- Home

- »

- Renewable Energy

- »

-

Offshore Wind Turbine Market Size, Industry Report, 2030GVR Report cover

![Offshore Wind Turbine Market Size, Share & Trends Report]()

Offshore Wind Turbine Market (2025 - 2030) Size, Share & Trends Analysis Report, By Capacity (Up to 3 MW, 3 MW–5 MW, Above 5 MW), By Water Depth (Shallow Water (<30 M Depth), Transitional Water (30-60 M Depth), Deepwater), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-408-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Offshore Wind Turbine Market Summary

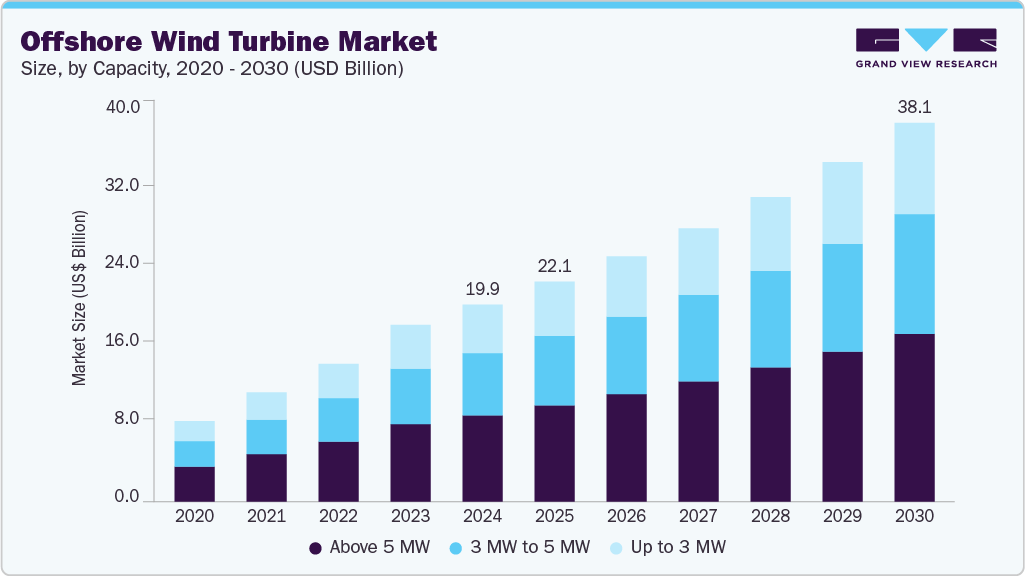

The global offshore wind turbine market size was estimated at USD 19.85 billion in 2024 and is projected to reach USD 38.13 billion by 2030, growing at a CAGR of 11.5% from 2025 to 2030. The rising interest in reducing the global carbon footprint and increasing demand for renewable energy are the key factors driving the industry growth.

