Nucleic Acid Isolation And Purification Market Size, Share & Trends Analysis Report By Product, By Type, By Application (Precision Medicine, Diagnostics, Drug discovery & Development), By Method, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-2-68038-580-9

- Number of Report Pages: 135

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

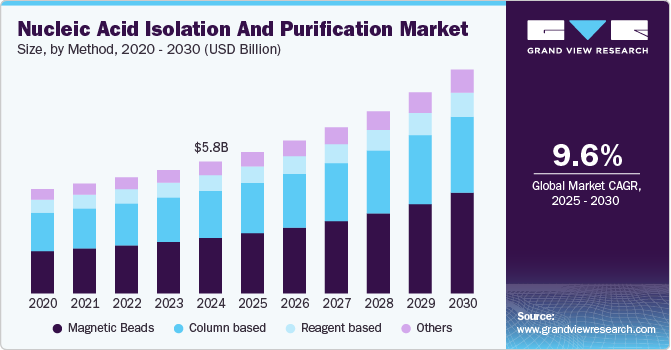

The global nucleic acid isolation and purification market size was USD 5.75 billion in 2024 and is anticipated to grow at a CAGR of 9.61% from 2025 to 2030. The nucleic acid isolation and purification (NAIP) market expansion is fueled by several factors, such as the rise in adoption of sequencing platforms for clinical diagnostics, growth in genomics & enzymology-based research, and increase in investments in R&D. In addition, the potential of molecular biology and advancement in precision medicine are further augmenting market growth. Increasing efforts of market participants to strengthen the manufacturing capacity is facilitating market expansion. For instance, in January 2023, Agilent Technologies announced an investment of USD 725 million to increase the manufacturing capacity of therapeutic nucleic acids.

The incidence of genetic disorders, cancer, and infectious diseases has been growing globally for the past few years. Disorders such as thalassemia, sickle cell anemia, and cystic fibrosis are caused by genetic aberrations in an individual’s DNA. Studying nucleic acids helps gain insights into these diseases. The race for developing cost-effective, point-of-contact testing kits and efficient laboratory procedures for detecting COVID-19 infection has driven a new scope of diagnostic innovation. An increase in the adoption of PCR for SARS-CoV-2 detection by a broad range of commercial laboratories drives the market, as nucleic acid isolation & purification is a significant step in the PCR workflow.

The biotechnology industry is also marked with advancements and innovations. Diagnostic tests have become more cost-effective and easier to use. The companies are investing to advance the DNA isolation process. For instance, in August 2023, Gold Standard Diagnostics (GSD) announced the launch of iMAGo PREDigest. This kit completes GSD's whole DNA isolation portfolio, delivering an automated (iMAGo Food) and manual (GeneSpin) solution with respective pre- and post-treatment offerings for difficult matrices. Automated and advanced instruments have entered the market with faster, more consistent, and cleaner processes. For instance, Thermo Fisher Scientific offers an Automated Nucleic Acid Extraction Workstation that uses revolutionary magnetic separation technology.

Enhancing DNA Extraction: The Role of Magnetic Beads

Advancements in DNA extraction have led to the adoption of magnetic bead-based methods, offering an efficient and contamination-resistant approach. These techniques streamline the purification process by utilizing magnetized particles that selectively bind to nucleic acids, reducing processing time and improving yield. Unlike conventional methods, which involve multiple washing and elution steps, magnetic bead-based extraction simplifies workflows and enhances consistency. This method has gained traction across various fields, from biomedical research to agricultural and forensic applications, due to its adaptability to different sample types and automation compatibility.

While magnetic bead-based techniques show high efficiency in many scenarios, their performance can vary depending on the nature of the sample. Research suggests that they excel in extracting nucleic acids from certain biological materials, yielding high purity and recovery rates. However, their effectiveness may differ based on factors such as sample composition and biomass concentration. Comparative studies highlight notable advantages over traditional extraction techniques, with promising results in optimizing DNA yield and quality.

