Observability Tools And Platforms Market Size, Share & Trends Analysis Report By Component (Solutions, Services), By Deployment (Cloud, On-premises), By Organization Size, By Vertical (BFSI, Manufacturing), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-419-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

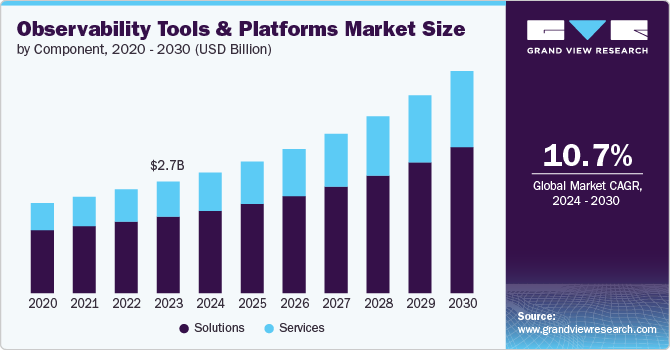

The global observability tools and platforms market size was estimated at USD 2.71 billion in 2023 and is expected to grow at a CAGR of 10.7% from 2024 to 2030. Businesses are undergoing rapid digital transformation, leading to a surge in data generation. Observability tools and platforms help organizations extract valuable insights from this data to improve decision-making and operations. Advanced IT environments are becoming increasingly complex with the rise of microservices, containers, and cloud-native architectures. Observability tools help organizations understand and manage this complexity. In addition, the widespread adoption of cloud computing has increased the need for robust monitoring and troubleshooting capabilities. Observability tools provide comprehensive visibility into cloud environments.

The proliferation of IoT devices generates massive amounts of data. Observability tools help organizations analyze this data to optimize device performance and identify potential issues. Moreover, advanced analytics capabilities powered by AI and ML enhance the ability of observability platforms to detect anomalies, predict issues, and automate incident response. Observability platforms enable organizations to monitor system behavior for security threats and compliance violations, ensuring data protection and regulatory adherence. By providing insights into application performance and user behavior, observability tools help organizations deliver better customer experiences.

Observability plays a crucial role in IT Operations Management (ITOM) by providing the necessary data to optimize IT operations and reduce downtime. In addition, the availability of open-source observability tools has lowered the barrier to entry for many organizations, driving market growth.DevOps and Agile Development methodologies emphasize rapid development and deployment cycles, which require real-time insights into application performance. Observability platforms support these practices by providing continuous monitoring and feedback.

Component Insights

The solutions segment led the market in 2023, accounting for over 68.0% share of the global revenue. The rise of microservices has led to distributed systems with numerous interconnected components. Observability tools are essential for understanding system behavior and troubleshooting issues.As organizations embrace cloud-native development, the complexity of software environments increases. Observability helps manage and optimize these complex systems. DevOps and agile methodologies demand rapid software delivery. Observability solutions provide real-time insights into application performance, aiding in faster troubleshooting and issue resolution.

The services segment is predicted to foresee the highest growth in the coming years. A shortage of skilled professionals with expertise in observability tools and platforms creates opportunities for service providers to fill this gap. In addition, service providers offer customized observability solutions to meet specific business requirements. Moreover, integrating observability tools with existing IT infrastructure and applications requires specialized expertise. Service providers help organizations extract valuable insights from observability data to optimize operations and improve decision-making.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2023. Cloud-based observability tools can handle fluctuating workloads and scale accordingly. By providing insights into resource utilization, cloud-based tools help optimize costs. In addition, cloud-based observability platforms can effectively monitor and manage distributed systems across different geographic locations. Cloud-based tools also enable real-time monitoring and analysis of global operations.

The on-premises segment is anticipated to exhibit a significant CAGR over the forecast period. Organizations handling sensitive data prefer on-premises solutions to maintain control over data security. Thus,industries with stringent data residency and sovereignty requirements necessitate on-premises deployments. Moreover, numerous organizations have substantial investments in on-premises infrastructure and applications. On-premises observability solutions can seamlessly integrate with existing systems.

