- Home

- »

- Smart Textiles

- »

-

Nylon Fiber Market Size And Share, Industry Report, 2030GVR Report cover

![Nylon Fiber Market Size, Share & Trends Report]()

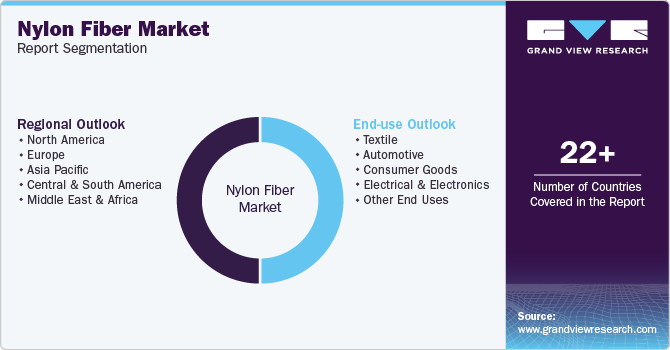

Nylon Fiber Market (2025 - 2030) Size, Share & Trends Analysis Report By End-use (Textile, Automotive, Consumer Goods, Electrical & Electronics), By Region (North America, Europe, Asia Pacific, MEA), And Segment Forecasts

- Report ID: GVR-4-68040-518-4

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Nylon Fiber Market Summary

The global nylon fiber market size was estimated at USD 35.66 billion in 2024 and is projected to reach USD 51.16 billion by 2030, growing at a CAGR of 6.2% from 2025 to 2030. The growth of the market can be attributed to its wide range of applications, including textiles, automotive, consumer goods, and industrial uses.

Key Market Trends & Insights

- Asia Pacific was the largest segment, valued at USD 13.86 billion in the global market in 2024.

- China nylon fiber market is the largest consumer of nylon fibers.

- Based on end use, automotive segment accounted for the largest revenue share of 35.6% in 2024

Market Size & Forecast

- 2024 Market Size: USD 35.66 Billion

- 2030 Projected Market Size: USD 51.16 Billion

- CAGR (2025-2030): 6.2%

- Asia Pacific: Largest market in 2024

As a synthetic polymer, nylon offers a unique combination of durability, flexibility, and resistance to abrasion, making it indispensable in various industries. The market is driven by several factors, including increasing demand for lightweight materials, growing urbanization, and advancements in technology.The primary driver of the nylon fiber industry is its widespread adoption across the automotive and textile industries. In the automotive sector, the push for lightweight materials that improve fuel efficiency and reduce emissions has led to an increased use of nylon in components such as airbags, fuel tanks, and engine covers. The growing trend towards electric vehicles (EVs) further accelerates this demand, as nylon helps reduce weight without compromising on strength and durability. In textiles, the growing demand for activewear and high-performance fabrics, especially in sports and fashion apparel, is driving the nylon market. Nylon’s elasticity, resistance to wear, and ability to retain shape make it ideal for these applications.

Another key driver is the increasing demand for durable consumer goods, such as luggage, sports equipment, and home furnishings. Consumers today prioritize products that are not only functional but also long-lasting, which makes nylon a preferred material. Furthermore, technological advancements have expanded the use of nylon in industries such as electronics and medical devices. Nylon’s insulating properties make it an excellent choice for cable coatings and components in electrical equipment. The versatility of nylon continues to drive its adoption across various industries, fueling market growth.

Despite its advantages, the nylon fiber industry faces significant restraints, the most prominent being its high production cost. Nylon production involves complex chemical processes, which are more expensive than those for natural fibers like cotton or alternative synthetic fibers like polyester. This makes nylon less competitive in cost-sensitive markets, especially in regions where low-cost materials dominate.

Another restraint is the volatility of raw material prices. Nylon production relies heavily on petrochemical derivatives, and any fluctuation in the prices of these raw materials, particularly crude oil, can significantly impact production costs. This uncertainty in pricing can make it difficult for manufacturers to maintain stable profit margins and pricing for end consumers.