Key Market Trends & Insights

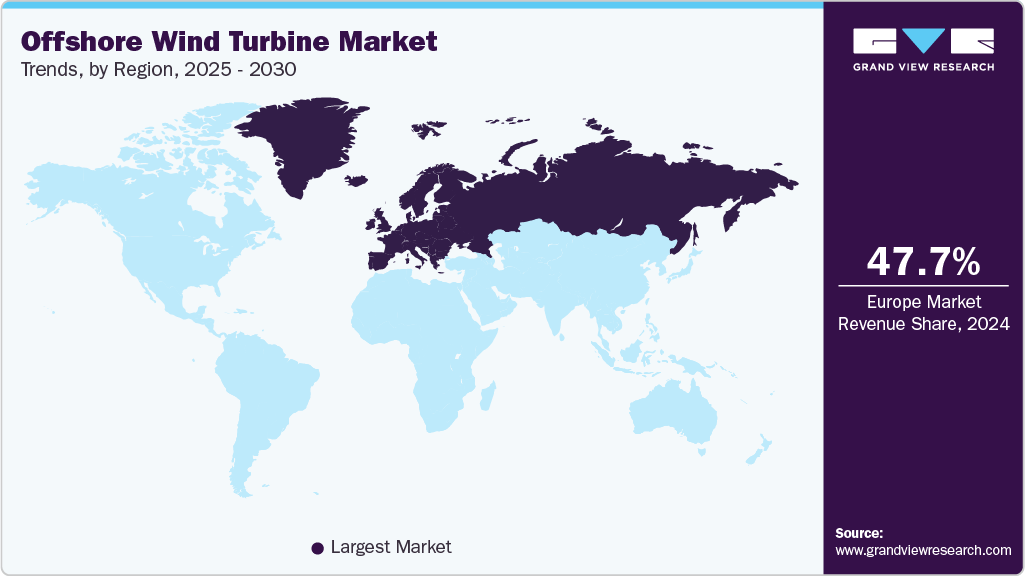

- Europe dominated global offshore wind turbine market and accounted for largest revenue share of over 47.7% in 2024.

- The UK dominates the Europe offshore wind turbines market, with the largest revenue share.

- In terms of capacity segment, the above 5 MW segment dominated the market with the largest revenue share of over 43.8% in 2024.

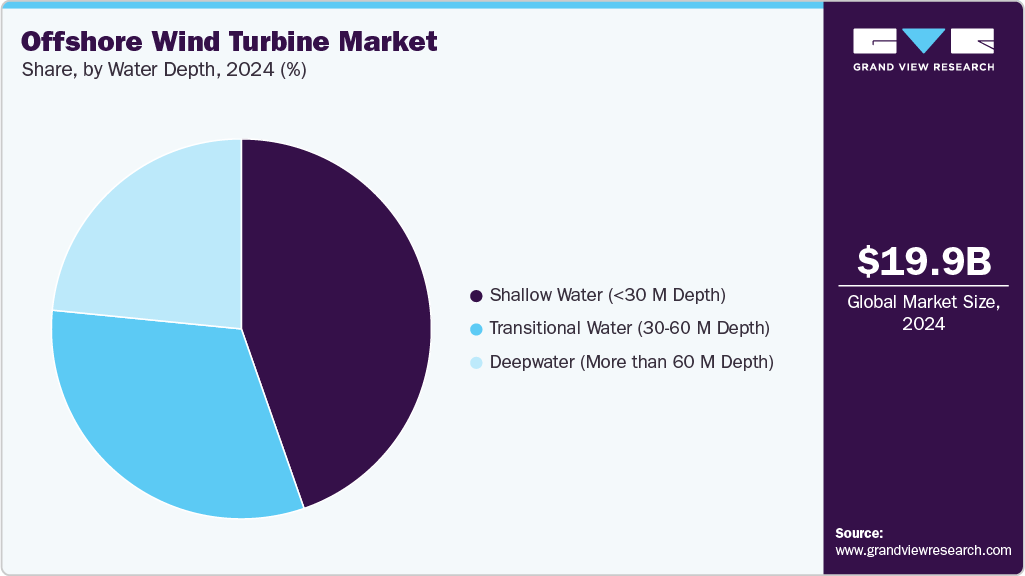

- In terms of water depth segment, the shallow water (<30 M Depth) segment dominated the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 19.85 Billion

- 2030 Projected Market Size: USD 38.13 Billion

- CAGR (2025-2030): 11.5%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing efforts by government agencies and electrical companies to reduce carbon emissions are major market drivers driving market expansion. A key trend in the offshore wind turbine industry is the growing expansion of the broader industrial sector, driven by increasing demand for clean, cost-effective, and reliable electricity. Offshore wind turbines play a vital role in meeting this demand, offering a sustainable energy solution for large communities. As technology advances and costs continue to decline, offshore wind energy is becoming more accessible and economically viable.

The rise in continued research, development, demonstration, and deployment of technologies to eliminate impediments to the widespread installation of turbines is likely to drive the offshore wind turbine market growth during the forecast period. According to a report by the U.S. Department of Energy in June 2024, the National Offshore Wind Research and Development Consortium (NOWRDC) has announced Solicitation 4.0, a USD 10.6 million funding opportunity to advance floating offshore wind technology in the U.S. Advances in turbine design, materials, and manufacturing processes have led to the development of more efficient and reliable turbines. This includes larger turbines with more power, which reduce the cost per megawatt of energy produced.

