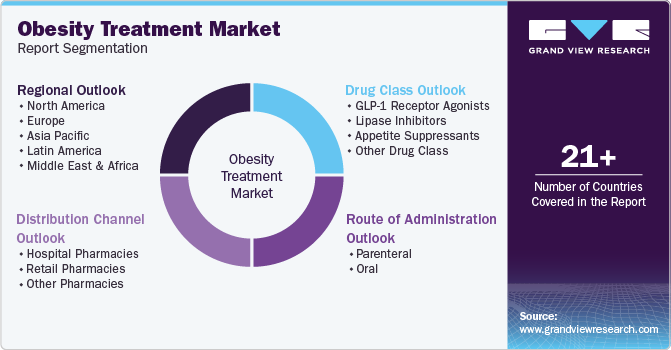

Obesity Treatment Market Size, Share & Trends Analysis Report By Drug Class (GLP-1 Receptor Agonists, Lipase Inhibitors, Appetite Suppressants), By Route Of Administration (Parenteral, Oral), By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-095-8

- Number of Report Pages: 153

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Obesity Treatment Market Size & Trends

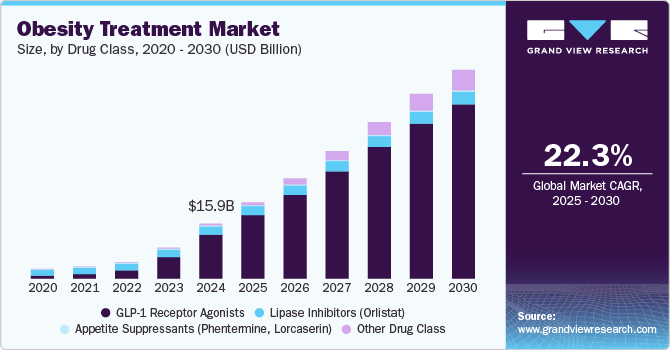

The global obesity treatment market size was valued at USD 15.92 billion in 2024 and is anticipated to grow at a CAGR of 22.31% from 2025 to 2030. The industry is driven by several key factors, including the rising global prevalence of obesity and its associated comorbidities, such as diabetes, cardiovascular diseases, and hypertension. The growing awareness of obesity as a chronic condition requiring medical intervention has led to increased demand for effective pharmacological treatments.

According to the World Health Organization (WHO), obesity is a chronic disease characterized by excessive fat accumulation that negatively impacts health, increasing the risk of type 2 diabetes, cardiovascular diseases, certain cancers, and a reduced quality of life. As of 2022, an estimated 2.5 billion adults were overweight, with 890 million classified as obese, along with 37 million children under the age of five being overweight. Obesity is primarily driven by factors such as poor diet, physical inactivity, and obesogenic environments.

While preventable and manageable through healthy eating, regular exercise, and lifestyle modifications, addressing obesity requires a comprehensive approach. WHO advocates for global action, including regulatory measures on food production and marketing, as well as stronger healthcare interventions to mitigate obesity-related health risks. As the prevalence of obesity continues to rise, businesses that address these needs will likely see significant market expansion.

Government regulations and guidelines are pivotal in shaping the obesity treatment market by establishing standards for prevention, diagnosis, and treatment. National health initiatives, such as Healthy China 2030 and the Obesity Care Continuum in the U.S., focus on reducing obesity rates through public awareness, lifestyle interventions, and improved access to medical treatments. These policies influence dietary regulations, the approval process for weight-loss medications, and insurance coverage for obesity-related treatments, ultimately driving market growth and ensuring broader patient access to effective therapies.