However, the industry is expected to experience growth due to the development of sustainable and bio-based nylon. As consumers and industries seek more environmentally friendly alternatives, there is a growing focus on developing bio-based nylon products that are produced from renewable resources. Innovations in recycling technologies also present a significant opportunity, as manufacturers explore ways to recycle used nylon fibers and reduce waste. Companies that invest in sustainable production methods and offer eco-friendly nylon options are likely to capitalize on this growing trend and gain a competitive edge in the market.

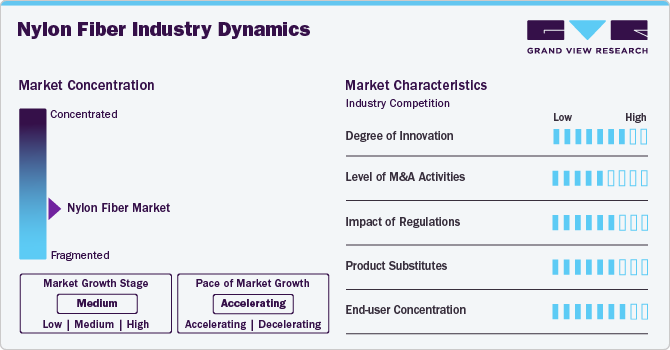

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market is highly fragmented, with numerous local and regional players competing alongside global manufacturers. The key players are focusing on product innovation, capacity expansion, and sustainability initiatives. As demand for high-performance, lightweight, and durable fibers grows across industries like textiles, automotive, and electronics, manufacturers are investing in bio-based and recycled nylon solutions to align with sustainability goals.

The nylon fiber industry is subject to stringent environmental regulations regarding carbon emissions, waste disposal, and chemical usage in production. Governments and regulatory bodies such as the Environmental Protection Agency (EPA), European Chemicals Agency (ECHA), and REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) enforce strict standards to reduce the environmental impact of synthetic fibers.

The threat of substitutes in the nylon fiber market is moderate, as alternative fibers like polyester, polypropylene, aramid fibers, and bio-based textiles are gaining popularity. Additionally, the shift towards sustainable and biodegradable materials, such as organic cotton, lyocell, and polylactic acid (PLA) fibers, is influencing demand for nylon alternatives, especially in the textile and apparel industries. However, nylon’s superior strength, abrasion resistance, and durability ensure its continued preference in high-performance applications, including automotive, industrial, and technical textiles.

End Use Insights

Based on end use, this market is segmented into textile, automotive, consumer goods, and electrical & electronics. Among these, automotive accounted for the largest revenue share of 35.6% in 2024, as the material’s lightweight nature and superior mechanical properties offer several advantages in vehicle manufacturing. Nylons are increasingly being used in automotive components such as airbags, fuel tanks, engine covers, and interior parts, where their durability, resistance to high temperatures, and weight-saving properties help improve vehicle performance.

Furthermore, as automotive manufacturers focus on reducing vehicle weight to improve fuel efficiency and reduce emissions, nylon is an attractive option for a variety of parts. The ongoing growth in the electric vehicle (EV) market further drives the demand for lightweight materials, with nylon offering a sustainable and efficient alternative to traditional materials.

Textile is a significant user of nylon fibers, primarily due to the material’s strength, elasticity, and durability. Nylon’s ability to resist wear, abrasion, and damage from outdoor elements makes it ideal for high-performance fabrics used in activewear, sportswear, and outdoor gear. In addition to its mechanical properties, nylon is lightweight and has excellent moisture-wicking capabilities, which further enhances its suitability for athletic apparel.

Moreover, with global demand for athleisure and functional clothing continues to rise, particularly in emerging economies, the textile segment for nylon fibers is expected to experience steady growth. Furthermore, nylon’s ability to retain its shape and color over time, as well as its versatility in blending with other fibers, helps manufacturers create a wide range of fabric types for various applications.

