- Home

- »

- Automotive & Transportation

- »

-

Off-highway Electric Vehicles Market Size, Share Report, 2030GVR Report cover

![Off-highway Electric Vehicles Market Size, Share & Trends Report]()

Off-highway Electric Vehicles Market (2025 - 2030) Size, Share & Trends Analysis Report By Propulsion (BEV, HEV), By Battery Type (Li-ion, Lead-acid), By Application (Construction, Agriculture), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-161-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Off-highway Electric Vehicles Market Summary

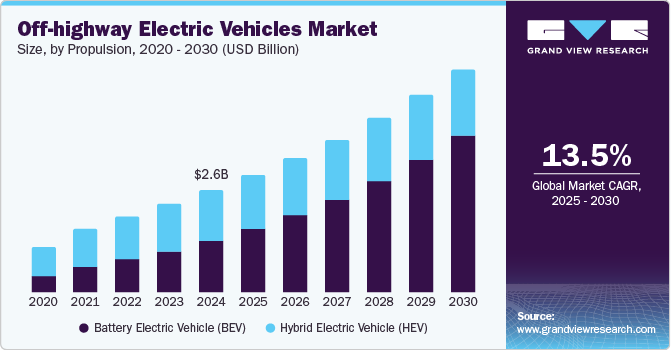

The global off-highway electric vehicles market size was estimated at USD 2.64 billion in 2024 and is projected to reach USD 5.75 billion by 2030, growing at a CAGR of 13.5% from 2025 to 2030. An increasing demand for off-highway electric vehicles in response to higher pollution standards and soaring fuel prices is a major factor behind the growth of the market.

Key Market Trends & Insights

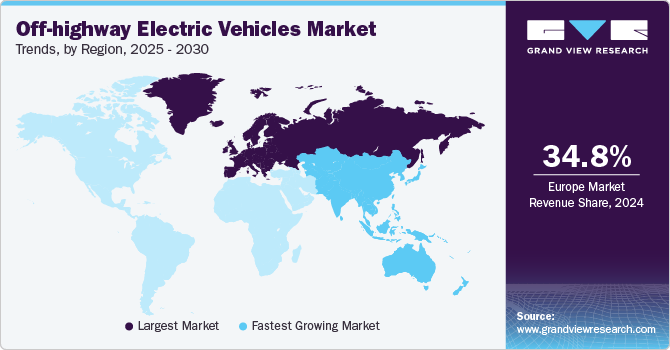

- Europe dominated the off-highway electric vehicles industry in 2024.

- The off-highway electric vehicles market in the UK is expected to grow at significant CAGR from 2025 to 2030.

- By propulsion, the battery electric vehicle (BEV) segment dominated the market in 2024 and accounted for a 50.14% share of the global revenue.

- By battery type, the lead acid battery segment dominated the market in 2024.

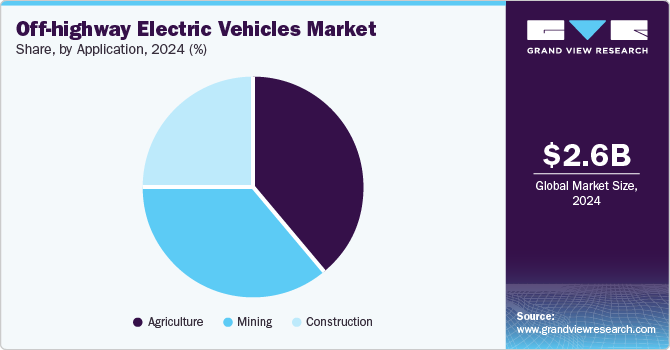

- By application, the agriculture segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.64 Billion

- 2030 Projected Market Size: USD 5.75 Billion

- CAGR (2025-2030): 13.5%

- Europe: Largest market in 2024

- Asia Pacific: Fastest growing market

Innovation, global competition, and new technologies are further driving the off-highway electric vehicle market growth. Furthermore, rapid advancements in battery technology and electric motors and increasing government support in terms of subsidies and incentives for using electric industrial machinery are expected to boost the growth of the market from 2025 to 2030.

The electrification of off-highway heavy-duty vehicles is gaining momentum, offering significant long-term cost savings due to reduced maintenance and lower fuel consumption compared to traditional internal combustion engine vehicles. The electrification of off-highway heavy-duty vehicles can significantly reduce maintenance requirements due to the fewer moving parts and electronic components in electric machines. This results in less wear and tear, minimizing unplanned downtime and associated costs, as well as maintenance costs. This reduction in maintenance needs contributes to lower overall operating costs for machine owners. Thus, increasing electrification of off-highway vehicles owing to its benefits is contributing to the growth of the off-highway electric vehicles industry.

