- Home

- »

- Consumer F&B

- »

-

Nutraceuticals Market Size And Share, Industry Report, 2030GVR Report cover

![Nutraceuticals Market Size, Share & Trends Report]()

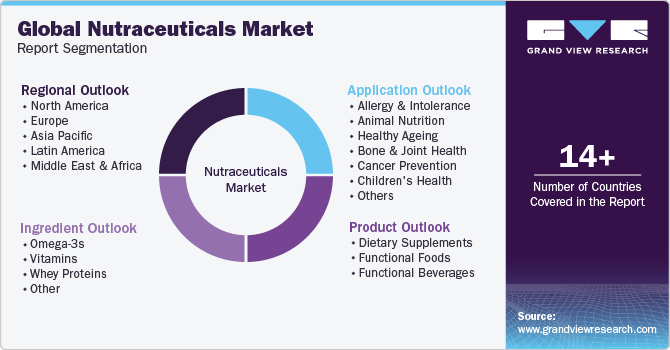

Nutraceuticals Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food), By Application (Diabetes, Eye Health), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-059-0

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Nutraceuticals Market Summary

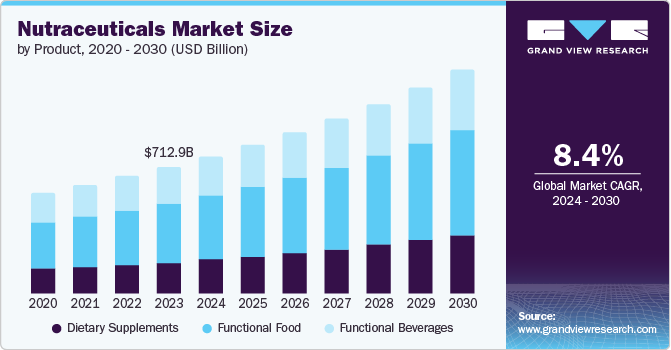

The global nutraceuticals market size was estimated at USD 591.1 billion in 2024 and is projected to reach USD 919.1 billion by 2030, growing at a CAGR of 7.6% from 2025 to 2030. The market growth is attributed to the increasing consumer awareness of preventative healthcare and the link between diet and well-being.

Key Market Trends & Insights

- The Asia Pacific nutraceuticals market held 38.9% of the global revenue in 2024.

- The China nutraceuticals market is set to grow at a CAGR of about 8.6% from 2025 to 2030.

- Based on product, the dietary supplements segment accounted for a revenue share of 32.6% in 2024.

- Based on application, the weight management & satiety application accounted for a revenue share of 16.6% in 2024.

- Based on distribution channel, the sales of nutraceutical products through offline channels accounted for a revenue share of 79.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 591.1 Billion

- 2030 Projected Market Size: USD 919.1 Billion

- CAGR (2025-2030): 7.6%

- Asia Pacific: Largest market in 2024

The aging global population, particularly in developed nations, is actively seeking solutions to maintain health and manage age-related conditions, leading to a surge in demand for supplements targeting joint health, cognitive function, and cardiovascular wellness. Simultaneously, rising rates of chronic diseases like obesity and diabetes are prompting individuals to adopt healthier lifestyles, including incorporating nutraceuticals into their daily routines. This proactive approach to health management is a key trend powering the industry forward.

Consumers are increasingly scrutinizing ingredient lists, seeking clean labels, and opting for plant-based options. This aversion to synthetic ingredients and a desire for transparency is driving demand for nutraceuticals derived from natural sources, such as fruits, vegetables, herbs, and botanicals. Innovations in extraction and processing technologies are also playing a crucial role, enabling manufacturers to create more potent and bioavailable formulations from these natural ingredients. This trend extends beyond just ingredient sourcing and encompasses ethical and sustainable production practices, further shaping consumer choices.

The increasing understanding of personalized nutrition and the role of gut health are also significant demand drivers. Consumers are moving away from a one-size-fits-all approach and are exploring nutraceuticals tailored to their individual needs based on factors like genetics, lifestyle, and health goals. The growing body of research highlighting the gut microbiome's influence on overall health has fueled demand for probiotics, prebiotics, and other gut-health-focused supplements. These developments are further supported by advancements in diagnostic tools and personalized health-tracking technologies, enabling individuals to make informed decisions about their nutraceutical needs.

In addition, the accessibility and convenience of nutraceuticals are significantly contributing to market growth. E-commerce platforms have made it easier for consumers to research and purchase a wide range of products, while the increased availability of convenient formats, such as gummies, powders, and drinks, has broadened the market appeal. Furthermore, the ongoing endorsement of nutraceuticals by healthcare professionals and fitness influencers is strengthening consumer trust and driving adoption. This combination of factors, from increased accessibility to trusted endorsements, is expected to continue driving the rapid expansion of the global nutraceuticals industry.