Regional Insights

In 2024, the Asia Pacific nylon fiber market was the largest segment, valued at USD 13.86 billion in the global market. The growing automotive, textile, and consumer goods sectors across the region are fueling the demand for nylon fibers. Furthermore, as governments of various countries in the region emphasize sustainability and energy efficiency, the demand for lightweight materials like nylon in the automotive industry is growing.

Moreover, the rising popularity of electric vehicles also presents new opportunities for nylon, as automakers look for materials that contribute to reducing the weight of vehicles. Therefore, as the region continues to develop, the demand for nylon fibers in these advanced manufacturing industries will support continued market growth.

China Nylon Fiber Market Trends

China nylon fiber market is the largest consumer of nylon fibers in the Asia-Pacific region, owing to its robust manufacturing industries, particularly in automotive, textiles, and electronics. In the automotive sector, China’s shift towards electric vehicles (EVs) and energy-efficient vehicles is boosting the demand for lightweight materials like nylon, which offer strength and durability while reducing vehicle weight. The textile industry in China also plays a significant role, as the country is a major producer and exporter of clothing and fabrics. Nylon fibers are extensively used in the production of activewear, sportswear, and technical textiles, where their durability and resistance to abrasion are highly valued.

North America Nylon Fiber Market Trends

The nylon fiber market in the North America is one of the key regions in the nylon fiber market, driven primarily by the strong industrial base, technological advancements, and growing consumer demand for high-performance materials across various sectors. In the textile industry, as consumer preferences shift towards durable, high-quality products, manufacturers are incorporating more nylon into their designs. Additionally, there is a growing push towards sustainability in North America, with manufacturers focusing on developing bio-based and recycled nylon fibers to meet consumer demands for eco-friendly solutions. This shift presents a significant opportunity for innovation within the market.

The U.S. nylon fiber market is the largest market for nylon fibers in North America, driven by strong demand across multiple sectors such as automotive, textiles, consumer goods, and electronics. The automotive industry, in particular, plays a significant role in the country’s consumption of nylon fibers. As automakers focus on reducing vehicle weight to improve fuel efficiency and reduce emissions, nylon’s lightweight, durable, and heat-resistant properties make it an ideal choice for manufacturing critical parts.

Europe Nylon Fiber Market Trends

The growing focus on sustainability in Europe nylon fiber market has led to a significant shift in production methods, with many companies prioritizing eco-friendly, recycled, or bio-based nylon fibers. As regulations become stricter regarding environmental impact, European manufacturers are looking for ways to reduce carbon footprints and use renewable resources. In addition to the textile and automotive sectors, electronics and medical devices are emerging areas of growth for nylon fibers in Europe. As the market becomes increasingly concerned with both performance and environmental impact, innovations in nylon production, such as the development of recyclable and biodegradable nylon variants, will shape the future of the European nylon fiber market.

Germany nylon fiber market is one of the largest consumers of nylon fibers in Europe, driven by its strong automotive and industrial manufacturing sectors. The demand for high-performance materials in the automotive sector is growing, with German automakers seeking lightweight and durable components for vehicles. Nylon fibers are used extensively in automotive parts such as fuel systems, airbags, and engine components, where their strength, resistance to wear, and lightweight nature provide critical benefits. Furthermore, Germany's focus on sustainable manufacturing practices has also driven the adoption of bio-based nylon and recycled nylon fibers in various industries.

Central & South America Nylon Fiber Market Trends

The nylon fiber market in Central and South America is experiencing growth due to rising industrialization and increased consumer demand for durable goods. In the automotive sector, countries like Brazil are seeing growing demand for lightweight materials such as nylon, especially as local manufacturers shift towards more fuel-efficient vehicles. Similarly, the textile industry in South America is expanding, with nylon used in the production of clothing, sportswear, and outdoor gear benefiting from its durability and strength. Therefore, as manufacturing capabilities improve, the regional demand for nylon is expected to grow over the coming years.