Governments are offering subsidies and tax rebates for off-highway electric vehicles to encourage their adoption. Electric vehicle policies are being formulated by various countries for environmental and sustainability reasons. For instance, the Carl Moyer Memorial Air Quality Standards Attainment Program and California’s Clean Off-Road Equipment Voucher Incentive Project (CORE) are some specific grants that include or focus on off-road equipment. The CORE is a substantial incentive project aimed at encouraging users of off-road equipment in California to either purchase or lease commercially available zero-emission off-road vehicle. This streamlined voucher program provides point-of-sale discounts to offset the higher costs associated with zero-emission technology. Such, government initiatives by various governments are expected to contribute to the market’s growth.

Several manufacturers are securing contracts with construction, agriculture, and mining companies to supply their off-highway electric vehicles (EVs), highlighting the growing demand for sustainable and environmentally friendly solutions in these industries. For instance, in December 2023, Sandvik AB secured a contract from LKAB, a mining firm based in Sweden, to provide automated loaders for operation at the Kiruna mine in northern Sweden. The mine stands as the largest underground iron ore mine globally. The contract was valued at around USD 23.9 million (SEK 250 million). Such initiatives are expected to bode well with the market’s growth.

Fluctuation in raw material prices could hamper the market growth. Various raw materials, including ferrous and non-ferrous metals and alloys such as aluminum, brass, copper, nickel, steel, and zinc are used to manufacture off-highway electric vehicles. These raw materials are obtained from various nations, and their supply is highly susceptible to fluctuations in commodity prices and exchange rates. The instability in the prices of these key materials directly impacts production costs and, consequently, the affordability of off-highway electric vehicles.

Propulsion Insights

The battery electric vehicle (BEV) segment dominated the market in 2024 and accounted for a 50.14% share of the global revenue. The dominance of the segment can be attributed to restrictions on CO₂ emissions and the decline in the adoption of internal combustion engine (ICE) vehicles. Additionally, various contractors are increasingly adopting battery-powered alternatives to traditional diesel-powered machinery, including loaders, excavators, and cranes, due to benefits such as lower emissions, quieter operation, and reduced operating costs. Advancements in battery technology and the decreasing cost of lithium-ion batteries are expected to further drive the demand for battery-electric vehicles (BEVs) over the forecast period.

The hybrid electric vehicle (HEV) segment is expected to grow at a significant CAGR from 2025 to 2030. HEV is designed to augment the use of the internal combustion engine in collaboration with the electric powertrain. The demand for hybrid propulsion off-highway equipment has increased due to strict emission standards set by regulatory bodies like the U.S. EPA and the European Commission. This has prompted automakers to create environmentally friendly off-highway vehicles. Since 2017, off-highway vehicle manufacturers have been adopting hybrid engines featuring diesel-electric propulsion systems. These diesel-electric hybrid drive systems enable engine down speeding, allowing users to run a smaller engine at a lower rpm and, thereby, providing fewer parts movement and high fuel efficiency. All these factors are expected to contribute to the growth of the hybrid electric vehicle segment predominantly supporting the growth of the off-highway electric vehicle industry.

Battery Type Insights

The lead acid battery segment dominated the market in 2024. The lead-acid segment in the off-highway electric vehicle market employs rechargeable batteries known for storing electrical energy. Although traditionally used, these batteries face competition from newer technologies due to their relatively lower energy density and shorter lifespan. Despite these limitations, lead-acid-equipped off-highway electric vehicles continue to serve specific applications where cost-effectiveness and established technology play pivotal roles.

The Li-ion battery segment is projected to witness significant growth from 2025 to 2030. Lithium-ion batteries are the most common battery type used in off-highway EVs owing to their lightweight design, high energy density, and long cycle life. They also provide a good balance between range and power, making them suitable for an extensive range of off-highway EV applications. With a focus on longer life cycles and increased energy efficiency, li-ion equipped off-highway electric vehicles are experiencing rapid adoption, meeting the evolving needs of the industry for reliable and high-performance energy storage.

Application Insights

The agriculture segment dominated the market in 2024. Consumers in North America and Europe are increasingly using modern farm machinery and advanced agricultural techniques, such as electric harvesters and electric tractors, to boost yields. The electrification of farming equipment not only enhances productivity but also allows for automation, addressing labor challenges and enabling workers to focus on other essential tasks. Electric drive technology is revolutionizing the agricultural sector by offering multiple advantages over traditional internal combustion engines (ICE). This shift towards electrification is driven by the substantial benefits it provides at both the vehicle and business levels, fostering improved efficiencies and a move towards a more sustainable future.

