- Home

- »

- Electronic & Electrical

- »

-

Office Supplies Market Size & Share, Industry Report, 2033GVR Report cover

![Office Supplies Market Size, Share & Trends Report]()

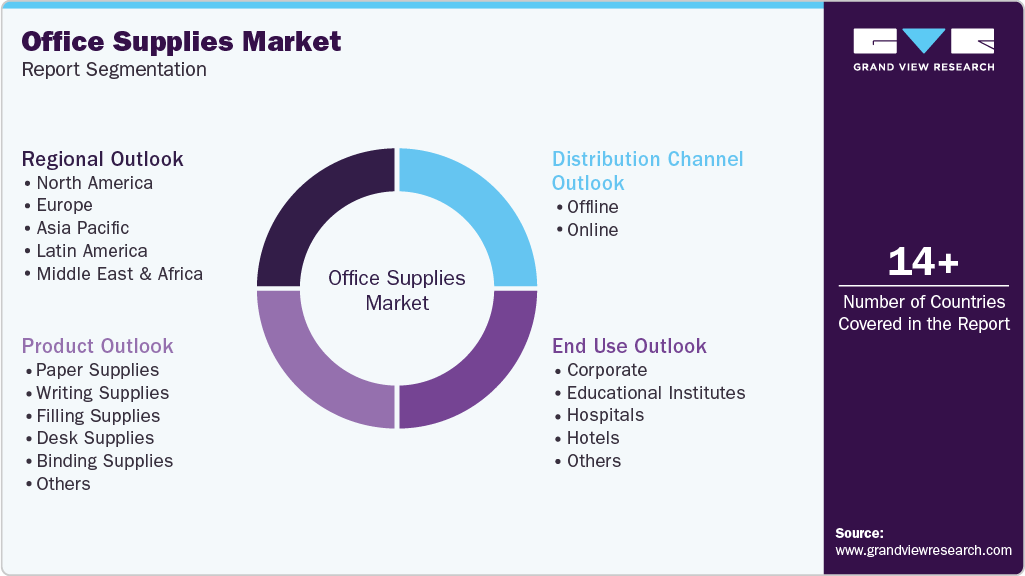

Office Supplies Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Paper Supplies, Writing Supplies, Filling Supplies, Desk Supplies, Binding Supplies), By Distribution Channel (Offline, Online), By End Use (Corporate), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-156-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Office Supplies Market Summary

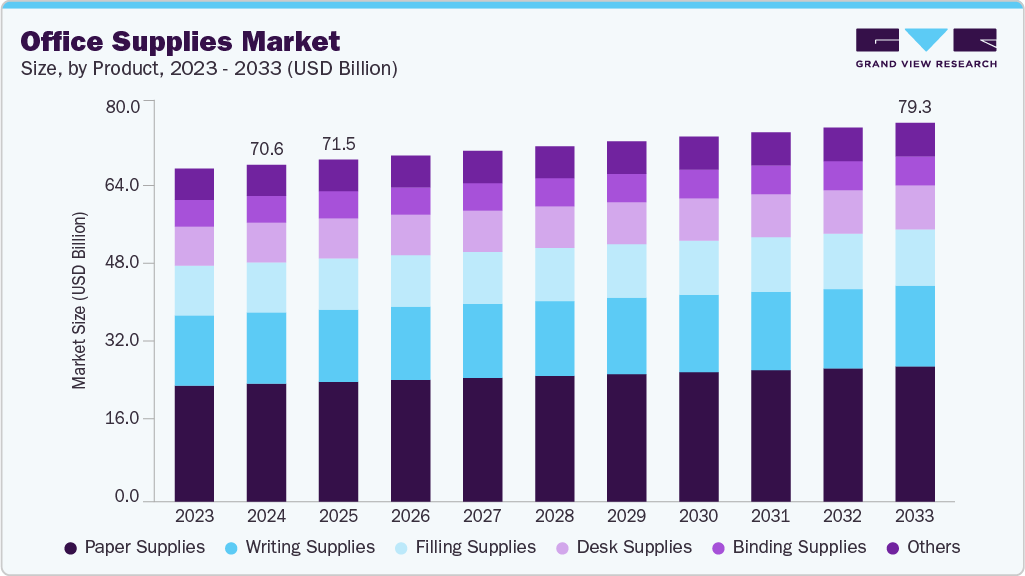

The global office supplies market size was estimated at USD 70.58 billion in 2024 and is projected to reach USD 79.28 billion by 2033, growing at a CAGR of 1.3% from 2025 to 2033. The market is primarily driven by the growth of the global services industry and increasing demand from the education sector.

