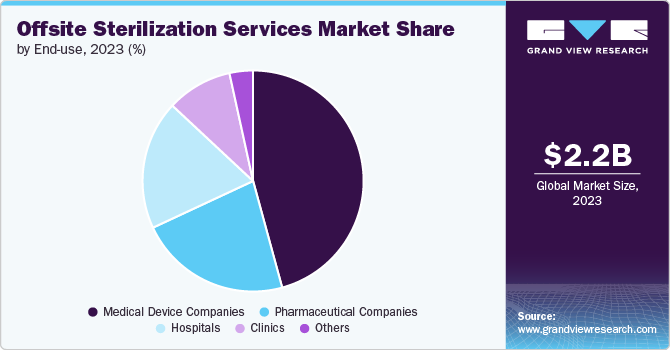

- Based on end-use, the medical device companies segment led the market with the largest revenue share of 45.76% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 2.15 Billion

- 2030 Projected Market Size: USD 3.47 Billion

- CAGR (2024-2030): 7.05%

- North America: Largest market in 2023

These factors collectively enhance the need for effective sterilization services in healthcare settings. The expansion of healthcare infrastructure and the ever-increasing awareness of sterilization practices among medical professionals also influence the market. For instance, in June 2022, BGS expanded its logistics and production facilities by crosslinking Rhine-Westphalia. The company is also investing in developing a new laboratory to address the growing material testing demands for radiation crosslinking.

One key factor driving market growth is the rising occurrence of hospital-acquired infections (HAIs). These infections pose a severe risk to patient safety and can result in significant complications, extended hospital stays, and heightened healthcare expenses. The growing awareness and concern surrounding HAIs led healthcare facilities to place a greater emphasis on effective sterilization methods. This shift in focus consequently increased the demand for offsite sterilization services designed to provide comprehensive decontamination of surgical instruments and medical devices.

There is a growing demand for advanced sterilization technologies. Innovations such as ethylene oxide (EtO), hydrogen peroxide gas plasma, and steam sterilization methods are being refined to improve efficacy and reduce environmental impact. Integrating automation and Internet of Things (IoT) technologies into sterilization processes is also gaining traction, allowing real-time monitoring and data analytics to optimize operations. Recent statistics indicate that the adoption of these advanced technologies is expected to increase significantly, with a notable rise in implementing low-temperature sterilization methods in healthcare facilities.

The growing emphasis on patient safety is a significant driver of the market growth. As healthcare providers strive to enhance the quality of care, there is an increasing recognition of the importance of effective sterilization in preventing infections and ensuring patient safety. This trend is reflected in the rising investments in sterilization infrastructure and services as hospitals seek to implement best practices in infection control.

Industry Dynamics

The degree of innovation in the global market is currently high, driven by technological advancements and increasing demand for efficient sterilization methods. Innovations such as ethylene oxide (EtO) sterilization, hydrogen peroxide gas plasma, and steam sterilization methods are being improved to boost effectiveness while reducing environmental impact. In addition, integrating automation and Internet of Things (IoT) technologies into sterilization processes is becoming more prevalent, enabling real-time monitoring and data analytics to enhance operational efficiency.

Level of merger and acquisition activities in the market is considered medium. In recent years, notable consolidations occurred as larger firms sought to expand their capabilities and geographic reach. For instance, in October 2023, Innovative Sterilization Technologies (IST) announced that Instrumentum exclusively selected their ONE TRAY Total Solution as the surgical instrument sterilization solution for their new Boca Raton, Florida headquarters.

The impact of regulations on the global market is high, as stringent health and safety standards govern the industry. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) impose rigorous guidelines on sterilization processes to ensure patient safety and product efficacy. Compliance with these regulations often necessitates significant investment in technology upgrades and staff training for service providers. FDA guidelines regarding ethylene oxide emissions prompted many facilities to invest in advanced filtration systems or alternative methods to mitigate environmental concerns while maintaining compliance.