Product Insights

The dietary supplements segment accounted for a revenue share of 32.6% in 2024, driven by the increasing consumer focus on preventative healthcare and wellness, with individuals proactively seeking to address nutritional deficiencies and support their overall health through supplementation. The aging global population, particularly in developed nations, is also contributing significantly to demand, as older adults often require specific nutrients to combat age-related health concerns. Furthermore, the rise of personalized nutrition and the growing availability of tailored supplements catering to specific needs, such as sports performance, weight management, and immune support, are attracting a wider consumer base. Technological advancements in supplement formulation, including enhanced delivery systems like liposomes and nanotechnology, are also boosting efficacy and desirability. Besides, a growing awareness of the link between gut health and overall well-being has driven up the demand for probiotics and prebiotics, further expanding the supplement landscape.

The functional beverages segment is anticipated to witness a growth rate of 7.6% from 2025 to 2030, driven by a consumer shift towards healthier and more convenient alternatives to traditional sugary drinks. A key trend is the desire for natural and "better-for-you" options, leading to increased demand for beverages enriched with vitamins, minerals, antioxidants, and plant-based ingredients. The rise of the fitness culture and the growing popularity of active lifestyles have boosted the demand for sports and performance drinks, including those with electrolytes, protein, and BCAAs. Moreover, the convenience factor plays a significant role, with time-constrained consumers seeking easy-to-consume options that offer specific health benefits, like energy boosts, stress relief, or improved sleep. The proliferation of innovative and diverse flavor profiles, coupled with novel ingredients like adaptogens and nootropics, is driving consumer product adoption rate. Besides, an increased awareness of the potential health risks associated with excessive sugar consumption has played a significant role in the shift away from traditional sugary drinks and towards functional beverage options.

Application Insights

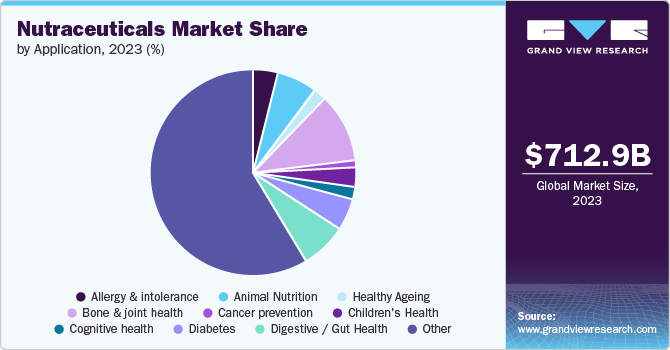

The weight management & satiety application accounted for a revenue share of 16.6% in 2024, owing to the rising global prevalence of obesity and associated health concerns, leading consumers to actively seek convenient and natural solutions beyond traditional dieting. This is fueling demand for products that promote satiety, regulate appetite, and support fat burning, with a particular emphasis on plant-based ingredients, fiber-rich formulations, and those backed by scientific research. Furthermore, the wellness movement is shifting the focus from mere weight loss to holistic health, leading to increased interest in nutraceuticals that support healthy metabolism, gut health, and balanced energy levels, indicating a desire for sustainable solutions rather than quick fixes. The convenience of ready-to-drink shakes, bars, and powders is also a key factor influencing consumer choices in this category, providing easy integration into busy lifestyles.

The men’s health nutraceuticals segment is estimated to grow at a CAGR of 13.5% from 2025 to 2030. Men are becoming increasingly proactive about addressing specific health concerns and maintaining overall well-being. Key demand drivers include a growing awareness of preventative healthcare and an increased understanding of how nutrition impacts performance, vitality, and long-term health. This translates to rising demand for supplements targeting areas such as prostate health, muscle development and strength, energy levels, and hormonal balance, especially as men age. Furthermore, the stigma surrounding discussing men's health issues is gradually diminishing, making it more acceptable to seek out supplements that address concerns like erectile dysfunction and stress management. The influence of fitness culture and the desire to maintain an active lifestyle are also contributing factors, leading to increased interest in products that support athletic performance, recovery, and overall vitality.

Distribution Channel Insights

The sales of nutraceutical products through offline channels accounted for a revenue share of 79.0% in 2024. The offline channel, comprising brick-and-mortar establishments such as pharmacies, supermarkets & hypermarkets, specialty stores, and grocery stores, remains a significant opportunity for nutraceutical sales. Consumers often prefer the tactile experience of physically selecting products and interacting with informed staff who can provide personalized recommendations. Pharmacies, in particular, are trusted sources of supplements due to their association with health and wellness solutions. Supermarkets & hypermarkets offer a broader reach with a wider selection of products, catering to more casual consumers. However, this channel's growth can be limited by geographical constraints and competition from e-commerce, requiring offline retailers to focus on creating engaging in-store experiences and building strong relationships with customers to maintain their market share.