Key Market Trends & Insights

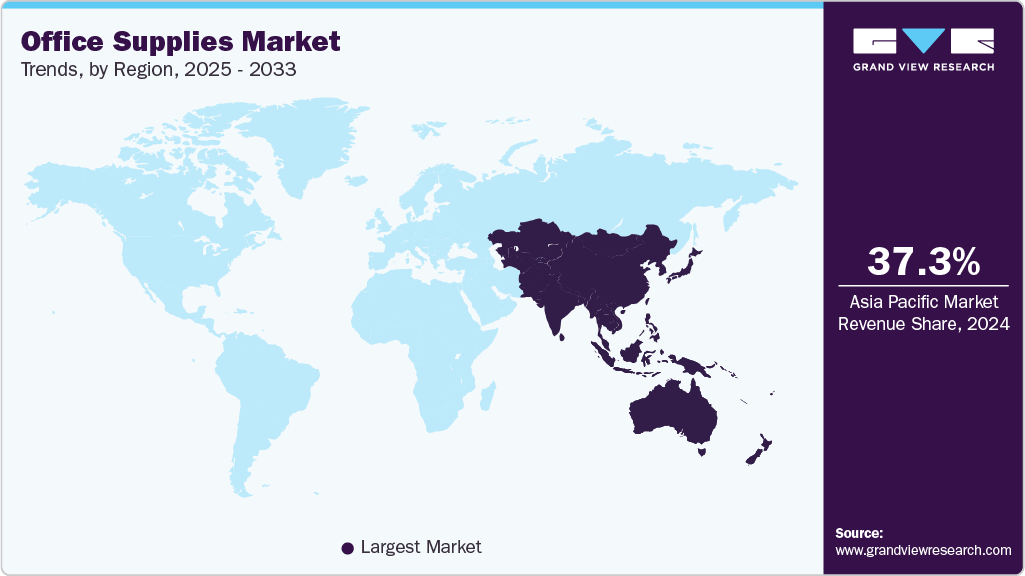

- The Asia Pacific market held the largest share of 37.3% of the global market in 2024.

- The Europe region is projected to grow at a CAGR of 1.3% from 2025 to 2033.

- By product, the paper supplies segment accounted for the largest share of 35.0% of the global revenue in 2024.

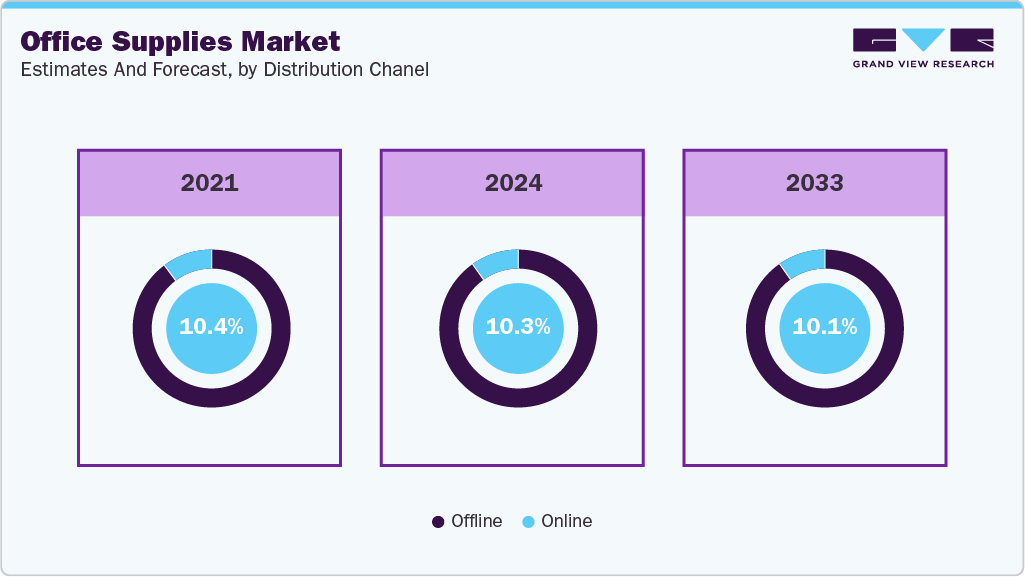

- By distribution channel, the offline channel segment held the largest market share of 89.7% in 2024.

