- Home

- »

- Organic Chemicals

- »

-

Octyl Alcohol Market Size, Share And Growth Report, 2030GVR Report cover

![Octyl Alcohol Market Size, Share & Trends Report]()

Octyl Alcohol Market Size, Share & Trends Analysis Report By Product By Application (2-Ethylhexanol, 1-Octanol, 2-Octanol), By Region (Asia Pacific, Europe, North America), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-077-0

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Octyl Alcohol Market Size & Trends

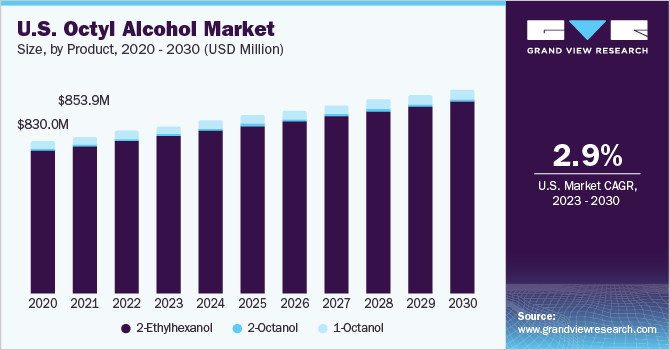

The global octyl alcohol market size was valued at USD 6.43 billion in 2022 and is expected to grow at a compounded annual growth rate (CAGR) of 2.9% from 2023 to 2030. The growth for the product market is attributed to its use in a variety of industries, including pharmaceuticals, cosmetics, cleaning chemicals, and paint and coatings, among others. One of the primary uses of octyl alcohol is that it can also be used as an intermediate in the production of fragrances, where it is used to produce various esters known for their sweet, fruity, and floral aromas. Additionally, octanol is also used in the pharmaceutical industry as a tool for evaluating the lipophilicity of drugs and other compounds, as well as a solvent in some manufacturing processes. It is also used in the production of various surfactants, which are used in the manufacturing of detergents, shampoos, and other cleaning products.

The U.S. is the largest consumer of the product in North America with a revenue share of over 83.0% in 2022. This is attributed to the growing application industries such as fragrances and flavors, cosmetics, and pharmaceuticals in the country. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), North America accounted for around 49.1% of the total pharmaceutical sales with U.S. accounting for 64.4% of the total sales of new medicines worldwide in 2021. Thus, as a result of growing pharmaceutical and other industries in the U.S. is anticipated to drive the product demand over the forecast period.

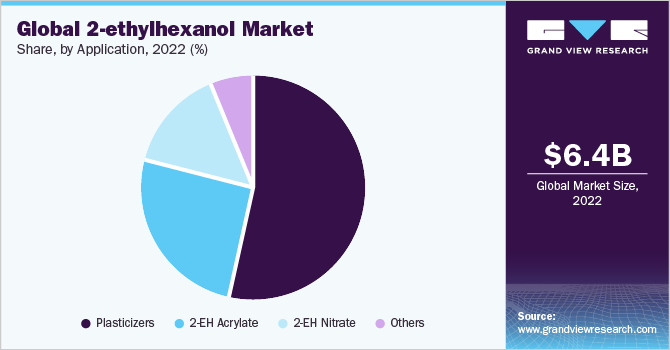

Product by Application

2-Ethylhexanol segment is expected to dominate the market with a revenue share of over 94% in 2022. This growth is attributed to the fact that it is used in the production of plasticized PVC in automobiles, as a solvent for surface coatings and inks, as a precursor for making plasticizers such as dioctyl phthalate (DOP), and as a raw material for producing acrylate esters, which are used in manufacturing emulsion paints and surface coatings.

Plasticizers accounted for the major application segment of 2-ethylhexanol with a revenue share of over 53%. This growth is due to growing demand for flexible and durable plastics across a wide range of end-use industries such as automotive, construction, and packaging. Plasticizers are added to polymers to enhance their flexibility, durability, and processability. Additionally, the increasing demand for bio-based and non-phthalate plasticizers due to growing health and environmental concerns is also contributing to the rise in demand for plasticizers.

