Nucleic Acid Therapeutics CDMO Market Size, Share & Trends Analysis Report By Type (Gene Therapy, RNA-based Therapies), By Service (Process Development and Optimization), By End-use, By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-125-4

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

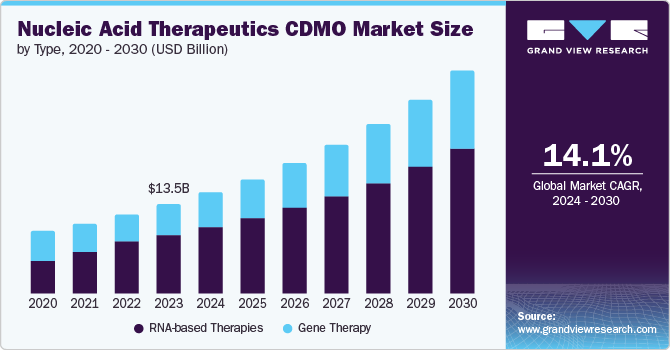

The global nucleic acid therapeutics CDMO market size was estimated at USD 15.35 billion in 2024 and is projected to grow at a CAGR of 14.20% from 2025 to 2030. Rising incidence of genetic disorders across the globe, increasing advancements in nucleic acid therapeutics, growing regulatory approval, rapidly expanding pipeline of gene & RNA based therapy, and robust expansion of the genomics research sector & strong traction gained by custom oligonucleotides are key major factors driving the market growth over the forecast period.

The growing number of global CDMOs, adoption of a one-stop-shop model & foreign direct investments for nucleic acid therapeutics, and rising need for personalized medicine are other aspects anticipated to propel overall market revenue growth.

Growing incidence of genetic disorders globally has fueled interest in nucleic acid therapeutics as a potential option for the treatment of such conditions. For instance, according to WHO, as of 2023, there are around 10,000 types of distinct monogenic or single-gene diseases globally. Such conditions are caused due to mutations in a single gene. Thus, increasing utilization of genetic materials such as RNA or DNA to prevent and treat genetic diseases. Genetic editing and sequencing technologies have significantly enhanced the comprehension of genetic diseases and considerably increased the development of nucleic acid therapeutics. Moreover, these drugs have high potential in treating rare genetic diseases for which the development process of traditional medicine is economically challenging. The high proficiency of nucleic acid therapeutics allows for a more precise and personalized treatment approach by specifically targeting the genetic abnormalities of the condition. Thus, rising prevalence of genetic ailments is one of the prominent factors driving the growth in demand for nucleic acid therapeutics, thereby proliferating overall market demand.

The genomics research industry is witnessing a robust expansion driven by the growing demand for personalized medicine and technological advancements. This can be attributed to growing adoption of advanced bioinformatics tools and high-throughput sequencing technologies. Custom oligonucleotides and short DNA or RNA sequences tailored for specific applications have gained significant traction in this market. Such molecular tools are pivotal in several genomic applications, including PCR amplification, DNA sequencing, and gene editing. Modifying oligonucleotides permits researchers to manipulate and accurately target genetic material, allowing enhanced precision and experimentation. This approach has witnessed considerable attention due to its potential to target several conditions, such as cancer, genetic ailments, and infectious diseases. Owing to the aforementioned factors, several biopharmaceutical companies have been focusing on developing novel nucleic acid therapeutics, including oligonucleotide products, over the past few years. Moreover, considerable investments are expected to be made for developing nucleic acid drugs, and a strong pipeline of products is anticipated to be commercialized during the forecast period.

There has been an increase in outsourcing of biologics manufacturing due to COVID-19. As per the BioPlan Associates 17th Annual Report and Survey of Biopharmaceutical Manufacturing, 65% of biotherapeutics facilities used contract development and manufacturing services for at least some of their bioprocessing, which accelerated the market demand during the pandemic. Moreover, service providers, such as CROs and CDMOs, witnessed a spike in inquiries and orders, mostly related to coronavirus vaccines & therapeutics. For instance, in 2020, Lonza received more than 200 inquiries about projects related to COVID-19. Thus, high demand for CDMO services to develop advanced therapeutics enhanced market revenue growth during the pandemic.