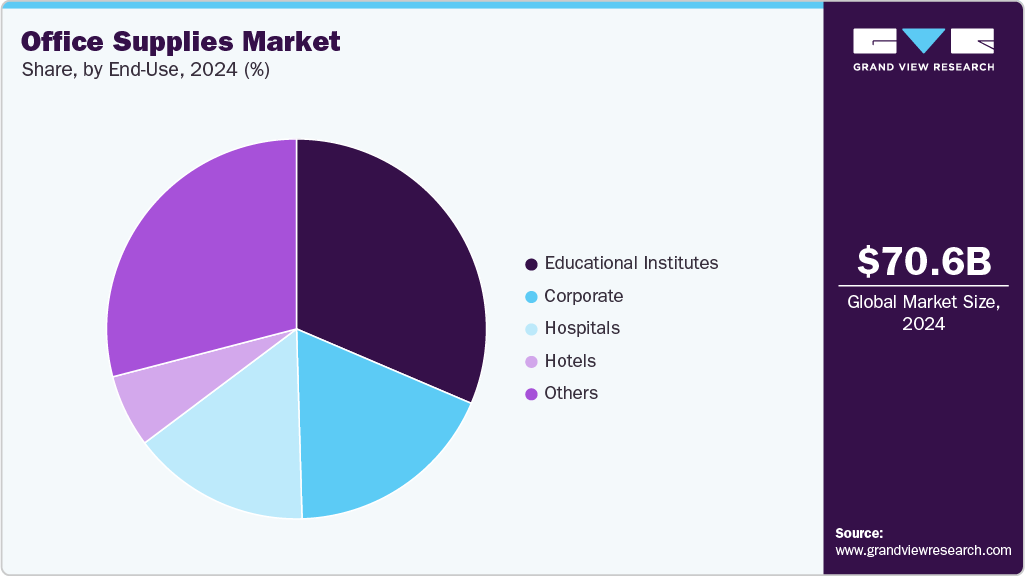

- By end use, the educational institutes held the highest largest market share of 31.5% in 2024.

Key Market Trends & Insights

- 2024 Market Size: USD 70.58 Billion

- 2033 Projected Market Size: USD 79.28 Billion

- CAGR (2025-2033): 1.3%

- Asia Pacific: Largest market in 2024

As businesses expand and educational institutions grow, the need for essential office products rises accordingly. Moreover, a growing emphasis on sustainability is influencing consumer preferences, with more individuals and organizations opting for eco-friendly and responsibly sourced office supplies. These trends, combined with ongoing digital transformation in workplaces, are shaping the evolution of the market.

The global pandemic significantly disrupted supply chains, leading to delays in the production and distribution of office supplies. Factors such as factory shutdowns, transportation limitations, and a smaller workforce contributed to shortages in the raw materials needed for manufacturing these products. In response, office supply manufacturers turned to e-commerce platforms, making their products available online and offering greater convenience for both suppliers and consumers during this period. Meanwhile, advancements in manufacturing practices have been driving market growth. Companies are increasingly investing in technologies aimed at lowering their carbon emissions, reducing waste, and incorporating renewable energy sources into their production processes.