Table 1 : Comparative Efficiency of Magnetic Bead-Based DNA Extraction Across Sample Types

|

Study/Comparison |

Sample Type |

Magnetic Beads Efficiency |

Comparison with Other Methods |

|

Comparison with Spin Column Method |

Cells |

Comparable DNA yield |

Supplier Q kits had higher yield |

|

Tissues (Rabbit Heart, Liver) |

Higher DNA yield |

Outperformed spin columns |

|

|

Whole Blood |

Similar extraction efficiency |

Comparable across methods |

|

|

High vs. Low Biomass Samples |

High Biomass (Stool) |

Efficient extraction |

Performed equally well as other methods |

|

Low Biomass (Chyme, BAL Fluid, Sputum) |

Less sensitive |

Not ideal for low biomass samples |

|

|

Mycobacterium tuberculosis DNA Extraction |

MTB DNA (Plasma) |

Higher yield |

Outperformed phenol-chloroform method |

|

Plasmid DNA Extraction |

Plasmid DNA |

Highest yield |

Outperformed Qiagen Kit, Phenol-Chloroform, Omega Kit |

|

Loss Ratio Comparison |

Various Samples |

Lowest loss ratio |

Best for plasma DNA extraction |

Advancements In Automation

Advancements in automation have significantly impacted the market, driving both efficiency and scalability. Automation technologies are transforming the way nucleic acid extraction and purification processes are carried out, particularly in high-throughput laboratories and clinical settings. Automated systems enable faster, more consistent, and reproducible results compared to manual methods, which are often labor-intensive and prone to human error. This improvement in accuracy and reliability is crucial for critical applications such as diagnostics, drug development, and genetic research. Automation allows for the processing of large volumes of samples in a shorter amount of time, addressing the increasing demand for rapid diagnostics and genetic testing. This is particularly beneficial in fields like cancer research, where time-sensitive genetic analysis can impact treatment decisions.

In addition to speed and consistency, automation reduces the risk of contamination, which is a key concern in nucleic acid isolation and purification. Automated systems are designed to minimize exposure to external contaminants, ensuring that the nucleic acids extracted are of high quality and purity. This is particularly important in the development of diagnostic tests and therapies, where the integrity of the genetic material is essential for accurate results.

Furthermore, advancements in automation have led to the development of user-friendly platforms that require less specialized training. This has expanded access to nucleic acid isolation and purification technologies in a broader range of research and clinical environments. As automation continues to evolve, it is expected to drive further innovation in nucleic acid isolation, making these processes more efficient, cost-effective, and accessible. Ultimately, automation is helping to meet the growing demand for genetic testing and research, thus fueling the expansion of the nucleic acid isolation and purification market.

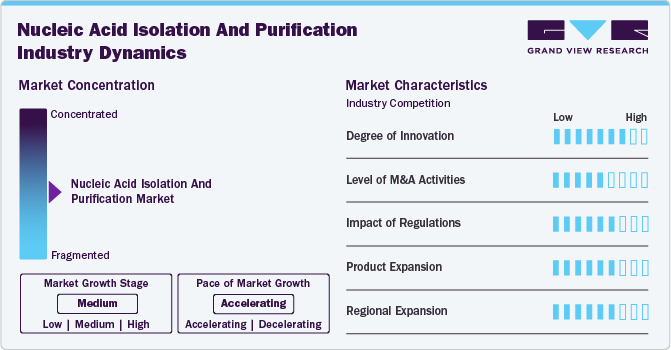

Market Concentration & Characteristics

The nucleic acid isolation & purification industry is characterized by a moderate to high degree of innovation due to rapid advancements and innovations in the biotechnology industry. It utilizes molecular detection platforms, robotic liquid handling technology, droplet digital PCR, NGS, and genome-wide sequencing, among others in effective extraction and purification of nucleic acid.

The nucleic acid isolation & purification industry is further characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new nucleic acid isolation & purification facilities, increase their capabilities, expand product portfolios, and improve competencies.

The nucleic acid isolation & purification industry is also subject to substantial regulatory scrutiny. Manufacturers and suppliers of nucleic acid isolation and purification kits and instruments must comply with various regulations, such as those related to genomics, forensics, molecular diagnostics, and genetic engineering.

The nucleic acid isolation & purification industry has a moderate level of product expansion. This expansion involves introducing new types of extraction and purification kits, improving extraction procedures, and development of novel instrumentation.The product expansion enables companies to expand their nucleic acid isolation and purification portfolio.