Innovations and speed-to-clinic are of critical importance for various biopharmaceutical and pharmaceutical companies. Specialty biopharmaceutical players and small companies significantly focus on delivering these important requirements within the industry. Several CDMOs and CROs act as one-stop-shop organizations. The service model of a one-stop-shop CDMO involves handling everything from API to dosage form and early development to commercialization. To offer such services, CDMOs must have a wide range of specialized handling capabilities and enabling technologies to address specific problem statements. Moreover, there is a wide range of product design capabilities among CDMO players that can be crucial in scaling a product concept and bringing it to the market.

Market Concentration & Characteristics

The market growth stage is high, and the pace is accelerating. The market is characterized by evolving technologies, regulatory considerations, materials innovation, and increasing globalization and outsourcing of manufacturing processes to leverage cost advantages and specialized capabilities.

The market fortifies a high degree of innovation. Innovation in nucleic acid therapeutics is becoming more important to treat numerous diseases, as it supports healthcare by establishing a pathway for advanced therapeutic products. Rapid technological development in gene editing, RNA interference (RNAi), and messenger RNA (mRNA) technologies drive innovation in nucleic acid therapeutics, thereby accelerating demand for CDMOs.

The market is witnessing a high level of M&A Activities to extend global capabilities in manufacturing and strengthen the current contract development and manufacturing services. The growing need to enhance capabilities and expand service portfolios propels consolidation in the market through mergers and acquisitions.

Regulations and restrictions on clinical trials are rapidly and accelerating the need for continual monitoring by regulatory authorities & clinical teams to maintain study integrity. Furthermore, the time and cost associated with obtaining regulatory approvals for new therapeutics influence the speed of bringing products to market. Compliance with rigorous regulatory standards set by agencies like the U.S. FDA, EMA, and several others ensures safety and efficacy of nucleic acid therapeutics, impacting cost and complexity of manufacturing processes.

Service expansion in the market is medium owing to increasing demand for end-to-end services, from drug discovery and development to manufacturing and packaging, which drives CDMOs to expand their service portfolios. Further, growing demand from biotech and pharmaceutical companies for specialized services in nucleic acid therapeutics stimulates CDMOs to expand their capabilities.

Market players leverage this strategy to increase manufacturing capabilities and enhance the geographic reach of their products. Growing healthcare infrastructure and increasing investment in biotech research in regions such as Asia-Pacific and Latin America drive CDMOs to expand geographically. In addition, regional expansions provide access to skilled labor and scientific talent, essential for innovation and high-quality manufacturing. Thus, they positively impact the overall market progression.

Type Insights

Based on type, the RNA-based therapies segment led the market with the largest revenue share of 65.65% in 2024. The demand for RNA-based therapies is expected to surge due to promising clinical trial outcomes and the potential to address a range of diseases. Hence, these therapies are currently in the highlight as the biopharma industry players emphasize RNA-based therapies in their future pipelines to meet rising healthcare demand.

The gene therapy segment is expected to witness at the fastest CAGR over the forecast period, due to the potential of gene therapy candidates to treat several disorders. For instance, in January 2023, Vector BioMed secured USD 15 million in its initial round of funding, marking a significant milestone for the startup. With the raised capital, the company aimed to address a substantial void in the production of cell and gene therapies. Further, with rising demand for robust disease treatment therapies, companies are accelerating Research & Development (R&D) efforts for effective gene therapies that target the cause of disease at a genomic level, which further propel industry progression.

Service Insights

Based on service, the manufacturing services segment accounted for the largest market share in 2024. The high segmental growth is attributed to the increasing highly specialized knowledge and expertise in the manufacturing of nucleic acid therapies. Moreover, CDMOs that focus on nucleic acid manufacturing have a deep understanding of these therapies, giving them a competitive advantage in the market. Besides, major CDMOs are undertaking substantial investments to expand their capacity and meet rising demand. For instance, in March 2024, Lonza announced the acquisition of a large-scale biologics manufacturing site from Roche in the U.S. The deal is worth USD 1.2 billion; through this acquisition, Lonza received access to one of the world's largest biologics manufacturing sites by volume to cater to its customer's needs. The investment undertaken by Lonza positioned the company to offer customers a fully integrated end-to-end solution. In addition, growing number of nucleic acid therapeutics projects is another key factor aiding segment growth.