The online segment is estimated to grow at a CAGR of 10.6% from 2025 to 2030. E-commerce platforms offer convenience, accessibility, and a wider selection of products compared to traditional retail. Consumers can easily research and compare products, read reviews, and often find lower prices online. The COVID-19 pandemic significantly accelerated the adoption of online shopping, and this trend is expected to continue. Moreover, direct-to-consumer online brands are also gaining prominence, allowing manufacturers to bypass intermediaries and foster direct engagement with their customers.

Regional Insights

The North America nutraceuticals market held over 31.8% of the global revenue in 2024. A strong emphasis on preventative healthcare and a growing awareness of the link between diet and wellness are anticipated to drive the growth of the North American nutraceuticals industry. Moreover, as the aging population seeks to manage age-related conditions, there is a rise in health-conscious consumers and increasing the adoption of personalized nutrition. Convenience and product innovation, particularly in functional foods and beverages, are also key trends, along with increasing interest in plant-based and clean-label options.

U.S. Nutraceuticals Market Trends

The nutraceuticals market in U.S. is expected to grow at a CAGR of 6.2% from 2025 to 2030. Key demand drivers include the high prevalence of chronic conditions such as obesity and diabetes, amplified by rising healthcare costs. Consumers are increasingly proactive about their health, leading to the widespread use of dietary supplements, vitamins, and minerals. E-commerce is a significant channel, and sports nutrition products and weight management solutions are particularly popular.

Europe Nutraceuticals Market Trends

The nutraceuticals market in Europe is expected to grow at a CAGR of 6.9% from 2025 to 2030, driven by an increasing awareness of the link between diet and health, as well as aging populations and rising rates of chronic diseases. The demand for products promoting cardiovascular health, joint mobility, and cognitive function is particularly high. Consumers across different European countries are increasingly conscious about the quality and origin of ingredients, favoring natural, organic, and plant-based options. Besides, the European regulatory landscape, though complex, is well-established and promotes transparency and consumer safety, affecting which products can be sold and how they are marketed.

Germany nutraceuticals market represents a leading market in Europe, driven by a strong consumer focus on health and wellness, a large aging population, and a well-established pharmaceutical infrastructure. The German market demonstrates a preference for science-backed products with clear evidence of efficacy. The demand for vitamins, minerals, and supplements is particularly strong, with consumers actively seeking solutions for specific health concerns like immune support, joint pain, and sleep disorders. The demand for natural and organic products also continues to rise, reflecting a growing consumer preference for products perceived as pure and safe.

Asia Pacific Nutraceuticals Market Trends

The nutraceuticals market in Asia Pacific is set to grow at a CAGR of about 9.0% from 2025 to 2030, driven by a combination of rising disposable incomes, increasing health awareness, and aging populations. Traditional medicine and wellness practices remain influential while consumers increasingly adopt Western-style supplementation. The demand is strong for products targeting immunity, digestive health, and cognitive function, and a large variety of novel ingredients with traditional origins are gaining popularity. Moreover, e-commerce plays a critical role in reaching consumers in this expansive region, and the growing adoption of smart technologies is further driving market growth, especially among younger demographic segments.

The China nutraceuticals market is set to grow at a CAGR of about 8.6% from 2025 to 2030. This growth is fueled by a rapidly expanding middle class with increasing health consciousness and government initiatives promoting public health. Traditional Chinese medicine principles significantly influence the demand for products that support immunity, beauty, and children's health. Moreover, e-commerce is a dominant force in the Chinese nutraceuticals industry, with online platforms providing access to a vast range of products from both domestic and international brands. Chinese consumers heavily rely on online reviews and influencer marketing, requiring companies to invest strategically in digital marketing channels. Besides, the regulatory environment in China is complex and rapidly evolving, requiring companies to adapt to changing guidelines and obtain necessary approvals for product importation and sales.

The Japanese nutraceuticals industry is a mature and sophisticated market shaped by its aging population, a strong tradition of preventive healthcare, and a high level of health consciousness among its citizens. The market is heavily driven by demand for products promoting healthy aging, cognitive function, and joint mobility, with consumers particularly interested in products with scientifically proven effectiveness. Moreover, increasing preference for established retail channels, including pharmacies and specialty stores, and e-commerce will further boost the nutraceuticals in the country.

The nutraceuticals industry in Australia & New Zealand is set to grow at a CAGR of about 9.5% from 2025 to 2030, driven by strong consumer interest in preventative healthcare, a focus on natural wellness, and a growing trend toward health and fitness. Consumers in this region prioritize products that are perceived as natural, clean-label, and sustainable. Moreover, the demand is particularly strong for supplements targeting digestive health, immune support, and sports performance. Besides, the emphasis on outdoor lifestyles and healthy living is a significant factor shaping consumer preferences for nutraceutical products in Australia & New Zealand.