Regional expansion is a significant factor with moderate to high growth in the nucleic acid isolation & purification industry. Since several end-user industries drive demand for DNA/RNA extraction and purification, the market players are investing in regional expansion to increase manufacturing capacity. Furthermore, regional expansion enables players to capture the untapped customer base, thereby contributing to the growth of the oligonucleotide synthesis market.

Product Insights

The kits & reagents segment dominated the market with the highest share 2024. The NAIP market comprises a wide range of DNA and RNA isolation/extraction and purification kits for preparing samples and libraries. The players are focusing on new product launches to cater to specific needs. For instance, in June 2023, Bionano Genomics, Inc. announced the launch of the Ionic Purification System, a kit for nucleic acid extraction from tumor tissue and formalin-fixed paraffin-embedded (FFPE).

Furthermore, the instruments segment is anticipated to grow considerably at a CAGR during the forecast period. This high growth is attributed to technological advancements in instruments, strong end-user demand, and increased demand for automated NAIP instruments. Also, recent product launches from manufacturers are another factor supporting segment expansion. For instance, in December 2023, Omega Bio-tek announced the launch of MagBinder Fit24, a lab hardware isolating DNA or RNA from diverse sample types.

Type Insights

The DNA isolation and purification segment registered the highest market share in 2024. DNA extraction and purification are used in a variety of molecular biology applications. The basic criteria that must be met by any method of DNA isolation and purification from any sample are efficient extraction and isolation, enough DNA for downstream steps, contaminant removal, and quality & purity of DNA. Hence, the market players are investing in DNA isolation & purification solutions. For instance, in May 2023, One BioMed launched X8 HMW DNA Cartridge Kits. It specializes in the automated isolation of high molecular weight DNA for genome assembly and long-read sequencing.

The RNA isolation & purification segment is anticipated to witness a steady CAGR growth over the forecast period. Purified mRNA is essential for the construction of a cDNA library. These libraries have various applications in the healthcare sector, such as in gene expression profiling, sequencing, and clinical diagnostics. Availability of a broad range of kits in the market for extracting and processing viral, bacterial, and total RNA, among other types. Hence, companies are launching several solutions for RNA isolation & purification. For instance, in November 2023, BioEcho Life Sciences announced the launch of EchoLUTION FFPE RNA Kit for simplified RNA extraction from FFPE samples.

Application Insights

The diagnostic segment led with the highest market share in 2024. The large revenue share of the segment can be attributed to the rising application of DNA and RNA isolation for identifying pathogens in routine sample processing. For instance, PCR techniques are widely adopted for rapidly detecting microorganisms, which was previously impossible with traditional microbiological detection methods. Hence, companies are launching new diagnostic solutions. For instance, in November 2023, QIAGEN launched RNeasy PowerMax and TissueLyser III Soil Pro Kit. The kit isolates pure RNA from PCR inhibitors-rich soil samples. Thus, the launch of new products for diagnosing emerging infections further contributes to segment growth.

Furthermore, the drug discovery & development segment is projected to witness a lucrative growth rate over the forecast period. Growth in the segment can be primarily attributed to robust investments in pharmaceutical and biotechnology companies to develop novel drugs. Nucleic acid purification methods are largely employed in drug discovery, target identification, and testing.

Method Insights

The magnetic beads segment dominated the market with the highest share in 2024. The magnetic bead method is an advanced and highly sophisticated DNA/RNA extraction procedure where small magnetic beads coated with DNA-binding oxides or antibodies are used. Since they show affinity toward DNA molecules, this method helps extract the purest possible form of DNA/RNA and exclude other unwanted materials from the sample mixture. Hence, companies use this method in nucleic acid isolation & purification solutions. For instance, in November 2023, CleanNA launched CE-IVD marked ‘Clean Cell Free DNA Kit’ to isolate cell-free DNA from human plasma. With its magnetic bead technology enables automation and use in diagnostic procedures.

The column-based segment is expected to register a significant growth rate during the forecast period. Silica columns are mainly preferred for getting higher-quality nucleic acids in less time. Moreover, these techniques can be incorporated in spin columns with various benefits such as fast process, higher yield, cost-effectivity, and compatibility with automated instruments. Therefore, these methods are widely adopted in DNA extraction processes.