The process development and optimization segment is anticipated to witness at a significant CAGR over the forecast period. The segment growth potential is owing to growing pipeline of nucleic acid therapeutics, with numerous candidates in various stages of clinical development, which fuels the demand for CDMO services. According to the American Society of Gene & Cell Therapy (ASGCT), there are 3,866 therapies in various stages of development, spanning from preclinical to preregistration phases. Around 2,082 therapies fall under gene therapies, including genetically modified cell therapies like CAR T-cell therapies. This accounts for 53% of the overall development of gene, cell, and RNA therapies. As a result, companies are seeking expertise in process development & optimization to scale up production for clinical trials and commercialization, thereby witnessing segmental market growth.

End-use Insights

Based on end use, the biotech companies segment held the highest market share in 2024. Some of the key factors contributing to segment growth are expertise in nucleic acid-based drug development, rising substantial investment for nucleic acid therapies across emerging countries, increasing R&D of innovative therapies, and expanding product portfolio. In addition, the promising advantages of therapies to cure various disorders are expected to fulfill unmet medical needs. Moreover, the adoption of emerging technologies and growing product approval & launches the segment growth.

The government & academic research institutes segment is anticipated to grow at the fastest CAGR over the forecast period. The segment is expected to witness growth at a significant pace due to increasing early-stage research & innovation, supported by significant investment and funding for drug development initiatives. For instance, in June 2022, Evonik announced a substantial investment of USD 220 million in collaboration with the U.S. government to establish a new lipid production facility dedicated to mRNA-based therapies in the U.S. Hence, adoption of such strategies is likely to impact segmental growth positively.

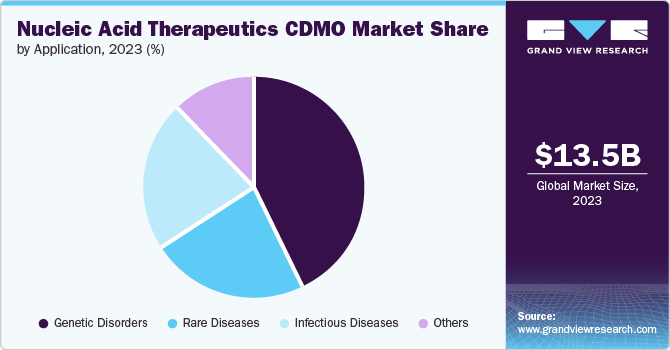

Application Insights

Based on application, the genetic disorders segment dominated the nucleic acid therapeutics CDMO market in 2024. Growth in the segment can be attributed to the increasing prevalence of genetic disorders and favorable government initiatives. Moreover, gene therapy support provides treatments for several disorders that currently have limited or no available treatments in the market. This factor created new possibilities for innovative therapy products targeting specific genetic mutations, further debilitating genetic conditions. Hence, the segment offers the unique potential to cure a genetic disease that impacts millions of patients positively.

The Infectious disease segment is expected to grow at a significant CAGR during the forecast period, primarily fueled by escalating application of these therapeutics in treating COVID-19 infections. The emergence of the COVID-19 pandemic has led to a paradigm shift in the research landscape, with a notable increase in the utilization of nucleic acid therapeutics for infectious diseases. Moreover, the momentum gained during the pandemic has positioned the infectious disease segment as a focal point for market growth, with ongoing endeavors focused on addressing a broader spectrum of infectious diseases beyond COVID-19.

Regional Insights

North America dominated the nucleic acid therapeutics CDMO market, accounting for a revenue share of 40.15% in 202. This can be attributed to a proactive regulatory environment, increasing investment & funding support, and a growing number of product approvals globally. Other factors contributing to the growth are increased R&D activities, the growing prevalence of chronic diseases, and increased government support for the healthcare sector. Moreover, the robust biotech industry, global expansion of CDMOs, presence of key CDMOs, advanced healthcare ecosystem, solid clinical trial infrastructure, and strong academic & research institutions are other factors boosting the market growth.