Product Insights

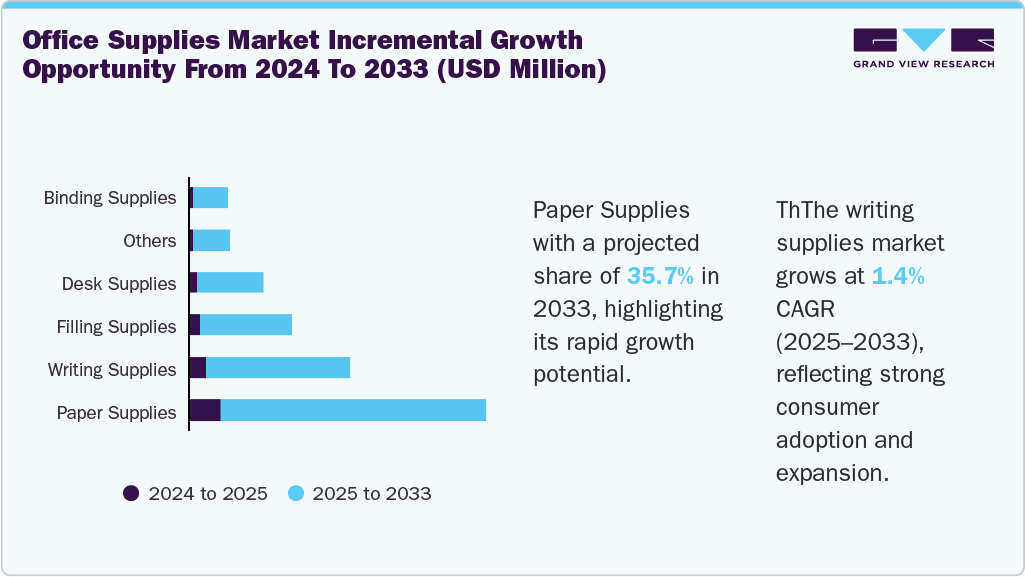

The paper supplies market held the largest share of 35.0% of the global revenue in 2024. The paper supplies segment is driven by consistent demand for printing, documentation, and administrative tasks across corporate, educational, and government sectors. Despite digitalization, physical paperwork remains essential for legal records, contracts, and internal communication. The growth of small and medium enterprises (SMEs) also boosts demand for basic paper products. Eco-friendly and recycled paper options are gaining traction due to rising environmental awareness. Many companies, such as Brown Living, Rescript, and Russell Richardson & Sons Ltd., offer recyclable paper products for office use.

The writing supplies segment is projected to grow at the fastest CAGR of 1.4% from 2025 to 2033. Writing supplies such as pens, pencils, highlighters, and markers are driven by their essential role in education, office work, and creative tasks. The continued use of handwritten notes, sketching, and manual corrections keeps demand stable across various sectors. Schools, universities, and exam settings heavily rely on these tools, sustaining regular consumption. Product innovation, such as ergonomic designs and eco-friendly materials, further fuels market interest. Branding and personalization trends also boost consumer appeal, especially in premium and gift segments. Companies such as Shachihata, based in Japan, launched eco-green and sustainable stationery, including writing supplies such as pens, markers, and highlighters.

The filing supplies segment is experiencing significant growth due to growing demand from the corporate and education sectors. Filing supplies specifically benefit from the need for organized documentation. Market growth is also influenced by bulk purchasing by enterprises. E-commerce platforms further boost accessibility and sales.

Distribution Channel Insights

The sales of office supplies through the offline distribution channel accounted for the largest share of around 89.7% of the global revenue in 2024. Traditional offline channels remain integral to the market. These include brick-and-mortar stores such as office supply retailers, supermarkets, and specialty stationery shops. Customers benefit from immediate product availability, the ability to physically inspect items, and personalized assistance from sales staff. This approach is particularly favored by small businesses and individuals who prefer in-person shopping experiences.

The sales of office supplies through the online distribution channel are projected to grow at the fastest CAGR of 1.1% from 2025 to 2033. The rise of e-commerce has transformed the market, with online platforms becoming increasingly popular. Consumers can browse extensive product selections, compare prices, and read reviews from the comfort of their homes or offices. E-commerce websites often provide detailed product descriptions, subscription services, and competitive pricing, appealing to both individual consumers and businesses. A few online office supply stores include Offimart, Bansal Stationers, and SCOOBOO. This channel offers convenience, accessibility, and the ability to reach a broader audience, including those in remote areas.

End Use Insights

The use of office supplies in educational institutions accounted for the largest share of around 31.5% of the global revenue in 2024. Educational institutions consistently drive the market through their need for textbooks, stationery, filing products, and classroom materials. The expansion of schools, colleges, and e-learning platforms increases demand for both traditional and digital supplies. Seasonal procurement cycles, such as the back-to-school period, further boost sales. Government investments in education infrastructure also support steady consumption. In addition, growing awareness around sustainable and customized school supplies shapes purchasing decisions. For instance, according to the data published in January 2022, ITC’s Paperkraft notebooks range offers education stationery products such as notebooks with a positive environmental footprint made from green paper and paperboards.

The use of office supplies in the corporate sector is projected to grow at the fastest CAGR of 1.3% from 2025 to 2033. Corporate is a major end user segment, requiring a wide range of supplies, including paper, writing tools, filing systems, and tech accessories, to maintain daily operations. The rise in hybrid and remote work models has expanded demand for home office setups. Companies also prioritize organized workflows and employee productivity, fueling demand for ergonomic and efficient supplies. Bulk purchasing and vendor contracts contribute to steady market volume. Companies such as xevbuy.shop, Arihant Office Solutions Pvt. Ltd., offers business/ corporate stationery products such as paper supplies and writing supplies.