The increase in the adoption of renewable energy across several emerging countries in regions such as South America, Asia, and Africa is expected to drive market growth in the coming years. Offshore wind turbines are gaining popularity due to their high energy production potential and ability to make a significant contribution to global efforts to reduce greenhouse gas emissions. For instance, according to a report by the Global Wind Energy Council in 2025, the world added a record 117 gigawatts of new wind power capacity, showing strong momentum in clean energy investment. This growth highlights wind power’s increasing role in meeting global energy demand and climate goals.

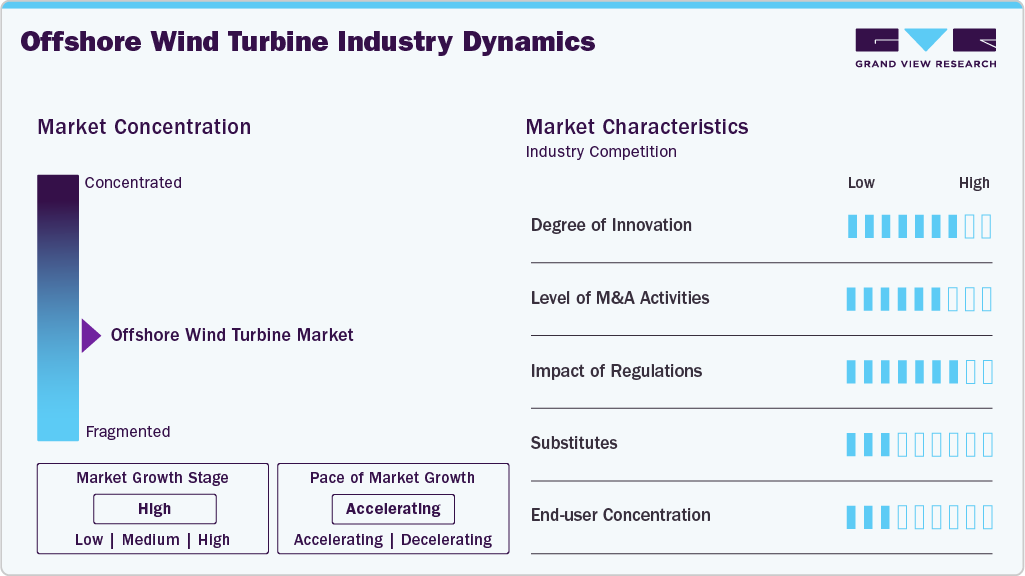

Market Concentration & Characteristics

The market growth stage is high, and the pace of the market growth is accelerating. The offshore wind turbine market is characterized by high innovation due to installation and maintenance innovations, technological advancements, government policies, and investment support. For Instance, in December 2022, Vestas installed its V236-15.0 MW prototype wind turbine at the Østerild National Test Centre in Denmark, marking a significant milestone by producing its first kilowatt-hour of electricity. This achievement initiates an extensive testing and verification program to ensure reliability before commencing full-scale production and commercial deployment.

The market is also characterized by the leading players' moderate to high levels of mergers and acquisition activity. This is due to increasing demand for renewable energy sources, market consolidation, and global expansion of the product. According to a report by the Institute for Mergers, Acquisitions & Alliances in November 2024, Brookfield Asset Management acquired a 12.45% stake in four of Ørsted's offshore wind farms in the UK for about $2.28 billion. This move marks Brookfield's entry into the UK offshore wind market and supports its focus on renewable energy investments.

The global market is also subject to high impact of regulations, due to its multiple layers of regulatory approvals such as federal, state and local regulations to govern the development and operations. For instance, according to a report by Harbinger Land on January 2025, following laws like the National Environmental Policy Act (NEPA) and working with local authorities is crucial. This helps companies get project approvals faster and avoid problems with environmental regulations.

There are a limited number of direct product substitutes for offshore wind turbine. Limited number of direct energy substitute are there for the wind turbine market. While other renewable energy sources like onshore wind, solar, and wave energy are not a direct substitute for the specific advantages offered by offshore wind turbines.

The end use concentration for the offshore wind turbine market is relatively low. Offshore wind turbines are primarily used by utility companies and independent power producers to generate electricity for the grid. This electricity is served to a wide range of end-users, including residential, commercial, and industrial consumers.