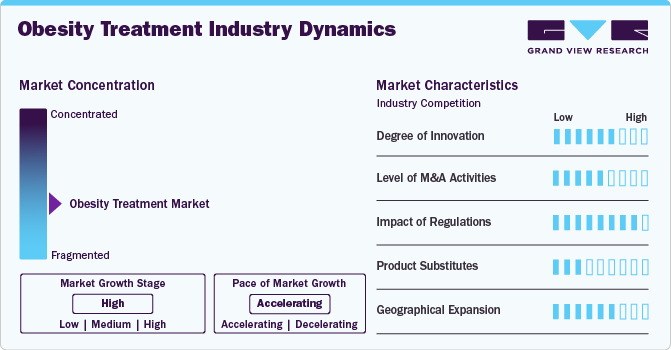

Market Concentration & Characteristics

The obesity treatment industry is undergoing rapid innovation, driven by advancements in GLP-1 receptor agonists, lipase inhibitors, and appetite suppressants. Breakthroughs in drugs like semaglutide (Wegovy), liraglutide (Saxenda), and tirzepatide (Zepbound) are significantly improving weight management outcomes. Additionally, the development of novel oral formulations and non-traditional therapies is expanding treatment options and accessibility.

Mergers and acquisitions are highly active in this market as pharmaceutical giants seek to strengthen their obesity treatment portfolios. Companies such as Novo Nordisk A/S, Eli Lilly and Company, and Boehringer Ingelheim International GmbH are actively acquiring biotech firms specializing in weight management solutions. M&A activities are primarily focused on gaining access to next-generation obesity drugs, enhancing formulation technologies, and expanding market presence.

Regulatory agencies, including the FDA and EMA, play a crucial role in the approval and commercialization of obesity treatments. While stringent efficacy and safety requirements ensure high-quality therapeutic options, they also contribute to lengthy approval processes. Additionally, reimbursement policies significantly impact market adoption, with payers evaluating the cost-effectiveness of newer anti-obesity drugs before widespread coverage is granted.

The market faces moderate competition from traditional weight-loss methods such as lifestyle modifications, dietary interventions, and surgical procedures like bariatric surgery. However, pharmacological interventions, particularly GLP-1 receptor agonists and appetite suppressants, are gaining traction due to their superior long-term efficacy and ability to address metabolic factors associated with obesity.

Leading pharmaceutical companies are aggressively expanding into regions with high obesity prevalence, including North America, Europe, and emerging markets in Asia-Pacific and Latin America. With rising obesity rates and increasing healthcare awareness, companies are focusing on enhancing drug accessibility through retail and hospital pharmacies, as well as direct-to-patient distribution channels.

Drug Class Insights

Based on drug class, the industry has been categorized into GLP-1 receptor agonists, lipase inhibitors, appetite suppressants, and other drug classes. The GLP-1 receptor agonists segment accounted for the largest revenue share of 80.19% in 2024. The growth of GLP-1 receptors is driven by their efficacy compared to other drug classes in achieving significant weight reduction. GLP-1 receptor agonists, such as semaglutide, liraglutide, and tirzepatide, copy the action of the peptide-1, which regulates appetite and glucose metabolism. GLP-1 receptor agonists act on multiple metabolic pathways, leading to reduced hunger, increased satiety, and improved glycemic control.

The other drug class segment is expected to exhibit the fastest growth in the market over the forecast period. The other drug class in obesity treatment, which includes setmelanotide, cannabinoid receptor antagonists, and serotonergic agents, has shown significant growth due to their unique mechanisms and targeted approaches to managing obesity. Similarly, cannabinoid receptor antagonists and serotonergic agents are also expected to witness significant growth owing to ongoing efforts to make them safer. Cannabinoid receptor antagonists help reduce appetite by blocking signals in the body that encourage overeating. Thus, the development of new drugs designed to provide the same appetite-reducing benefits without the risks associated with older treatments is expected to increase their demand and drive segment growth over the forecast period.

Route of Administration Insights

Based on the route of administration, the obesity treatment market has been categorized into parenteral and oral. The parenteral segment captured the largest revenue share at 82.20% in 2024. Parenteral are witnessing significant demand in the obesity treatment market, driven by their ability to deliver targeted, sustained therapeutic effects. Parenteral are known for their improved bioavailability and faster action, making them a preferred choice for both healthcare providers and patients seeking more effective weight management solutions. Many leading treatments in this segment utilize GLP-1 receptor agonists and other peptide-based drugs, which are difficult to administer orally due to degradation in the gastrointestinal tract.