U.S. Nucleic Acid Therapeutics CDMO Market Trends

The nucleic acid therapeutics CDMO market in the U.S. held the largest share in North America in 2024, owing to a strong presence of industry participants in the country. The U.S. market has benefited from the immense potential of nucleic acid therapeutics to treat a range of diseases such as oncology, genetic disorders, infectious diseases, and others. Moreover, increasing investments, a rising number of clinical trials, rapid advancements in medicine development, and a growing gene therapy pipeline across the country are expected to drive the market growth.

Europe Nucleic Acid Therapeutics CDMO Market Trends

The nucleic acid therapeutics CDMO market in Europe is expected to grow at a significant CAGR during the forecast period, owing to the presence of key pharmaceutical and biotechnology companies in this region. In addition, there are a large number of CDMOs specializing in therapy innovation in various European countries, such as Germany, the UK, and France, which is expected to contribute to market growth in this region.

The UK nucleic acid therapeutics CDMO market held the largest share in Europe in 2024. The growth can be attributed to various factors such as the presence of various multinational CDMOs, significant R&D spending, healthcare research, and rapidly evolving therapeutic approaches with developments of gene therapies, modified nucleotides, circular RNA, self-amplifying RNA, and tissue targeting have fueled the demand for UK nucleic acid therapeutics CDMOs.

The nucleic acid therapeutics CDMO market in Germany is anticipated to grow at a significant CAGR over the forecast period. Technological advancements and quality clinical resources are some of the primary factors expected to propel market growth over the forecast period. Moreover, government initiatives for clinical research activities have accelerated the market growth in Germany.

Asia Pacific Nucleic Acid Therapeutics CDMO Market Trends

The nucleic acid therapeutics CDMO market in Asia Pacific is expected to grow at the fastest CAGR over the forecast period. The high market growth potential is attributed to the changing business model of MNC outsourcing, and R&D activities are expected to increase nucleic acid therapeutics CDMO demand in Asia Pacific owing to cost-efficiency offered by CDMO in countries such as India and China. These countries are expected to witness lucrative market growth. In contrast, countries such as South Korea, Australia, and Thailand are also expected to witness steady growth over the forecast period. The establishment of several CDMOs across the Asia Pacific region has also strengthened innovation in therapies in the region.

The China nucleic acid therapeutics CDMO market held the largest share in Asia Pacific in 2024. The market growth is owing to the increasing number of nucleic acid therapeutics approvals due to their potential to become blockbuster drugs for treating a range of diseases, including cardiovascular and metabolic diseases, liver diseases, and a variety of rare diseases.

The nucleic acid therapeutics CDMO market in Japan is expected to grow at the fastest CAGR over the forecast period, due to various factors such as the growing pharmaceutical industry, increasing demand for outsourcing services, and rising R&D activities.

The India nucleic acid therapeutics CDMO market is anticipated to grow at the fastest CAGR over the forecast period. Growth in the country can be attributed to the availability of low-cost labor, low manufacturing costs, considerable demand for high-quality medications, and strong presence of WHO-cGMP-compliant facilities & a skilled workforce.

Latin America Nucleic Acid Therapeutics CDMO Market Trends

The nucleic acid therapeutics CDMO market in Latin America is anticipated to grow at a substantial CAGR over the forecast period, owing to the expanding CDMO industry, which reduces the monitoring cost associated with outsourcing services. Moreover, growing approval for gene therapy, rising investments in R&D research, and increasing product launches are expected to drive the market growth in the region.

The Brazil nucleic acid therapeutics CDMO market is anticipated to grow at a significant CAGR over the forecast perio1d. Growing prevalence of blood cancer, genetic disorders, and infectious diseases in the region has created a requirement for nucleic acid therapeutics CDMO. This has led to the business expansion of gene therapy products, creating substantial demand for the market in recent years.

MEA Nucleic Acid Therapeutics CDMO Market Trends

The nucleic acid therapeutics CDMO market in MEA is expected to grow at a substantial CAGR over the forecast period. Several companies in the region are innovating nucleic acid therapeutics due to growing concerns about treating various chronic & genetic disorders and increasing government support to attract CDMO companies to further innovate various vaccines & therapeutics for the patient population.