Key Nutraceuticals Company Insights

The global nutraceuticals industry is characterized by a diverse landscape of players, ranging from established pharmaceutical giants to specialized ingredient manufacturers and innovative startups. Key companies including Yakult Honsha Co., Ltd., Amway Corp., Herbalife Nutrition Ltd., Nestlé S.A., The Kraft Heinz Company, The Hain Celestial Group, Inc., GlaxoSmithKline plc., General Mills Inc., Danone, and Tyson Foods, Inc. hold significant positions due to their extensive product portfolios, established distribution networks, and strong brand recognition. These major players often employ strategies such as strategic acquisitions to expand into new product categories or geographies, as seen with Nestlé’s increasing focus on personalized nutrition through acquisitions of smaller, specialized firms. They also invest heavily in R&D to develop new ingredients and formulations, as well as launch new product lines that heavily emphasize natural, organic, and plant-based ingredients to cater to evolving consumer preferences and health concerns. This continuous innovation and expansion contribute to their leading positions within the market, influencing consumer trends and shaping the competitive dynamics. Besides, key industry participants also leverage partnerships and collaborations to access broader distribution channels and gain research capabilities.

Key Nutraceuticals Companies:

The following are the leading companies in the nutraceuticals market. These companies collectively hold the largest market share and dictate industry trends.

- Amway Corp.

- Yakult Honsha Co., Ltd.

- General Mills Inc.

- Danone

- Nestlé S.A.

- The Kraft Heinz Company

- The Hain Celestial Group, Inc.

- Herbalife Nutrition Ltd.

- Tyson Foods

- Haleon Group of companies

- Otsuka Pharmaceutical

- GlaxoSmithKline plc.

Recent Developments

-

In November 2024, Danone strategically capitalized on the escalating functional beverage market by introducing STōK Cold Brew Energy. This product line extension leverages the popularity of their existing STōK Cold Brew brand, positioning it to capture consumers seeking both caffeine and enhanced performance. By blending coffee with energy drink attributes, including 195mg of caffeine, B vitamins, ginseng, and guarana, Danone targets a clear consumer need with a differentiated "energy coffee" offering.

-

In October 2024, TopGum Industries Ltd. launched liquid honey-based gummy dietary supplements featuring a higher dose of honey in liquid form than a commonly powdered form. The product line includes five functional gummies targeting various health conditions.

Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 636.2 billion

Revenue forecast in 2030

USD 919.1 billion

Growth rate

CAGR of 7.6% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel,region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S, Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, South Korea, Australia & New Zealand, Philippines, Thailand, Vietnam, Malaysia, Singapore, Indonesia, Brazil, Peru, Chile, Argentina, Colombia, South Africa, Saudi Arabia, UAE

Key companies profiled

Amway Corp.; Yakult Honsha Co., Ltd.; General Mills Inc.; Danone; Nestlé S.A.; The Kraft Heinz Company; The Hain Celestial Group, Inc.; Herbalife Nutrition Ltd.; Tyson Foods; Haleon Group of companies; Otsuka Pharmaceutical; GlaxoSmithKline plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nutraceuticals market report based on product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Dietary Supplements

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint Health

-

Cancer Prevention

-

Children's Health

-

Cognitive Health

-

Diabetes

-

Digestive / Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men's Health

-

Nutricosmetics

-

Oral Care

-

Personalised Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women's Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

Philippines

-

Thailand

-

Vietnam

-

Malaysia

-

Singapore

-

Indonesia

-

-

Central & South America

-

Brazil

-

Peru

-

Chile

-

Argentina

-

Colombia

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global nutraceuticals market was estimated at USD 591.1 billion in 2024 and is expected to reach USD 636.2 billion in 2025.

b. The global nutraceuticals market is expected to grow at a compound annual growth rate of 7.6% from 2025 to 2030 to reach USD 919.1 billion by 2030.

b. Asia Pacific dominated the global nutraceuticals market with a share of 38.0% in 2024, driven by a combination of rising disposable incomes, increasing health awareness, and aging populations. Traditional medicine and wellness practices remain influential while consumers increasingly adopt Western-style supplementation.

b. Some of the key market players in the global nutraceuticals market are Yakult Honsha Co., Ltd., Amway Corp., Herbalife Nutrition Ltd., Nestlé S.A., The Kraft Heinz Company, The Hain Celestial Group, Inc., GlaxoSmithKline plc., General Mills Inc., Danone, and Tyson Foods, Inc.

b. The global nutraceuticals market growth is driven by the increasing consumer awareness of preventative healthcare and the link between diet and well-being. Moreover, the ongoing endorsement of nutraceuticals by healthcare professionals and fitness influencers is strengthening consumer trust and driving adoption.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.