Capacity Insights

The above 5 MW segment dominated the market with the largest revenue share of over 43.8% in 2024 and is estimated to grow at the fastest CAGR over the forecast period. Higher power rating turbines are in high demand to make offshore wind power generation more energy-efficient and economically sustainable. According to offshore WIND.biz, December 2024, Offshore wind turbines are getting bigger, allowing each one to produce more electricity. However, some Asian manufacturers are planning even larger turbines, potentially up to 22 MW. This trend helps generate more power from fewer turbines. Large-scale offshore wind projects benefit from economies of scale, making them more cost-effective in terms of power generation per megawatt-hour (MWh).

3 MW to 5 MW is another significant application that is expected to grow significantly over the forecast period. The expansion of offshore wind projects with capacities ranging from 3 MW to 5 MW represents a key component of the offshore wind market. Offshore wind projects ranging from 3 MW to 5 MW provide a good blend of scale and flexibility. They are adaptable to diverse wind conditions and water depths, making them useful for a wide range of applications. For instance, according to the U.S. Department of Energy's August 2024 report, the average capacity of new wind turbines in the U.S. grew to 3.4 MW in 2023, continuing a long-term trend of increasing capacity. More of the newly installed turbines are now 3.5 MW or larger in size, which allows wind farms to produce the same amount of power with fewer turbines. Moreover, the widespread use and standardization of turbines of this size facilitate production, installation, and maintenance, reducing overall project risk.

Water Depth Insights

The shallow water (<30 M Depth) segment dominated the market with the largest revenue share in 2024 and is expected to grow at the fastest CAGR over the forecast period. The presence of considerably less demanding weather and ease of maintenance makes it a suitable choice for the establishment of offshore wind farms. Moreover, shallow water installations are less expensive than deep-water any other installations, making them a cost-effective choice for large population centers seeking to source more of their power from clean sources. For instance, according to a report by SceinceDirecrt, research indicates that foundation costs for water depths of 40-50 m can be almost twice as high as those for depths of 10-20 m. The market is predicted to expand internationally as investments in renewable energy increase. This factor is expected to boost the shallow water installation market.

The transitional water (30-60 M Depth) segment is anticipated to experience significant growth in the offshore wind turbine industry. This is driven by access to stronger, more consistent winds; in addition, advancements in foundation technology, such as the increasing use of jacket foundations and innovative suction bucket jackets in projects like East Anglia ONE and Borkum Riffgrund, are enabling economically viable deployments in these depths.

Regional Insights

North America has experienced a gradual growth in the offshore wind turbine industry. The market is driven by the ambitious renewable energy targets set by several states and the federal government of North America. For instance, according to an article published by the Department of Environmental Conservation, New York State aims to get 70% of its electricity from renewables by 2030 and be completely carbon-free by 2040. A key part of this plan is developing 9,000 MW of offshore wind by 2035, which can power up to 6 million homes. In addition, some government policies and growing awareness regarding sustainability are also increasing the demand for the offshore wind turbine market.

U.S. Offshore Wind Turbine Market Trends

The U.S. dominates the North America Offshore Wind Turbine and is expected to grow significantly over the forecast period. The increasing demand for dependable and scalable energy sources in the U.S. is driving the growth of the offshore wind turbine industry. For instance, according to an article by ENERGY CURATED in July 2024, The U.S. offshore wind industry is projected to see substantial investment, with estimates reaching $65 billion by 2030. This growth is expected to create around 56,000 jobs in the United States. This initiative is expected to significantly affect the economy.

Europe Offshore Wind Turbine Market Trends

Europe dominated global offshore wind turbine market and accounted for largest revenue share of over 47.7% in 2024. Governments across Europe are providing various subsidies, grants and tax breaks to support the development of offshore wind projects. Moreover, the European Union (EU) has set ambitious renewable energy targets, aiming to become climate-neutral by 2050. This is expected to drive the installation of offshore wind turbines across the region.