The South Africa nucleic acid therapeutics CDMO market is anticipated to grow at the fastest CAGR over the forecast period, owing to growing demand for nucleic acid therapeutics to treat various chronic & genetic disorders, approval of products, and expansion of CDMO manufacturing sites. In addition, the country is the largest market for pharmaceuticals in the sub-Saharan African region. It has one of the most developed infrastructure facilities with the presence of a significant number of life sciences companies.

Key Nucleic Acid Therapeutics CDMO Company Insights

The prominent market players operating across the global market focus on implementing numerous strategic initiatives such as acquisitions, mergers, service launches, partnerships, expansions, and collaborations, among others, to broaden the geographical reach and gain a competitive edge in the overall market. For instance, in November 2023, LGC’s unit LGC Biosearch Technologies acquired PolyDesign, a leading manufacturer & supplier of solid support embedded frits used for low- & ultra-low-scale DNA & RNA oligonucleotide synthesis & purification. Such acquisition broadened the service offerings of the company in a significant market.

Key Nucleic Acid Therapeutics CDMO Companies:

The following are the leading companies in the nucleic acid therapeutics CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- Agilent Technologies, Inc.

- Curia Global, Inc.

- Ajinomoto Co., Inc.

- Danaher (Aldevron)

- KNC Laboratories Co., Ltd.

- LGC Limited

- Merck KGaA

- WuXi AppTec

- BIOSPRING

- Univercells Inc.

- Exothera

Recent Developments

-

In September 2023, Curia announced that Replicate Bioscience received IND clearance from the FDA. It dosed RBI-4000, a srRNA rabies vaccine, in the first participant during the phase 1 clinical study, utilizing clinical material developed as part of the Curia partnership.

-

In September 2023, Aldevron, a part of Danaher Corporation, partnered with Integrated DNA Technologies to deliver key CRISPR components to cell & gene therapy developers.

-

In January 2023, Agilent Technologies, Inc. announced an investment of USD 725 million to expand nucleic acid-based therapeutics manufacturing capacity. Such strategic innovations are anticipated to boost market revenue over the forecast period.

Nucleic Acid Therapeutics CDMO Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 17.43 billion |

|

Revenue forecast in 2030 |

USD 33.86 billion |

|

Growth rate |

CAGR of 14.20% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, service, end-use, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

Agilent Technologies, Inc.; Curia Global, Inc.; Ajinomoto Co., Inc.; Danaher (Aldevron); KNC Laboratories Co. Ltd.; LGC Limited; Merck KGaA; WuXi AppTec; BIOSPRING; Univercells Inc.; Exothera |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Nucleic Acid Therapeutics CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nucleic acid therapeutics CDMO market report based on type, service, end-use, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Gene Therapy

-

RNA-based Therapies

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Process Development and Optimization

-

Manufacturing Services

-

Analytical and Quality Control Services

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Government & Academic Research Institutes

-

Biotech Companies

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Rare Diseases

-

Genetic Disorders

-

Infectious Diseases

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global nucleic acid therapeutics CDMO market size was estimated at USD 15.35 billion in 2024 and is expected to reach USD 17.43 billion in 2025.

b. The global nucleic acid therapeutics CDMO market is expected to grow at a compound annual growth rate of 14.20% from 2025 to 2030 to reach USD 33.86 billion by 2030.

b. North America dominated the nucleic acid therapeutics CDMO market with a share of 40.15% in 2024. This is attributable to the robust biotech industry, advanced healthcare ecosystem, substantial investment and funding support, extensive clinical trial infrastructure, and strong academic and research institutions.

b. Some key players operating in the nucleic acid therapeutics CDMO market include Agilent Technologies, Inc., Curia Global, Inc., Ajinomoto Co., Inc., Danaher (Aldevron), KNC Laboratories Co., Ltd., LGC Limited, Merck KGaA, WuXi AppTec, BIOSPRING, Univercells Inc., and Exothera, among others.

b. Key factors that are driving the market growth include advancements in nucleic acid therapeutics, complex manufacturing processes, and increased investment. Moreover, rising regulatory approval for nucleic acid therapeutics and increasing demand for personalized medicine across the globe are also expected to boost market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."