Oral is the second largest segment in the route of administration segment of the market. The oral route of administration is witnessing significant growth in the obesity treatment market due to its high patient compliance, ease of use, and non-invasive nature. Patients often prefer oral formulations over injectable or implantable options, as they eliminate the need for professional assistance during administration. Moreover, oral drugs are convenient for the long-term management of chronic conditions such as obesity, where treatment adherence is crucial.

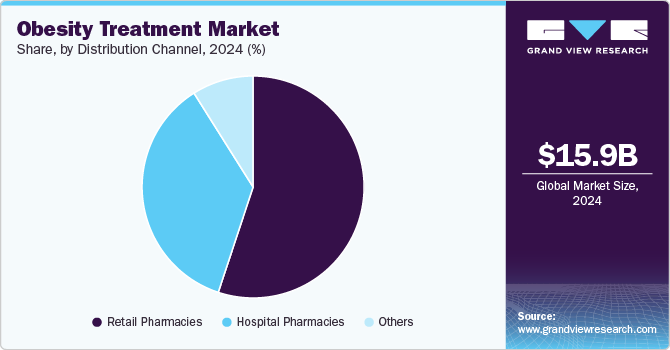

Distribution Channel Insights

Based on distribution channels, the market has been categorized into hospital pharmacies, retail pharmacies, and others. The retail pharmacies segment held the largest revenue share of 55.08% in 2024. Retail pharmacies are witnessing significant growth driven by the growing demand for both prescription medications and over-the-counter (OTC) products targeting weight management. These pharmacies serve as accessible points for patients seeking anti-obesity drugs, dietary supplements, and wellness products, offering convenience and ease of access. One of the key reasons for the growth of retail pharmacies in this market is their ability to address the demands of a diverse population, including those who may not regularly visit healthcare facilities.

The other pharmacies are expected to grow at a considerable growth of over the forecast period. The other segment, encompassing mail-order pharmacies, specialty clinics, and online drug stores, has been witnessing significant growth in the obesity treatment market. This growth is driven by the increasing demand for convenience and personalized care solutions among patients seeking obesity management therapies. This segment is set for rapid growth, driven by increasing demand for convenience and accessibility in healthcare delivery.

Regional Insights

North America obesity treatment market dominated the global industry with a revenue share of 73.39% in 2024. The North American industry is witnessing significant growth driven by the rising prevalence of obesity across the region. The U.S. and Canada are at the forefront of this trend, with both countries witnessing significant increases in obesity rates over the past two decades due to sedentary lifestyles, high consumption of processed foods, and genetic predispositions. The increasing usage of online pharmacies is also contributing to expanding access to therapies across the region

U.S. Obesity Treatment Market Trends

The obesity treatment market in the U.S. held a revenue share of 95.78% in 2024. The industry in North America is witnessing significant growth driven by the rising prevalence of obesity across the region. The growth of the obesity treatment market in the U.S. is being driven by the increasing prevalence of obesity in the country’s population. According to the Centers for Disease Control and Prevention (CDC), between August 2021 and August 2023, the obesity prevalence among U.S. adults was reported at 40.3%. Thus, the rising prevalence of obesity in U.S. adults is expected to drive market growth.

Europe Obesity Treatment Market Trends

The obesity treatment market in Europe is witnessing significant growth due to a combination of rising obesity rates and an increasing focus on addressing this health challenge through innovative treatment solutions. Obesity has become a significant public health issue across European nations, with countries such as the UK, Germany, and France showing high obesity prevalence figures.

The UK obesity treatment market is primarily driven by the rising prevalence of obesity across all age groups. According to data published by the government of the UK, around 64% of adults in the UK were classified as overweight or obese. Such a high prevalence of obesity in the country significantly increases the demand for effective treatment solutions. Moreover, various organizations in the country are launching initiatives aimed at improving obesity awareness in the country’s population.