Organization size Insights

The large enterprises segment accounted for the largest market revenue share in 2023. Large enterprises are at the forefront of adopting observability tools and platforms due to the complexity of their IT environments and the critical nature of their operations. Large enterprises operate across multiple cloud platforms and on-premises data centers, requiring comprehensive observability. Integrating legacy systems with modern applications necessitates robust monitoring and troubleshooting capabilities. The observability platform helps identify inefficiencies and bottlenecks in complex operations.

The SMEs segment is anticipated to exhibit the highest CAGR over the forecast period. SMEs are rapidly adopting digital channels to reach customers, making application performance and reliability critical.SMEs operate with limited resources, making efficient use of IT infrastructure essential.Delivering excellent customer experiences is crucial for SMEs to compete with larger players.Observability helps ensure application performance and user satisfaction.

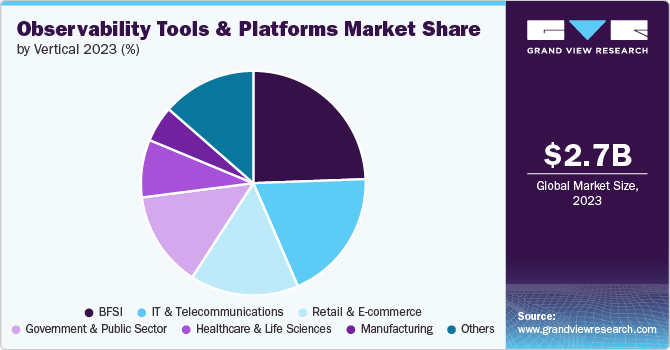

Vertical Insights

The BFSI segment accounted for the largest market revenue share in 2023. The BFSI industry is undergoing rapid digital transformation, making observability a critical component for ensuring system reliability, performance, and security. In addition, the BFSI sector is heavily regulated, with strict compliance standards for data privacy, security, and operational resilience. Observability helps in monitoring systems for compliance adherence.Observability data can be used to generate audit reports, reducing the burden on compliance teams. Furthermore, observability tools can identify unusual patterns in system behavior, helping detect fraudulent activities.

The retail & e-commerce segment is anticipated to exhibit the highest CAGR over the forecast period. The retail & e-commerce platforms involve intricate systems, including websites, mobile apps, payment gateways, and inventory management. Observability platforms help in managing this complexity. In addition, retailers often experience peak traffic during sales or holiday seasons, requiring robust monitoring and performance optimization. Understanding customer behavior and preferences in real time is crucial for enhancing customer experiences. Observability tools also help in optimizing inventory levels and preventing stockouts or overstocks. Thus, there is high growth of the observability tools and platforms in the segment.

Regional Insights

North America dominated the market with a revenue share of over 38.0% in 2023. The region has been a pioneer in adopting cloud-native architectures, leading to a surge in demand for observability solutions to manage complex cloud environments. Moreover, the increasing complexity of IT infrastructure due to hybrid and multi-cloud strategies necessitates robust observability tools. North American businesses prioritize delivering better customer experiences, driving the need for real-time insights into application performance.

U.S. Observability Tools And Platforms Market Trends

The U.S. market is anticipated to exhibit a significant CAGR over the forecast period. The U.S. is a hub for technological innovation, fostering a competitive environment where businesses invest in observability tools and platforms to gain an edge. Moreover, various early adopters of observability platforms are based in the U.S., driving market demand. In addition, the availability of venture capital has fueled the growth of observability startups in the region.

Europe Observability Tools And Platforms Market Trends

The market in the Europe region is expected to witness significant growth over the forecast period. European organizations are prioritizing data security, and observability plays a crucial role in identifying and mitigating threats.The financial services sector in Europe is heavily regulated, making observability essential for compliance adherence. The growth of digital banking and fintech has increased the demand for observability solutions to ensure system reliability and security.

Asia Pacific Observability Tools And Platforms Market Trends

The market in the Asia Pacific region is anticipated to register the fastest CAGR over the forecast period. Businesses across the region are undergoing digital transformation to enhance customer experiences. Developing countries such as India and China are emerging as global innovation hubs, fostering the development of new observability solutions. Observability tools are essential for understanding customer behavior and optimizing digital channels. The region has witnessed a surge in e-commerce, leading to increased demand for real-time monitoring and performance optimization.