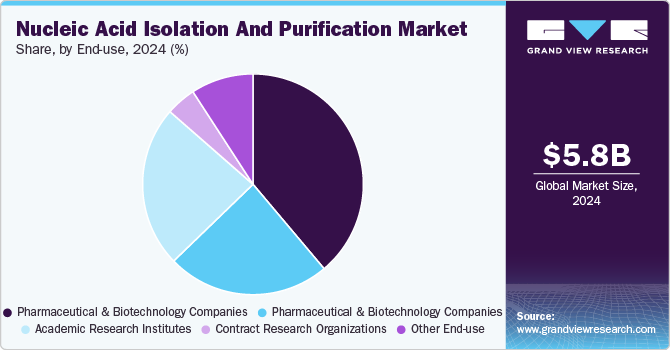

End-use Insights

Hospitals and diagnostics centers held the largest share in 2024 as the use of nucleic acids in hospitals and diagnostic centers has increased due to their wide range of applications in healthcare segments, such as genetic fingerprinting, prenatal testing, and liquid biopsies. DNA and RNA isolation and purification techniques are considered efficient tools for diagnosing certain genetic diseases- sickle cell anemia, hemophilia A, fragile x syndrome, cystic fibrosis, Down’s syndrome, and Tay-Sachs disease, to name a few. Thus, the availability of such technologies at low prices is projected to drive their adoption rate in diagnostic centers and hospitals.

Furthermore, the pharmaceutical and biotechnology companies segment is expected to register the fastest growth rate during the projected period. The rising adoption of advanced technologies by companies to develop various novel therapies is projected to drive segment growth. For instance, in 2023, the FDA's Center for Drug Evaluation and Research (CDER) approved 55 new drugs. As nucleic acid purification and isolation is a critical step in drug discovery and development, higher demand for DNA extraction kits and instruments in pharma and biotech companies is anticipated to drive segment growth.

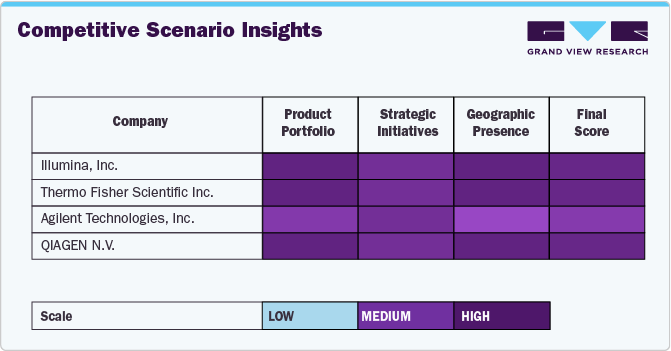

Competitive Scenario Insights

The nucleic acid isolation and purification market is witnessing intense competition driven by technological advancements, increasing demand for genetic research, and expanding applications in diagnostics and therapeutics. Leading biotechnology and life sciences companies continuously innovate to enhance extraction efficiency, purity, and automation capabilities. The market is characterized by the presence of key players such as Thermo Fisher Scientific, Qiagen, Merck KGaA, and Promega Corporation, who offer diverse product portfolios, including magnetic bead-based, column-based, and reagent-based extraction methods.

The growing adoption of automated solutions is reshaping market dynamics, with companies investing in high-throughput systems to meet the rising demand from clinical and research laboratories. Strategic collaborations, mergers, and acquisitions further fuel competition, as companies seek to expand their market reach and technological expertise. Additionally, emerging biotech firms are entering space with innovative, cost-effective solutions, intensifying the rivalry. The increasing focus on precision medicine and molecular diagnostics is expected to drive further advancements, making efficiency, scalability, and cost-effectiveness key differentiators in this competitive landscape. As the market evolves, companies that prioritize automation, sensitivity, and workflow integration will gain a strategic edge

Regional Insights

North America nucleic acid isolation and purification market held the highest share of 41.59% in 2024. The presence of many market players in the region and their various initiatives are projected to drive the regional market. In addition, leveraged government support, a favorable regulatory framework, and consistent R&D efforts are expected to drive the market during the forecast period. Moreover, the local presence of several major market players in the U.S., such as Thermo Fisher Scientific, Inc. and Agilent Technologies, also drives technological progression in the market. These players are undertaking significant efforts to develop automatic nucleic acid purification systems for downstream applications, including next-generation sequencing and real-time PCR.