Service expansion within the offsite sterilization sector is rated as high, fueled by increasing demand from healthcare facilities seeking reliable outsourcing solutions for their sterilization needs. Companies are expanding their service offerings beyond traditional sterilization methods to include additional services such as logistics management, packaging solutions, and even consulting services related to infection control practices.

The market's region expansion aspect is assessed as a medium, with companies increasingly targeting emerging markets where healthcare infrastructure is rapidly developing. Regions such as Asia-Pacific are seeing a surge in demand due to rising healthcare expenditures and a growing awareness of infection control practices among healthcare providers. For instance, Ecolab is actively investing in expanding its presence in Southeast Asia through partnerships with local healthcare institutions, tapping into this burgeoning market segment.

Service Insights

Based on service, the ethylene oxide (EtO) sterilization segment led the market with the largest revenue share of 40.50% in 2023, due to its effectiveness, versatility, and widespread acceptance in various industries, particularly healthcare. Ethylene oxide is a potent antimicrobial agent that can penetrate complex devices and materials. It is ideal for sterilizing heat-sensitive medical equipment and instruments that cannot withstand traditional steam sterilization methods.

The gamma sterilization segment is anticipated to grow at the fastest CAGR during the forecast period, due to its effectiveness in sterilizing a wide range of medical products and its ability to handle complex and heat-sensitive materials. Gamma radiation sterilization is particularly advantageous for disposable medical devices, pharmaceuticals, and packaging materials, as it provides thorough sterilization without compromising the integrity of the treated items. For instance, the gamma irradiation process utilizes Cobalt-60 radiation for various purposes, including sterilization, decontamination, and material modification.

End-use Insights

Based on end use, the medical device companies segment led the market with the largest revenue share of 45.76% in 2023. This growth is primarily driven by the increasing demand for sterile medical devices and stringent regulatory requirements surrounding their production and use. As healthcare facilities strive to maintain high infection control standards, they often outsource sterilization processes to specialized service providers that can ensure compliance with industry regulations such as those set forth by the FDA and ISO standards. This is further fueled by the growing complexity of medical devices, which often require advanced sterilization techniques that may not be feasible in-house due to cost or technological limitations.

The pharmaceutical company’s segment is expected to grow at the fastest CAGR during the forecast period, driven by several key factors. The increasing demand for sterile pharmaceutical products amid rising global health concerns and regulatory scrutiny necessitated robust sterilization processes to ensure product safety and efficacy. Pharmaceutical companies are increasingly outsourcing their sterilization needs to specialized service providers to maintain compliance with stringent regulations set forth by agencies such as the FDA and EMA.

Regional Insights

North America dominated the offsite sterilization services market with a revenue share of 39.54% in 2023, driven by increasing demand for cost-effective and efficient sterilization solutions. One of the key trends is the rising adoption of contract sterilization services among healthcare providers, which allows them to focus on core competencies while outsourcing sterilization processes. In addition, there is a growing emphasis on regulatory compliance and patient safety, leading to increased investments in advanced sterilization technologies. The shift towards environmentally friendly practices is also notable, with many companies exploring sustainable sterilization methods such as ethylene oxide (EtO) alternatives and hydrogen peroxide plasma systems.

U.S. Offsite Sterilization Services Market Trends

The offsite sterilization service market in the U.S. is characterized by rapid technological advancements and a surge in mergers and acquisitions among key players seeking to enhance their service offerings. Companies are increasingly investing in innovative sterilization technologies that improve efficiency and reduce turnaround times, such as automated systems integrating real-time monitoring capabilities. The market is also witnessing a trend toward consolidation as larger firms acquire smaller specialized providers to expand their geographic reach and service portfolios.