Middle East & Africa Nylon Fiber Market Trends

The Middle East & Africa nylon fiber market is expanding due to ongoing industrialization, and the rise of e-commerce, that presents growth opportunities. The demand for sustainable nylon production will also be a key driver of growth as the region becomes more focused on environmental impact reduction.

Key Nylon Fiber Company Insights

Some key players operating in the market include Solvay, INVISTA, and DuPont :

-

Solvay is involved in advanced materials and specialty chemicals, producing high-performance nylon fibers for applications in the automotive, aerospace, textiles, and industrial sectors. The company focuses on sustainable innovation, developing bio-based and recycled nylon solutions to reduce environmental impact and enhance product durability.

-

INVISTA, a subsidiary of Koch Industries, is a leading manufacturer of nylon fibers, polymers, and intermediates, supplying industries such as apparel, automotive, and industrial textiles. Known for its CORDURA and STAINMASTER brands, the company focuses on durability, performance, and eco-friendly fiber solutions to drive market growth.

Ascend Performance Materials, and LIBOLON are some emerging market participants in the nylon fiber market.

-

LIBOLON is an Asian manufacturer of nylon fibers and textiles, specializing in sustainable and functional fiber solutions for apparel, home textiles, and industrial applications. The company integrates recycled and eco-friendly materials into its production, aligning with global sustainability trends and circular economic initiatives.

-

Ascend Performance Materials is a producer of nylon 6,6 fibers, resins, and engineered plastics catering to automotive, textiles, consumer goods, and industrial applications. The company prioritizes innovation in lightweight, high-strength, and sustainable nylon solutions, investing in bio-based alternatives and advanced manufacturing technologies.

Key Nylon Fiber Companies:

The following are the leading companies in the nylon fiber market. These companies collectively hold the largest market share and dictate industry trends.

- Solvay

- Radici Partecipazioni SpA

- Shenma Industrial Co., Ltd.

- Ascend Performance Materials

- INVISTA

- Asahi Kasei Corporation

- DuPont

- EMS-CHEMIE HOLDING AG

- Shakespeare Company, LLC.

- LIBOLON

Recent Developments

-

In December 2024, Universal Fibers announced the expansion of its Nylon 6,6 production capabilities to address growing customer demand and market shifts. The company invested in enhancing the spinning capacity for Solution Dyed Nylon (SDN) and natural yarns, strengthening its role as a reliable supplier in the carpet and textile industries. This expansion underscores the continued significance of Nylon 6,6 for its durability and high performance, while also aligning with Universal Fibers’ focus on innovation, customer support, and sustainable growth.

Nylon Fiber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 37.87 billion

Revenue forecast in 2030

USD 51.16 billion

Growth rate

CAGR of 6.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea

Key companies profiled

Solvay; Radici Partecipazioni SpA; Shenma Industrial Co., Ltd.; Ascend Performance Materials; INVISTA; Asahi Kasei Corporation; DuPont; EMS-CHEMIE HOLDING AG; Shakespeare Company, LLC.; LIBOLON

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nylon Fiber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nylon fiber market report based on end use, and region:

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Textile

-

Automotive

-

Consumer Goods

-

Electrical & Electronics

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global nylon fiber market size was estimated at USD 35.66 billion in 2024 and is expected to reach USD 37.87 billion in 2025.

b. The global nylon fiber market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2030 to reach USD 51.16 billion by 2030.

b. Automotive accounted for the largest revenue share of 35.6% in 2024, as the material’s lightweight nature and superior mechanical properties offer several advantages in vehicle manufacturing.

b. Key players operating in the market are Solvay, Radici Partecipazioni SpA, Shenma Industrial Co., Ltd., Ascend Performance Materials, INVISTA, Asahi Kasei Corporation, DuPont, EMS-CHEMIE HOLDING AG, Shakespeare Company, LLC., and LIBOLON.

b. The key factors that are driving the nylon fiber include its wide range of applications, including textiles, automotive, consumer goods, and industrial uses.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.