U.S. Nucleic Acid Isolation And Purification Market Trends

The nucleic acid isolation and purification market in U.S. is expected to grow due to increasing demand for genetic testing, rising adoption of precision medicine, and advancements in molecular diagnostics. In addition, growing research in genomics and biotechnology further drives market expansion.

Europe Nucleic Acid Isolation And Purification Market Trends

The nucleic acid isolation and purification market in Europe is expected to grow due to increasing research in molecular biology, rising demand for personalized medicine, and advancements in genomics and biotechnology. In addition, government funding for life sciences research further supports market expansion.

The nucleic acid isolation and purification market in the UK is expected to grow due to increasing investments in genomics research, rising demand for molecular diagnostics, and the expanding biotechnology sector. Government support and advancements in precision medicine further drive market growth.

The nucleic acid isolation and purification market in France is expected to grow due to rising investments in biotechnology, increasing demand for molecular diagnostics, and advancements in genomics research. Government initiatives supporting life sciences and personalized medicine further drive market expansion.

The nucleic acid isolation and purification market in Germany is expected to grow over the forecast period due to increasing investments in biotechnology and genomics research, rising demand for molecular diagnostics, and advancements in precision medicine. Government support and strong healthcare infrastructure further drive market expansion.

Asia Pacific Nucleic Acid Isolation And Purification Market Trends

The nucleic acid isolation and purification market in Asia Pacific is expected to register the fastest growth throughout the forecast period. Ongoing developments, growing patient population, private-public collaborations, and supportive government initiatives have offered immense opportunities for the growth of the Asia Pacific market. Also, various leading companies in China, India, and Japan, among other countries, operate in the region and offer a broad range of kits for isolating and purifying genomic and plasmid DNA from various samples, including serum, blood, cells, tissue, forensic, and plant samples. More such efforts are expected to contribute toward the regional market's growth.

The nucleic acid isolation and purification market in China is expected to grow due to increasing investments in biotechnology, rising demand for molecular diagnostics, and advancements in genomics research. Government initiatives supporting precision medicine and expanding healthcare infrastructure further drive market expansion.

Japan's nucleic acid isolation and purification market is expected to grow over the forecast period due to advancements in molecular diagnostics, increasing investment in genomics research, and the rising adoption of precision medicine. Government support and a strong biotechnology sector further drives market expansion.

The nucleic acid isolation and purification market in India is expected to grow over the forecast period due to increasing investments in biotechnology, rising demand for molecular diagnostics, and expanding genomics research. Government initiatives and the growing healthcare sector further drive market expansion.

Middle East & Africa Nucleic Acid Isolation And Purification Market Trends

The nucleic acid isolation and purification market in the Middle East & Africa is driven by increasing investments in genomic research, expanding diagnostic applications, and rising demand for precision medicine. The region's growing focus on personalized healthcare has boosted the adoption of advanced nucleic acid extraction technologies in research and clinical settings. In addition, government initiatives to improve healthcare infrastructure, particularly in countries such as Saudi Arabia and the UAE, are fueling market growth. Notably, Qiagen announced plans to expand its business in Middle East with new regional headquarters and major projects, enhancing access to efficient nucleic acid purification products. This aligns with the growing need for streamlined genetic testing processes in infectious disease control, oncology research, and other medical applications.

The nucleic acid isolation and purification market in Saudi Arabia is expected to grow over the forecast period due to increasing investments in biotechnology, rising demand for molecular diagnostics, and expanding genomics research. Government initiatives supporting healthcare innovation and precision medicine further drive market expansion.

Key Nucleic Acid Isolation And Purification Company Insights

Many companies in the nucleic acid isolation & purification market are aiming for product approvals and launch to strengthen their market position. In addition, companies are undertaking regional expansions and collaborations to increase the manufacturing capacity and sharing of technologies to develop efficient nucleic acid isolation and purification solutions.

Key Nucleic Acid Isolation And Purification Companies:

The following are the leading companies in the nucleic acid isolation & purification (NAIP) market. These companies collectively hold the largest market share and dictate industry trends.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- Danaher

- F. Hoffmann-La Roche Ltd

- Merck KGaA

- Agilent Technologies

- Bio-Rad Laboratories, Inc.