The UK dominates the Europe offshore wind turbines market, with the largest revenue share, and is expected to grow fastest over the forecast period. The demand for the offshore wind turbine industry is rising due to various government policies, incentives, and investment support. For instance, according to an article by the UK Energy Research Centre in April 2024, the UK has implemented the Contracts for Difference (CfD) scheme, providing long-term revenue certainty for offshore wind projects. This mechanism has attracted a broader range of investors by reducing financial risks, leading to increased investment in the sector. In addition, energy security and economic growth due to the offshore wind turbine market are increasing the demand for the market.

Asia Pacific Offshore Wind Turbine Market Trends

Asia Pacific is expected to experience the fastest CAGR over the forecast period. The offshore wind turbine market in the region is experiencing significant growth due to several key drivers. With an increasing focus on sustainable energy sources around the world, offshore wind power has emerged as a lucrative alternative for a variety of countries, including China, India, and Japan, driving regional market growth.

The China Offshore Wind Turbine market held a substantial market share in 2024. The increasing demand for coastal energy and geographical advantages are driving the country's offshore wind turbine market. According to an article published by ScienceDirect in October 2022, with an extensive coastline exceeding 18,000 km and over 6,000 islands, China possesses significant offshore wind resources, estimated at 758 GW, approximately three times its onshore wind potential. Developing offshore wind farms in coastal areas alleviates the pressure on long-distance power transmission projects from the resource-rich western regions.

Key Offshore Wind Turbine Company Insights

The offshore wind turbine market is highly competitive, with several key players dominating the landscape. Major companies include General Electric, Equinor ASA, Iberdrola, S.A., Mitsubishi Heavy Industries, Ltd, and Goldwind. The offshore wind turbine market is categorized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

-

GE Vernova provides offshore wind turbines, including the Haliade-X, designed for high energy production in strong offshore winds, contributing to the growth of offshore wind power globally. Their technology focuses on reliability and efficiency to lower the cost of offshore wind energy for customers.

-

Equinor has been in the offshore wind industry for over five decades and intends to be a global offshore wind energy major. They have wind farms in Germany and UK that power over one million European homes, and the Dogger Bank offshore wind farm will power 6 million British homes..

Key Offshore Wind Turbine Companies:

The following are the leading companies in the offshore wind turbine market. These companies collectively hold the largest market share and dictate industry trends.

- General Electric Company

- Equinor ASA

- Iberdrola, S.A.

- Mitsubishi Heavy Industries, Ltd

- Goldwind

- Naval Group

- Nordex SE

- Siemens

- ABB

- MODEC, Inc.

Recent Developments

-

In May 2025, DEME, a clean energy company, acquired Norwegian offshore wind contractor Havfram for USD 1,028.9, including all of Havfram's shares. This acquisition is expected to help DEME expand its reach in the offshore wind energy market and improve its ability to install turbines and foundations.

-

In March 2025, Italian engineering company Saipem partnered with the Divento consortium, which includes Plenitude, CDP, and Copenhagen Infrastructure Partners. Together, they plan to use Saipem’s STAR 1 floating wind technology for offshore wind projects in Sicily and Sardinia to generate 1.6 terawatt-hours of electricity per year.

-

In October 2024, Skyborn Renewables, backed by Global Infrastructure Partners (GIP), partnered with Ørsted on the US's South Fork Wind and Revolution Wind offshore wind farms. This partnership was formed after GIP acquired Eversource Energy's 50% stake in these projects.

Offshore Wind Turbine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.13 billion

Revenue forecast in 2030

USD 38.13 billion

Growth Rate

CAGR of 11.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Capacity, water depth, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; The Netherlands; Denmark; China; India; Japan; South Korea; Indonesia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

General Electric; Equinor ASA; Iberdrola, S.A.; Mitsubishi Heavy Industries, Ltd; Goldwind; Naval Group; Nordex SE; Siemens; ABB; MODEC, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Offshore Wind Turbine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global offshore wind turbine market report based on capacity, water depth, region.

-

Capacity Outlook (Revenue, USD Billion, 2018 - 2030)

-

Up to 3 MW

-

3 MW to 5 MW

-

Above 5 MW

-

-

Water Depth Outlook (Revenue, USD Billion, 2018 - 2030)

-

Shallow Water (<30 M Depth)

-

Transitional Water (30-60 M Depth)

-

Deepwater (More than 60 M Depth)

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

The Netherlands

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.