Europe Offsite Sterilization Services Market Trends

The offsite sterilization service market in Europe is experiencing a notable shift towards increased automation and digitalization. Innovations such as advanced sterilization technologies and hydrogen peroxide plasma systems are gaining traction due to their efficiency and effectiveness. In addition, regulatory changes to enhance patient safety and infection control drive healthcare facilities to outsource sterilization services. A significant trend is the rise of partnerships between hospitals and third-party sterilization providers, which allows for improved resource management and cost efficiency. For instance, in August 2023, Orrick advised Ionisos to acquire a facility for E-beam sterilization and crosslinking from Studer Cables AG located in Däniken, Switzerland. This acquisition aims to enhance Ionisos’ sterilization capabilities, broaden its range of technologies, and expand its presence across Europe.

The UK offsite sterilization service market is anticipated to grow at the fastest CAGR during the forecast period. A growing emphasis on sustainability and environmental responsibility characterizes the market growth in the UK The National Health Service (NHS) has been actively promoting green initiatives, leading to an increase in demand for eco-friendly sterilization methods. Companies are launching innovative solutions that minimize waste and reduce carbon footprints, such as reusable surgical instruments processed through environmentally conscious sterilization techniques. For instance, NHS Shared Business Services (NHS SBS) launched a £1.7 billion framework agreement to assist NHS hospitals and surgical centers in efficiently managing the sterilization, decontamination, and repair of surgical instruments and meeting clinical demand.

The offsite sterilization service market in France is expected to grow at a significant CAGR during the forecast period, driven by technological advancements and an increasing focus on quality assurance in healthcare settings. The French government implemented stricter regulations regarding medical device reprocessing and sterilization standards, prompting healthcare facilities to adopt offsite solutions that comply with these new requirements. Innovative service launches focusing on rapid turnaround times for sterile supplies are becoming common as hospitals strive to improve patient care without compromising safety.

Asia Pacific Offsite Sterilization Services Market Trends

The offsite sterilization service market in Asia Pacific is expected to grow at a significant CAGR during the forecast period. A growing emphasis on stringent sterilization standards and technological advancements characterizes the market growth in the Asia Pacific. A notable trend is the increasing adoption of innovative sterilization methods, such as electron beam and gamma sterilization, which offer practical solutions for complex medical devices. In addition, several companies are launching new service offerings to cater to the rising demand for sterilization in healthcare settings. For instance, in May 2022, Sterigenics, a unit of Sotera Health, announced the commencement of operations at its expanded electron beam (E-beam) facility in Columbia City, Indiana.

The Japan offsite sterilization service market is characterized by a strong emphasis on quality control and regulatory compliance. The country’s stringent healthcare regulations necessitate high standards for sterilization processes, leading to increased reliance on certified offsite services that can guarantee compliance with national safety standards. Furthermore, technological advancements such as automated tracking systems for sterilized instruments are being integrated into existing services to improve traceability and efficiency within hospitals.

The offsite sterilization service market in China is rapidly evolving due to the government's push for improved healthcare infrastructure and infection control measures. The rise of private healthcare facilities created a burgeoning demand for reliable offsite sterilization services that meet diverse medical environments' needs. Unique factors influencing this market include significant investments from domestic players and foreign investors looking to capitalize on China's growing healthcare sector.

Latin America Offsite Sterilization Services Market Trends

The offsite sterilization service market in Latin America is experiencing a notable shift towards increased adoption of advanced sterilization technologies, driven by rising healthcare standards and regulatory compliance. A significant trend is a growing emphasis on sustainability and environmentally friendly practices, with many facilities opting for ethylene oxide (EtO) sterilization due to its effectiveness and lower environmental impact than traditional methods.

The Brazil offsite sterilization service market is experiencing significant growth driven by the growing demand for effective infection control measures, particularly in healthcare settings. This trend is primarily influenced by the rising prevalence of hospital-acquired infections (HAIs), which heightened awareness around hygiene and sanitation practices. In addition, advancements in sterilization technologies, such as ethylene oxide and gamma sterilization, enhance service efficiency and effectiveness.