Regional Insights

The North America office supplies industry accounted for a market share of 31.7% in 2024. The demand for office supplies in the region is primarily driven by factors such as its strong demand in the large corporate sector, extensive educational infrastructure, and widespread adoption of hybrid work models. Innovation in eco-friendly and ergonomic products is also a key growth factor. E-commerce penetration and strong distribution networks make supplies easily accessible. Government and institutional spending further support consistent demand. For instance, the U.S. government, through the Office of Management and Budget, has launched the Federal Strategic Sourcing Initiative for office supplies. This initiative aims to enhance opportunities for small businesses by at least 5%.

U.S. Office Supplies Market Trends

The office supplies industry in the U.S. held the largest market share of 80.0% in the North America region in 2024. The market is experiencing growth with high consumption from businesses, schools, and home offices. Rapid digitalization has prompted a shift toward smart and tech-enabled office supplies. The rise of remote work continues to boost demand for home office essentials. In addition, a strong retail and e-commerce ecosystem ensures widespread product availability.

Asia Pacific Office Supplies Market Trends

The Asia Pacific office supplies industry accounted for the largest market share of 37.3% in 2024. The region sees rapid growth due to rising literacy rates, expanding education systems, and increasing urbanization. Developing economies like India and Southeast Asian nations are investing heavily in school and office infrastructure. E-commerce and bulk manufacturing keep prices competitive, while growing startups and tech hubs boost corporate supply needs.

Europe Office Supplies Market Trends

The office supplies industry in Europe is projected to grow at a CAGR of 1.3% from 2025 to 2033. Europe's office supplies industry is driven by strong corporate demand, a large education sector, and environmental regulations encouraging sustainable products. Countries across the region prioritize workplace efficiency and compliance, which supports consistent demand for office tools. Digitization in education and business also boosts sales of smart stationery and organizational products. According to the data published in April 2025, the Delegation of the European Union to Switzerland and the Principality of Liechtenstein is inviting tenders for the provision of office supplies, stationery, and coffee break products.

The office supplies industry in Germany is projected to grow at a CAGR of 1.3% from 2025 to 2033. In Germany, as Europe’s economic leader, it shows a high demand for advanced and sustainable office supplies from both corporates and institutions. Its strong manufacturing and SME base requires reliable supply chains and office efficiency tools. In addition, government support for digital learning in schools drives the need for modern stationery and tech-integrated supplies.