1-Octanol segment is also anticipated to witness growth over the forecast period. It is a fatty alcohol that is primarily used for the synthesis of esters, which are used in perfumes and flavorings, which further finds application in the food and beverages, and cosmetics industry. Moreover, aside from its use in perfumes and flavorings, 1-octanol has also been used in pharmaceutical products to evaluate their lipophilicity. Thus, all these factors are anticipated to contribute towards the growth of 1-octanol over the forecast period.

Regional Insights

The Asia Pacific region has emerged as the predominant contributor with over 46% revenue share in the octyl alcohol market in 2022. The region's growth can be attributed to the advancing cosmetics, cleaning chemicals, and pharmaceutical industries.

The beauty and personal care industry in China recorded a significant sale of USD 88 billion in 2021, marking a 10% increase compared to the previous year, according to the International Trade Administration. Moreover, according to the National Investment Promotion & Facilitation Agency, the beauty & personal care market in India is the 8th largest in the world, accounting for USD 15 billion, which is further expected to grow at a CAGR of 12% to 16% in the coming years. The advancement of end-use industries in China, India, and Japan will likely drive the demand for octyl alcohol over the forecast period.

North America is another region witnessing growth over the forecast period. According to the Government of Canada, the pharmaceuticals sector is one of the innovative industries in Canada making it the 9th largest pharmaceuticals market worldwide. Additionally, according to the Wisconsin Economic Development Corporation, Mexico is the 2nd largest pharmaceuticals market in North America and 15th largest globally. Thus, the increasing usage of octanol in pharmaceutical is driving the product demand in the region.

Key Companies & Market Share Insights

The octyl alcohol market is characterized by intense competition, with a significant number of both manufacturers and suppliers operating within the industry. Key players in the market typically focus on mergers, innovation and product development, while smaller participants tend to compete primarily on the pricing strategies.

Players are entering into partnerships, mergers, product innovations, and price hike so as to establish their position and maintain profitability. For instance, in March 2023, companies such as Andhra Petrochemicals Ltd and Bharat Petroleum Corporation Limited increased the prices of 2-ethylhexanol in India. This price hike is due to increased raw material prices coupled with strong demand for the product in the market. Some of the prominent players in the global octyl alcohol market include:

-

Sasol

-

BASF

-

SABIC

-

BharatPetroleum

-

KLK OLEO

-

The Andhra Petrochemicals Limited

-

Ecogreen Oleochemicals

-

Arkema

-

Axxence Aromatic GmbH

-

Liaoning Huaxing Group Chemical

-

SRL

Octyl Alcohol Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.63 billion

Revenue forecast in 2030

USD 8.07 billion

Growth rate

CAGR of 2.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 – 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons, Revenue in USD Million, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product by application, region

Key companies profiled

Sasol; BASF; SABIC; BharatPetroleum; KLK OLEO; The Andhra Petrochemicals Limited; Ecogreen Oleochemicals; Arkema; Axxence Aromatic GmbH; Liaoning Huaxing Group Chemical; SRL

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Octyl Alcohol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global octyl alcohol market report on the basis of product by application, and region:

-

Product By Application Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

1-Octanol

-

Flavors & Fragrances

-

Pharmaceutical

-

Others

-

-

2-Octanol

-

Flavors & Fragrances

-

Agrochemicals

-

Resins

-

Others

-

-

2-Ethylhexanol

-

Plasticizers

-

2-EH Acrylate

-

2-EH Nitrate

-

Others

-

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Octyl Alcohol market was valued at USD 6.43 billion in 2022

b. Octyl Alcohol market is anticipated to grow at a compounded annual growth rate (CAGR) of 2.9% from 2023 to 2030.

b. 2-Ethylhexanol segment is expected to dominate the market with a revenue share of over 94% in 2022. This growth is attributed to the fact that it is used in the production of plasticized PVC in automobiles, as a solvent for surface coatings and inks, as a precursor for making plasticizers such as dioctyl phthalate (DOP), and as a raw material for producing acrylate esters, which are used in manufacturing emulsion paints and surface coatings.

b. Some of the prominent players in the industry include: • Sasol • BASF • SABIC • BharatPetroleum • KLK OLEO

b. One of the primary uses of octyl alcohol is that it can also be used as an intermediate in the production of fragrances, where it is used to produce various esters known for their sweet, fruity, and floral aromas.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."