The obesity treatment market in Germany has experienced significant growth due to the rising prevalence of obesity and its associated health conditions, such as type 2 diabetes, cardiovascular diseases, and certain types of cancer. Moreover, various initiatives and health campaigns by public and private organizations have played a crucial role in raising awareness about the long-term health risks of obesity, leading to increased demand for treatment solutions.

France obesity treatment market is witnessing significant growth owing to the increasing awareness about the importance of obesity treatment to counter the prevalence of obesity in wide demographic groups and the increasing access to advanced treatment options for patients. Moreover, the competitive landscape within the French obesity treatment market is intensifying as both established international players and local market players compete to meet the increasing demand for obesity treatment in the country and increase their presence in the country’s market share.

Asia Pacific Obesity Treatment Market Trends

The obesity treatment market in the Asia Pacific is driven by a significant increase in obesity rates across countries such as China, India, Japan, and Australia. This rise is attributed to urbanization, sedentary lifestyles, and unhealthy dietary habits. In China and India, economic development has significantly increased disposable incomes, which has led to a rise in the consumption of calorie-dense, processed foods. These factors are also significantly increasing the prevalence of obesity in Southeast Asian countries.

Japan obesity treatment market in Japan is growing significantly owing to lifestyle changes and increasing public awareness of obesity-related health risks. Traditionally, Japan had one of the lowest obesity rates among developed countries owing to a diet high in fish, vegetables, and rice. However, changing eating patterns influenced by fast food is significantly increasing the obesity risk in the country. Additionally, the aging population has led to increased focus on managing obesity-related conditions, such as type 2 diabetes and cardiovascular diseases.

The obesity treatment market in China is witnessing significant growth, driven by the country’s rising prevalence of obesity. Rapid urbanization and increased consumption of processed and high-calorie foods have contributed to a growing public health concern regarding obesity.

Latin America Obesity Treatment Market Trends

The obesity treatment market in Latin America is witnessing significant growth, driven by the increasing prevalence of obesity and related health complications in the region. Factors such as rising urbanization, changing lifestyles, and increased consumption of processed and high-calorie foods are contributing to growing obesity in the region. Governments in Latin America are becoming more aware of the economic burden of obesity, initiating public health initiatives and policies aimed at reducing its prevalence.

Brazil obesity treatment market is witnessing significant growth, driven by the country’s rising obesity prevalence and increasing public health concerns. Additionally, rising awareness of the long-term health risks associated with obesity, such as diabetes, cardiovascular diseases, and joint disorders, is fueling the demand for medical treatments. The proactive approach of the government to counter the increasing obesity rates among various population demographics is contributing to the increasing obesity awareness in the country.

MEA Obesity Treatment Market Trends

The obesity treatment market in the Middle East & Africa is witnessing growth due to a combination of changing lifestyles, increasing disposable incomes, and developing health infrastructure. Countries such as Saudi Arabia, South Africa, UAE, and Kuwait have significantly high obesity rates globally, driven by high-calorie diets and reduced physical activity.

Saudi Arabia obesity treatment market is driven by the country’s alarming obesity prevalence. Moreover, increasing public health awareness campaigns launched by government bodies, such as the Vision 2030 Health Sector Transformation Program, which also aims to reduce obesity by 3% in the country by 2030, are raising awareness about obesity-related health risks, including diabetes and cardiovascular diseases.

Key Obesity Treatment Company Insights

Some prominent players in the global market are Novo Nordisk A/S, Rhythm Pharmaceuticals, Inc., Gelesis, Rhythm Pharmaceuticals, Inc., and Boehringer Ingelheim International GmbH. The market is shaped by mergers, acquisitions, and partnerships, along with significant investments in research & development to address unmet needs and expand treatment options.

Product innovation and regulatory approvals are key strategies for leading companies in the obesity treatment market to maintain a competitive edge. Established players focus on developing advanced therapies, such as next-generation GLP-1 receptor agonists and oral weight-loss drugs, while securing regulatory approvals to expand market reach. Meanwhile, emerging companies are targeting niche areas, including personalized obesity treatments and novel drug delivery mechanisms, to address unmet needs.