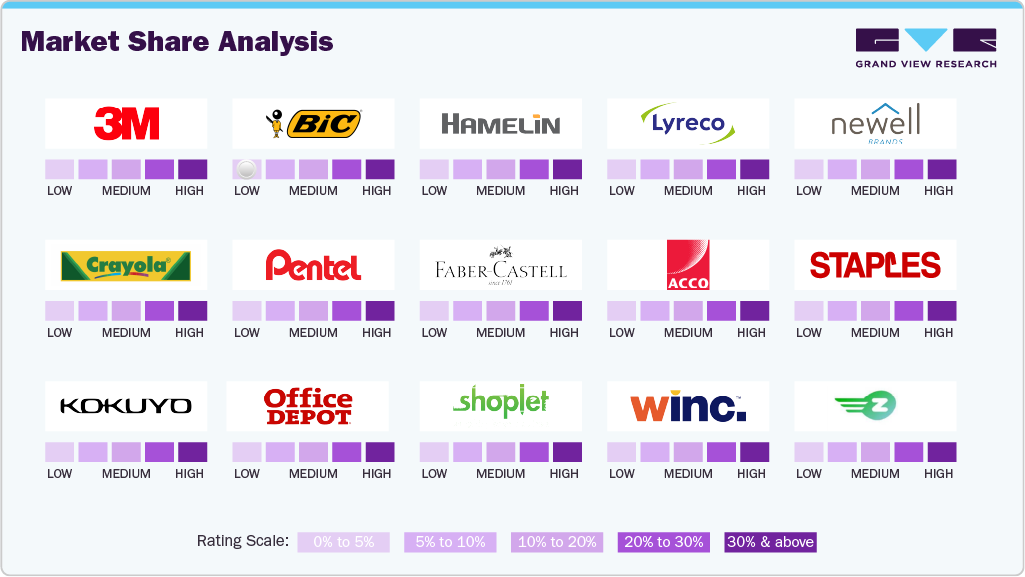

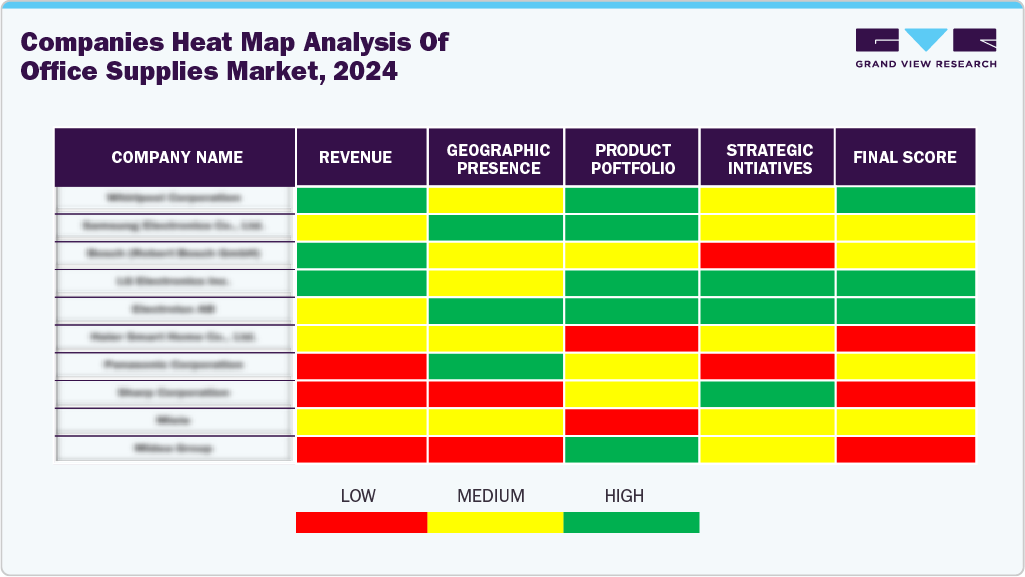

Key Office Supplies Company Insights

Many brands in the office supplies industry have identified untapped opportunities within their product lines and are taking steps to address these market gaps. This often involves developing new product designs or marketing campaigns to better meet consumer needs and preferences.

Key Office Supplies Companies:

The following are the leading companies in the office supplies market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- BIC

- Hamelin

- Lyreco

- Newell Brands

- Crayola

- Pentel Co., Ltd.

- Faber-Castell

- ACCO Brands

- Staples, Inc.

- Kokuyo Co., Ltd.

- Office Depot, LLC.

- Shoplet

- Winc Australia Pty. Ltd.

Recent Developments

-

In November 2024, Grubhub announced the expansion of its marketplace by partnering with Office Depot, LLC to offer office supplies. The platform will now feature items like paper supplies, writing tools, ink, and more, all available for on-demand delivery across over 800 locations.

-

In February 2023, Nauticon Office Solutions announced the acquisition of Digital Office products. The acquisition aims to strengthen Nauticon Office Solutions with the addition of Digital Office resources and customers.

Office Supplies Market Report Scope

Report Attribute

Details

Market value size in 2025

USD 71.50 billion

Revenue Forecast in 2033

USD 79.28 billion

Growth rate (Revenue)

CAGR of 1.3% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative (Revenue) units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, end use, region

Regional Scope

North America; Europe; Asia-Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Hong Kong; Indonesia; Singapore; Vietnam; Australia & New Zealand; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

3M; BIC; Hamelin; Lyreco; Newell Brands; Crayola; Pentel Co., Ltd.; Faber-Castell; ACCO Brands; Staples, Inc.; Kokuyo Co., Ltd.; Office Depot, LLC.; Shoplet; Winc Australia Pty. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Office Supplies Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the office supplies market report based on product, distribution channel, end use, and region:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Paper Supplies

-

Notebooks and Notepads

-

Printing Paper

-

Others

-

-

Writing Supplies

-

Pens & Pencils

-

Highlighters & Markers

-

Others

-

-

Filling Supplies

-

File Folders

-

Envelopes

-

Others

-

-

Desk Supplies

-

Desk & Drawer Organizer

-

Paperweights & Stamp Pads

-

Others

-

-

Binding Supplies

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Corporate

-

Educational Institutes

-

Hospitals

-

Hotels

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Hong Kong

-

Indonesia

-

Singapore

-

South Korea

-

Vietnam

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.