Middle East & Africa Offsite Sterilization Services Market Trends

The offsite sterilization service market in the Middle East and Africa is experiencing significant growth driven by increasing healthcare demands, mainly due to the rise in surgical procedures and hospital-acquired infections. The region saw a surge in investments to enhance healthcare infrastructure, including adopting advanced sterilization technologies. Notably, there is a growing trend towards outsourcing sterilization services as hospitals seek to focus on core medical activities while ensuring compliance with stringent health regulations. Furthermore, regulatory bodies are increasingly emphasizing the importance of maintaining high standards of sterilization processes, leading to an uptick in demand for certified offsite services.

The Saudi Arabia offsite sterilization service market is anticipated to witness at a robust CAGR during the forecast period, fueled by government initiatives to improve healthcare quality and accessibility. The Vision 2030 program emphasizes modernizing healthcare facilities and enhancing patient safety, directly impacting the demand for reliable sterilization services. The emphasis on infection control measures also increased healthcare professionals' awareness of the importance of proper sterilization techniques.

Key Offsite Sterilization Services Company Insights

The market is characterized by a diverse range of companies that provide critical sterilization solutions to healthcare facilities, including hospitals and clinics. These companies held significant market shares due to their established reputations, extensive service networks, and advanced technological capabilities.

Key Offsite Sterilization Services Companies:

The following are the leading companies in the offsite sterilization services market. These companies collectively hold the largest market share and dictate industry trends.

- Steris Plc

- Sotera Health

- Cretex Medical

- Scapa Healthcare

- BGS Beta-Gamma-Service GmbH & Co. KG

- E-BEAM Services, Inc.

- Medistri SA

- Midwest Sterilization Corporation (MSC)

- Microtrol Sterilization Services

- ClorDiSys Solutions Inc.

Recent Developments

-

In March 2023, Getinge purchased Ultra Clean Systems Inc., a U.S.-based company specializing in ultrasonic cleaning technologies designed to sanitize surgical instruments in hospitals and surgical centers.

-

In June 2023, STERIS plc disclosed that the company entered into a formal agreement to acquire the assets related to surgical instrumentation, laparoscopic instrumentation, and sterilization containers from Becton, Dickinson, and Company.

Offsite Sterilization Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.30 billion

Revenue forecast in 2030

USD 3.47 billion

Growth rate

CAGR of 7.05% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Steris Plc; Sotera Health; Cretex Medical; Scapa Healthcare; BGS Beta-Gamma-Service GmbH & Co. KG; E-BEAM Services, Inc.; Medistri SA; Midwest Sterilization Corporation (MSC); Microtrol Sterilization Services; ClorDiSys Solutions, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Offsite Sterilization Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global offsite sterilization services market report based on service, end-use, and region.

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Ethylene Oxide Sterilization

-

Gamma Sterilization

-

Electron Beam Sterilization

-

Steam Sterilization

-

No2 Sterilization

-

Other

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

Medical Device Companies

-

Pharmaceutical Companies

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global offsite sterilization service market size was valued at USD 2.15 billion in 2023 and is projected to reach USD 2.30 billion in 2024.

b. The global offsite sterilization service market is projected to grow at a compound annual growth rate (CAGR) of 7.05% from 2024 to 2030 to reach USD 3.47 billion by 2030.

b. The ethylene oxide (EtO) sterilization segment held the largest revenue share of 40.50% in 2023 of the offsite sterilization service market due to its effectiveness, versatility, and widespread acceptance in various industries, particularly healthcare.

b. Some of the key players operating in this market include Steris Plc, Sotera Health, Cretex Medical, Scapa Healthcare, BGS Beta-Gamma-Service GmbH & Co. KG, E-BEAM Services, Inc., Medistri SA, Midwest Sterilization Corporation (MSC), Microtrol Sterilization Services, ClorDiSys Solutions Inc.

b. An increasing demand for advanced sterilization technologies, stringent regulatory requirements, and a growing emphasis on patient safety are the kwy drivers for this market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.