Key Observability Tools And Platforms Company Insights

Key observability tools and platforms companies include Broadcom, Dynatrace, Inc., and GitLab B.V. Companies active in the observability tools and platforms market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance,in August 2023, LogicMonitor Inc. announced expanded integrations, insights, and workflows to the LM Envision Platform, the observability platform. The LM Envision Platform generates insights, automate fixes, and utilizes advanced machine learning technologies.The platform is built on advanced machine learning, intelligence, and automation. This combination is designed to simplify complexities and create significant business outcomes by facilitating collaboration around IT data. The company has directed its product development strategy towards enhancing intelligence, user experience, and flexibility.

Key Observability Tools And Platforms Companies:

The following are the leading companies in the observability tools and platforms market. These companies collectively hold the largest market share and dictate industry trends.

- Broadcom

- Dynatrace, Inc.

- GitLab B.V.

- International Business Machines Corporation

- LogicMonitor Inc.

- Microsoft

- Monte Carlo

- Riverbed Technology

- ScienceLogic

- Splunk Inc.

Recent Developments

-

In May 2024, Riverbed Technology introduced AI-Powered observability and acceleration platform designed to accelerate IT operations and bolster digital interactions, IT Operations teams are confronted with the formidable challenge of navigating massive volumes of data and alerts while lacking adequate context or actionable insights. The platform equips IT experts by simplifying the analysis and correlation of cross-domain data, thereby diminishing the volume of alerts end users’ teams have to handle. It further automates the processes of diagnosis and remediation.

-

In January 2024, Dynatrace, Inc. launched new capabilities for data observability based on AI to enhance the analytics and automation platform. By utilizing Dynatrace Data Observability, users can depend on the complete range of observability, security, and business events data within Dynatrace, Inc. This comprehensive data support fuels the platform's Davis AI engine, ensuring reliable business analytics and automation.

-

In January 2024, ScienceLogic partnered with LTIMindtree Limited, digital solutions provider, to offer a cohesive, smart platform designed to help organizations optimize their cloud resources while maintaining scalability, and effectiveness. By leveraging the integrated capabilities of the ScienceLogic and LTIMindtree Limited platforms, businesses can achieve comprehensive visibility, enhance cloud management, scale efficiently, and propel digital innovation.

Observability Tools And Platforms Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.94 billion |

|

Revenue forecast in 2030 |

USD 5.40 billion |

|

Growth Rate |

CAGR of 10.7% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion/million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, organization size, vertical, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, UK, France, China, India, Japan, Australia, South Korea, Brazil, UAE, South Africa, KSA |

|

Key companies profiled

|

Broadcom; Dynatrace, Inc.; GitLab B.V.; International Business Machines Corporation; LogicMonitor Inc.; Microsoft; Monte Carlo; Riverbed Technology; ScienceLogic; Splunk Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Observability Tools And Platforms Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global observability tools and platforms market report based on component, deployment, organization size, vertical, and region.

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Solutions

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Enterprises

-

SMEs

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Manufacturing

-

Retail & E-commerce

-

Government & Public Sector

-

IT & Telecommunications

-

Healthcare & Life Sciences

-

BFSI

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global observability tools and platforms market size was estimated at USD 2.71 billion in 2023 and is expected to reach USD 2.94 billion in 2024.

b. The global observability tools and platforms market is expected to grow at a compound annual growth rate of 10.7% from 2024 to 2030 to reach USD 5.40 billion by 2030.

b. North America dominated the observability tools and platforms market with a share of 38.9% in 2023. The region has been a pioneer in adopting cloud-native architectures, leading to a surge in demand for observability solutions to manage complex cloud environments. Moreover, the increasing complexity of IT infrastructure due to hybrid and multi-cloud strategies necessitates robust observability tools. North American businesses prioritize delivering better customer experiences, driving the need for real-time insights into application performance.

b. Some key players operating in the observability tools and platforms market include Broadcom, Dynatrace, Inc., GitLab B.V., International Business Machines Corporation, LogicMonitor Inc., Microsoft, Monte Carlo, Riverbed Technology, ScienceLogic, and Splunk Inc.

b. Businesses are undergoing rapid digital transformation, leading to a surge in data generation. Observability tools and platforms help organizations extract valuable insights from this data to improve decision-making and operations. Advanced IT environments are becoming increasingly complex with the rise of microservices, containers, and cloud-native architectures. Observability tools help organizations understand and manage this complexity.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."