- Takara Bio Inc.

- Promega Corporation

Recent Developments

-

In December 2023, Thermo Fisher Scientific Inc. launched an automatic nucleic acid purification instrument, Thermo Scientific KingFisher Apex Dx, and Applied Biosystems MagMAX Dx Pathogen/Viral NA Isolation Kit to isolate and purify bacterial and viral pathogens from biological samples.

-

In November 2023, LGC Biosearch Technologies announced the acquisition of PolyDesign, a manufacturer of solid support embedded frits used for DNA/RNA oligonucleotide synthesis and purification. The proprietary frit technology aligns with LGC’s Nucleic Acid Chemistry product catalog.

-

In August 2023, CD Bioparticles launched a new line of DNA Extraction and Purification Kits. The kits are designed for reliable and rapid isolation of DNA, including plasmid DNA, genomic DNA, cell-free DNA (cfDNA), mitochondrial DNA, tissue DNA, and PCR products.

-

In July 2023, INOVIQ Limited and Promega Corporation announced a global collaborative marketing agreement to market Promega Nucleic Acid purification systems and EXO-NET exosome capture technology.

-

In February 2023, Agilent Technologies, Inc. announced the selection of Fluor Corporation's Advanced Technologies & Life Sciences business to expand its oligonucleotide therapeutics manufacturing unit in Colorado. The facility would provide for the synthesis, lyophilization, and purification of custom nucleic acids therapeutics.

-

In January 2023, QIAGEN announced the launch of the EZ2 Connect MDx platform for automated sample processing in diagnostic labs to enable the purification of DNA and RNA from 24 samples in parallel in under 30 minutes.

Nucleic Acid Isolation and Purification Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.17 billion |

|

Revenue forecast in 2030 |

USD 9.77 billion |

|

Growth rate |

CAGR of 9.61% from 2025 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, type, application, method, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

QIAGEN; Thermo Fisher Scientific, Inc.; Illumina, Inc.; Danaher; F. Hoffmann-La Roche Ltd; Merck KGaA; Agilent Technologies; Bio-Rad Laboratories, Inc.; Takara Bio Inc.; Promega Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Nucleic Acid Isolation And Purification Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global nucleic acid isolation and purification market report based on product, type, application, method, end-use, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Kits & reagents

-

Instruments

-

Manual

-

Automatic

-

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

DNA Isolation & Purification

-

Genomic DNA Isolation & Purification

-

Plasmid DNA Isolation & Purification

-

Viral DNA Isolation & Purification

-

Other

-

-

RNA Isolation & Purification

-

miRNA Isolation & Purification

-

mRNA Isolation & Purification

-

Total RNA Isolation & Purification

-

Other

-

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Precision Medicine

-

Diagnostics

-

Drug Discovery & Development

-

Agriculture and Animal Research

-

Other Applications

-

-

Method Outlook (Revenue, USD Billion, 2018 - 2030)

-

Column Based

-

Magnetic Beads

-

Reagent Based

-

Others

-

-

End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Academic Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Contract Research Organizations

-

Hospitals And Diagnostic Centers

-

Other End-use

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global nucleic acid isolation and purification market size was estimated at USD 5.75 billion in 2024 and is expected to reach USD 6.17 billion in 2025.

b. The global nucleic acid isolation and purification market is expected to witness a compound annual growth rate of 9.61% from 2025 to 2030 to reach USD 9.77 billion by 2030.

b. Kits and reagents accounted for the largest share in 2024 due to the wide availability of robust kits for isolation of DNA or RNA from the given sample contributed to the dominance of this segment.

b. Some key players operating in the nucleic acid isolation and purification market include Thermo Fisher Scientific, Inc., QIAGEN, Merck KGaA, Illumina, Inc., Danaher, F. Hoffmann-La Roche Ltd, Agilent Technologies, Bio-Rad Laboratories, Inc., Takara Bio Inc., Promega Corporation

b. Expanding pipeline for RNA therapeutics, plummeting sequencing cost, and growing popularity of nucleic acid-based diagnostics are some key driving factors of the nucleic acid isolation & purification market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."