Key Obesity Treatment Companies:

The following are the leading companies in the obesity treatment market. These companies collectively hold the largest market share and dictate industry trends.

- Novo Nordisk A/S

- GlaxoSmithKline plc

- VIVUS LLC

- Currax Pharmaceuticals

- Boehringer Ingelheim International GmbH

- Rhythm Pharmaceuticals, Inc.

- Gelesis

- Eli Lilly and Company

View a comprehensive list of companies in the Obesity Treatment Market

Recent Developments

-

In May 2024, Palatin Technologies received FDA clearance to begin a phase 2 clinical study of bremelanotide, a Melanocortin Receptor 4 (MCR4) agonist, combined with tirzepatide (GLP-1/GIP) for obesity treatment. Expected to start mid-2024, the study aims to assess safety and efficacy, with topline results anticipated by year-end. Palatin will host a virtual Key Opinion Leader (KOL) event on May 8, 2024, to discuss its metabolic program and novel treatments.

-

In July 2024, Currax Pharmaceuticals announced the approval of a new manufacturing site for CONTRAVE/MYSIMBA in the EU and EEA, doubling production capacity to ensure continuous supply amid GLP-1 supply issues. This site can scale production as needed. CONTRAVE is an affordable anti-obesity medication, and its primary clinical trial, INFORMUS, aims to assess cardiovascular safety.

-

In November 2023, Eccogene entered an exclusive license agreement with AstraZeneca for its oral GLP-1 receptor agonist, ECC5004, targeting obesity, type 2 diabetes, and cardiometabolic conditions. AstraZeneca will develop and commercialize ECC5004 globally, except in China, where both companies will codevelop and commercialize the drug. Eccogene will receive an initial payment of $185 million, with potential earnings of up to $1.825 billion in milestones and royalties. Currently, in phase I trials, ECC5004 has shown promising preclinical results as a low-dose, daily oral therapy.

Obesity Treatment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 22.11 billion |

|

Revenue forecast in 2030 |

USD 60.53 billion |

|

Growth rate |

CAGR of 22.31% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Drug class, route of administration, distribution channel, and region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE, Saudi Arabia, and Kuwait |

|

Key companies profiled |

Novo Nordisk A/S, GlaxoSmithKline plc, VIVUS LLC, Currax Pharmaceuticals, Boehringer Ingelheim International GmbH, Rhythm Pharmaceuticals, Inc., Gelesis, Eli Lilly and Company. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Obesity Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global obesity treatment market report on the basis of drug class, route of administration, distribution channel and region:

-

Class Outlook (Revenue, USD Million, 2018 - 2030)

-

GLP-1 Receptor Agonists

-

Semaglutide (Wegovy)

-

Liraglutide (Saxenda)

-

Tirzepatide (Zepbound)

-

-

Lipase Inhibitors

-

Appetite Suppressants

-

Other Drug Class

-

-

Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Parenteral

-

Oral

-

-

Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Other Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global obesity treatment market size was estimated at USD 15.92 billion in 2024 and is expected to reach USD 22.11 billion in 2025.

b. The global obesity treatment market is expected to grow at a compound annual growth rate of 22.31% from 2025 to 2030 to reach USD 60.53 billion by 2030

b. Based on drug class, the GLP-1 Receptor Agonists segment accounted for the largest revenue share of 80.19% in 2024, due to their efficacy in promoting weight loss by regulating appetite and enhancing insulin sensitivity.

b. Key players operating in the market are Novo Nordisk A/S, GlaxoSmithKline plc, VIVUS LLC, Currax Pharmaceuticals, Boehringer Ingelheim International GmbH, Rhythm Pharmaceuticals, Inc., Gelesis, Eli Lilly and Company.

b. The growth of the obesity treatment market is primarily driven by the increasing prevalence of obesity-related conditions, government regulations and guidelines, and advancements in treatment options.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."