The construction segment is projected to witness significant growth from 2025 to 2030. The construction equipment industry is witnessing a significant shift towards electrification, driven by the increasing cost-effectiveness of electric construction equipment. As fuel costs continue to increase and operating expenses for diesel-powered equipment remain high, the advantages of using electric construction equipment are becoming more apparent. The growing demand for electric construction equipment, combined with advancements in technology, is making it a more attractive solution for construction companies, which in turn drives the segment’s growth.

Regional Insights

The off-highway electric vehicles industry in North America is expected to grow at a notable CAGR of 11.9% from 2025 to 2030. The growth can be attributed to the presence of companies such as Caterpillar Inc. and Deere & Company in North America. Moreover, the growth of the construction industry in the region is further driving the demand for off-highway electric equipment.

U.S. Off-highway Electric Vehicles Market Trends

The off-highway electric vehicles market in the U.S. is expected to grow at a significant from 2025 to 2030. The growth fueled by technological advancements, increasing environmental awareness, and favorable government initiatives encouraging the adoption of cleaner power sources across industries.

The off-highway electric vehicles market in Canada is expected to grow at the considerable growth rate from 2025 to 2030. The increasing awareness of environmental concerns and the need for sustainable practices are driving demand for electric off-highway vehicles, which offer significant reductions in emissions and operating costs.

Asia Pacific Off-highway Electric Vehicles Market Trends

The Asia Pacific region is expected to grow at a highest CAGR from 2025 to 2030. Countries such as China, India, and Japan are at the forefront of the regional market for off-highway electric vehicles, with significant growth expected in the coming years driven by factors such as infrastructure development, demand in the construction and agricultural sectors, and government initiatives to reduce emissions and dependence on fossil fuels.

The China off-highway electric vehicles market is expected to witness steady growth rate from 2025 to 2030. This growth can be attributed to the high demand in the construction and agricultural sectors, as well as the presence of a large network of charging infrastructure and several off-highway electric vehicle manufacturers in China.

The off-highway electric vehicle market in India is witnessing notable growth, primarily driven by the agricultural sector's crucial role in the country's economy. As agriculture is a vital sector in India, the government's initiatives to encourage the adoption of e-tractors are expected to play a crucial role in driving market expansion.

The Japan off-highway electric vehicles market is expected to grow at a considerable CAGR from 2025 to 2030. The country’s focus on technological innovation and environmental consciousness can be attributed to the market’s growth.

Europe Off-highway Electric Vehicles Market Trends

Europe dominated the off-highway electric vehicles industry in 2024. Government initiatives supporting clean energy solutions and offering incentives for EV adoption have significantly influenced market expansion. In addition, increasing concerns regarding the adverse environmental impact of ICE vehicles have led to the establishment of stringent emission regulations, prompting a shift toward EVs.

The off-highway electric vehicles market in the UK is expected to grow at significant CAGR from 2025 to 2030. The UK's commitment to a zero-emission future for all new cars by 2035 is creating significant opportunities for the off-highway electric vehicle market. Various government mandates related to this shift not only offer clarity to manufacturers but also emphasize a sustainable approach toward achieving net-zero emissions.

The Germany off-highway electric vehicles market is expected to grow at a notable CAGR from 2025 to 2030. Germany, a significant player in Europe's automotive sector and a global leader in vehicle exports, has substantial potential for off-highway electric vehicle (EV) development. The government's strategic initiatives have positioned the country as a hub for e-mobility advancement, fostering a favorable environment for the growth of the off-highway EV market.

MEA Off-highway Electric Vehicles Market Trends

The off-highway electric vehicles industry in MEA is anticipated to grow at a considerable CAGR from 2025 to 2030. The increasing demand for more efficient and environmentally friendly vehicles in the mining and construction sectors is expected to be a key driver of the off-highway electric vehicle market in the MEA region.

The off-highway electric vehicles market in Kingdom of Saudi Arabia (KSA) is expected to witness moderate growth rate from 2025 to 2030. The Saudi Arabian mining sector is anticipated to experience significant growth in the coming years, playing a vital role in the Kingdom's economic diversification efforts. Thus, rapid growth in the country’s mining sector is expected to drive the demand for environment-friendly mining vehicles from 2025 to 2030.

Key Off-highway Electric Vehicles Company Insights

Some of the key companies operating in the market include Caterpillar Inc.; CNH Industrial N.V.; Sandvik AB; J C Bamford Excavators Ltd.; Komatsu Ltd.; and Volvo Construction Equipment AB.

-

Caterpillar Inc. manufactures and sells mining and construction equipment, industrial gas turbines, diesel and natural gas engines, and diesel-electric locomotives for construction, energy & resource, and transportation industries. The company operates through three primary segments, namely construction industries, resource industries, energy & transportation. The company also offers financing and related services through its financial products segment.

-

CNH Industrial N.V. is a provider of industrial equipment. The company designs and manufactures a wide range of agricultural and construction equipment and parts. The company operates under three business segments, namely agriculture, construction, and financial services.

Deere & Company, Doosan Corporation, and Epiroc AB, are some of the emerging companies in the off-highway electric vehicles market.

-

Deere & Company is a manufacturer of heavy equipment, agricultural machinery, diesel engines, forestry machinery, and drivetrains used in heavy equipment and lawn care equipment. The company operates under four business segments, namely small agriculture and turf, production and precision agriculture, construction and forestry, and financial services.

-

Epiroc AB is a productivity partner for construction and mining customers. The company leverages innovative technology to develop safe and advanced equipment, such as rock excavation equipment, drill rigs, and construction tools and equipment for both underground and surface applications.

Key Off-highway Electric Vehicles Companies:

The following are the leading companies in the off-highway electric vehicles market. These companies collectively hold the largest market share and dictate industry trends.

- Caterpillar Inc.

- CNH Industrial N.V.

- Hitachi Construction Machinery Co., Ltd.

- J C Bamford Excavators Ltd.

- Komatsu Ltd.

- Volvo Construction Equipment AB

- Deere & Company

- Doosan Corporation

- Sandvik AB

- Epiroc AB

Recent Developments

-

In January 2024, Caterpillar Inc. signed a strategic agreement with a provider of building materials solutions, CRH plc, to increase the deployment of its zero-exhaust emissions solutions, specifically focusing on the deployment of 70 to 100-ton-class charging solutions and battery electric off-highway trucks at a CRH plc’s North American site.

-

In November 2023, Volvo Construction Equipment AB partnered with CRH, a provider of building materials solutions, to decarbonize construction. The strategic partnership would focus on charging infrastructure, electrification, renewable energy, and low-carbon fuels, which have the combined potential to reduce emissions.

-

In March 2023, Doosan Corporation’s subsidiary Bobcat Company showcased its offerings and cutting-edge technologies during the CONEXPO/CON-AGG 2023 event at the Las Vegas Convention Center (LVCC). The company introduced two concept loaders and various models of electric excavators.

Off-highway Electric Vehicles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.05 billion

Revenue forecast in 2030

USD 5.75 billion

Growth rate

CAGR of 13.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Propulsion, battery type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Caterpillar Inc.; CNH Industrial N.V.; Hitachi Construction Machinery Co., Ltd.; J C Bamford Excavators Ltd.; Komatsu Ltd.; Volvo Construction Equipment AB; Deere & Company; Doosan Corporation; Sandvik AB; Epiroc AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Off-highway Electric Vehicles Market Report Segmentation

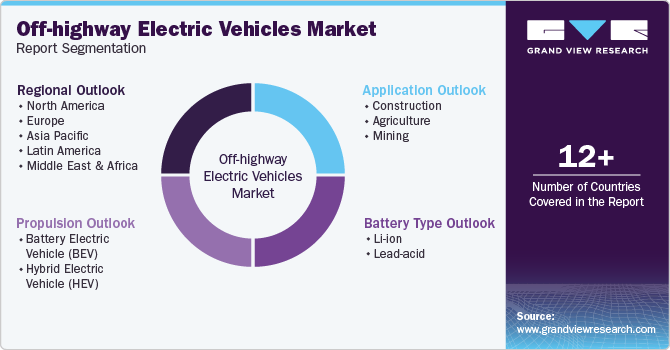

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the off-highway electric vehicles market based on propulsion, battery type, application, and region:

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicle (BEV)

-

Hybrid Electric Vehicle (HEV)

-

-

Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Li-ion

-

Lead-acid

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Construction

-

Agriculture

-

Mining

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global off-highway electric vehicle market size was estimated at USD 2.64 billion in 2024 and is expected to reach USD 3.05 billion in 2025.

b. Some key players operating in the off-highway electric vehicle market include Caterpillar, Volvo Construction Equipment AB, Komatsu Ltd., Deere & Company, Sandvik AB.

b. Key factors that are driving the off-highway electric vehicle market growth include increasing stringency in the emission standards for off-highway vehicles, improved efficiency, and high cost of ventilation of diesel emissions in mining.

b. The global off-highway electric vehicle market is expected to grow at a compound annual growth rate of 13.5% from 2025 to 2030 to reach USD 5.75 billion by 2030.

b. North America dominated the off-highway electric vehicle market with a share of 34.84% in 2024. Europe’s regulatory push, strong OEM presence, technological advancements, and high adoption in construction & agriculture make it a key player in the Off-Highway Electric Vehicles Market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.